Consider This Strategy Before You Turn Down Your Next Low Margin Loan

Our previous publications discussed current banking industry dynamics for loan pricing, how community banks are responding, and some winning strategies for community bankers. We contend that excess liquidity and tepid loan demand are the main culprits in driving community bank net interest margin (NIM) to the lowest level in recent history. With loan-to-deposit ratios dropping below 70%, NIM falling below 3.40%, and underwriting standards easing, the trajectory of future loan margins is clear – pressure will continue to drive commercial loan margins lower. Some community bankers believe that they should not chase loans with lower margins and will wait for credit pricing to improve. We think that is a mistake for the reasons outlined below.

Why Book Loans Now

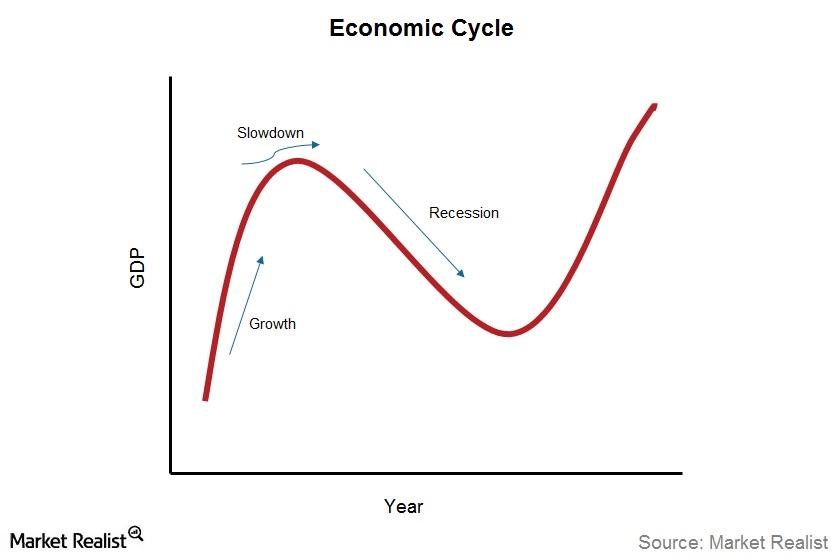

First, in a business recovery cycle, banks need to be more aggressive in taking credit risk. Historically, the best time to book loans is at the beginning of a recovery and as early as possible in the growth stage. The typical economic cycle is shown in the graph below. Banks want to amortize and season their credit as far in advance of a recession as possible. Waiting to book credit closer to a slowdown is not a winning strategy.

Second, the trajectory is clear. Margins are shrinking, and excess liquidity is growing. Waiting will most likely lead to even lower margins and more intense competition. We are not proponents of underpricing credit, but for the stellar bankable deal and solid relationship, the time to book loans is more likely now than in the near future.

Third, every loan proposal reflects a bank’s view of the credit and, even more importantly, the bank’s view of the future of the economy. A bank’s decision to extend credit is a conscious decision about the positive outlook of the economy – banks that hold a positive view of the future of the economy and are maintaining a minimum NIM requirement cannot properly express their economic view and cannot execute on their business model in the long run. Again, this is premised on making enough margin to be compensated for the credit risk.

Fourth, some bankers are holding the line on loan margins to achieve a forecasted NIM or to make minimum earnings. Unfortunately, the alternatives to loans (fed funds and fixed income) result in much lower NIM and earnings.

Fifth, the strongest argument we hear from bankers is that being more selective in the loans booked will result in higher overall NIM and earnings. In other words, waiting for a less price-conscious borrower or a borrower with urgent closing requirements will translate to more pricing power for the bank, and higher NIM and earnings. The analysis and our observation show that this is a fallacy. For every month that a bank does not book a loan, a substitute loan in the future must be booked with a higher NIM to offset the funds that were not deployed (since that cash sat in fed funds or fixed-income securities).

Currently, average loan spreads are 2.19% for community bank commercial credits. We assume a 10-year relationship for a new borrower/loan, and we measured the higher margin required for a future loan for each month that the bank waited. The graph of our data appears below. For each month that a bank waits to book a credit, the loss of income must be made up with a higher margin on a future loan. Waiting one month to book a higher margin loan requires only one basis point in higher loan spread for a loan in the future. But that grows to two basis points per month in additional spread required, then three basis points per month, and eventually six basis points per month. There is an ever-increasing higher-margin required the longer a bank waits to book a loan. If the bank waits a year to book a loan, the credit spread must be 22 basis points higher for the remaining life of that loan to make up for the lost revenue because cash was sitting in fed funds or fixed income. Waiting two years will require the future loan to have almost 50 basis points more loan margin.

Again, we stress that banks must be compensated for acquisition, credit, and origination costs, but once expenses are considered, we stress that community banks cannot hope that loan demand will return and credit spreads increase. Now is the best time to book solid credit quality relationship customers, and cash not deployed today must be deployed at higher margins in the future to make up for missed revenue.

Conclusion

All industry indicators are pointing to a strong economic recovery, and during a recovery banks that book credits early have an opportunity to minimize losses during the next downturn. Banks tout they are all about relationships and that is exactly what they should be managing – relationships. Investing in a relationship that can grow will make a profitable bank. Being transactional and waiting for credit spreads to rebound has not been a successful strategy for banks in the past. There are too many compelling reasons to book commercial loans now despite pressure on credit spreads.