Current Commercial Loan Pricing, Opportunities, and Risks For Banks

The Covid-19 pandemic has decimated the US economy, and the recovery may take longer than initially suspected. However, currently, community banks have an opportunity to identify and win or retain longer-term, credit-worthy relationships at better credit spreads. There are also substantial challenges facing the entire banking industry. One major challenge is to understand is that solely pricing for credit risk is almost certainly a losing strategy in the long term. In this article, we give a current update on pricing and risk and explore other alternatives to managing lending in this environment.

Current Pricing Environment

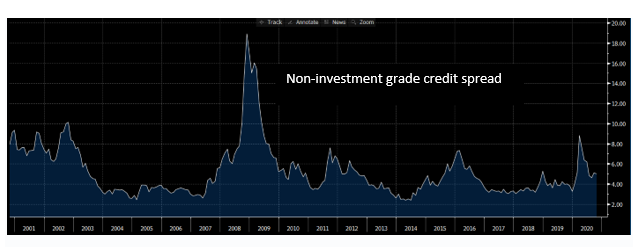

The graph below shows the broadest measure of credit spread for non-investment grade credits month-by-month for the last 20 years. The vast majority of community bank loans are to non-investment grade credits; therefore, the graph below is a good proxy for prevailing credit spreads in the broad commercial market.

The graph shows that credit spread (to Treasuries) for non-investment grade credits is 115bps higher today than the pre-pandemic level, but is still low by historical comparison and below the historical average. Therefore, banks have an opportunity to book credit spreads that are wider than pre-pandemic, but much narrower than one would expect to earn during an economic recession – comparing current spreads to those prevailing in the recessions of 2001, 2007, and even the financial turbulence of 2015 and 2016. It appears that banks are not being fairly compensated for taking credit risk in this uncertain economic environment. This is precisely what we see in risk-adjusted return on capital (RAROC) modeling. Any properly calibrated probably-of-default and loss-given-default are showing that market-driven loan pricing results in a sub-12% return on equity (ROE).

Breaking this down further, as of the end of September, for banks alone (those loans not reported to the public markets like the above data) the average Risk Grade “4” loan had a spread of approximately 2.12%, While the average Risk Grade “5” loan was 2.54%. These spreads mean three things:

Margins: Bank’s risk-adjusted net interest margins are now well under 3.00%;

Wtd. Avg. Yield: The weighted average new yield, to include fees and excluding PPP loans, will likely be below 3.00% in the fourth quarter.

Quality Borrower Competition: The difference between these two spreads have increased as banks focus on those quality borrowers that have benefited by the pandemic or are only lightly impacted. A majority of loans over 2x debt service coverage are usually in the 2.25% range or below as are loans over $5mm.

The question is this – “is the current pricing environment presenting community banks with an opportunity to book adequate return versus risk?” We believe that the answer is an absolute yes if banks are pricing for relationship and lifetime value, versus emphasizing return based on credit risk.

Risk-Return Analysis

Most bankers are familiar with the concept of risk-return trade-off (see graph below). That is, potential return rises with an increase in risk. Lower-risk assets pay lower returns, whereas higher-risk assets pay higher returns. But return does not translate to profitability – for various reasons, but most importantly, credit losses. Historically credit risk in banking has not yielded adequate return for capital at risk.

Bankers want to get loans above the red line and avoid loans below that red line (get a higher return for the risk taken, or take the lower risk for the same return). The analysis shows that mispricing occurs much more frequently on more risky credits than less risky credits. Bankers tend to underprice higher risk loans to a greater extent than lower-risk loans, especially in uncertain economic environments – the case today. This makes sense for a number of reasons:

- Riskier credits have a wider dispersion in performance (the distribution around the expected probability of repaying is wider), leading to more possibility for mistakes.

- Credit risk is a distant cost, while yield is immediate gain. Humans tend to favor immediate gratification at the expense of a remote cost.

- Bankers are typically paid incentives for higher yield, but the bank’s shareholders must pay for future credit mistakes. This is a classical agency/principal dilemma.

- Competition is continually leading us astray in pricing. The old adage in the industry has been that you can only perform as well as your dumbest competitor. If your competition is underpricing risk, the borrower is more than willing to take someone else’s capital, and your only choice is to lose that loan. It is more likely that some lenders will inevitably make a risk analysis mistake on the riskier loan than the less risky loan.

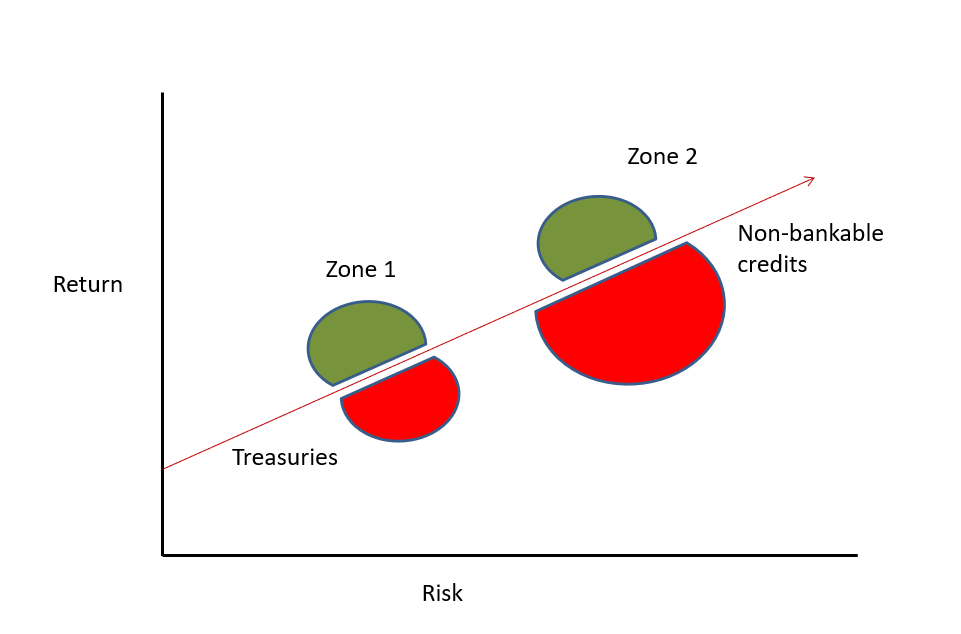

Because of the above factors, the risk-return trade-off actually looks more like the graph below. On the far left of the graph are securities (with next to zero risks and meager return), and on the far right of the graph are non-bankable credits. A banker’s job is to find where between zone 1 (less risk credit with lower return) and zone 2 (higher risk credit with higher return) the bank should deploy its capital. Unfortunately, the red semi-circle in zone 2 is quite large, and many banks get trapped in the game of wanting to outwit the market (gain additional NIM without taking the additional risk to obtain higher yield). Bankers vying for credits in zone 2 are more likely to be in the red semi-circle than the green semi-circle.

In today’s market, bankers are much better off to compete for less risky credits because those credits are more efficiently priced for their risk, given the current unknowns in the market. We believe that bankers should be emphasizing the ultra-strong obligors (2.0X DSCR, 50 to 65% LTV, and 9 to 10% debt yield), thereby reducing credit risk to the extent possible and pricing for long-term relationships and high lifetime customer value. Of course, these customers come with lower credit spreads but given investment alternatives, these loans are probably the best current use of capital available at scale.

Conclusion

While the casual observer may believe that the current market allows banks to obtain above-average credit spreads, reaching for those spreads in an uncertain business environment is the exact wrong decision. Banks should be targeting the very best credits for long-term retention, and those clients are highly contested, translating to lower yields for lenders but higher long-term ROE.