How to Set Up For PPP Forgiveness

As you wind down and clean up Round 2 of the Paycheck Protection Program (PPP) and before you produce your 1502 report to the SBA, it now merits thinking about how to best set up for the wave of forgiveness work that starts immediately after funding. Obtaining forgiveness is critical to both the bank and the borrower as it increases profitability, enhances cash flow, aids in liquidity and removes the risk for both parties. Unlike the origination process, banks now of the luxury of some time to get this process right. Being proactive now is the difference between getting a 70% forgiveness response rate and a 90% rate.

The PPP Forgiveness Challenge

After talking to hundreds of small businesses, there is now a building level of anxiety about how to file for forgiveness. As such, it is incumbent upon banks to get out ahead of this and help educate borrowers now on what to expect. This task is made more difficult because of the lack of information around both the calculation methodology and the workflow.

Do you need an application to help with forgiveness taking into account the below? We are exploring ways to help for about $60 per successful application. If interested, take a 2-minute survey and register HERE. We will then provide more information.

Solving the Challenge

To solve the challenge, the first step is to start with the end in mind and try to figure out what are your objectives. Most banks will want to obtain an 85% or greater level of forgiveness while producing a clean loan file. If this is your objective, below is one potential end-state of where you want to end up as far as a complete, auditable loan file.

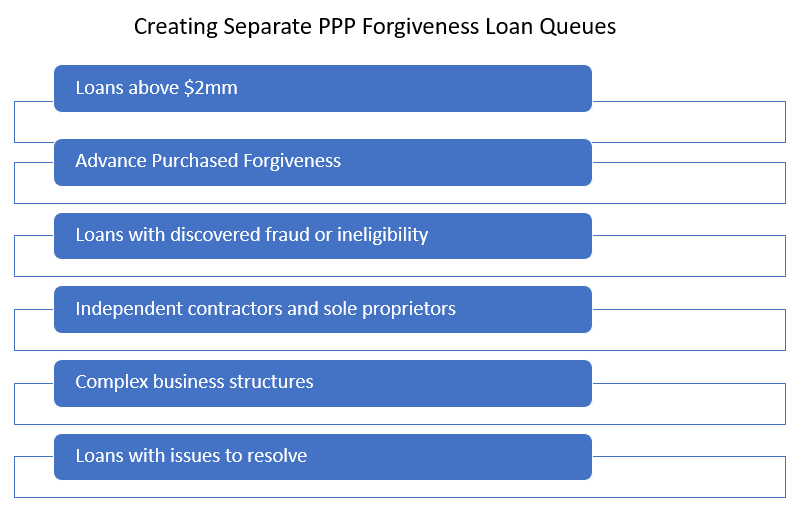

Next up, banks want to consider their process that will allow the greatest level of efficiency. Using the lessons we learned at origination, the most successful banks developed specific process queues according to speed and risk. Larger loans, loans to non-profits, loans to businesses owned by other businesses, and loans with issues were all likely channeled into a specific queue for processing. Banks are going to want to do the same thing for forgiveness.

To accomplish this, banks first describe what the “happy path” looks like which is a loan that sails through the process with no delays. From there, banks can benchmark and resource other queues. Below are some common bank queues that are being used.

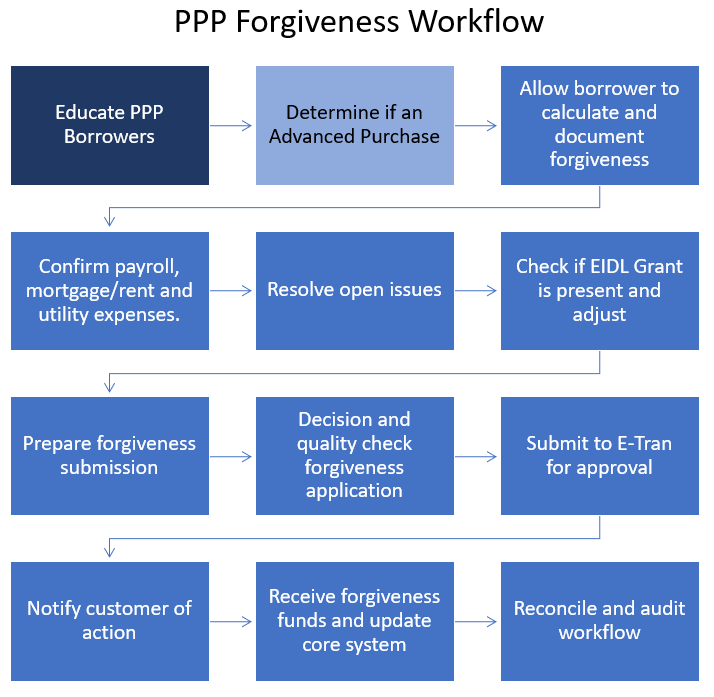

Once a bank decides on their loan queues, next a happy path workflow must be designed to meet the processing time objective. In addition, banks now have the luxury of designing better tracking mechanisms in order to be more Amazon-like. Being able to allow borrowers to look up online or on their phones where they are at any time of the day is ideal. If nothing else, creating email automation to handle this will be the default. This process step is critical for reducing questions from borrowers and bank contact points (relationship managers, branches, call centers, etc.) as everyone will want to know where they are in the process.

To save you time, we present our preliminary main workflow below.

Driven by this workflow, we highlight several of the more material tasks:

Education and communication: Banks should consider educating their borrowers as early as possible to prepare for forgiveness. Borrowers should be instructed on what documents will be required, in what form, and then give them tips on organizing the information. For example, letting borrowers know that lease agreements and utility bills may be required and those should be in Adobe pdf form will be helpful to allow them to gather this information now. Conversely, borrowers that also use mobile or online banking may be able to tag their payments now so that they are easily read by the bank.

Banks also need to establish a clear communication channel and methodology whether through email updates, call center, information on the website or text alerts there are many unanswered questions that need to be answered in the next several weeks. How to handle past due expenses; the definition of full-time equivalents as it pertains to forgiveness; the treatment of partner earnings; incentive payroll treatment; if all eligible payments must be on a cash, not accrual basis; can transportation/recurring software cost be included under utilities; treatment of profit-sharing; the treatment of qualified small employer HRAs; how the Advance Purchase feature technically works and, tons more questions all need to be nailed down and communicated to the borrower as soon as possible.

Do you need an application to help with forgiveness taking into account the above? We are exploring ways to help for about $60 per successful application. If interested, take a 2-minute survey and register HERE. We will then provide more information.

Within the forgiveness workflow, banks will need to design how to efficiently request further documentary evidence, resolve errors, and seek clarification. Thinking through and creating a response plan that is in alignment with the risk and the complexity of the request now will help save a tremendous amount of time later. Banks have the ability now to pre-write and refine responses that we did not have during origination.

It is also recommended that banks allow their borrowers an immediate opportunity to return the PPP funds under amnesty in cases where they were inaccurate on the application, they have reconsidered the tax implications of forgiveness (a material aspect of the Program that we find many borrowers have overlooked); they are not eligible or do not want to trouble with an audit. If this is a message to customers, banks need a workflow and plan to be able to handle terminated loans.

Advance Purchase: In Week Seven, the bank can request that the SBA purchase the expected forgiveness amount of the PPP loan based on not actual expenses, but on expected expenses. If this is evoked, banks will need to furnish the required documentation to support the forgiveness assumptions and a determination if the expected costs are reasonable. If approved, the SBA will purchase the forgiven portion of the loan within 15 days and the bank will need to further verify the actual expenses. The critical aspect here is that this feature creates yet another workflow that banks need to message, test for, and consider as this will be an alternative path for many borrowers.

Error Tolerance and Resolving Open Issues: Many banks built in an error tolerance into their initial PPP loan origination workflow, such as the loan amount had to be within 10% of the documentary evidence. Because of the short amount of time, most banks did not have the luxury to go back to every borrower to try to reconcile fully. Now, the problem arises around how to deal with this error tolerance if the borrower cannot substantiate the amount for loan forgiveness. Banks need to not only think about how they will resolve these and other issues, but how to construct their process to automate the process.

Banks also need to come up with a risk position and metrics to monitor this error risk. At some level of non-reimbursable error, it is not worth fighting with the borrower or the SBA. Banks need to define what this is level is and be able to monitor it. Conversely, banks need to be clear when and how to go back to the borrower and attempt to resolve these errors.

There is then the question of hundreds of thousands permeation of issues that will arise that are not covered by the SBA’s guidance that banks will need to decide. When the customer comes to you with a combined internet/telephone/TV package, a structure that is common, how will you figure out what portion to allocate to utilities? When borrowers want to take a home office expense because their office or warehouse is not available, how will your bank make that decision?

Our point is that the additional expense section will be a quagmire of questions many of which there will be no definitive SBA guidance. Establishing a methodology now and working that into the design of your process can save you a tremendous amount of time. Consider as well that the non-payroll part of allowable expenses becomes increasingly important as the company struggles to rehire workers in the time. The longer it takes to establish FTE numbers and salary levels, the more PPP recipients will need to come up with expenses to attempt to gain 100% forgiveness.

EIDL Verification: Many borrowers applied for an EIDL grant before, and many will apply after the PPP loan closing. The essential element here is that all banks will need to check with both the borrower and electronically with the SBA to validate the EIDL status. For those borrowers that have dispersed grants prior to the granting of forgiveness, banks will be required to deduct the EIDL grant amount from the loan forgiveness calculations.

Audit & Quality Control: The SBA has already stated that they plan to audit loan above $2mm and sample the rest. If true, it pays for banks to construct their electronic file organization now, create control schedules (to make auditing more efficient), and assign a single point of contact to channel audit requests.

Regardless of what your bank does for audit preparation, it is a good time now, if you have not already done so, to send all or a sample of loans through a quality assurance process to uncover any issues now while you still have an opportunity to repair items like the loan amount with the SBA. Banks that wait will find a much harder time later.

Resource Management

The other aspect of this effort is resource planning and budgeting. No doubt by now, you have a separate general ledger account set up to handle the fees and expenses under this program. Some banks have taken this a step farther and have enacted budgets for this effort to include loan forgiveness and management. For those banks, it is crucial to create a feedback loop and process to update that budget as new information becomes available. For example, it is unclear the amount of development effort will be required to use the SBA’s XML/API connection to transfer forgiveness data. It has been rumored that the requirements will be out by the end of the month, this means banks need to set aside both budget and engineering resources to handle in early June.

Putting This Into Action

Banks had to cut a lot of process corners during origination in order to meet the timelines and pressure. This undoubtedly has created more problems than the industry knows about. In addition, the origination process largely focused on eligibility, which was clear, and the calculation was based on a simple 2.5x payroll. Now, banks are going to not only have to deal with all the issues that were planted during production but all the hundreds of thousands of varieties of problems to process. The more banks think through this process now, the more we will be equipped to reduce risk, contain cost, and keep risk to a minimum.

Do you need an application to help with forgiveness taking into account the above? We are exploring ways to help for about $60 per successful application. If interested, take a 2-minute survey and register HERE. We will then provide more information.