Office Lending – Here is Why It is Not as Bad as The Market Thinks

Between now and the end of 2027, it is estimated that $2.2T of office loans is coming due. Much of this product lies on banks’ balance sheets. A high percentage of those office loans on banks’ balance sheet are balloon structures where the bulk of the loan’s principal is due. Equally worrisome is the large number of loans on banks’ balance sheets that are due for a rate reset where the interest rate will be almost double, thereby putting stress on borrowers. There is some good news, however. In this article, we highlight the state of the bank commercial real estate office lending sector and make an argument about why banking might be better off than most analysts think.

The State of Office Lending Risk – Traffic

2024 will mark the fifth consecutive year where office demand has declined. Compared to 2019, lower office attendance is one of the main drivers of lower space requirements by small businesses and corporations, a fact that has dramatically curtailed office lending. However, lower demand is just one of many factors. To understand the state of office demand, we first turn to an interesting data set (below) that can help bankers triangulate office usage.

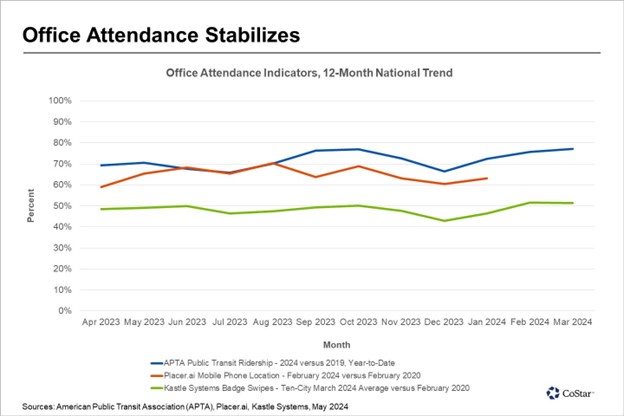

Public transit ridership is one metric we track. Though transit passengers include more than office workers, ridership comparisons over time provide insight into traffic coming into urban centers. The American Public Transit Association, or APTA, provides up-to-date weekly estimates of transit ridership that bankers can follow to include in their underwriting. APTA’s data shows that transit ridership in the U.S. has risen 10% over the past year.

Banks can glean another interesting view around office lending by looking at cell phone data. Just like we use in our branch profitability model, we can look at cell phone traffic coming in and out of most office buildings. Placer.ai built an index around this, and it shows that since early 2023, the number of workers in these buildings has hovered between 60% and 70% of the level of activity seen before the pandemic in February 2020.

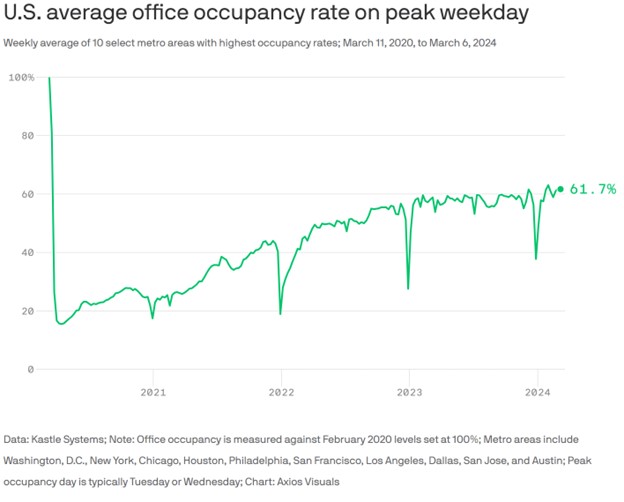

A final source of insight comes from Kastle Systems, a building access control platform. Kastle’s data shows that badge swipes from workers entering office buildings have recently increased to over half as many swipes as in February 2020. Current usage is pegged at 61.7%. Badge swipes have been on an upward trend that should continue.

If you add these metrics, office attendance has stabilized nationally and started to trend higher in 2024.

Lease Space Coming Due

Part of this trend is due to the expiration of office leases executed before the pandemic. CoStar estimates that about 45% of the office square footage leased before April 2020 has yet to be renewed. Thus, building lessors have not yet had the chance to adjust the size of their actual needs.

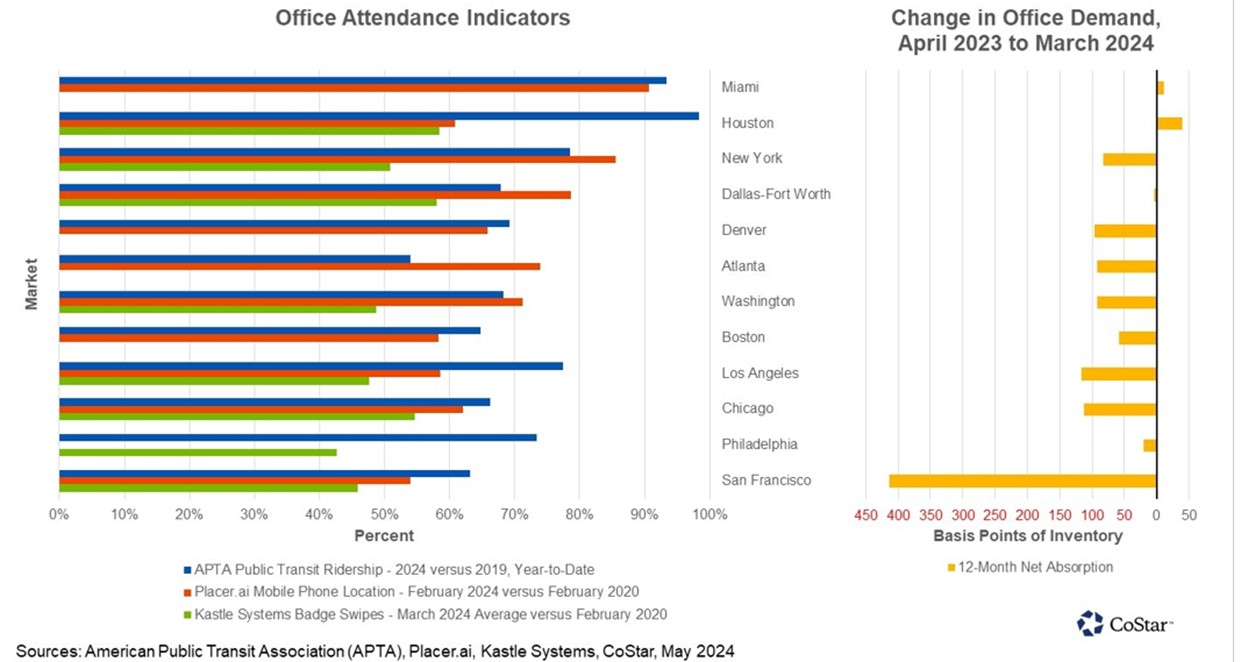

As seen below, the correlation between office attendance and change in office demand is not always correlated. It is in locations like San Francisco and Miami but less so in Philadelphia.

Attendance in Philadelphia is relatively low, yet office demand has held up, and delinquencies remain controlled. One factor in building the model is the “peak-day” attendance issue. There are more workers in the office on some days than others. These days, peak attendance usually occurs on Tuesdays, followed by Wednesdays and Thursdays. The higher the peak attendance, the more likely a lessor will renew their lease. Thus, it is not the average attendance where employers judge space considerations but peak attendance.

Office Lending and Usage

Due to the Peak Day syndrome in office risk, employment is a larger part of bank credit underwriting. In addition to looking at attendance, placing more emphasis on projected employment and locality job creation is now critical for risk profiling.

The Bureau of Labor Statistics shows that aggregate employment in the significant office-using sectors is up only 0.2% in the past year. This is well below its average rate in the 2010s. With low growth, most lessors and office owners do not have the catalyst to add space.

As can be seen below, the net result, based on CoStar data, is that we expect office rents to continue to fall and capitalization rates to continue to rise until late 2025, should the economy remain stable.

On the good news front, the supply pipeline continues to decline. Groundbreakings declined to below 300,000 square feet in the nation, the lowest volume on record. Overall inventory will also continue to decline as inventory removals outpace completions. As such, there is a balance of supply vs. demand.

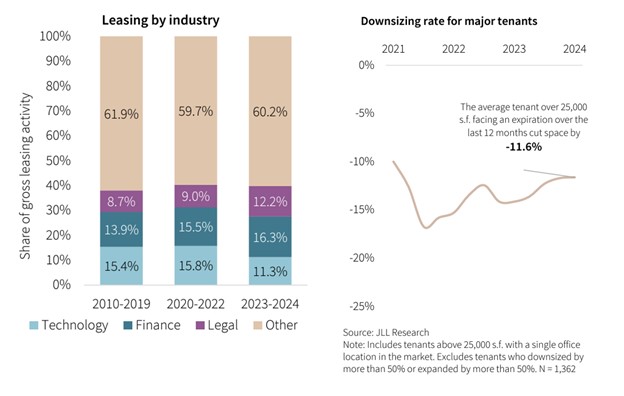

Because of strong corporate earnings and substantial employment, the office market is getting a reprieve from a full-fledged downturn. While technology companies continue to downsize, certain sectors, such as financial services, lawyers, and insurance, continue to increase demand for space.

While we have suggested in the past that banks write to a 40% to 50% vacancy stressed rate in urban markets, the reality is that most lessors have been giving up only about 12% of space (below).

The good news is that tertiary markets have performed better than secondary markets, often better than urban core markets. This fact is a positive for banks since this is the bulk of their lending. Banks are not lending on double tower skyscrapers in the middle of Manhattan, yet those buildings garner the bulk of the media attention.

Medical office buildings, another favorite of banks, have demonstrated consistent occupancy. Further, owner-occupied properties have retained much more value than multi-tenanted ones. This also is a net positive for banks and underscores the point that banks may need to get more granular in their sector categorization.

Putting This into Action

While the office sector has an array of risk factors, it is not a foregone conclusion that office loan losses for banks will be as catastrophic as most pundits believe. Leasing activity is on pace to be about 10% better than 2023. While these leases are for lower square footage, they are only about 12% lower. While net operating income and debt service coverage will be down from most banks’ underwriting, the loans remain current. Capital remains plentiful, corporate earnings are strong, and the economy looks stable. If this can continue, lower supply caused by the current halt of new construction and conversion activity should bring the risk more in line with the bank’s desired profile by the end of 2025.

There is a bias to the upside in our forecast. While many employers will remain hybrid and remote, many more will require more of their workforce to be in the office for productivity reasons. In addition, overall office-using employment has grown more than 6% since the pandemic began and continues to trend upwards. The office use trend will eventually bring vacancies back to normal. As demand continues to grow and new inventory is limited, better credit conditions are on the horizon. While office lending could be the next bubble that bursts and throws us into a recession, there is a higher probability that office lending will heal in a measured and gradual manner.