Managing the Risk Surface of a Loan Given Tariffs

When a bank makes a loan, it’s stepping onto a multidimensional terrain of risk. Credit, interest rate, liquidity, optionality, legal and operational risk all interplay with each other to expose the bank, and the borrower, to a set of risk that can be visualized as a three-dimensional area. Given the current state of the economy, this risk is near an all-time high. In this article, we look at what this risk surface is, who is responsible for managing the surface and how banks can better protect themselves.

The Current Market

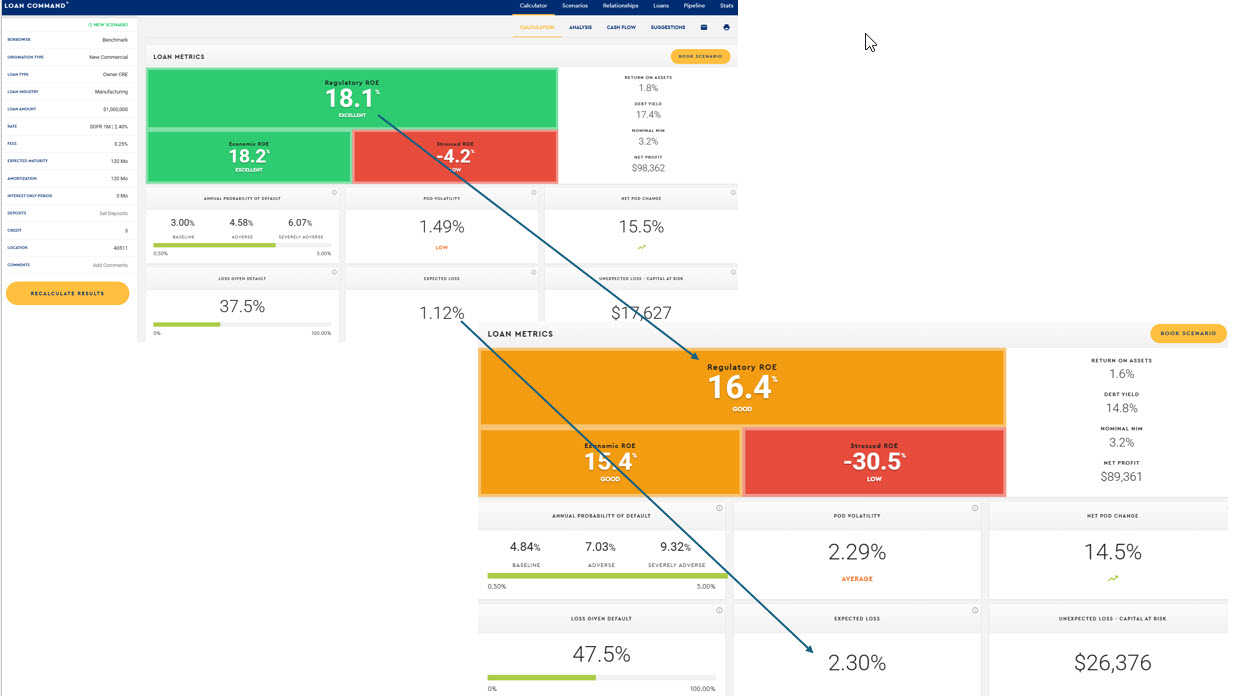

The combination of the trade war, DOGE and immigration has caused a high level of uncertainty that has ushered in volatility. This uncertainty has served to increase bank loan pricing an average of 30 basis points over the past week. Another way to look at this is the pricing output below. The higher credit risk caused by potential supply chain disruption has moved risk substantially up. If pricing is held constant, the higher risk decreases risk-adjusted return from an average of 18% to 16%. What was a 1.12% expected loss (loan loss allowance) has now moved to a 2.30% projected expected loss. This means that many banks, in the span of three weeks, have gone from an over-reserved to an under-reserved situation.

We used our relationship profitability model, Loan Command, to price the same loan, one month apart.

This increase in credit spreads is on top of the interest rate changes. The 5Y Treasury, for example, was at 3.70% at the start of the month and today sits at 4.17%. That is almost 50 basis points of movement that banks making 5Y fixed rate loans are not only loosing out on, but they are not getting paid to take this risk either.

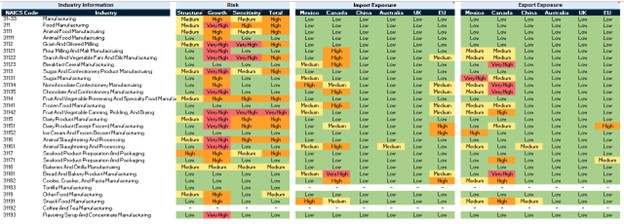

Finally, loan liquidity in every sector has decreased and has dropped to zero in many cases. Tools like the US Trade Tariff Exposure matrix from IBISWorld help us manage the potential future outlook for each industry thereby allowing banks to adjust credit allocation and pricing.

What is the Risk Surface of a Loan?

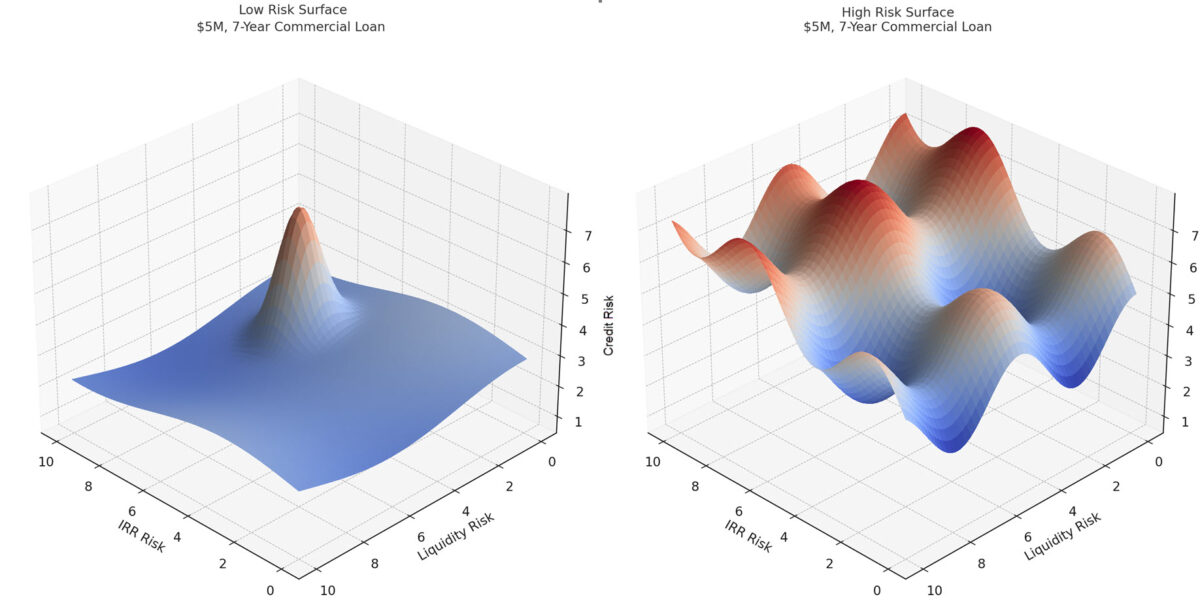

Imagine the risk of a loan as a three-dimensional landscape where each axis represents a different type of risk: credit risk (the chance the borrower won’t repay), interest rate risk (the risk of adverse changes in market rates), liquidity risk (how easily the loan can be converted to cash or sold), and even other factors like operational, regulatory, or market risk.

Each point on this surface reflects the combined intensity of those risks for a given loan or loan portfolio. A flat, low-lying surface might represent a well-collateralized, floating-rate loan to a government entity. That is, a loan of this nature has low credit, interest rate, and liquidity risk. Conversely, loans to companies with more volatile earnings, fixed rates loans without prepayment penalties, and limited secondary markets, the surface starts to rise sharply. It becomes jagged, volatile – it’s a mountainous terrain of risk.

In modeling, a risk surface allows lenders and analysts to visualize how risk accumulates and interacts across different dimensions. Rather than seeing risks in isolation, the surface helps reveal how a small change in one area say, a rise in interest rates could dramatically increase the total risk of the loan by impacting credit and liquidity.

For example, a 7-year fixed-rate commercial real estate loan may seem stable at origination. But if interest rates rise quickly, or if the property’s value declines (raising credit risk), or if the market for selling such loans dries up (increasing liquidity risk), the risk surface becomes steeper signaling a more vulnerable position to a bank’s capital.

By mapping loans across this surface, banks can more effectively compare loans, price them appropriately, and allocate capital based on overall risk not just the perceived risk in a single category.

In this way, the “risk surface” becomes a tool for holistic risk awareness – one that helps decision-makers see beyond spreadsheets and into the complex topography of lending.

How the Current Market Impacts the Risk Surface

Whenever volatility consistently increases, alarm bells go off at banks. Over the last week, market volatility has more than doubled and loan pricing has dramatically increased. Some lending markets, such as hospitality, retail and construction have completely dislocated. Liquidity, as a measure of risk, has gone to near-zero.

Interest rate swings of 15 to 20 basis points and credit swings of 10 to 150 basis points during the day have placed many loans in a negative value position.

What was the loan on the left with a single borrower default scenario now becomes the loan on the right with many ways to fail. The weaker the structure of the loan (fixed rate, adjustable, lack of prepay protection, no covenant driven pricing adjustments, etc.), the more uneven the risk surface will be.

The goal of bankers is to set your risk envelop and ensure you get paid for that risk. What you want is not only more low risk loans like the one on the left in times like these, but loans that maintain that shape during market stress.

This likely means:

- Limiting interest rate risk in loan structures to include the onboarding of loans

- Ensuring adequate yield maintenance and prepay provisions on the loans

- Understanding the credit risk changes in each sector

- Be more dynamic with pricing to align with risk

- Limit balloon structures where possible or place outside the 66-month mark so the loan can season and risk moderate

- Ensure you have a relationship profitability model to calculate risk-adjusted return on capital

The Interesting Question – Who is Responsible for the Risk Surface?

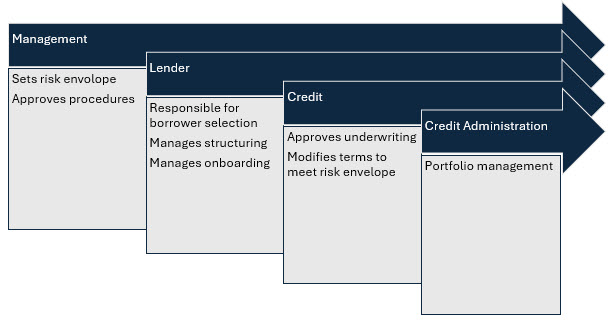

Understanding who is responsible for the risk surface starts to solve the problem around how to manage the risk surface. The answer is that executive management is first and foremost responsible for setting risk targets and procedures, so you don’t end up with the loan on the right. What and how much credit risk to take on, how much fixed rate exposure you want to take and how you allow your lenders to structure and onboard loans has the greatest impact on a loan’s risk surface.

For example, last month when we published a similar article, we noted that interest rates are likely to move plus or minus 100 basis points this year. Now, that number is closer to 300. As such, longer-term fixed rate loans or procedures that honor holding the rate for the borrower constant for 90 days now has an outsized impact on loan value. The same is true for banks lending to certain credit sectors.

After management, lenders/relationship managers have the next largest influence on risk and are responsible for managing the risk of the loan from structuring to booking. Even if management allows it, it is irresponsible to choose to hold a fixed rate, instead of a spread, constant for an extended period when interest rates are so volatile. The same is true for credit. While management or your credit group may not tell you to decrease credit to your manufacturing clients, lending should be slowed until the bank, and the borrower, better understands the risk of supply chain disruption.

After the lender, the underwriting function of the credit group, has the next largest impact. This group ensures that management’s risk targets are met. The issue, however, is once they get a loan for underwriting, there is a limited amount of influence they can have other than turning down the credit.

Finally, the credit administration of a bank has responsibility. While this group can have the largest impact on credit, once a loan is onboarded, credit administration has few levers that it can pull to impact a loan’s outcome. The better job management and the lenders do, the more efficient credit administration can be. In cases, where the lender also serves a credit administration role, limited your risk upfront is doubly important. Not only will poorly structured loans create risk, but it will also take lenders off the line from producing future revenue.

Conclusion

Everyone is a risk officer at a bank. Understanding the risks in this market and taking responsibility for managing loan risk is more than the credit group’s responsibility. As our past chairman used to say, “our bank is for sale every day.” Saddling your financial institution with long-term fixed rate loans without interest rate management, volatile credit and poor structured loans ends up hurting the risk-adjusted return on capital and could force the bank into a sale, or worse.