Customer Satisfaction – How To “Wow” Your Customer in Banking – Part I

While we believe in “Wowing” your customers as a concept, we don’t believe in it as a strategic focus as a bank. The idea is too challenging to execute. However, we do believe that every banker should understand what “customer delight” (we will use interchangeably with “wowing”) quantitatively looks like so delight can be operationalized. This article proposes several frameworks for what “wowing” looks like and provides a path to improve customer satisfaction.

Customer Satisfaction – The Intangibles of Customer Delight

When most bankers attempt to define what wowing looks like, it turns out to be akin to pornography – it’s hard to define, yet everyone knows it when they see it. Hundreds of banks attempt to wow their customers by sending birthday cards, banking anniversary cards, offering chocolates at the teller window, and providing a free month of interest on their consumer loans.

If you boil down these examples, you end up with a definition that being delightful is providing an unexpected amenity in addition to superior service. Pioneered by the hotel industry, many banks have copied this tactic, but none have been able to scale it.

Once provided, these amenities are both copied and become expected. The wow factor is decreased. There must be a better definition.

Better Than Customer Satisfaction

Often, banks confuse above-average customer satisfaction with customer delight. Can wowing your customer just be defined as exceeding expectations?

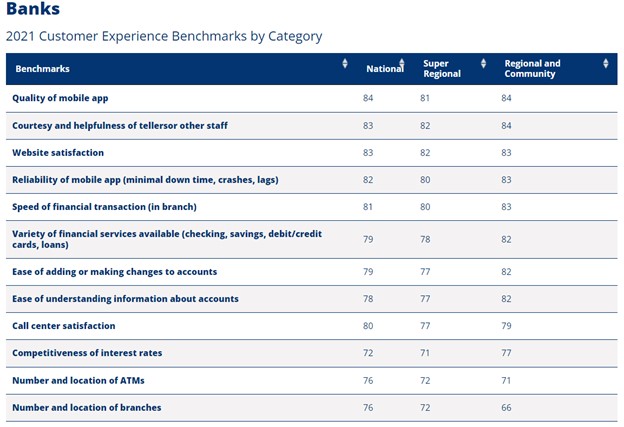

Here, most banks either use a Net Promoter Score (NPS) or a Customer Satisfaction Score (CSS). While both are sufficient but not great, at least it is a start. Banks often benchmark themselves to the categories and classes below published by the American Customer Satisfaction Index.

To track if they are wowing the customer, banks compare their score to the benchmark. The average for community banks last year was a composite score of “80.” Thus, if a particular bank’s score were “85,” they would claim they are wowing the customer.

We are all for tracking either NPS or CSS, but every banker should understand the limitations. Scores can be manipulated, terms are often vague, rendering inaccurate results, NPS is often too simple to be instructive, and CSS is often too granular and annoys some customers.

While we do recommend that CSS is an excellent place to start if service quality is essential to your bank, above all else, we are not convinced that above-average satisfaction and wowing your customers are the same. At the start, our premise of wowing was defined as delivering an unexpected benefit to the customer. We can all agree that you can have above-average customer satisfaction scores but deliver no unexpected benefit.

Using Disconfirming Theory in Customer Satisfaction

Some banks twist customer satisfaction to get to customer delight and use a disconfirmation scale relative to satisfaction questions. Here, customers are asked to rate whether a product or service was worse, the same, or better than initially expected (below).

While this is a little closer to delivering an expected benefit, having an unexpectedly positive experience may have more to do with low expectations than the bank providing “delight.”

Customer Satisfaction, Delight, and the Emotional Wheel

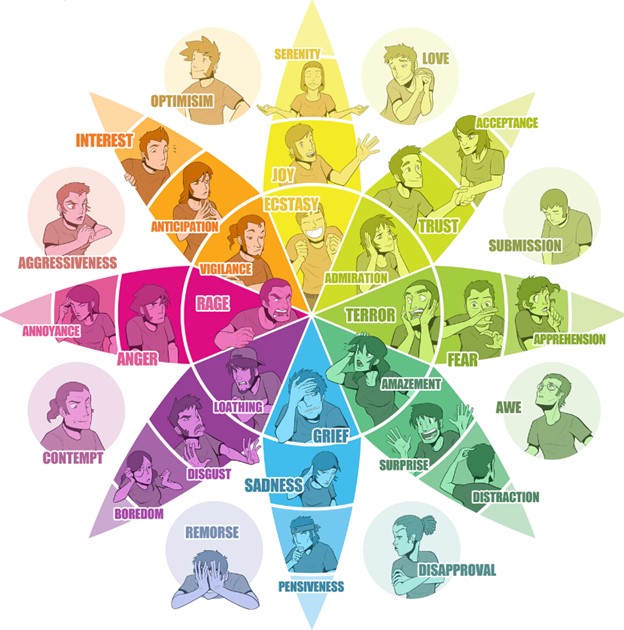

While disconfirmation theory frames wowing your customer as a combination of expectations and experience, a famous psychologist, Robert Plutchik, puts forth his Theory of Emotions. The theory identifies the eight emotions in the center below (we reprint our favorite anime version from the Ad Planner’s Pocketbook below).

Plutchik arranged these basic emotions in a circle as part of his psycho-evolutionary framework and expounded that these emotions come in pairs (thus sitting opposite each other). These emotional pairs cannot be felt at the same time (e.g., joy and sadness). Secondary emotions such as love are combinations of Joy and Trust.

The closer an emotion is to the center of the wheel, the more intense the feeling. For example, anticipation and surprise make customers want to share social media content. A combination of surprise and sadness or anticipation and anger makes customers defect to another bank.

By evoking these emotional dyads, bank marketers and product managers can target the customer’s actions. Thus, you can lay the foundation for evoking customer delight by creating “customer moments” such as Joy/Trust, such as the famous Mastercard Priceless campaign. The same is true for banks targeting the pairs of Joy/Trust, Fear/Trust, Fear/Surprise, Sadness/Surprise, or Anticipation/Joy.

All these dyads can form the basis of creating those wow moments, and the theory goes that bankers need to have intent on creating situations that result in customer delight.

Aroused Pleasantness and Product Layers

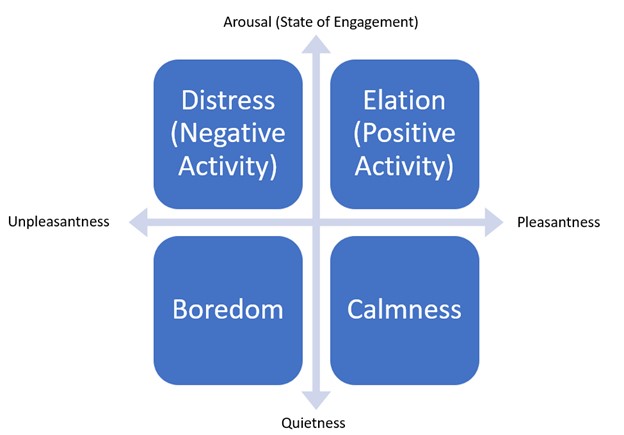

In a similar fashion, other banks simplify the emotional wheel and use a two-dimensional matrix created by JA Russel back in 1979. Russel’s theory provides us with an “affect circumplex” framework based on the four emotions of arousal, pleasantness, quietness, and unpleasantness.

To create the customer wow factor, banks need to move their products, marketing, and touchpoints to the upper right. Evoke arousal and pleasantness enough times, and your customers will never stop using your bank.

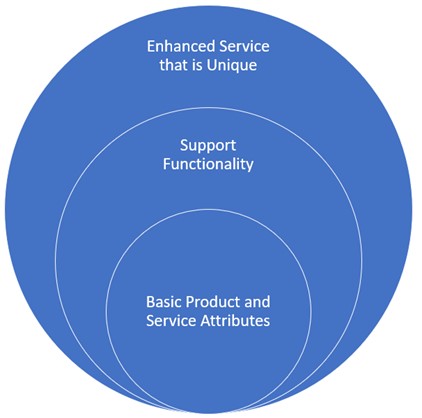

Bankers have executed this theory by looking at each customer journey within a product and service delivered and then mapping the attributes back to one of three areas.

The goal is to satisfy the customer’s basic needs by providing an array of attributes that get the job done. Then laying on attributes of support that provides a high level of customer satisfaction. Finally, bankers design attributes and processes for each customer journey that does nothing but provides a unique experience in the form of an enhanced service.

By ensuring that each product or service has three or more touchpoints for enhanced services, banks can be assured that they are generating customer delight.

Kano Modeling

Finally, some banks employ the “Kano Method,” which is similar to the previous product layer model but with the injection of more rigor. In the Kano model, a product or service features are defined as such:

- Delighting: The attribute provides additional satisfaction when present but does not harm when absent.

- Performance: The more of the feature, the better.

- Must Haves: Lack of the feature would lead to dissatisfaction.

- Indifferent Attribute: A feature that customers don’t care about and doesn’t increase or decrease customer satisfaction.

- Reverse Feature: Including this feature leads to dissatisfaction.

- Questionable: It’s unclear whether this feature adds or detracts from satisfaction because of conflicting responses from customers.

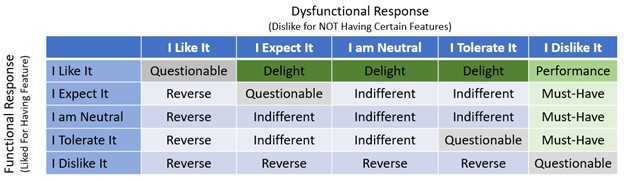

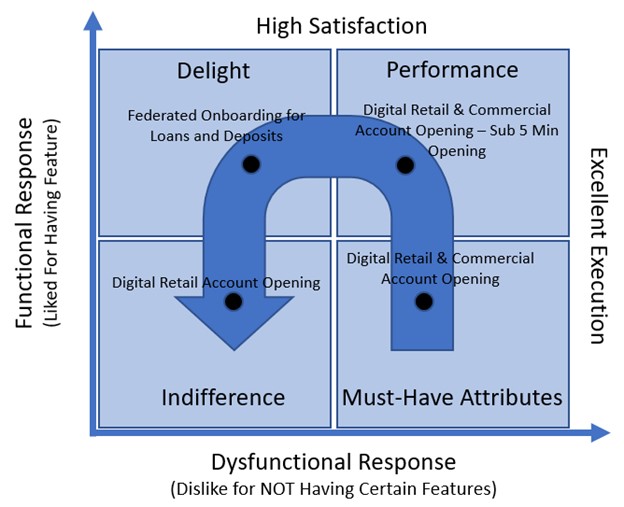

Under the Kano model, delight happens when a feature is present, but they are not upset when it is not included. Further, some features should not be added as they cause disutility. These six attributes can be laid out in a matrix (below) to allow bankers to better understand when a particular feature is included and not.

For example, digital account opening for retail and commercial is now a “Must-Have” product for banks. Being able to utilize third-party data to allow customers to open an account online or mobile in under five minutes is now a performance feature. Having the technology for creating a single application for multiple products to include loans, deposits and fee income lines is what is now delighting customers. Just having retail account opening online has now sunk to a place of indifference when trying to impress customers.

This brings up one of the main teachings of the Kano Model. Over time, all product or service attributes sink to a point of indifference. Worse, some attributes go from generating delight to being dysfunctional in their response outcome. That is, a bank is better off by not having the attribute in question. Chained pens in branches are a classic example. What was a positive functional “must-have” now generates negative emotions when present.

The feelings around overdraft protection, paper checks, remote deposit capture, wires, and a whole array of other banking products all follow the Kano Model and are becoming hurtful to banks.

Putting This into Action

The key takeaway for bank managers, marketers, and product managers is to understand the essence of what it might take to consistently wow your customer while delivering above-average customer satisfaction.

To delight the customer, there must be an element of surprise and unexpectedness that considers at least some elements of joy, surprise, trust, and anticipation. To offer a customer experience that goes beyond satisfaction, bankers must view the customers (and employees, for that matter) through these lenses.

In a forthcoming article, we will take these concepts to the next strategic level and show banks an easy way to operationalize these lessons at scale so that your bank can offer greater delight to its customer consistently and across the enterprise.