How to Use FTP For Deposit Gathering and Profitability

Over the last few months, we have been hosting dozens of banks to lender lunches across the country. At these lender lunches we discuss credit and pricing trends, deposit gathering strategies, loan pricing and structuring, and fee generation opportunities for community banks. While we will author a separate article about what we heard from community bankers and topics discussed, almost all community bankers in attendance expressed an interest in honing and refining their deposit gathering strategies. In this article we will discuss how community bank managers can propel profitable deposit gathering through the implementation of Fund Transfer Pricing (FTP) for their relationship managers portfolio profitability analysis and incentive pay.

Fund Transfer Pricing

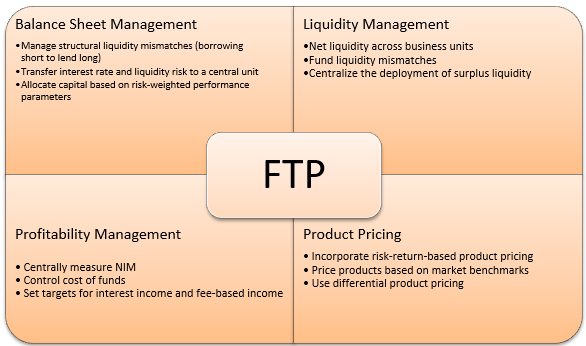

We have written about FTP and how it relates risk measures and profitability analysis. FTP measures interest rate, credit, and liquidity risk and enables costs to be transferred from central treasury functions to the bank’s products and business lines. Fundamentally, FTP divides a bank’s overall NIM into two major sub-margins (one for deposits and one for asset origination). Banks can then measure the economic value obtained from each action taken separately. FTP can also be extended to provide other analytical tools, as shown in the graph below.

FTP and Deposit Gathering

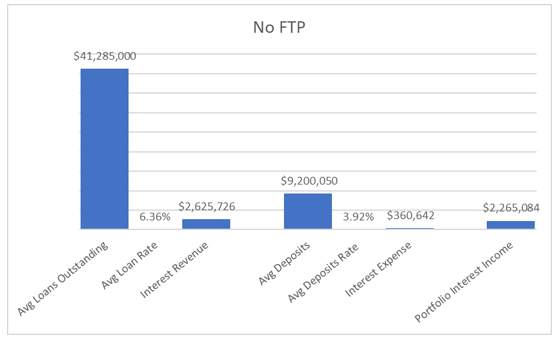

Let us consider a live example of a relationship manager at a bank that we work with. This RM had a $41mm loan portfolio and $9.2mm in deposits. The loans earned an average of 6.36% (roughly SOFR plus 2.49% credit spread to term) and the deposits cost the bank 3.92% (mostly CDs and high yield MM accounts). Without FTP the RM’s portfolio interest income (before overhead, credit costs, and fee income) is $2.3mm – not bad for one employee. The breakdown of the portfolio is shown graphically below.

The above is an incorrect representation of the RM’s contribution to the bank, and it would also be a poor calculation of profitability to motivate this RM to find deposits in his portfolio and for new deposit business gathering.

Without considering FTP, the bank is subsidizing the RM’s loan portfolio with the bank’s other deposits. This RM is a net funds user and must be charged for deposit cost that the bank incurs based on a transfer cost – also called FTP for deposits.

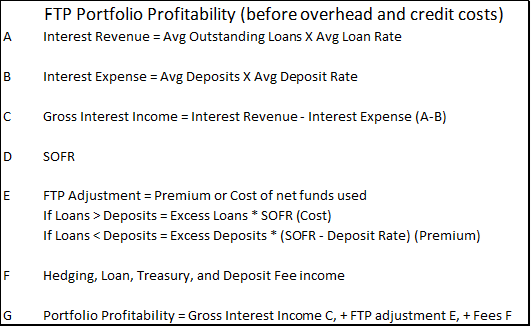

This RM’s bank uses the formula below for calculating FTP portfolio profitability (before overhead and credit costs).

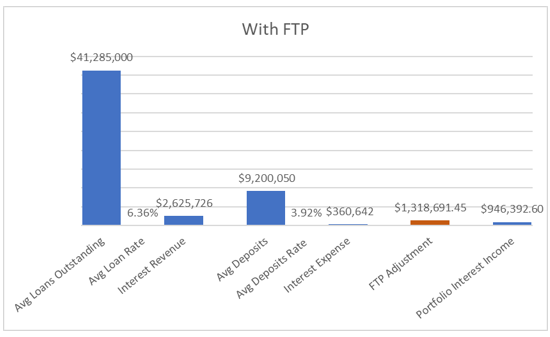

This calculation makes sense, and we can now apply the benefit and costs of loans and deposits for this RM and calculate the FTP adjusted portfolio interest income number as shown below.

The FTP interest income calculation drove the RM’s behavior by highlighting the benefit of deposits (both volume and cost) for the bank’s income. The RM has a bonus structure tied to portfolio interest and fee income – the RM is motivated to maximize personal gains and the bank’s gains because the two are now aligned. Asking RMs to bring cheap deposits may work, but aligning the compensation structure to the bank’s targeted goals works much better.

Utilizing FTP allows bank management to allocate profits differently between lending and funding teams, and it allows management to motivate behavior that is more favorable to the bank. Further, while lenders do not dismiss the value of the deposit cross-sell, allowing lenders to participate in upside of bank’s success drives harder work and attention to what matters for the bank.

Conclusion

Community banks should consider incorporating a simple FTP model for appropriate product pricing and incentive compensation. Incorporating an FTP framework can change the understanding of the makeup of interest income, motivate lenders to cross sell cheaper deposits, and contribute to the bank’s economic profitability.