Working with Commercial Borrowers Through Fed Rate Cuts

Many clients are relying on their commercial relationship managers for advice on how to finance their business or real estate assets in the face of Fed rate cuts. We work with thousands of community bank lenders across the country, and some have been advising their borrowers to finance long-term assets with short-term loans in the anticipation of interest rate cuts by the Federal Reserve. We believe that community bankers who can provide thoughtful guidance to borrowers on their options, and specifically the relationship between short-term interest rates and long-term financing, can increase their value to, and loyalty with, their borrowers. In this article we want to share insights that lenders can use to discuss finance entry points with their borrowers.

Interest Rate Relationships

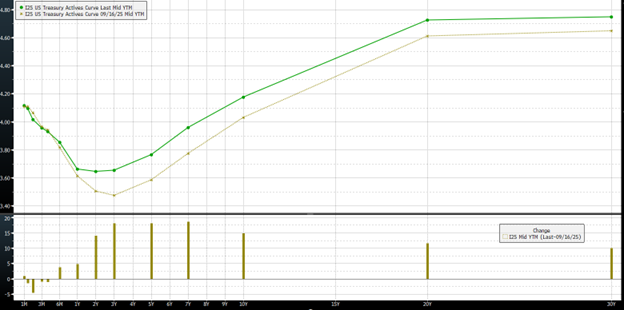

Many borrowers believe that the Federal Reserve lowering of short-term interest rates will lower their financing costs, but that may not be the case. For instance, the graph below shows the US Treasury yield curve from one month to 30 years, right before the Fed lowered rates by 25 bps to the time of writing of this article. The graph shows that the yield curve from 6 months to 30 years rose by 4 to 18bps. Therefore, borrowing costs increased by similar amounts.

The actual change in yield curve is not important, as rates will fluctuate, but the takeaway is that Treasury yields (as the best proxy for borrowing costs) will move in unanticipated ways, and often not in the direction of short-term interest rate changes. The market’s expectation of a 25bps rate cut was already built into the forward curve before the Fed cut rates on September 17th. Short-term rates are not necessarily correlated with long-term rates. Therefore, what the Fed does with the overnight rate (the index which it directly controls) has little bearing on a borrower’s cost of term debt.

The Right Entry Point for Borrowers with Fed Rate Cuts

So how should lenders advise borrowers in determining the right entry point to fix long-term financing with a back drop of Fed rate cuts? No one can predict the future, but a few basic and intuitive rules can frame the correct approach. Every specific situation with borrowers is different, but the following basic concepts should apply to most customers wanting to make a prudent decision:

- Timing the market for the lowest cost is an impossible task. However, for obligors with multiple facilities, a laddered approach should be considered. This means staggering credit facilities rather than having all facilities with similar start and termination dates.

- Short-term assets should be financed with short-term credit facilities. Each asset should be assessed for its useful life and expected hold period. Long-term assets should be financed with stable, longer-term credit facilities.

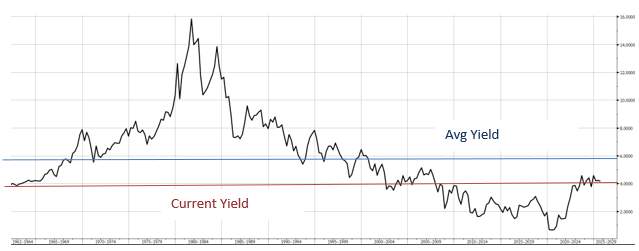

- Borrowers should appreciate their cost of financing in the correct context. Context is created by comparing current rates to historical rates given similar set of circumstances. Therefore, borrowers should not compare the cost of borrowing today versus the cost of borrowing during the pandemic, the greater financial crises, or during the exceedingly high inflation periods of the 1970s and 1980s. The graph below shows the cost of financing 10-year debt without credit charge (the underlying index with no credit spread). The graph shows the 10-year treasury yield over the last 50 years. The average 10-year Treasury yield over the period is 5.82%, at the time of this article the yield was 4.16% (1.66% below the historical average). Similar conclusions analysis for 3, 5, 7, 15 or 20-year Treasury yields is available. If you need to show these graphs to your clients, contact us at ARC@southstatebank.com and we would be happy to share these graphs with you.

- Changes in market expectations can move too quickly for borrowers to be able to make a swift change. In the time it takes for borrowers to lock a rate on a long-term facility (two to six weeks, on average), interest rates may move 50 to 100bps. No one can predict future economic realities, and this is especially true during inflection points when government behaviors can change quickly. Most borrowers cannot react fast enough to market changes to protect their downside risks.

- Credit risk is one sided for interest rate movements. Financing long-term assets with short-term liabilities adds credit risk that is borne by the lender. If rates are higher when a short-term loan matures or cash flow is lower, the borrower’s DSC ratio may not meet the bank’s underwriting criteria, or the ratio may be below 1.0X. Further, on most amortization schedules, the principal repayment in the first few years is exceedingly small, thus exposing the lender to more risk. Both the borrower and lender are subjected to credit risk if rates are higher than expected in the future. This is a risk that is well understood by lenders and should also be communicated to borrowers with marginal cash flow or higher leverage.

- The market is mostly wrong about the future of interest rate, but the market is especially poor in predicting extreme events. As the Federal Reserve’s independence is challenged in court, and the economy is reacting to trade and immigration policy changes, the magnitude of volatility for borrowers can be severe.

- Lenders should be aware of the free option to borrowers who finance with temporary credit facilities with anticipated savings in the future. Let us assume that a borrower financed long-term assets with a 2-year floating or fixed rate, a recession did not occur, and market rates are lower as predicted by the forward curve. The result is that the borrower paid higher interest rates during the short-term financing period (because the yield curve is currently inverted) and the borrower will obtain a lower rate (as predicted by the forward curve) on longer-term financing. The borrower’s blended rate is no better than had the borrower taken the longer-term facility at the initial entry point – this is the math of the forward curve and its current inversion. However, the bank will now need to compete for that borrower’s business again with possible irrationally priced competitors. Neither the borrower nor lender achieved an optimal outcome. If interest rates are higher at the end of the 2-year floating or fixed rate, again the bank may need to compete for that business, but the borrower is now facing tighter cashflow coverage, or worse.

Conclusion

There is no right answer in every financing situation, but short-term financing of long-term assets may not be the right choice for some borrowers. Given the Fed rate cuts it is anyone’s guess on where rates to borrowers move to. Lenders can enhance their value with a client and be indispensable trusted advisors by understanding the nuances of the market by discussing them with their clients.