The Problem With DSCR and LTV in Lending

Many community banks today are willing to underwrite real estate secured loans on just two metrics: debt-service-coverage ratio (DSCR) and loan-to-appraised value (LTV). Banks typically approve credits above 1.20x DSCR and below 75% LTV – with many loan-specific factors that may skew these acceptable levels. For competitive reasons, we see banks dipping to 1.10X DSCR, and some deals are approved at 85% or even higher LTVs. However, in today’s interest rate cycle, banks must alter their acceptable underwriting standards in two ways: 1) add debt yield as another credit metric and 2) rethink the minimally acceptable project DSCR. We will consider the minimal project DSCR in this article and cover the debt yield topic in future blogs.

Why DSCR and LTV are Misleading

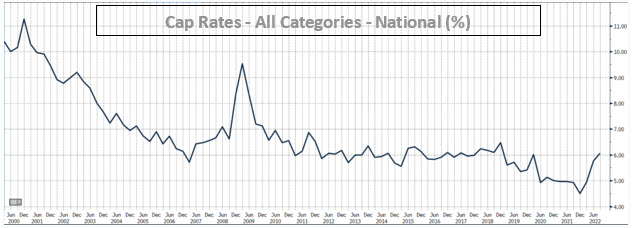

Many banks believe that 1.20x DSCR and 75% LTV are good credit safeguards and that credits that started at those levels were unlikely candidates for special asset management. However, in today’s economy and rapid interest rate changes, the 1.20x and 75% LTV are highly misleading measures, and the reason for this is the expected increase in currently low real estate capitalization (cap) rates. Cap rates were at historically low levels for several reasons, including an extraordinary amount of monetary stimulus, low-interest rates, and hyper-liquidity in the banking sector. Still, all of this is expected to change. Below is a graph showing national cap rates for all categories of real estate nationwide.

Cap rates started to increase with the increase of the benchmark 10-year Treasury rate. The current cap rate for all real estate categories is 6.06% – an increase from the 4.50% nadir reached in December 2021. The average cap rate from 1993 to the present is 6.79%, and the high is 11.27%.

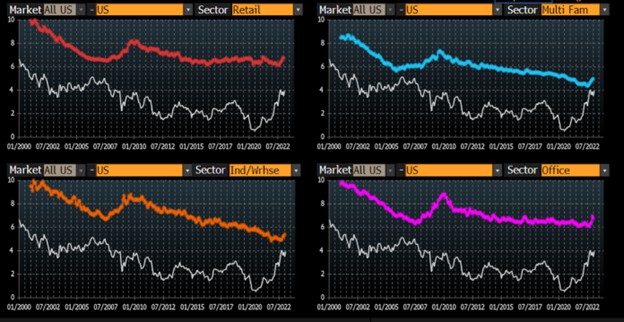

Cap rates for different categories of real estate vary (see graph below). Hospitality is currently at 8.2%, retail at 8.6%, multifamily at 4.99%, industrial/warehouse at 5.40%, and office at 6.8%. As shown in the graph below, cap rates for all categories are increasing. The white line in the graph below represents the 10-year Treasury rate, and historically cap rates increase with the increase in this benchmark rate, albeit with a lag.

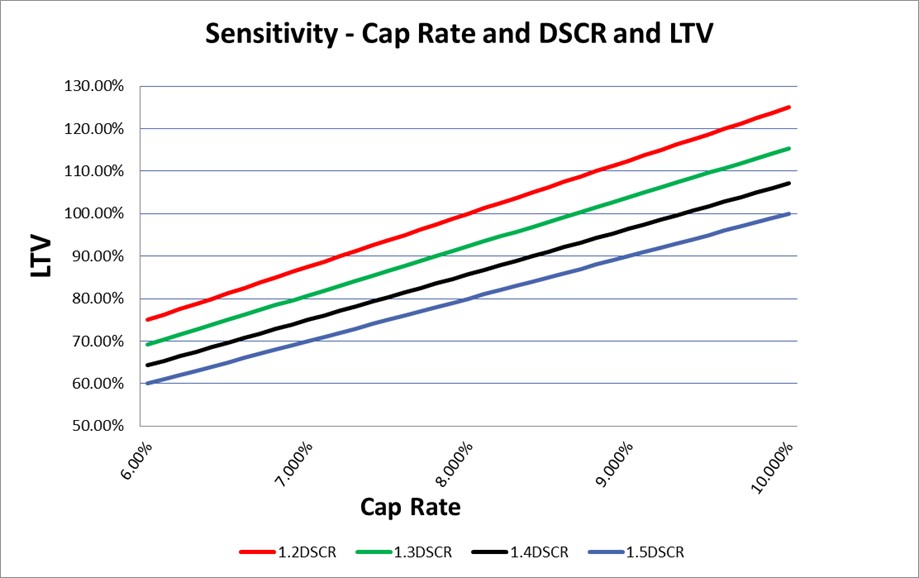

As cap rates rise in the future (which they will), the value of the real estate collateral will decline, and the lender’s secondary form of repayment will erode. This phenomenon explains why there is only one source of loan repayment: cash flow. Increasing cap rates (decreasing real estate values) have different impacts on lenders depending on the starting or expected DSCR. In a lower cap rate environment, banks must insist on higher project minimum DSCR to have the same quality credit versus in a higher cap rate environment. Below is a graph showing the sensitivity of different DSCR loans, all starting at a 6% cap rate (6.5% fixed rate loan on a 25yr amortization). The lower the starting DSCR, the faster the LTV reaches 100% as cap rates increase.

The graph above shows that loans with 1.20x DSCR will experience collateral coverage shortfall and cash flow impairment if cap rates move from today’s 6.00% to historical average levels. The 1.20x DSCR, 75% LTV loan in today’s 6% cap rate environment becomes a 100% LTV loan if cap rates move to just below 8.00%. This all occurs without any change in NOI or interest rate levels. Any decrease in NOI or increase in interest rates degrades credit quality further.

By contrast, the 1.50x DSCR loan will not break 100% LTV until cap rates rise to just over 10% (above standard recession cap levels). The issue in real estate lending today is that while LTV and DSCR are highly correlated metrics (which is bad in that they measure the same variable – cash flow), both are under pressure in a competitive lending environment, and lenders should not be accepting lower DSCR and higher LTV. Loans booked today with minimal cash flow cushion in a low cap rate environment, and still, by historical standards, low-interest rates are the worst possible combination for banks. Some banks are originating loans with very little room for error – low-interest rates, low cap rates, low DSCR, and high LTVs all point to highly vulnerable credits from every conceivable angle.

Conclusion

Banks should focus more on the interplay between DSCR and LTV because both are driven by cash flow (NOI). The relationship between cap rates, interest rates, DSCR, and LTV are all now conspiring to make real estate lending especially perilous. Furthermore, community banks should embrace one additional metric that national banks have used to measure the health of their real estate portfolios – debt yield. In a future article, we will analyze how debt yield can help community banks correctly measure the interplay between cap rates, interest rates, and cash flow.