20 Takeaways from our Inaugural Deposit Conference

Last week we concluded the industry’s first and only pure deposit focused conference in Denver in conjunction with S&P Global. Given that deposits are a bank’s most important product, there is plenty of room for most banks to improve deposit performance, and we could potentially coming up to a period of changing rates, we thought this was an ideal time to bring bankers and experts together to talk best practices. In case you missed it, below are 20 of our most impactful takeaways from our deposit conference.

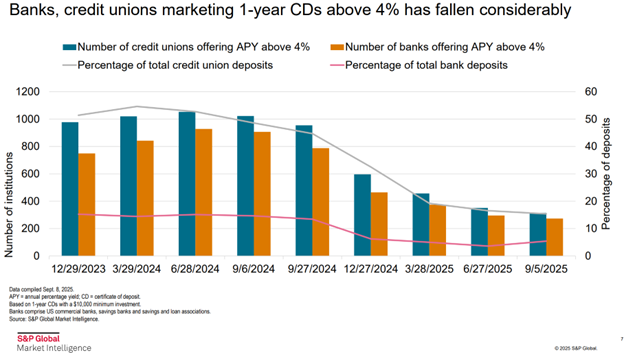

- State of Deposits: S&P Global’ s Nathan Stoval gave us an overview of the current state of deposits starting with a breakdown around how deposit performance drives valuations. In particular, its not deposit growth that is important, but deposit cost over time. The best traditional tactic that banks can do to positively influence valuations – grow transaction accounts. Stoval detailed how 2Q saw slowing growth down from 1.6% to an anemic 0.1% and banks have been reducing their reliance on CDs and shortening their duration on the CD portfolio. This is against a backdrop of loan production that is increasingly putting more pressure on deposit performance. The bulk of the higher yield offering banks are around 3.5%. As we look ahead, the expectation is that most banks will drop below 4% and 3.25% becomes the new common competitive level. As we look further out, if you assume a 1.50% reduction in Fed Funds for this cycle through 2026, banks are projected to reduce their cost of funds by only 0.50% which likely isn’t aggressive enough.

2. Better regulatory regime: Acting FDIC Chairman Travis Hill spoke about the potential for extending exam periods to five years with a mid-year review for qualifying banks. He stressed the need for diversified funding sources, the desire for prudential regulators to have real-time access to payments/account balance data and the desire for more de novo banks in the U.S. Chair Hill expressed the Agency’s support of bank innovation and the strong possibility of hiring a head of innovation at the FDIC.

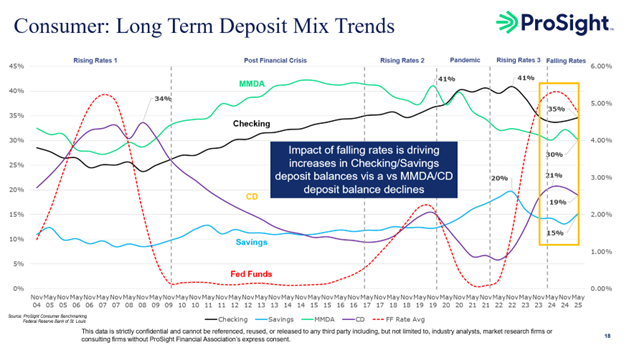

3. The Consumer Deposit Mix: John Rountree at ProSight detailed how the threat of falling rates is not only causing some banks to back off of rate promotions, but banks are being successful with tactics of moving that MMDA and CD money back into transactional and savings accounts (below).

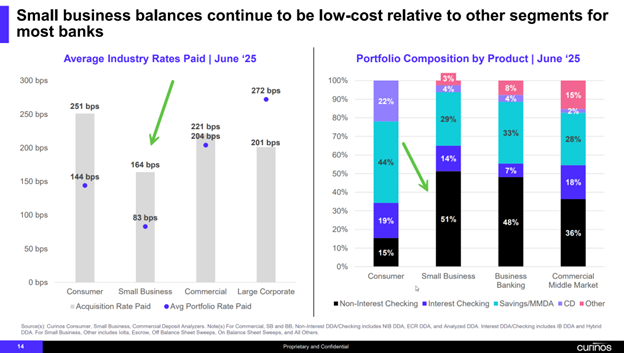

4. Using Analytics to Optimize Deposit Performance: Curinos’ Brad Reznick focused on how traditional banks can better compete with direct banks (i.e., Amex, Capital One, etc.) and fintechs (i.e., Chime, Paypal, CashApp). Their collective market share continues to grow. The answer lies in better analytics so your bank can better understand how to effectively market deposits. Many banks mistakenly hurt themselves through not knowing the key drivers of acquisition, cannibalization and portfolio rate influences. Knowing what your decay, attrition and elasticities are for by product, geography, customer relationships, channel, line of business and internal segmentation helps in optimization. In this manner, you can apply the lowest rate to achieve your goals of building balances or lowering deposit costs.

5. The Value of Small Business: In addition to covering retail, the deposit conference also focused on small business and commercial. Of all the business segments, Curinos pointed out that the analytics point to the value of going after small business balances (below).

6. Booked Rates Align to the Extremes: In an interesting piece of analysis, Curinos showed that while a bank may offer an evenly distributed set of rate offers, it are usually the highest rate (40% of the time) and lowest rate (30% of the time) that get taken, in almost equal proportions. The insight here is that the majority of your customers are at your bank for a reason – either they are after return, or they are after service. The insight here is to design products, marketing and sales efforts to gather more service-centric customers while letting rate-sensitive customers go to the direct banks.

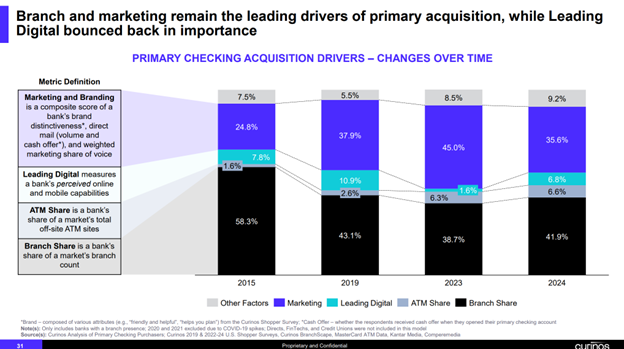

7. The Importance of Branch and Marketing: Curinos provided data (below) showing the importance of the branch and marketing has on effective deposit gathering. They also highlighted that both the branch and digital channels are growing in importance. Prosight showed how checking balances were declining but the average balances were higher from branch originated accounts and cumulative life was longer. Banks that focus on digital transaction account acquisition had higher attrition and need to do a better job at keeping these accounts through product and service delivery.

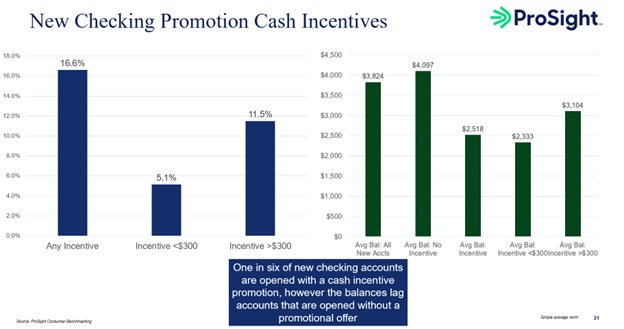

8. CD Conversions and Structure: Several experts and banks discussed the need to be proactive with marketing and sales to convert CD customers to non-rate sensitive customers. Starting this process by cross-selling other products within two weeks of CD booking is ideal. We also advocated doing away with shorter maturity CDs and focusing on the 24- and 36-month area with the goal of strengthening that contractual relationship through stronger redemption penalties and keeping your rate sensitive customers in one place – away from cannibalizing your money market and savings accounts. This single tactic can materially improve deposit performance in a variety of products. ProSight brought some good data on the current offerings (below) and also highlighted the fact that digital marketing for cash bonus offers is 2.5x more effective than in-branch promotions.

9. Cash Bonus Offers: Several experts and banks also discussed the growing importance of cash bonus offers (HERE), particularly effective with the mass affluent. Some banks reported that to increase effectiveness a combination of digital and direct mail was best.

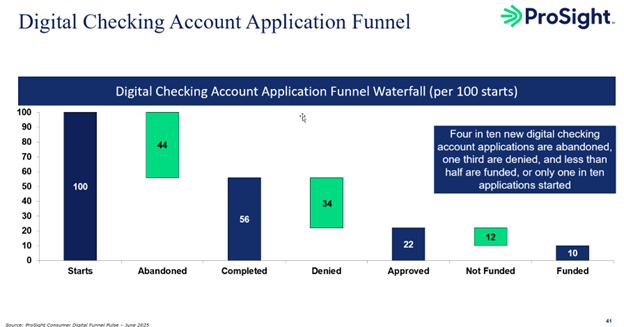

10. The Importance of Onboarding: Several speakers and banks highlighted the need to get your onboarding process right. This is not digitizing an existing process but streamlining the process to allow the fastest onboarding possible. If there is one workflow and technology platform to invest in, it is digital onboarding. Not only does digital onboarding open up geographies where banks do not have a presence and make digital marketing possible, but it adds performance to other products by more efficient cross-selling. You can’t hope to retain higher-yield CD and MMDA customers unless you have an effective onboarding process where you can open up other accounts as well as sell items like bill pay, payments, and positive pay.

- Regulatory Trends: John Geiringer, of BFKN highlighted a series of regulatory trends to include last year’s shift from the “Chevron deference” where the courts look to an agency’s interpretation of an ambiguous statute to the “Skidmore deference” that says the courts can now decide the interpretation. The outcome of this is that Congress, and the agencies, will need to be more prescriptive in their rulemaking and banks will be more empowered to challenge regulatory agencies in court. Of particular interest in this domain is Federal preemption over state banking laws. John also discussed how banks need to stay vigilant and aware of new state regulations that take up defunct CFPB rules. John also discussed the trend of regulators looking to focus on core risks, taking another look at liquidity requirements of large banks, providing quicker approval of M&A transactions, streamline examinations and speed innovation. John also underscored the continued importance of vendor management, fraud and new product approval. While the agencies will look to clarify and streamline Bank Secrecy Act requirements, John highlighted the $3B in cartel-related money laundering penalties that TD Bank suffered due to compromised first-line employees (the proverbial inside job), unmonitored payment channels (i.e., Zelle, instant payments and ACH) and lax BSA controls.

- BaaS Lives: Brett Fahr, the CEO of Pathward Financial, highlighted the risk and the reward of integrated banking. Brett discussed the Bank’s strategy of focusing on payments, card management (acquiring and processing), credit and tax solutions. This model was radically different than most banks’ strategy in the room so it was interesting to see where the more traditional bank might expand within their market.

- AI for Deposits: Multiple panels and banks highlighted that they remain in the early stages of AI usage which has mostly centered around the point solutions of productivity and marketing. The more advanced banks discussed how gen and agentic AI unlock machine learning to help with treasury management, churn projections, liquidity management, profitability and rate setting. Further being able to monitor login frequency was able to help better inform churn probability. Microsoft’s Copilot was the AI most often cited for helping with deposit analytics. One big area of focus for 2026 is the need to use AI to reduce exception pricing processing.

- “Hollowing Out the Core”: In an interactive session led by Helen Pavaklo of ARCOne (treasury management), the vast majority of banks in the room are in process of stripping away deposit and payment rails from their core to make themselves more innovative and less reliant. She had a panel discussing the importance of offer and rate management.

- “Always on Marketing”: A common theme at the deposit conference for improving performance was this concept of the constant marketing of deposit products. Banks should have a variety of campaigns constantly promoting cross-sell, balance building, treasury management and savings.

- Customer Segmentation: Many top performing banks drove deposit value by focusing on specific customer segments such as healthcare, car dealerships, insurance companies and schools.

- Profitability and FTP: Another theme among top performing deposit banks is the need to invest in a profitability system complete with a funds transfer price mechanism. Understanding customer and product level profitability is the key to making informed, data-driven decisions to improve performance.

- Not Indexing Off Fed Moves: To lower your bank’s beta and improve performance, consider moving deposit rates driven off market rates and/or supply/demand. Banks that cut rates by a series of smaller amounts now or between Fed meetings, in anticipation of a future 25bp cut, can pick up savings and lower beta.

- Modifying CD Maturities: Banks were intrigued with the idea of starting their CD offering latter at the 18 month mark and building out with two or three maturities to the 36 month area. Getting rid of your shorter CDs improves performance of both your CDs, your MMDA accounts and your DDA accounts. Give your customers the option to go shorter for a higher yield, and they will hurt performance.

- Awards: S&P Global handed out their 2025 Deposit awards. S&P Global Market Intelligence ranked the 100 top deposit businesses among banks with less than $3 billion in assets through the end of the second quarter. Titan Bank NA ($639mm assets, TX) took first place. Integrity Bank (KS) took second and Tejas Bank (TX) took third. For a complete list of winners, go HERE.

Save the Date for Next Year’s Deposit Conference

Thanks to all those that attended, particularly our speakers. We look to announce next year’s location and date for the Deposit Conference soon so plan on attending late Sept. likely in the Midwest in 2026.