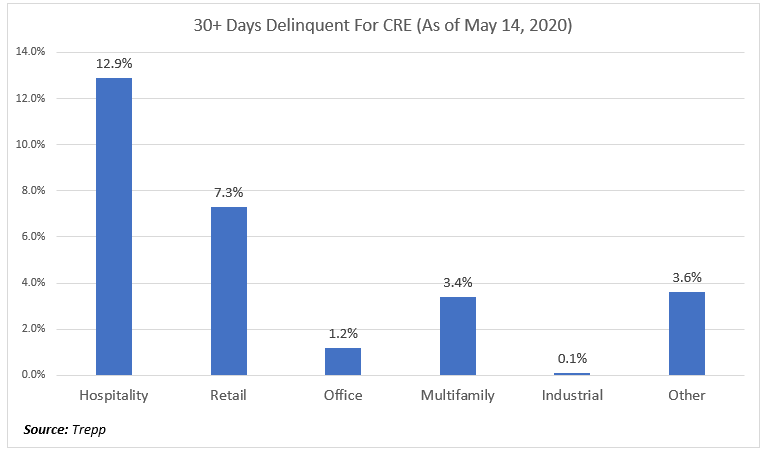

CRE Loan Delinquency Data

While it is too soon to get the data on bank commercial real estate (CRE) portfolio delinquencies and forbearances, we take our benchmarks from the commercial mortgage-backed securities market as of May 14th. As any commercial banker can tell you, hospitality and retail remain under the most pressure, jumping up more than 5x and 3x, respectively. Office delinquencies are up 71%, month-over-month, industrial properties remain relatively unchanged while Other (self-storage, specialty, etc.) is up 3.5x.

A Lesson in Loan Structuring

One item that is not making it into the data below is the number of banks that are allowing their customers to draw on reserve account balances. Banks that were smart with their initial loan structuring and paid attention to our Commercial Loan Documentation tips back in 2016 (HERE) are thankful as they are now allowing their borrowers of higher-risk properties, such as hospitality, to draw on their reserve funds thereby limiting delinquencies.

Oftentimes, in order to allow the borrower to achieve lower than average pricing, or just to offset absolute credit risk, bankers have required the establishment of a reserve fund over a period post origination. Usually, covenants require the payment into a reserve fund once cash flow exceeds a certain net operating income until the reserve fund can meet 90-days or debt service, taxes, insurance and sometimes, special repairs.

Those banks that do have these reserve funds are now allowing borrowers to draw down on them to keep their obligations current.