How The Pandemic Permanently Changed Branch Strategy

The combination of the greater pandemic-induced adoption of banking technology, higher branch operating costs, a greater number of workers working from their homes, and the changing needs of those workers, has altered branch mathematics and profitability. In this article, we look at the game theory behind branching and why there is a new equation for banks of all sizes to take into account.

In branch banking, there was always the dilemma in gathering customers. The number of customers a branch would attract was a mathematical function based on location of the nearest competing branch, services/products, brand, and price. All things being equal, customers tend to choose the branch that is the closest. Lower the price of a product, increase the brand value (marketing), or offer some unique services/products, and a branch could pull from a wider service area and increase market share. This explains why major banks such as Bank of America and Wells Fargo generally have larger circles of influence and larger branches compared to community banks, as they tend to have more valuable brands and a wider array of products and services. However, things have now changed.

Background – Optimizing Branch Location

Bankers that have a background in game theory will recognize the above non-cooperative problem as a Nash equilibrium around a condition of geography where each branch tries to optimize their profit by locating their branch strategically and then maximizing the other elements to reach a market share equilibrium. While some bankers would want to locate their branch away from other branches, that turns out to be the wrong strategy. While that would maximize utility for the population as a whole (as you would get more people close to a branch) it comes at the price of hurting profits for those banks not located in the middle of the greatest population.

If you work the math, you reach the counter-intuitive solution that it is better to cluster your branch around a population center. Adding competitive branches does not alter the math enough to change the strategy. From an intuitive standpoint, locating in a central location, regardless of competition, exposes your branch to the greatest number of households/businesses, which is a material driver of the branch usage function. In addition, not only is time to the branch important but so are traffic patterns and parking which are other reasons to locate in a central location regardless of competition. This Nash function explains why gas stations, hotels, and fast-food restaurants are often clustered together.

However, as banks move more customers to mobile and online banking, plus with the changing traffic patterns now emerging from a post-pandemic return to work structure, branch placement has permanently changed.

Pandemic Shifts

As the pandemic as caused an increase of employees that work from home, traffic patterns have changed. Urban core branches such as those in downtown Los Angeles, Chicago, New York, and hundreds of other cities are now less productive, and as a result, less valuable for the foreseeable future.

Suburban branches, perhaps the largest branch segment have also dropped in value by more than 20%. In addition to fewer customers leaving their homes, those customers that are leaving are making fewer stops. For example, branches at retail centers used to be highly prized because they used to not only get destination traffic but attract those customers that were going to other locations. Now with more online purchases and a jump in retail store closures, not only traffic is down, but time-on-property is down as well hurting suburban branch foot traffic to a large extent.

While many of these urban core and suburban areas will undoubtedly bounce back, it will take time. Because many of these branches were not clearly profitable to begin with, a large portion will never generate the new deposit growth, transactions, and engagement to accrete over an 11% risk-adjusted return. As such, the capital invested in these branches would be better spent on technology or even returned to the shareholders.

The New Nash Equilibrium

While the Nash equilibrium concept has been the fundamental strategy in branch banking for almost 200 years, the equation is now being altered by technology, particularly mobile banking. Solving for the location of a branch becomes less important as households/businesses have already started to choose their bank based on technology ease of use. For the last five years, this has been the dominant strategy when it comes to game theory.

There are a couple of important takeaways here that will alter the strategy for a bank that understands the new Nash equation. First, ease of technology has now replaced geography as the primary condition in the Nash equation. Because of this, it means that banks must have at least similar technology as their competition to maintain their market share. In other words, technology is now a substitute (in part) for the branch. Thus, banks that are trying to increase profit and market share will increase their investment in technology while decreasing their investment in physical branches.

Another takeaway is that banks are now less dependent on geography while at the same time each bank can utilize its technology and marketing to dramatically increase its reach. It used to be that a branch could service an area five to ten miles around the branch now that service area extends 20 or more miles.

This all may seem obvious, but we see many banks not taking head to the change in the market. Many banks still treat their technology spend as additive to their branch spend and not as a trade-off or alternative. Not considering technology physical branch cost saves, dramatically hurts the return of a technology project. As such, many projects do not get greenlit.

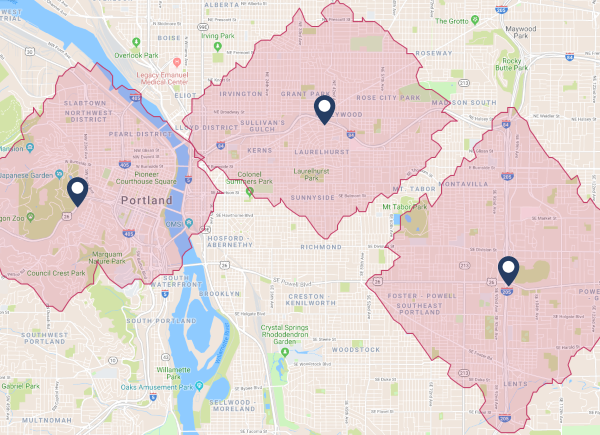

Banks that have branches within twenty miles of each other also need to rethink their investment. In many cases, a branch will find that by reallocating the operating cost of the branch to a product or technology product, market share can be increased. Below, is an example of a more optimized branch positioning structure with a wider, non-contiguous service area. Instead of having three branches in a downtown metro center. Current post-pandemic analysis call for spreading the branches out more into suburban areas with high freeway traffic and more weighting on public transportation. In this manner, a greater number of work-from-home customers gain quicker, and easier, branch access.

This also means banks have more economic incentive than ever to redefine community and organize around another construct other than geography. Maybe it is an industry, affinity, or other customer segment, but whatever it is banks can now seek a community that encompasses a greater geographic span and may or may not have a geographic limitation.

For example, banks that find themselves within a concentrated area for medical offices, can specialize here and increase their service area from five to 30 miles. As a result, a branch would not only end up with more customers but would end up with more profitable customers making that branch’s profitability greater in the process.

The Benefits of the New Nash Equilibrium

Unlike the new equation in the past, reconstructing the Nash equilibrium around technology means that more households and businesses can enjoy a greater range of banking products and services. Unlike the branch equation in the past, this will increase the overall utility for society. The other outcome is the rapidness of change.

In a normal Nash equilibrium equation, the cost of the strategic choices is the same. One branch cost structure is pretty much the same as the others. However, when you substitute technology for a branch, not only may you increase market share, but you also lower your cost structure by making delivery less expensive. This gives more of an economic incentive for banks to swap branches for technology and will serve to speed up the rate of change.

Banks would be served well to understand how technology is altering the game theory problem of increasing market share. While the Nash equilibrium doesn’t say anything about what the optimal strategy might be, the highest profit path most likely is a mix of both branches and technology depending on the sensitivities of the customer. However, the important takeaway here is that from a strategy point of view, banks need to think of technology not as another banking product, but as a complement or substitute for delivery within a market share strategy.