How Community Banks Can Take Advantage of Rising Interest Rates

As shown in the graph below, we may be witnessing the end of a multi-decade bull run in bonds. After many decades of decline, interest rates may be on the rise for years to come. This development is creating an opportunity for community banks to book longer-term fixed-rate loans with higher profit margins. However, borrower demand is forcing banks to make loans with 5, 10, and even 20-year fixed-rate maturities. How should banks protect themselves from the rising cost of funding and at the same time improve interest margins? CenterState Bank uses a strategy that enables the pricing of loans at a fixed rate to 20 years but converts the riskier longer-term portion of that loan to an adjustable-rate. The result is higher margins today, upfront fee income, and protection from rising cost-of-funds in the future.

What is Driving an Increase in Rates?

There are a host of reasons why interest rates are increasing and in our opinion, these are the most important:

- 2021 is a transition year as the market expects the rollout of the Covid-19 vaccines to change the trajectory of the US economy.

- The scale of fiscal response to Covid-19 is unprecedented and deeper than the Great Depression when comparing the impact to GDP, Industrial Production, and Unemployment. U.S. debt has ballooned to almost $28 trillion, or 122% of GDP. For context, during our last recession, we were at 61%. The current and projected debt-to-GDP ratio will result in crowding out of private debt and even higher interest rates in the future.

- With the unification by the Democrats of executive and legislative branches, investors are anticipating the blue-wave playbook of higher spending and additional deficits. The new administration is anticipated to focus on additional aid to support states and local governments and additional stimulus payments. The market anticipates that this will lead to higher inflation and higher interest rates.

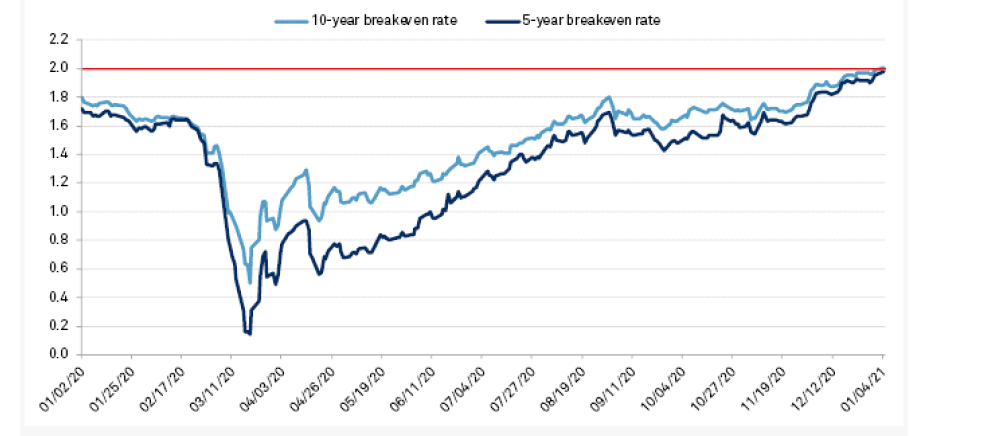

We are finally seeing inflation expectations averaging above 2% for the next decade. The 10-year breakeven rate (a measure based on inflation-linked Treasuries) has been climbing, as shown in the graph below. The Consumer Price Index and core Personal Consumption Expenditures Price Index have also been rising. The rise of current and expected inflation is not surprising since the mix of a) monetary stimulus, b) fiscal stimulus, c) the Fed staunch intent to lift inflation, and d) an expected recovering economy aided by the rollout of an effective vaccine are potent and symbiotic weapons to increase inflation. Markets are signaling belief that the Fed will be successful in raising inflation – but apparently not yet convinced that the Fed will be able to halt its rise when necessary.

How Banks Should React

Interest rates are expected to keep rising. Consider that the Fed Reserve has stated that monetary policy will be accommodative for “quite some time,” which is longer than “some time,” but some time is generally between 3 and 12 months. So how can banks take advantage of longer-term interest rates rising now with shorter-term rates expected to rise in the near future?

Many conservative borrowers are looking for fixed-rate certainty on their term loans, and lenders want to maximize earnings without taking interest rate risk. CenterState Bank is using the Adjustable Rate Conversion Program (ARC)

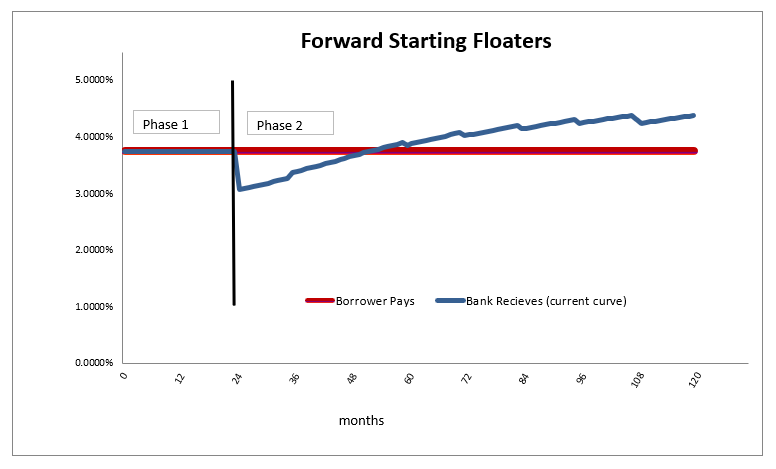

program to achieve these objectives by structuring forward-floating loans. This involves dividing the loan into two phases as follows:

- Phase 1 is a one to three-year period during which the lender is earning a fixed rate yield. This phase offers the bank a higher yield than an equivalent adjustable rate.

- Phase 2 is a three to 19-year period during which the lender is earning an adjustable yield. During this phase, we expect interest rates to be materially higher, and the lender’s NIM is expected to expand.

- The lender earns an additional fee, which is the monetization of future payments that the borrower will pay over the life of phase 2 of the loan. This can be as much as 2% of the loan amount and can be recognized as upfront income.

The borrower pays one fixed rate for the entire life of the loan (both phase 1 and 2 are identical for the borrower). The graph below demonstrates the phases and borrower payment versus lender yield for current interest rates.

Why This Strategy Makes Sense

The above graph demonstrates the borrower is paying 3.75% fixed for the entire 10-year life of the loan, while the bank receives 3.75% fixed for two years, followed by an adjustable rate that is determined by the then-prevailing short-term interest rates. The strategy makes sense today for the following reasons:

- Rates are still low in historical context and many borrowers want to lock in the cost of funding their business for longer periods.

- Borrowers now expect longer-term interest rates to rise and are willing to pay a premium for rate protection.

- The lender can lock in higher interest rates during Phase 1 of the loan. This is appealing, given the low level of short-term rates.

- The lender obtains interest rate protection during Phase 2 of the loan when banks have less visibility to determine the future path of interest rate increases. During Phase 2, interest rate risk is eliminated because the adjustable yield will move closely with the bank’s funding cost.

- Lastly, the bank has the ability to generate additional fee income that greatly helps profitability in the initial year when the bank needs to boost profits in a challenging transition year.