Deposit Tiering For Performance

Adjusting pricing for deposit tiering according to account size is essentially a tradition in banking. A typical bank’s money market accounts often have six tiers ranging from $2,000 to $100,000. The question that always comes up is whether you have suitable tiers and the correct number of tiers. Are you using your tiers to drive profit by giving low rates, or are the tiers just confusing your customer and driving-up operational cost? Further, are you paying the correct rate on the tiers to motivate the deposit behavior you want? Let’s explore each question, as the answers may change how you feel about deposit gathering.

Active Deposit Portfolio Managers

Let’s challenge the assumption that you want to use your tiers to better control deposit behavior. While this is what many banks say, many don’t sell the tiers much during account opening. It is rare that a banker can get a customer or potential customer to move more money over to qualify for a higher tiered rate. If you listen to the selling process, this is often a question to the customer rather than a discussion about the customer’s liquidity. More to the point, few banks train on how to use deposit tiering for performance.

Conversely, it is rare that a deposit manager actively manages and adjusts their tiers to optimize performance. In 2020, for instance, banks saw a material increase in average balances, yet few banks adjusted their tiers.

It is also true that most banks are not active deposit portfolio managers. Few banks employ deposit cost management strategies such as balance-building promotions or retention cross-selling that leverages deposit tiering.

That said, there are banks that actively market their tiers to build balances, and in those cases utilizing a tiering structure makes sense.

How To Optimize Deposit Tiering

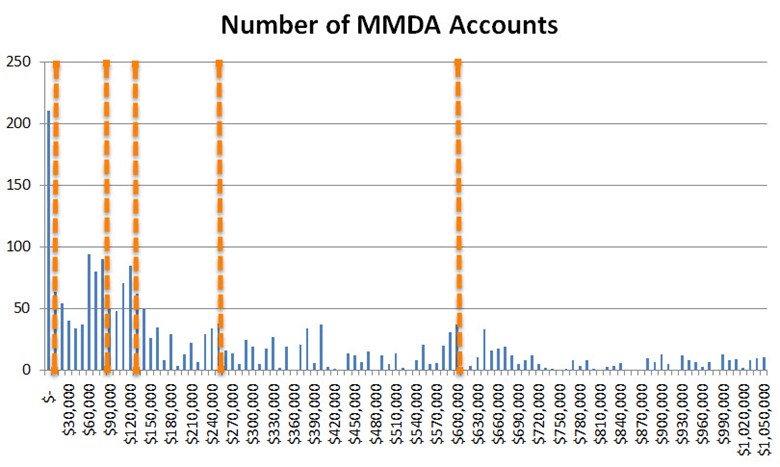

From a behavioral economics standpoint, a bank wants to set its tier levels right above the clusters or groupings of accounts. In this manner, deposit tiering has a value proposition that increases balances. The orange lines in the example below would illustrate one strategy of account tiering if the goal were to optimize account balance creation.

Note above. Statistically, a bank needs three to five tiers depending on the customer base. The answer to how many tiers you should have depends on how sensitive your customers are and the dispersion of balances.

Some banks have over ten different tiers. Having a large number of tiers could be a positive if a bank’s deposit base warrants it. However, often, either a bank hasn’t given it much thought or has created so much granularity that it has made tiering worthless. If you are only increasing your rate by a handful of basis points between tiers, then it is likely that it is not motivating the behavior you want. It is likely better to consolidate tiers.

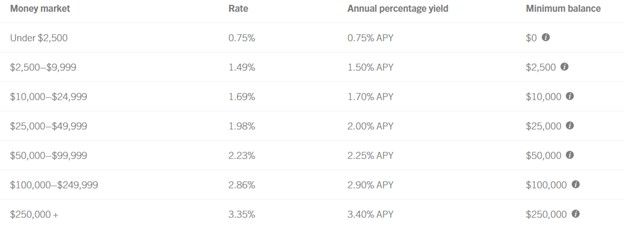

Conversely, it is also possible that pricing is too aggressive between tiers, and the bank is potentially overpaying for the behavior it desires (below).

Of course, if your marketing turned out to be ineffective at building up balances, or you simply don’t do account balance marketing, then there is reason to question if you need deposit tiers at all.

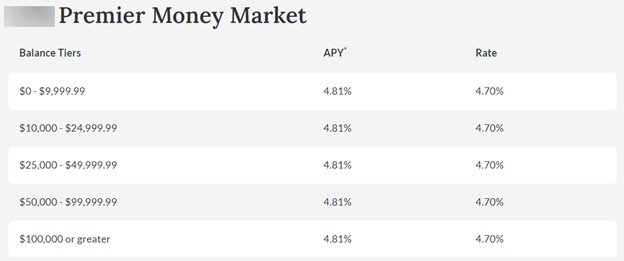

These days, many banks maintain deposit tiering but with a single rate (below). Here, the customer and employee get confused, and the bank suffers higher operational and compliance costs of maintaining various tiers.

Account Balance Behavior – The Positive Convexity of Large Balanced Accounts

There are other reasons to tier deposit accounts, and behavior is one of those reasons. If accounts with balances between $10k and $25k reacted differently to rates, this might be a reason to tier accounts. There is evidence that larger balance accounts tend to be more rate sensitive, but the evidence is weak, which also puts the entire tiering methodology in question.

In looking at the relationship between account size and rate sensitivity, our analysis indicates that for accounts over $5,000, the rate explains 21% of the account balance changes. This compares to about 15% for accounts between $500 and $5,000. This might be as expected, except when you look at accounts over $50,000, the relationship turns to a negative 12%, which casts some doubt on the theory that balances are as rate sensitive as we believe. In some markets, accounts over $50,000 exhibit negative convexity and tend to increase balances when rates go down and decrease when rates go up.

This raises the question of whether banks should be tiering at all. For some accounts, such as business savings, banks shouldn’t tier. These accounts exhibit positive convexity, regardless of tier plus tend to be more uniform across account balances. It is difficult to draw any clear conclusions here, but often the presence of tiers makes account holders more rate sensitive (and thus less valuable).

Keeping Your Deposit Tiering Tight

What banks don’t want to do is create a tier that substantially jumps the deposit rate. In these cases, banks end up mixing non-rate-sensitive and rate-sensitive customers together. Instead of this scenario occurring, it is far better to create a higher-rate product with some additional constraints so that a bank can segment all its rate-sensitive customers. This tactic allows a bank to target a broader market while protecting the performance and value of the lower-rate deposit segment.

Of course, things are not that simple. Deposit management is one of the more complicated sciences in finance. Coming up in a future article, we will add another layer to the onion as we discuss other forms of tiering and other machine-learned tiering methodologies and highlight more tactics around tiering.