3 Rules to Getting Your Deposit Promotion Right

In our industry, many banks need to put more thought into the science and strategy of deposit promotions. This is, unfortunately, occurring as the number of deposit promotions is approaching a near-term high, and banks are throwing away money like an untargeted ad campaign. Not leveraging media, not having a current deposit pricing strategy, not leveraging relasticity data, and taking a “one-size-fits-all” approach undermine the average deposit promotion strategy. This article uses data and machine learning to give banks three of the most critical lessons regarding deposit promotions.

One – Media Drives Demand, and Demand Drives Relasticity

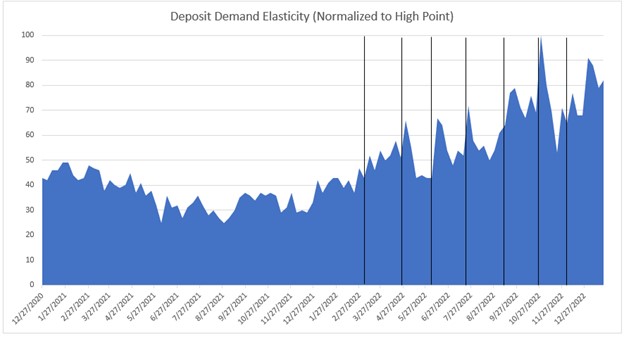

Promotions without regard to media are one of the largest significant areas where banks shortchange themselves – literally. Deposit demand often spikes when the media discusses rising interest rates around Fed meetings. The graph below charts the volume demanded of interest-bearing deposits against the Fed meetings (the black lines) where they raise rates.

As can be seen, a spike in demand for deposit transactions occurs when the Fed hikes short-term interest rates. When media attention drives behavior, you want to run a deposit promotion to get the greatest return on your marketing investment. The more demand and the larger the addressable market – the more likely your bank will find desired low-interest rate sensitive customers.

While we charted Fed rate movements below, we can see similar spikes when there are material equity declines, negative economic news that increases the need to save, financial news that increases interest rates, and world events, such as a war or pandemic, that cause a flight to investment safety.

Let’s say you are a retailer, it’s right before Christmas, and your goal is to maximize revenue. Do you run a promotion before or after Christmas? The answer is before when demand is high. Demand drops markedly if you wait until after Christmas, and you must offer deeper discounts to move the same product. By offering a small discount before Christmas, you will optimize sales and margins. The same is true for deposit marketing.

Any deposit promotion will do better and achieve a greater return on marketing investment (ROI) if it is run when demand spikes. While banks want to try to avoid marketing on rate, if you must, market right after the Fed increases rates when media attention drives higher savings rate demand. Even if you don’t market on rate, marketing toasters when elasticity is high is still a good idea. You will increase your likelihood of grabbing less interest rate-sensitive and more service-sensitive customers.

The critical element here is to use your marketing and advertising prowess to shift the conversation from rate to service, convenience, safety, or any other non-rate factor. In this current market, while many customers THINK they want rate, what they want, according to behavioral economics, is security against a potential recession.

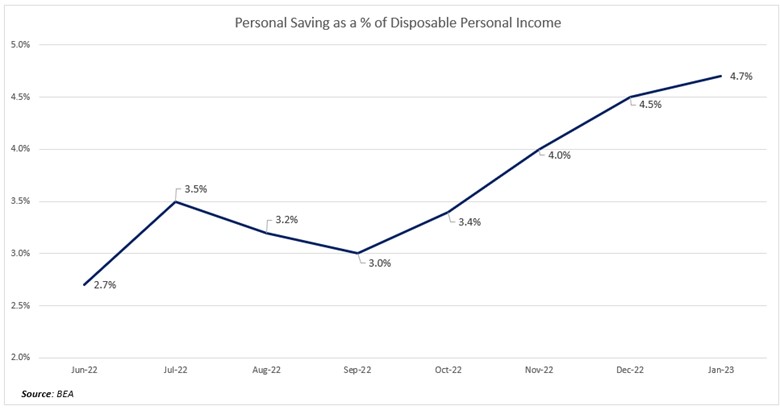

One way to validate this is to see what is occurring with the Personal Savings Rate (below). The Savings Rate is always a critical factor to check (HERE) as a proxy for relasticity. When households and businesses need to save, that is, the savings rate as a percentage of disposable income is rising, chances are there is a negative relasticity adjustment to elasticity, and banks do not have to pay as much as they think they do or what competition may portend.

Two – Get More Granular for Deposit Promotions

Don’t confuse a higher yield rate promotion with marketing. A high rate is a substitute for marketing, not a compliment. When it comes to deposit marketing, the adage is that you use rate for attracting volume and marketing to attract deposit performance.

Optimizing the marketing of deposits is about getting the right price in the right channel for the right product at the right time for the right customer. This means that bankers need to choose what product they are going to promote to what customer base and only then choose the appropriate rate.

Banks are not required to run the same promotion for everyone, and in this age of personalized marketing, there is little need to. Instead of just raising rates or putting out a general promotion, bankers should first consider a specific marketing campaign based on deposit strategy and objectives. Personalization can always help target the less interest rate-sensitive customers, but it is even more effective when demand for deposits increases.

Three – Isolate High-Rate Customers from Service-oriented Customers

When demand spikes, if you have to offer a higher-than-average rate, do it in an isolated product and preferably to an isolated customer segment. The common mistake is to take a lower-rate-sensitive product or customer segment, offer a promotional rate and serve to bastardize the product or segment by mixing more rate-sensitive customers with service-oriented customers. Creating a separate, rate-sensitive product is far better than mixing cohorts.

A separate rate-sensitive product allows management to monitor performance, allows for the customization of a product, and allows marketing to attempt to convert these rate-sensitive customers to service-sensitive customers. Higher-rate customers should have different tiering, different terms/conditions, and a greater marketing cadence.

This means that a bank will likely have two near-duplicate products. A bank might have a savings account for its service-oriented customers and another for its rate-sensitive customers. Duplicate products aren’t ideal since it drives up operating costs, but it is critical to limit customer AND EMPLOYEE confusion. With a high-yield designated product, at least your employees will better understand the bank’s strategy and segmentation.

Moving to Action in Deposit Promotions

While planning your next deposit promotion, consider timing the move to a specific event such as a data release, Fed move, headline news event, or media trend. As demand for deposits increases, take the opportunity to run marketing campaigns that capitalize on behavioral economic trends and convenience. By doing so, you will not only increase your marketing effectiveness through a better volume response, but you should see a better performance response as well.