How to End Price Your Deposit Accounts

You oversee pricing your checking accounts and you are trying to decide between $10.00 per month, $9.99, or $9.95. Which one do you choose? In a prior article where we tested “charm” account pricing, where we showed that conversion rates were almost twice as high when we used a $1.99 price point for a product compared to $2.00 (HERE). In this article, we go a level deep in pricing deposit accounts and look at various tactics around “pricing syntax” or “end price.”

Pricing Tactics for Deposit Accounts

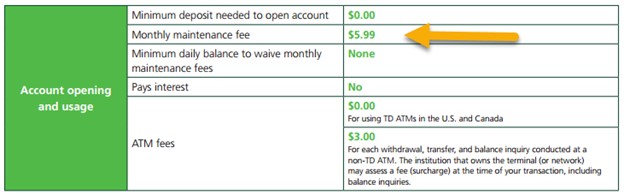

Survey deposit pricing and you will see a mix of pricing strategies. Some banks, (below), have accounts that end in $0.99, while other like Chase often use end pricing of $0.95. This is against the majority of banks in our industry that prefers rounded numbers such as $10.00 or $15.00.

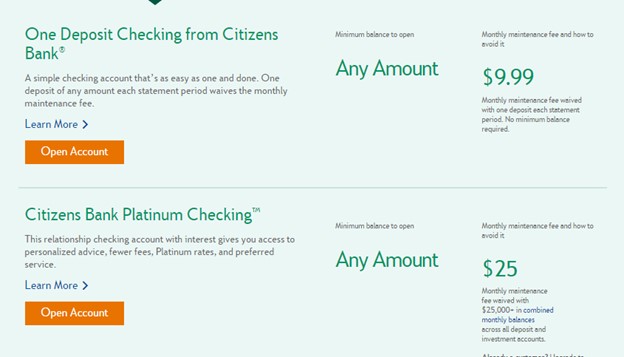

Then there are also a handful of banks that use a combination of both pricing structures. For example, Citizens, uses a combination of both. These banks usually use odd digit pricing on their lower tier accounts while using rounded pricing for their higher end packages.

This brings up the question, which strategy is better?

Pricing Data Around Deposit Accounts

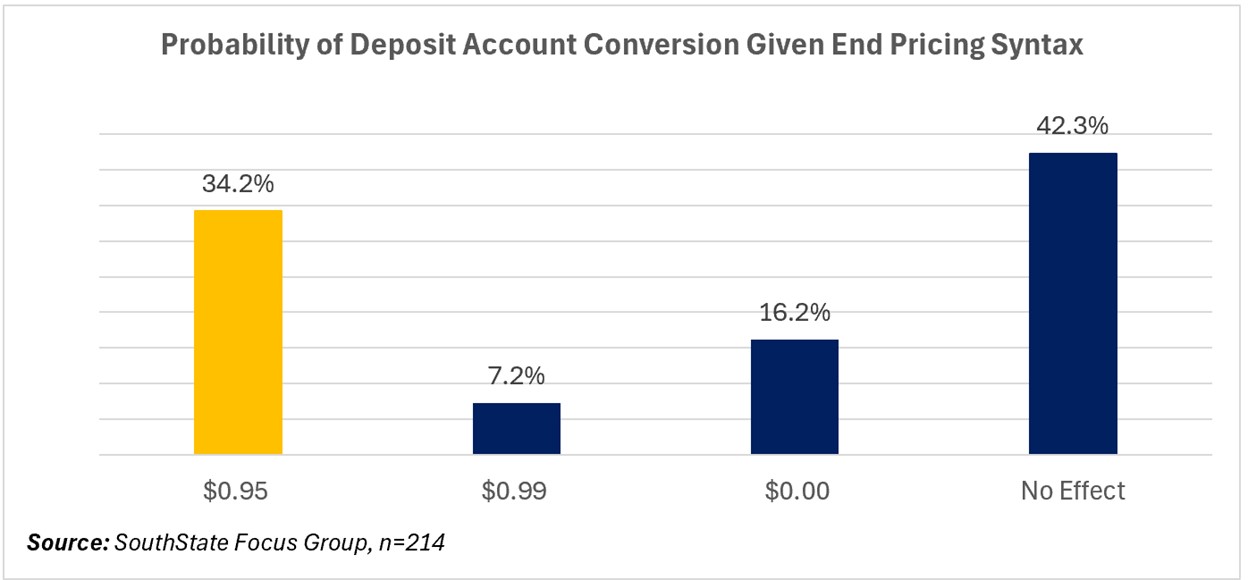

Behavioral economics as applied to pricing strategies is difficult to understand because of the large number of variables. Demographic factors, account attributes, economic cycle and competition all play a role. However, the data is strong (below) on which path to choose.

We conducted a series of A/B tests where we rotated pricing between $5.99 and $24.00 for a group of accounts. We had both retail and business customers look at two similar accounts but with different pricing syntaxes. We then recorded their choices.

As can be seen above, for the largest segment of customers, the difference in pricing had little impact. However, for a material amount of customers, checking accounts ending in $0.95 had the highest conversion rates by almost double of the next highest converting syntax. Accounts ending in $0.00 converted the next best with a probability of 16.22%, or more than double the rate for accounts ending in $0.99.

Younger Customers Are Different When It Comes to End Digit Pricing

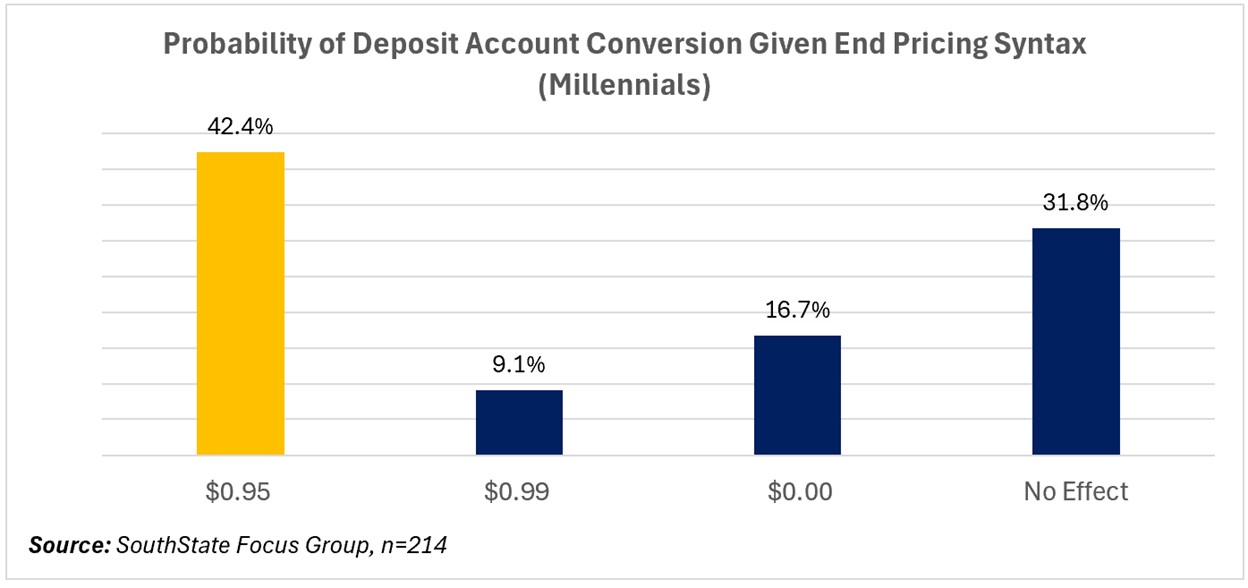

This syntax effect was approximately the same across genders, locations, and household income. Millennials, however, were more biased to odd digit pricing and were more strongly influenced by a pricing structure that ends in $0.95 (below).

Putting This Into Action

We do not know if moving account pricing to numbers that ends in $0.95 will help your bank but it works well for many banks. Our data indicates that it can make a material impact on account conversion. While end pricing isn’t the only attribute that matters, it is a significant consideration. If you can increase your deposit account conversions by 18%, then changing your end pricing syntax may be worth trying. You will never know unless you test and if the above data is somewhat representative of your market, it will be worth your effort.