10 Ideas to Help Reduce Deposit Portfolio Volatility

When it comes to determining the value of a deposit base, there are three major components that drive franchise value: effective cost of funds, interest rate sensitivity (duration and convexity), and volatility. It is a rare bank that can manage all three dimensions of deposit performance and one that stands out is Citibank as they have been good at proactively taking steps to increase deposit performance. As cost of funds and interest rate sensitivity are well known, we focus on creating value through reducing deposit portfolio volatility.

A non-interest-bearing operating account of a business is usually the most valuable account at the bank. Not only are costs low, but balances are larger. Most importantly, balances are usually inversely correlated to rates so that higher rates usually mean businesses are doing better and cash flow is increasing. On average, a good business account has a risk-adjusted return of approximately 40%. Should rates go higher, a properly structured business account will skyrocket in value, approaching an average of greater than 300% return on equity.

Buffering Deposit Portfolio Volatility

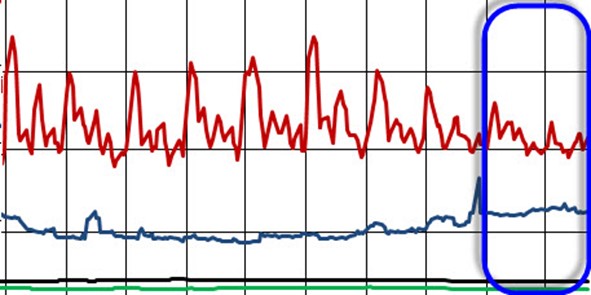

The downside of an operating account is volatility. Large daily swings in balances place stress on a bank’s liquidity and limit the amount of funds a bank can invest in longer-duration investments. The image below shows the volatility of checking (top in red), money market accounts (blue), time deposits (black), and savings (green).

As can be seen with the red checking line, this bank has some accounts that have large swings in balances due to payroll, mortgage, and tax payments. For deposits, we measure volatility by looking at the aggregate standard deviation of balances, which gives us a picture of how balances change day to day. The greater the standard deviation, the more volatile the account and the less it can be leveraged.

The Low Volatility Savings Account

For comparison, the average community bank has a business checking account volatility of around $10,000. That means that most accounts (68%) vary plus or minus $10,000 on any given day. The savings account, on the other hand, has the lowest volatility in banking and usually has a volatility of around $250.

For this bank in our case study, the volatility of their checking is about 2.5 times the average due to their account composition. For the record, this case study bank has one of the lowest cost of funds in the industry, but our point is that even a top performing bank can still have room for improvement. In this case, these volatile accounts can change in balance by about a 14% variance. This compares to money markets, time deposits and savings that usually exhibit rock solid stability and have a variance of about 3%.

Getting Proactive

Understanding account volatility is important to at least have a feel for the risk. However, this data now allows a bank to get proactive in account management so that it can undertake several tactics to optimize deposit value.

At a minimum, more resources can be put into sales and marketing to bring in accounts that have different cash flow profiles. For example, some payroll companies require funds two days in advance while some require five days in advance. Having a diversified portfolio helps smooth out cash volatility. Further, being able to bank different industries also provides deposit diversification.

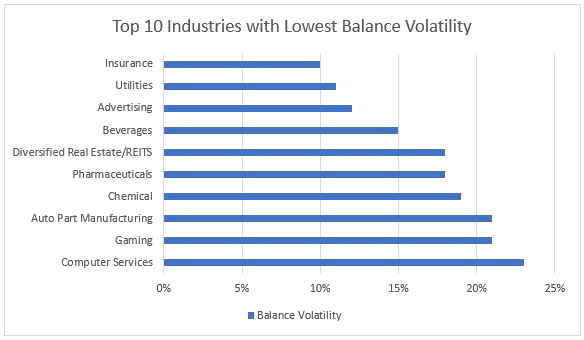

Banks that go after homeowners’ associations have much different balance fluctuations compared to auto dealers. Industries that are heavy on labor such as some forms of manufacturing or that have high commission payouts monthly, tend to be more volatile. Allocating resources and proactively managing the deposit sales effort is one way to build a diversified deposit base to better optimize deposit value.

10 Ideas to Help Reduce Deposit Portfolio Volatility

- Dynamic Pricing: Volatile accounts can have a higher fee structure and/or lower rate to offset the risk.

- Tiered Earning Credit Rate (ECR) or Yield Incentives: Reward balance stability instead of volume. For example, banks with modern core systems can add 10 basis points to the rate for balances that are maintained within a 10% plus or minus band over a rolling 90 days. Alternatively, banks can institute a “step-down” ECR rate if set fluctuation thresholds are violated.

- Internal FTP Adjustments: Introduce funds transfer pricing (FTP) that penalizes high-beta and volatile deposits. This better aligns internal incentives with franchise value.

- Account Tagging: Accounts can be tagged in the core system as to intent (for example, escrow, primary operating, secondary operating, payroll, or excess liquidity) providing further intelligence as to the nature of the account.

- Account Scoring: We discuss our methodology for elasticity scoring HERE.

- Enhance Data: Track and quantify large balance clients to understand payoff, transfer activity, or off-cycle balance fluctuations. Utilize real-time dashboards to visualize payment activity and ECR changes to predict balance shifts.

- AI-Driven Cash Flow Projections and Alerts: Use machined learned projections that can detect anomalies in client balances or transactions (such as $0.01 payments) that foretell balance transfer. Provide both client and bank with more accurate cash flow projections and liquidity optimization metrics.

- Instant Payment: Utilize the ability to transfer money instantly and set future pay dates to help clients more precisely manage cash flows.

- Product Development: Introduce products such as earned wage access that smooth payroll and balance fluctuations.

- Relationship Managers as Balance Coaches: Help educate employees how to target customers with lower balance volatility such as insurance companies and utilities. Meanwhile, help customers better manage their balances with treasury management and analytical products.

By employing these tactics, balances can be smoothed, resources more efficiently allocated, deposit balances better managed and fee income increased. The end result is lower deposit portfolio volatility, greater liquidity and more investable balances.

Putting This into Action

The quality of deposits count when you tally bank performance.

In the graph above, this bank employed several tactics, highlighted in the blue rectangle, which has successfully limited volatility. Volatility for their business checking product is now back down to normal as they have a more diversified deposit base. The net result is 7% of its checking account base (in this case this equated to about $14mm) can be invested in loans or longer-term securities. This helps increase the interest earnings from 25 basis points to between 1% and 3%. In other words, through proactive deposit management and portfolio building, earnings efficiency can increase.

Managing deposits is often thought of as more art than science. However, deposit management is rapidly changing and by monitoring the data and applying basic management techniques such as focused sales and dynamic pricing, a bank can become more profitable.