Using Data in Banking – Get This Framework

One challenge in banking is that many banks know data is the bank’s future but lack a data framework. As a result, their progress in leveraging data and machine learning is slow. In this article, we explore what a data strategy looks like, how that translates into tactics, and how the “Next Best Action” should be a near-term goal to build towards.

Using Data in Banking

While making decisions based on experience and intuition is easier and faster, it is often inaccurate. The problem is that it is hard to know when to make the effort to use data or not. Data-driven decision-making is often superior to relying solely on intuition or opinions. Misleading narratives can easily sway decisions based purely on the latter. Often, these narratives come from the highest-paid person (HIPPO), making it difficult to challenge them without concrete evidence.

What a Data Strategy Looks Like

First, let’s state that you likely DO NOT NEED A DATA STRATEGY. A “data strategy” is a concept sold by vendors, consultants, and some misguided banking schools to make banks feel empowered. A “strategy” implies that you are doing something different than your competition to drive value. That is not what banks should be doing to start. Most banks should just strive to master basic data engineering (below).

You don’t have an “internet strategy,” an “insurance strategy,” or a “digital strategy.” At this stage of banking evolution, it is a foregone conclusion that banks need to leverage data, analytics, and machine learning to survive. What banks need is data competency and a broader, bank-wide vision to incorporate data in almost every endeavor.

This effort starts with using a vendor and/or getting your data architecture right (HERE). After that, it is about staffing, educating line bankers, and developing an execution plan to tackle various problems. Banks like Capital One, for example, have 23% of their employees in some data analytical role. Many of these analysts go through a two-year training program (HERE) and then get embedded within a business line.

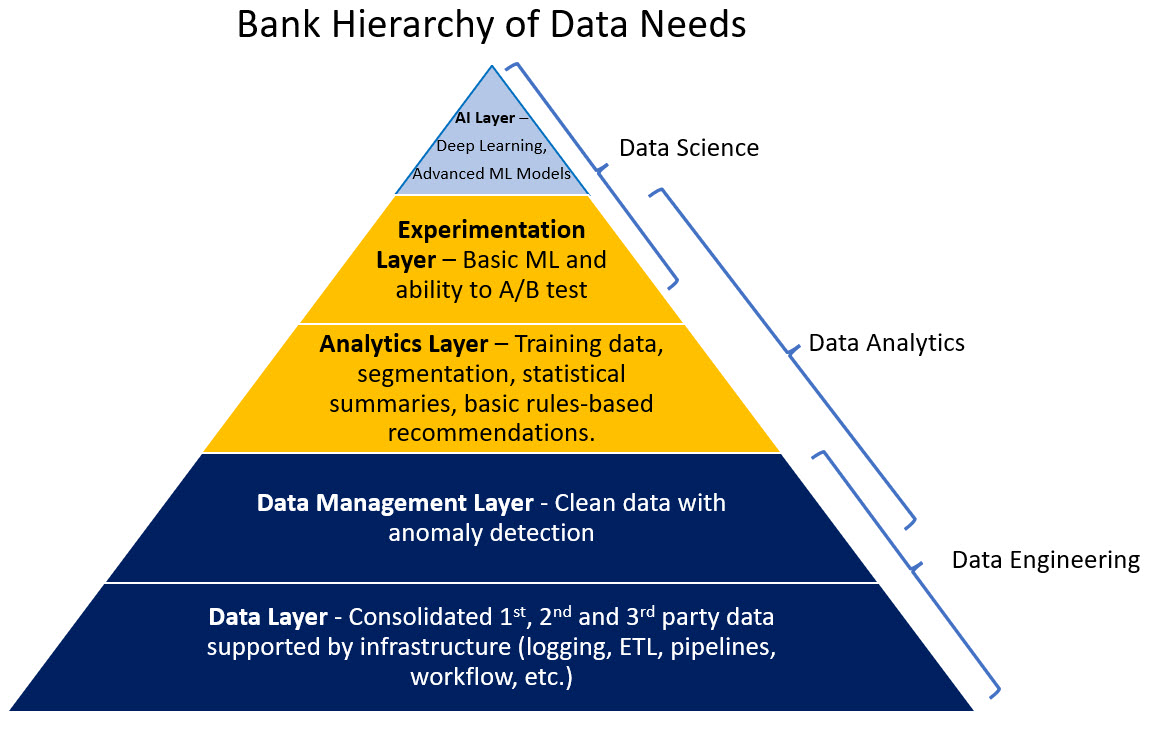

After those moves, adopting something similar to the data framework below will help.

Framing The Problem

For any banking challenge, the key to success is framing the problem. While framing the problem seems easy and obvious, it is not. In fact, if you don’t understand the problem, it is unlikely you will come up with the best answer. A well-framed problem in banking might be which customer segment to focus on, how to apply rates to your deposits, or how to optimize capital among lending segments.

To pressure test your problem’s frame, below is a helpful framework for banks to ensure they have the right problem frame to understand better when to use data.

Putting Data Between You and I

Here, we learned the mnemonic “U-DATA-I.” Or, as we remember it, we put the “data between “U” and “I.””

For a problem to be analytically solvable within this framework, it should be:

- (U)ntested: The problem should have an easy answer to it. If the problem has been solved before, then it is usually worth the effort to obtain the results. They may be done by researching an academic paper, talking to other banks, or working with a partner.

- (D)efined: Clearly stating what, where, and why of what an investigation looks like. For example, your bank may want to know how best to allocate capital amongst lending lines to optimize risk-adjusted profit. Here, it would be essential to know the predicted credit performance for each lending line, the cost, the risk, and the profitability. From there, a data project would easily inform you how much volume should be driven for each line and what is the best price to achieve that volume.

- (A)cute: It should be crucial to the business. While analytical problems abound, many will not be “needle movers” and are likely not worth the cost and effort. Allocating capital is an acute problem to solve for banks, as is determining the “next best action” for a particular customer. Morgan Stanley, for example, found that their bankers took 45 minutes analyzing a customer’s holdings before they could recommend a banking product.

To solve this problem, the bank trained its analytics on the next best action (NBA). Now, in a matter of 15 seconds, a banker can generate a personal plan that provides a roadmap for the customer to follow. This has been used more than 11 million times and has served to increase customer satisfaction and profitability.

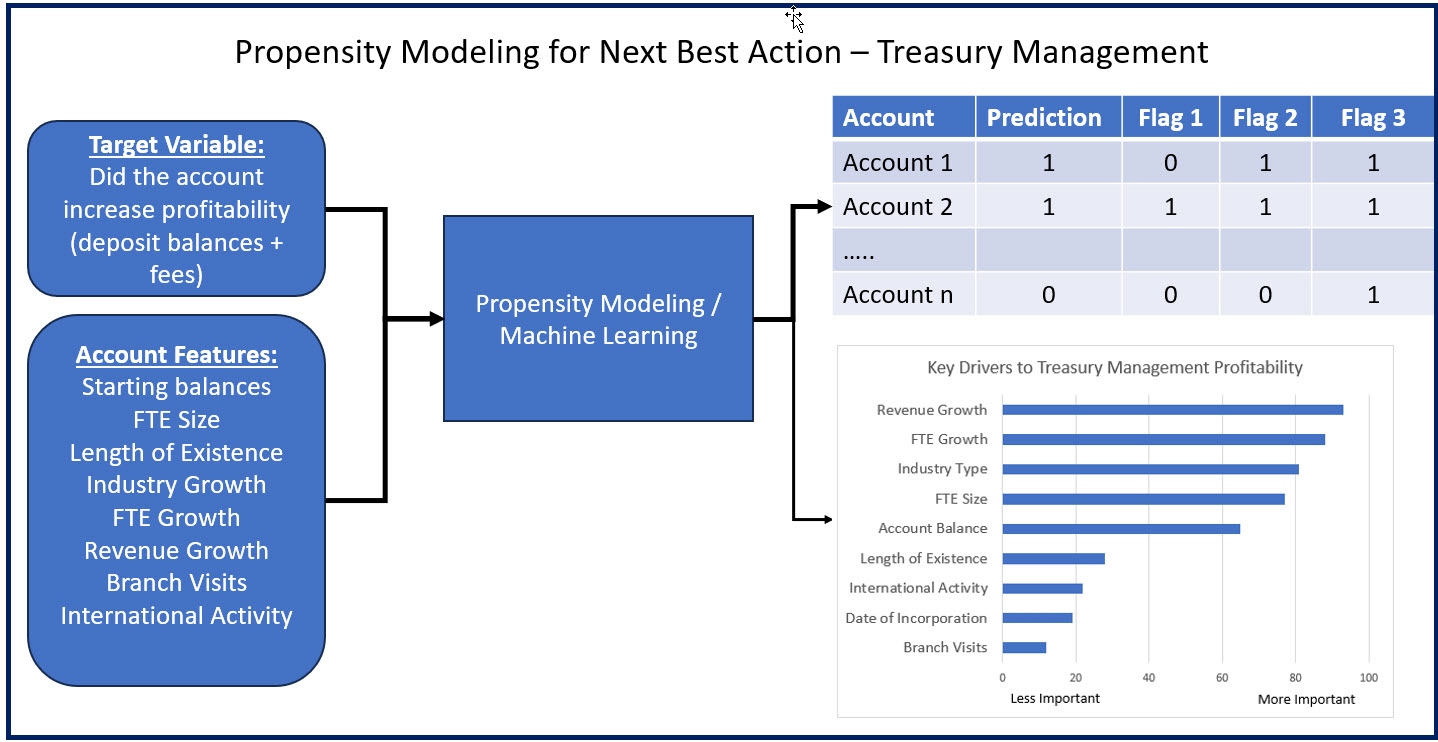

One side note to data that is often overlooked is that data not only can point to what to do but HOW to do it. Using another NBA example, for banks that are looking to drive treasury management sales, it is not only helpful to know which accounts to target to get more treasury management fees and balances but also how to target them. This is often referred to as a “key-driver analysis” that provides bankers with which behaviors most contribute to an overall goal, such as the increase in profitability. Below is a treasury management data model using a random forest machine-learning model applied to easily obtainable bank customer data. The model produces which customer factors are most influential and predictive of treasury management profitability. Banks can now target these customers with personalized email and in-person follow-up suggestions.

- (T)estable: A data problem should be provable through a straightforward test. One bank, for example, wanted to know if opening up branches an hour later would impact traffic and profitability. Instead of a considerable analytical effort, the bank took 100 of its 300 branches and reduced hours. It tracked the results for six months, and it turns out that opening later didn’t have a material impact on traffic or revenue. Because a test was clearly defined, the bank was able to form a hypothesis and test with little effort. The right problem framing resulted in a clear solution.

- (A)ctionable: The results should lead to concrete actions. Not all data project results are actionable. The “Netflix Prize” resulted in a million dollars to the team that can produce a 10% improvement in their recommendation engine. Bell Labs came up with the answer, but unfortunately, it was so complex that it wasn’t deemed actionable.

- (I)mpactful: The solution should create significant, sustainable results for at least one important metric. A bank recently used its data team to produce a lead-scoring model that resulted in a 5% greater conversion rate for its loans and deposits. 5% doesn’t sound like much, but over $20B of loans and deposits equated to $30M in earnings. That is impactful.

In addition to having an impact, the problem also has to be persistent. A one-time problem likely isn’t a good candidate for a data analytical project. On the other hand, projects such as deposit optimization are impactful and persistent enough problems to be worthy of a large-scale data analytics effort.

The more the U-Data-I criteria are satisfied, the higher the probability that a data analytic effort can solve the problem. Of course, not all problems are as well suited for analytics. If you need to decide quickly and don’t have time to do all that testing or gathering data, that may not be a solid candidate. If a decision needs to be made quickly and bankers have made the decision in the past and know the outcome, then it might be a situation where analytics is not the right approach for the bank.

Data in Banking – Key Learnings

Data Analytics is Iterative – It is important to note that data analytics is an iterative process. It’s natural to slide back and forth between steps. In many cases, the banker will have to frame the problem and then figure out what data is available. So we’re talking about data first, but there really is this kind of iterative, circular relationship between the data that a bank might need to solve my problem and how a bank frames the problem in the first place.

Make Sure the Problem Scales – Evaluate a problem and whether it’s acute, impactful, and untested before assessing other categories. Why bother if it’s not an acute or impactful problem?

Frame the Problem – Resist rushing into analysis and not spending time to understand your bank’s problem fully. Fully framing or investigation will pay off in the future. In many cases, bankers don’t spend enough time on the framing of the problem because it’s very unstructured. It is worth putting some rigor around the problem-framing phase and getting input from multiple units and business lines. As you go through the process, document the various ways that you could have framed the problem so that you can go back and analyze the project’s decision-making process. Often, a suboptimal answer is achieved because the situation was correctly presented.

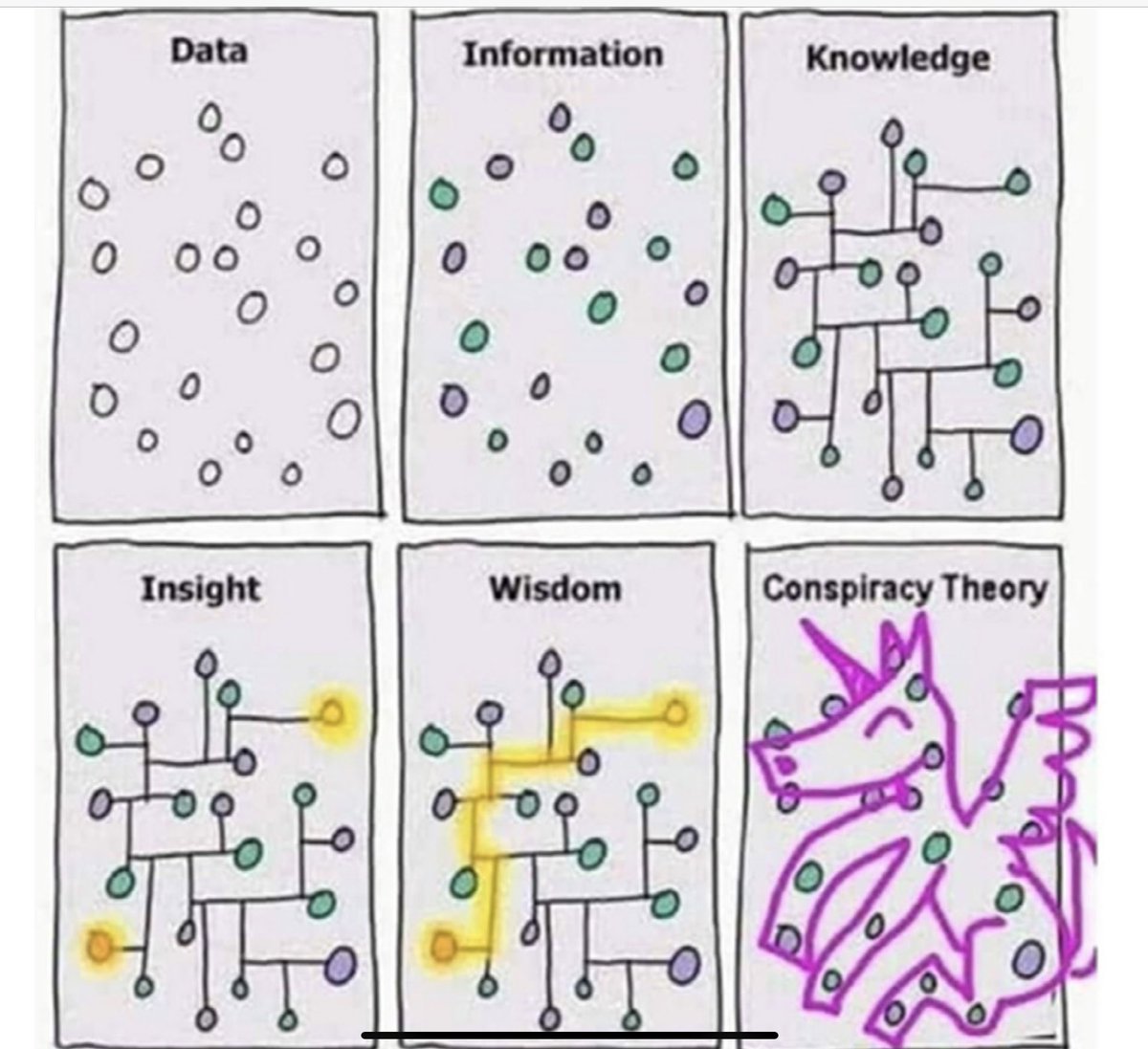

Know the Limitations of Data – If “a picture is worth a thousand words,” then this cartoon meme (origins unknown) is an entire data class in one graphic. It teaches how data can turn into wisdom while cautioning against the “overfitting” of data analytics to lead to inaccurate conclusions. As Ronald Coase of the Coase theorem fame famously said – “If you torture data long enough, it will confess to anything.”

Many banks will be evolving from a data-centric bank to an AI-centric bank over the next five years. This journey starts with frequently using data in banking to make decisions. Recognizing when to make data-informed decisions and developing a data culture will help the bank in almost every endeavor. Data-driven decisions can be made faster, with more accuracy, with more confidence, and often at a lower cost than decisions made on intuition. Data can not only help inform bankers what is happening but what is going to happen and provide prescriptive recommendations on how to increase profitability while decreasing risk.

One recommendation is to build to the capability of being able to deliver the next best action as a goal. Banks with a data warehouse or CRM system, such as Salesforce, can likely do this now. However, if you don’t have these capabilities now, then lay the groundwork to get your bank there over the next three years. Doing so would be a worthy endeavor that will serve to give your bank the data competency required to compete in the future.