Managing Time Deposits – How To Use “Specials” And Odd-Month CDs

Something might be getting lost in the tribal knowledge of managing time deposits. Certificate of deposit (CD) “specials” and the odd-month CD offering are good examples. As the legacy knowledge of deposit gathering is passed down from generation to generation of banker, some of the finer points of liability structuring are getting diluted with some knowledge just plain forgotten about. In this article, we highlight how to better manage time deposits to prevent banks from destroying value.

Managing Time Deposits – A Historical Context

With loans booming and deposit growth hard to come by in the 1950s, it was hall of fame banker Walter Wriston, then an EVP of First National City Bank of New York (and future CEO when the bank later became Citibank), that grew frustrated when he had no tools other than a savings account to attract new money to the bank. At the time, as rates went up, corporations and wealthy depositors would take their money out of banks and put them in Treasuries.

By 1961, Walter had received the necessary regulatory approvals and found the perfect test case with a commercial customer that was threatening to leave the bank. Walt was able to pay an attractive rate in exchange for the customer agreeing to leave their money at the bank for a contractual amount of time. The CD market was born and managing time deposits was a new banking skill.

By 1966, there was $15B of CDs issued by banks, a market that was second only to Treasuries. Then, it was common practice to publish your “on-the-run” CD rates but not publish your “special” rates. As Wriston used to admonish his executive team, the rates on “specials” were never to be published as you never wanted to upset your existing customers that were not getting that rate or cannibalize your current deposit base. Specials were kept quiet and were only the domain of EVPs and CEOs who had the authority to grant them for customers who you either want to reward because they could bring over business to the bank or that were already rate sensitive and you wanted to retain.

Fast forward to the 1990s when the “odd month” CD became popular. Instead of issuing a 12-month and a 24-month CD, bankers often issued a 13, 15, 18, and 26-month CD in the place of the on-the-run traditional CDs. The concept was that depositors wouldn’t care much between 12 and say, 13 or 15 months of maturity and would treat these maturities all the same. As a result, you could offer the same rate while picking up a couple months of maturity and duration in the process.

Over time, it became common practice when managing time deposits to make your special CD offerings maturing in odd months. These specials, also called the “off-the-run” CDs, were not published, but became more standardized with authority to issue these specials given to the branch and assistant branch manager. When that was done, specials became more widespread and were used for almost any customer who threatened to leave, regardless of profitability. In addition, these off-the-run CDs were also pitched to almost any new prospect.

Around the same time, smart bankers started to use the off-the-runs as an asset-liability tool to save money and “buy” a little extra duration. Bankers would pay a couple of basis points higher than their 12-month CD offering for their special, non-published 15-month CD. The rate would be lower than the linear interpolated rate between the 12-month CD and the 24-month CD. In this manner, bankers limited the impact of these “specials” while customers were happy because they were getting more interest than a 12-month CD offering.

Today’s Confusion When Managing Time Deposits

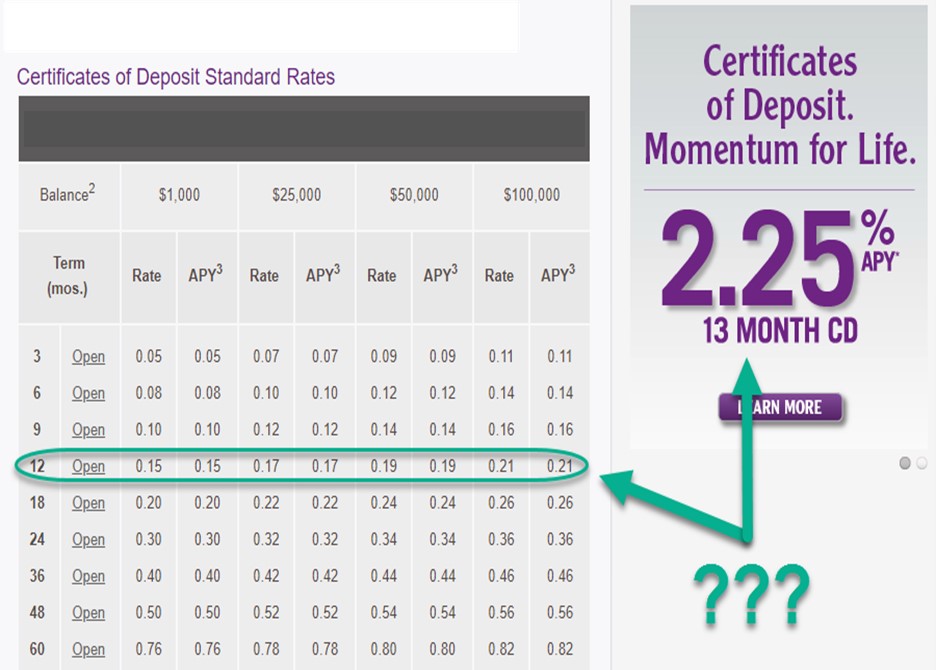

Somewhere around 2004, we lost track of history and bankers started to mix concepts forgetting the purpose of both specials and odd-month CDs. In today’s market, for example, banks publish a 12-month and 13-month CD right next to each other allowing for easy comparison. Worse yet, many banks publish their specials, often right next to their on-the-run offerings (below) thereby not only training customers to be rate-sensitive but obliterating their on-the-run offerings causing both customer (and employee) confusion and increasing operational cost.

Very few customers would choose any other maturity other than a special due to the significant rate difference.

The Better Way To Use Off-The-Run CDs and Specials

Banks need to get back to their roots when it comes to managing time deposits. While any time you market on rate, you have failed to properly convince the customer of your value proposition, sometimes you have no choice. Here are some best practice tips culled from some of the best CD managers in the country.

Dual Strategy: Adopt a dual approach to deposit pricing – use a base rate for retention of existing balances, and higher yielding “specials” for the acquisition of new accounts. By separating the two, you are avoiding mass cannibalization of existing accounts. Moreover, keep your base rate at the optimal pricing position for maximum rollover response, and optimize your specials to compete with the higher yielding deposit offerings in your market.

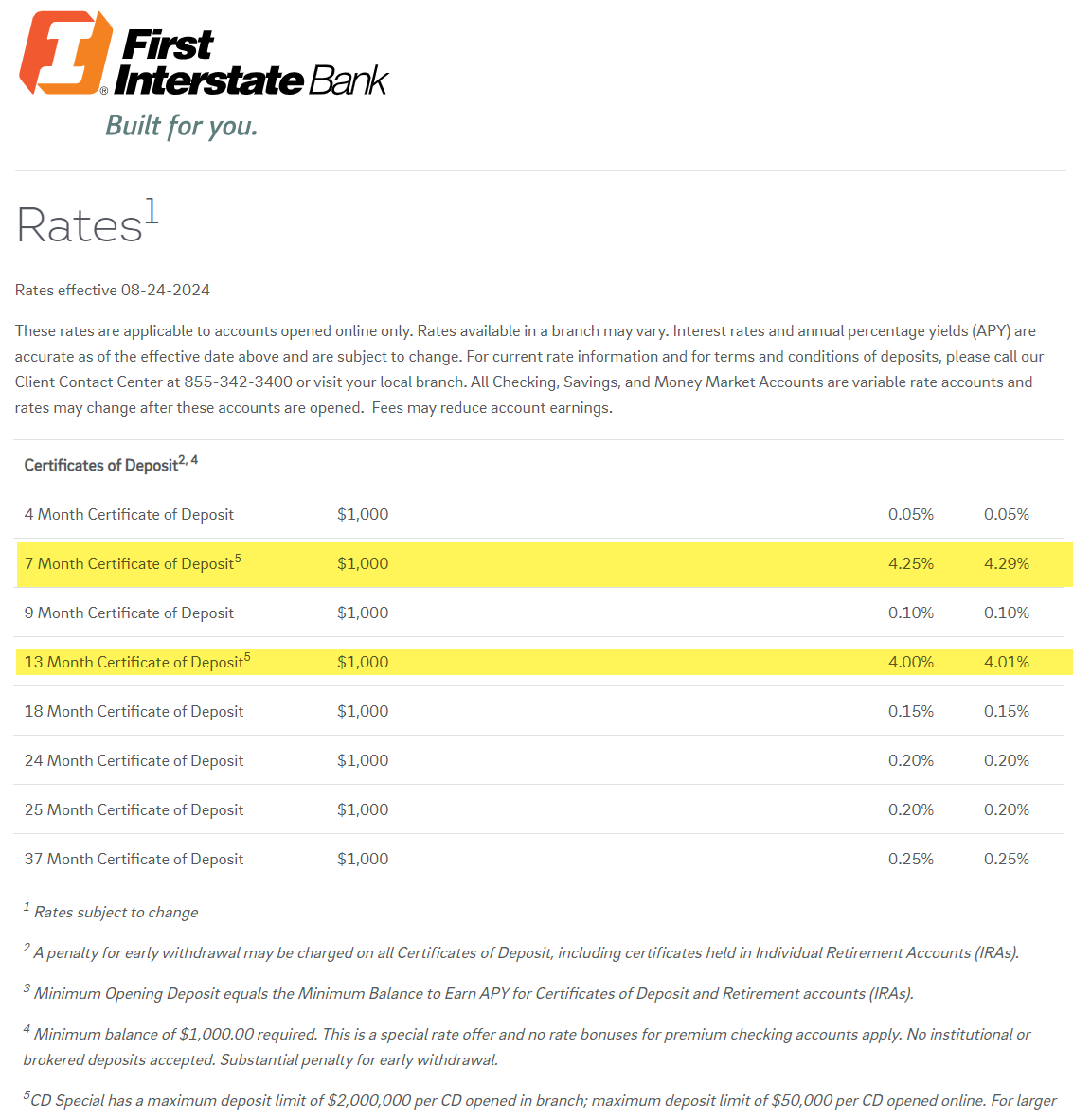

Reduce Your CD offerings: One way to boost liability performance is to get rid of all your on-the-run CDs and just offer odd-month CDs the way First Interstate does (below). This is one reason why First Interstate has one of the lowest interest-bearing deposit account costs in the market.

The approach focuses deposit marketing on checking, savings and money market accounts, three areas that hold the most value for a bank while allowing a limited number of options for maturity-focused accounts. The odd-month CD limits the comparison to other banks further helping to bring in the less interest-rate-sensitive customer.

If you are intent on keeping a full run of CD maturities, at least create gaps in your offering, so you limit competition with yourself. If you are going to publish an odd-month, 14-month CD, then do away with the 12-month and 18-month CD.

The customer’s time is valuable; you would rather be discussing other bank solutions than taking time explaining if a 3.00% 12-month CD is better than a 3.08% 14-month CD. Unfortunately, it is common for a bank to have ten or more published on-the-run CD offerings, five specials, five callable CDs, each with three tiers plus a “Bump” and “Add-on feature.” That’s 20 CDs with 100 variations. Do you really want to take all that cognitive and operational time for one of the least profitable products in banking?

Keep Specials Special: Specials should be, well, special. The minute you publish specials they just become CD promotions and you just set a new floor for CD pricing. High-rate promotions train both employees and customers something that takes days to do, but years to undo. Limit your use of specials when you absolutely must have rate as a weapon and keep your employees and deposit base focused on your core value proposition – service.

Putting This Into Action

Banks do not apply enough strategic and analytical thought to their deposit base. Every bank should have a clear and stated strategy for their deposit base while defining specific goals for their various deposit products, to include managing time deposits.

If used correctly, time deposits can add value. Unfortunately, too many banks don’t put enough thought into how to use CDs in conjunction with money market accounts and brokered deposits. More importantly, many banks don’t respect the destructive power of cannibalization and don’t have an appreciation for how they inadvertently train their employees and customers to be more rate sensitive.

As the Fed continues to tighten its balance sheet, look for deposit competition to continue to increase and for deposit beta to increase. As it does, look for CDs to become more competitive.

The good news here is that the majority of banks are showing admirable restraint in managing their beta. The national average rate for a two-year CD is at 1.58%, a level that is well below the breakeven level of 4.01% (above that level the two-year CD subtracts value). During the last rate cycle, the average bank two-year CD rate was almost at the breakeven level.

As rates and beta increase, mistakes in deposit structuring and pricing become more costly. Watching how you use odd-month and special CDs is an easy solution in protecting your balance sheet and an easy way to follow in Walter Wriston’s footsteps.