Don’t Make This Bank Marketing Mistake (It’s Common)

Since you probably spent time today discussing the Super Bowl ads (Smaht Pahk, Google, and Snickers were our favorites), we wanted to highlight an all-too-common bank marketing mistake that many make. It can be argued that despite its high price, Super Bowl advertising is one of the best deals in marketing as you are assured a certain level of attention. Unfortunately, some brands waste it. Tim Pannell, the CEO of Financial Marketing Services, asked us last week what we thought of the picture below as it highlights the concept of waste in marketing. In one picture, he captured the essence of what is wrong with marketing, which is the same trap that many banks fall into. In this article, we do a quick recap of everything that is wrong with this approach and how banks can avoid it.

The 25th Anniversary of Techron

At first pass, the below advertising is seemingly benign. 25 years ago, in an attempt to distinguish themselves against a crowded field of other commodity providers, Chevron brilliantly introduced Techron, a gasoline additive. Similar to “Intel Inside” and other campaigns, a company plays up some small aspect of their brand proposition by branding a subcomponent of a larger system and, in so doing so, moves the brand to more of a premium position.

In 2019, when the 25th anniversary rolled around, Chevron decided to play up the anniversary, and so they created collateral similar to what you see below. Again, this seems fine on the surface, but it captures everything that marketing should not be.

4 Lessons From Chevron- Bank Marketing Mistakes To Avoid

Here are the four lessons from this tactic that should be in every bank marketer’s mind every day:

It is not about you; it is about us: Our biggest issue with this move is that Chevron decided to spend money to talk about themselves instead of the customer. We don’t care if Techron was invented two days ago or 100 years ago. There is no value proposition in marketing, no social validation, and no cultural value transference. This is an all too common bank marketing mistake. If your marketing campaign isn’t doing one of those three things, you are wasting your resources. At a minimum, what Chevron should have done is said something to the effect of “25 Years of Increasing Your Gas Mileage” or “25 Years of Making Your Car Run Longer.”

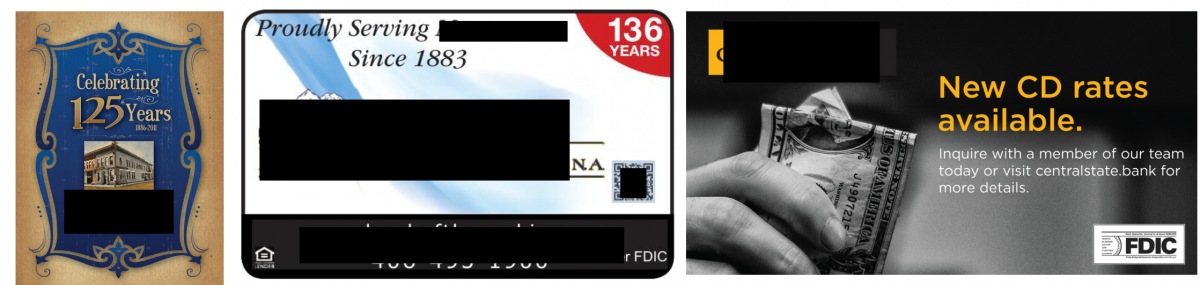

Unfortunately, banks spend money all the time on marketing that does very little to motivate the customer (examples below).

Taking Up Real Estate: Some banks have a billboard with just their name on it. Again, to our point above, this bank-centric approach drives little value. However, the other aspect of this point is that it takes resources away, including valuable real estate, that could be used for effective marketing.

Cognitive Blindness Training: Old Spice, Geico, Progressive, and a host of other companies have trained us to pay attention. Their ads are creative, funny, and intelligent. Even if we are not in the market for deodorant or insurance, we pay attention. The tactic of advertising bank-centric information does the opposite. We tune this out. We train our customers to become blind to our advertising as we send a signal that when we pay attention to us, we waste your time. Thus, bank-centric advertising not only isn’t effective and a waste of resources, but also hurts future campaigns.

Misalignment: Banks that advertise their anniversaries, profitability, or trite slogans (Our all-too-common favorite – “We are here for you”) do little to reinforce a message. Worst yet, and even more common, are when banks say their value proposition is about service, yet they advertise the low price of their loans or high rate on their CDs. Marketing dollars are too scarce to waste. Whatever your value proposition is, make sure that 90% of your marketing efforts support that message.

Putting This Into Action

To avoid these bank marketing mistakes, make sure every piece of marketing collateral either highlights a customer-centric value proposition; provides social validation that shows your customers why they are worthy of their trust and attention, or shows that your culture and target customer’s culture are aligned. When marketing, you are paying money to grab attention, so consider how you will get the best return on that attention now and in the future.

By aligning your message and making sure everything is about the customer, your return on your efforts could easily be Super Bowl worthy.