Behavioral Deposit Pricing – Optimizing the Three-Package Offer

We have discussed the importance of bundling or packaging deposit account services to speed up customer choices, increase profitability, and enhance deposit performance. However, many banks still offer just two choices, whereas if they offered three, they would increase profitability. In this article, we examine how behavioral deposit pricing works and how to use it to your bank’s advantage.

The Set Up

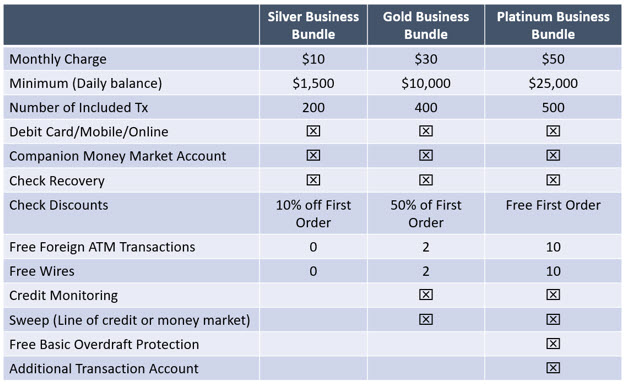

For this example, let’s say your bank offers a “Silver,” or basic, transaction account package and a more expensive “Gold” bundle similar to the account packages below.

You sell these packages online/mobile and in the branches, and your sales are approximately 60% for Silver and 40% for the Gold bundle. The average small business can’t appreciate how many transactions they will have in the future, how often they send wires, or whether credit monitoring or a sweep is essential. As a result, they will tend to the less expensive package.

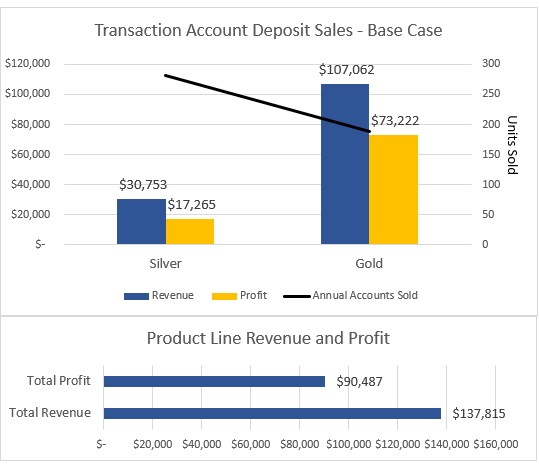

Base Case – Two Account Bundle Performance

For this bank, promoting two account bundles, they sell 281 new accounts annually for their Silver bundle and 188 accounts for their Gold package. This produces annual revenue (net interest earnings and fees) and profit (Revenue less interest and non-interest expense) of $137,815 and $90,487, respectively.

The Role of Behavioral Deposit Pricing – Adding a Third Package

If you want to see behavioral pricing in action, add a third package. Your account package offerings then look like the matrix below, which includes an upper-tier or “platinum package.” This premium package carries both the highest price, the highest balances, and the highest margins. It is important to note that the platinum package isn’t a high-transaction account option but just a more expensive and wider-margin version of the Gold Bundle.

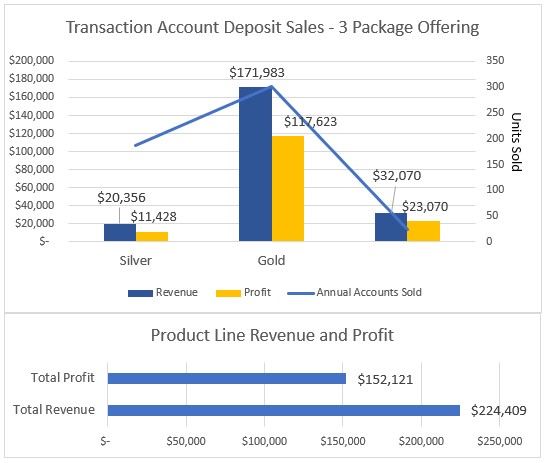

When you add a third premium offering, several things happen, all of them good for banks. First, you give your customers another choice, but you don’t give them too many choices to cause cognitive overload and slow the decision process. Some larger accounts will naturally have larger balances, send more transactions, and use more wires, thus warranting the Platinum Bundle for purely rational and economic reasons.

The other impact is the “premium effect,” which is the fact that some customers want the best, even though they may not use all the features of an account package. These accounts find intangible value in having the “platinum” moniker associated with their account, even if there is no difference in service level. This customer type chooses this package for rational but non-economic reasons.

The third effect is called the “middle option bias,” or what used to be called the “center stage effect,” and is the tendency for buyers to anchor on the higher priced option but then choose the middle option as they rationalize their preferences and feel like they are getting a better value. The middle option bias works best when a bank communicates the account differences and prices the package at a materially higher price level.

The middle option bias results in a net increase in new accounts as more buyers choose one of the three options instead of shopping around and moving to another bank. As more account openers decided on the bank, they were impacted by the middle option bias, and new accounts went up from 188 units to 306 units, a 63% increase. Put another way, a portion of this customer category chooses the middle package for irrational and non-economic reasons. That is, a portion of this middle customer base (approximately 3% of total customers) would have chosen the Platinum package for rational and economic reasons but fell back to the more conservative Gold package.

In total, because of the behavioral deposit pricing of having three account package options, the bank went from opening 469 accounts to opening 513 new accounts for a net increase of 9% on a per unit basis. Account balances, on the other hand, jumped from $2.8M to $4.8M, or an increase of 70%. Net profit went from $90,487 per year to $153,121, a 69% increase.

Putting Behavioral Deposit Pricing into Action

Bundling products and putting them in sets of three is a tried and trusted marketing strategy among banks. Too many banks overlook behavioral deposit pricing tactics, which creates room for improvement that can increase product conversion, balances, and deposit performance.

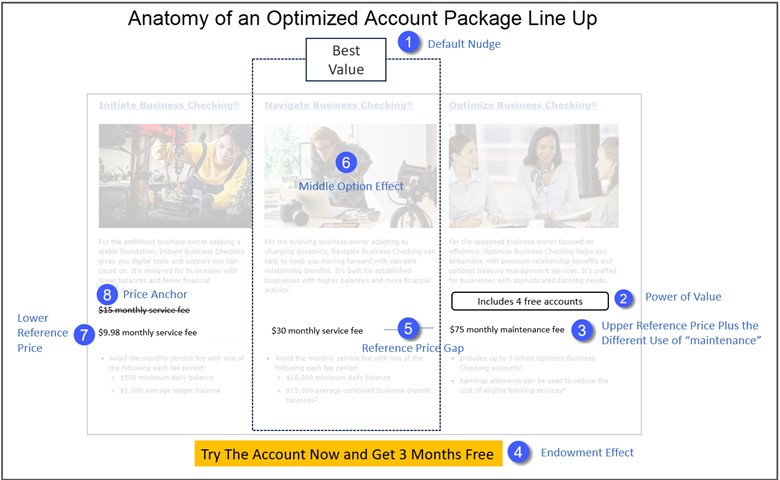

The tactic of threes can be combined with various other behavioral deposit pricing tactics (below) to provide an even greater marketing and sales lift. Shortly, we will be covering more of these tactics in depth.

We will also be discussing more about deposit price elasticities. We have spoken at length about price elasticities of deposits as it relates to rate. However, we often overlook the price elasticities around monthly fees. While fees and terms matter less than when you advertise a deposit rate, they matter, particularly for transaction accounts.

Stay tuned to this column to learn more about modern deposit marketing in the age of behavioral economics and machine learning. Given the changing rate environment, combined with the focus on data analytics and the ability to offer personalized pricing, deposit pricing is in the midst of a radical transformation.