Quantifying Your Market When Raising Deposits

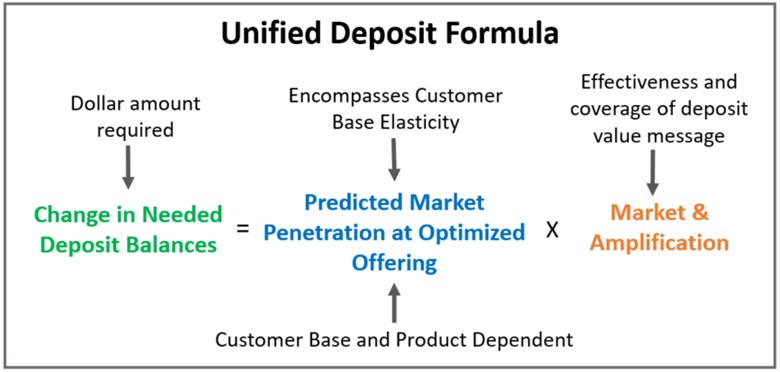

Last week we highlighted the lessons that machine learning taught us about the Unified Deposit Formula (HERE). Embodied in the Unified Deposit Formula is a marketing and amplification equation. In this article, we expand on the lessons we learned from artificial intelligence regarding raising deposits and explore how we can better use the Formula, and its lessons, to optimize deposit gathering.

Raising Deposits With The Unified Deposit Formula

To recap, the Unified Deposit Formula brings various disciplines of the bank together to help explain and then optimize deposit costs. It takes a bank’s asset growth and funding gap to determine the deposit needs and then looks at the value sensitivities of the service base. It is acknowledgment that a bank’s ability to raise lower-cost deposits is also based on the bank’s marketing reach and prowess. The stronger the marketing effort, the lower the deposit cost.

Also inherent in the model is the concept that deposit marketing is more than just price and promotions and that a bank’s customer base, products, and employees contribute to determining the value sensitivities of any given deposit-raising effort. The Formula can be seen below:

Marketing & Amplification

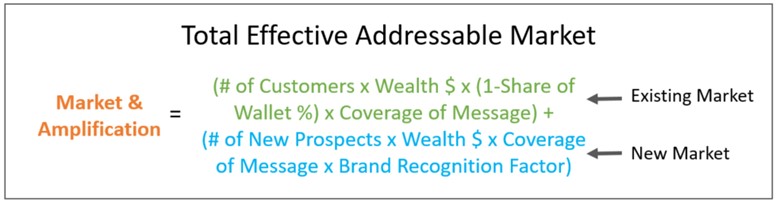

For the sake of this article, we want to focus on the details of the Marketing & Amplification calculation. This part of the Unified Deposit Formula equation measures the “Total Effective Addressable Market.” This is the dollar size of the market that you can effectively market deposits. It includes the portion of the deposits not kept at your bank by your current customers plus the service areas net of your existing customers.

The addressable market can be a wide geographical area, such as a state, or a niche market, such as all agricultural workers or doctors within a town.

This portion of the Formula looks like this:

Available Wealth Dollars For Raising Deposits

For this calculation, you take the number of potential customers you are trying to market to and then multiply that number by their “Wealth $s,” which is your assumption on the investable assets available for deposits. This number varies by geography and customer set, but this data is usually available through third parties or by utilizing your bank’s in-house data set. As a rule of thumb, we generally take 10% to 20% of the household net worth number for a given area or customer segment.

Since you already have a portion of your customer’s wealth, you want to deduct that from the equation. If you have 20% of your customer’s deposits, you can obtain 1-20% or 80% of the available deposits that are likely stored at other banks or investment firms.

One key point is that the more wealth available and the wider the disbursement of wealth, the lower your cost of funds and interest rate sensitivity should be when raising deposits. Going after a smaller piece of the wealth pie allows you to choose the lower rate-sensitive customers.

This concept will be useful later when we compare various deposit marketing campaigns.

Coverage Percentage

Once the market’s total size is known, it is a question of your marketing effort. You have already captured the effectiveness of your message in the Elasticity Equation, so now you are trying to figure out if you can show your value proposition to that market.

For example, suppose you are sending a message to your commercial loan customers about a new $500 bonus offer for a new checking and savings account. 16% open the email and click on your website to learn more. In that case, your message coverage is 16%.

Customer Discernable Wealth

To put this equation into action, we figure out the “Customer Discernable Wealth” first. If you have 3,000 commercial loan customers that do not have a deposit relationship with your bank (a 0% share of wallet), each with $85,000 of investable funds and a 16% coverage area, then the size of your existing market would be approximately $41 million.

Service Area Discernable Wealth

We then do the same calculation for your prospects with one additional factor. Suppose your service area has a population of 150,000 target commercial prospects that are not your customers, each with investable funds of $45,000, and you can assume a marketing coverage of 5%. In that case, your addressable new market is approximately $338 million.

However, another lesson from machine learning is to build in an adjustment factor for your brand. Because the Elasticity Equation data is from a test of known customers and focus groups, that number overestimates the response. Some banks call this a conversion factor, but we think it is knowledge about our bank or a “Brand Recognition Factor.”

While a machine learning algorithm can adjust for this Brand Recognition Factor, banks that want to do this calculation in Excel can use a simplified version. Since your customers already know your bank, they get a “1.” Prospect has a spectrum of knowledge and gets a 0.15 factor if they have never heard about your bank before your marketing message. The marketing message serves as an introduction, which is why the factor is usually a positive non-integer.

If you have some brand recognition and you have marketed to the customer before so that the household can recall your name, then the factor is 0.50%. If your local bank has the brand recognition that a national bank might have, then the Brand Recognition Factor is usually between 0.75 and 0.85.

The result of this equation is the effective size of the market scaled for your bank. In our example above, our existing customer base could provide us with $41mm of deposits while our new market could provide us with $338mm, so we know that our total addressable market is $379mm.

The Value of Marketing When Raising Deposits

Another material takeaway from this Formula is the power and quantification of marketing. By building your brand, you increase your Brand Factor making your bank more effective with its message. Expanding the coverage factor also increases the size of the market. This is why it pays to constantly build your prospects while experimenting and quantifying your marketing efforts. If you can add another 10,000 prospects to your email database, increase your Brand Recognition Factor from 0.15 to 0.35, and increase your open rate by 10%, then your bank can pick up another $9mm in addressable deposits from just that one effort. Do that repeatedly and scale it; a bank can double its addressable deposit base from which to draw.

Up Next

Next, we will look at setting strategies and tactics to optimize deposit gathering. We will show how instead of raising rates for one product across your market, you should consider lots of smaller deposit promotions to achieve better value. We will also examine why raising rates on your most rate-sensitive customers may not be your best tactic.

Until then, use the Market & Amplification calculation, or at least the concepts above, to expand your bank’s brand, market, and marketing effectiveness when raising lower-cost deposits.