7 Steps to Solve the Right Problems in Banking More Efficiently

The reality is bankers are fantastic problem solvers. It’s in their blood. The problem is that, as an industry, we leave much to be desired about DIAGNOSING the right problem. Present a challenge to a banker, and they will quickly switch to solution mode without first analyzing what the issues are. They don’t fully understand the “intent” of the customer and usually fail to understand the universe of solutions. This article presents the seven-step framework that we have found helpful in coaching banking teams in solving the right problem in the right way.

Highlighting Problem Diagnosis

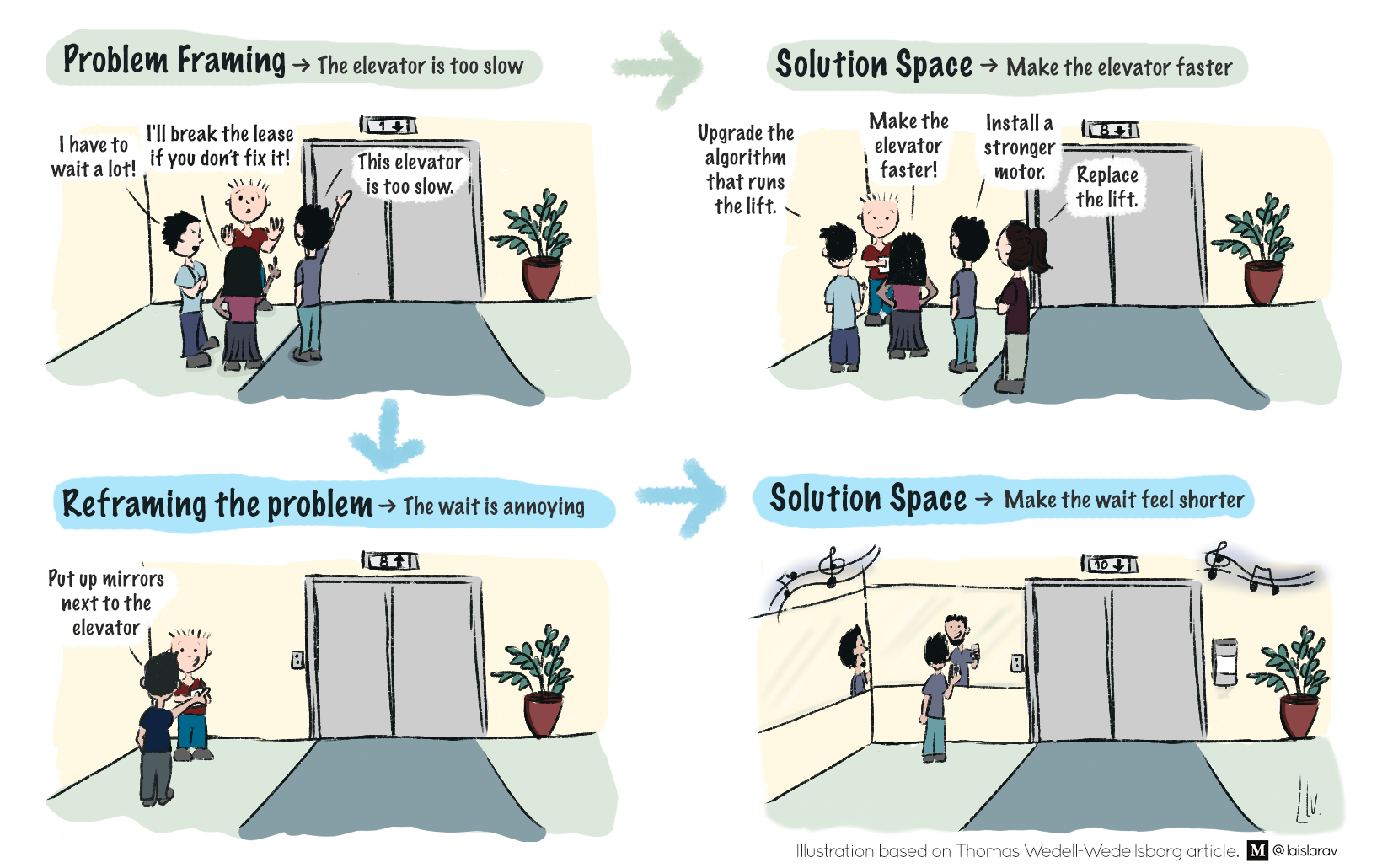

The challenge of problem diagnosis is best summed up by the classic Harvard Business School case study “Slow Elevator Problem.” An 11-story hotel gets frequent complaints about its slow elevator. When asked, most managers quickly identify the solution as replacing the elevator, installing a stronger motor, adding another elevator, or upgrading the algorithms to preposition the elevator where people are predicted to be. Each solution is over $100,000 with a three-month minimum time to implement.

Each of the above solutions frames the problem as such: Elevator is slow, therefore find a way to increase the speed of the elevator.

After brainstorming, the hotel owners came up with a different solution – Install mirrors next to the elevator on each floor. People will lose track of time as they look at themselves. This solution costs $3,500 and took two days to install. The owners decide to try this first, and to their amazement, complaints were dramatically reduced.

This solution reframed the problem as the elevator is slow, waiting for an elevator is annoying, therefore let’s make the wait feel shorter.

While the mirror solution solved the problem, the brainstorming didn’t need to stop there. After looking at the complaint data, most of the complaints came around 11 am. Here, the problem is yet reframed again: too many people need the elevator at the same time around checkout. The solution: stagger the checkout to reduce peak load times. The cost of this solution was $800 to design a new system that could be implemented in 24 hours.

By reframing the problem, you arrive at a more efficient solution set.

Exploring Solution Sets To Banking – The Chime Case Study

All the above solutions are correct; they may be correct for a different problem. Further, some solutions are more efficient than others. The exercise of reframing is to validate facts, challenge underlying assumptions and explore alternative solutions to the initially stated problem. Sometimes, after investigation, no real problem exists as it is a perception problem or problems are multicausal and need to be addressed in a multitude of ways.

The core point here is that you don’t fully understand a problem until you spend time understanding what the issues are. The wisdom is supported by the famous Einstein quote when he is reported as saying – “If I only had one hour to solve a problem, I would spend 55 minutes defining the problem and then take five minutes to solve it.”

Reframing the problem was just successfully executed by Chime to make banks look foolish. The recurring complaint that we all get is that our overdraft fees are too much. Upon trying to solve this, many banks reduced their overdraft fees from $45 to $30. However, at the start of the year, Chime asked – Why are customers over-drafting their account? While there were multiple reasons, one major one, supported by the data, is that most overdrafts came right before the pay period, and the customers needed a bridge to their paycheck.

This was a solution at several innovative banks as they introduced the “emergency line of credit” to reduce overdrafts. This worked to some extent. However, Chime took it a step further and concluded, if we know the customer is going to get paid, why not give them their paycheck ahead of time? The problem wasn’t that the customer didn’t have enough money; the issue was that the customer’s pay periods and expense periods didn’t line up. Chime recently introduced their “Get paid early” attribute that makes direct deposits available two days early. That attribute not only helped solve part of the problem but is responsible for a considerable number of new customers, thereby dropping customer acquisition costs.

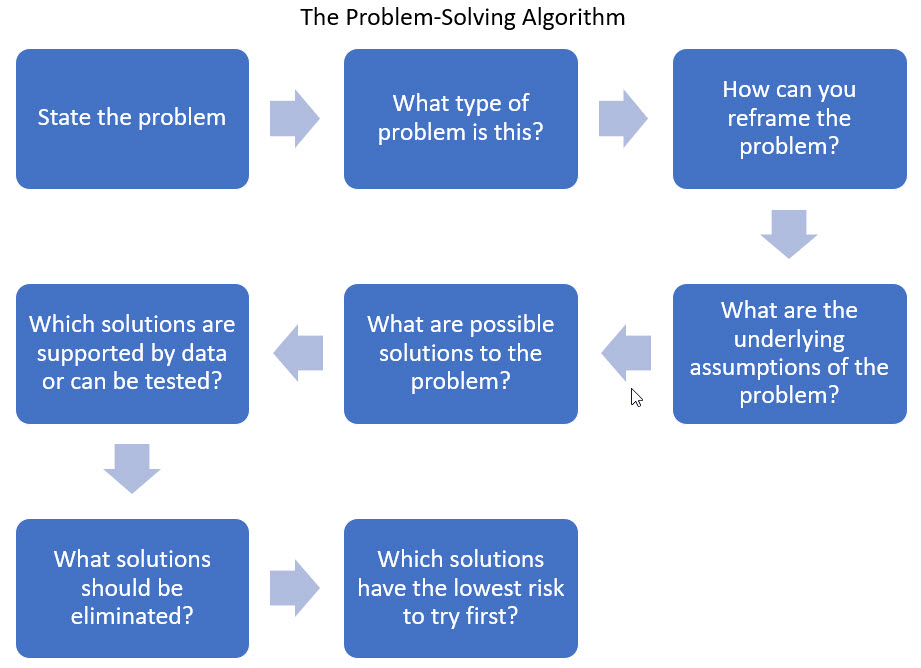

The 7 Step Framework for Reframing Banking Problems

Educate the team: Step one is to educate the team on problem reframing. If you don’t, the knee-jerk reactidon is that you are wasting time solving the wrong problem, and then you don’t get the participation you need. It is natural for us to want to solve problems, but this framework is to fight that urge and spend the first portion of the time understanding the problem.

Strive for diversity, including third parties: The need for diversity recently came to light in 2020 in Karlskoga, Sweden, when the town council wanted to reduce the number of injuries related to snowfalls. The town council, composed of men, voted to move snow clearing earlier and increase the number of snowplows on secondary streets. Their experience led to the framing of the problem as injuries from overnight snowfall occurred as citizens walked to work on roads. The injury rate persisted.

It took a woman, the wife of a council member, to point out that the data showed that 69% of the injuries were women not during commute times but right after people walked into town and spouses took kids to school. Instead of adding more expensive snowplows to clear roads earlier, the more efficient solution was to prioritize the clearing of sidewalks into town before plowing the secondary streets. This cheaper solution proved successful at reducing injuries.

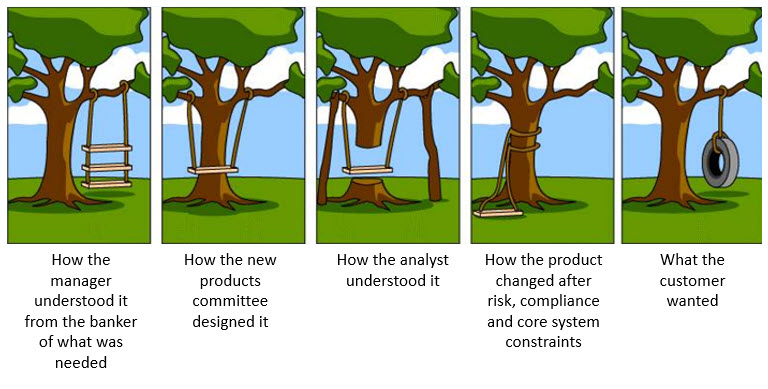

In order to limit biases and gain a new perspective, it helps to brainstorm problems with a more diverse group. In banking, we see this issue almost every day when managers, those often farthest from the customer, attempt to solve problems for the customer. Any problem-solving group should be diverse as to position, race, gender, and orientation. Further, third parties such as vendors, regulators, customers, and other outsiders should be included as they can bring an additional perspective.

Go Broad, Then Deep: When brainstorming possible solutions, there is a natural inclination to delve into details of either a proposed definition of the problem or solutions. It is incumbent upon the facilitator to keep asking the question – “What else is missing?”

Brainstorm about improving your bank’s stock price, and you will get a bunch of ideas about generating more fee income, getting more customers, and making more loans. After about the fifth “What else is missing” question, you will get to items about better investor relations, more press releases, and creating more bank stock liquidity.

Commit in Writing: In order to avoid group-think and influence, start a problem-solving session with a pre-meeting task of sending an email with a paragraph, not a bullet point of defining the problem. This allows people to speak more freely, prevents opinions from being influenced, and eliminates getting “target lock” on one definition. Further, require all employees to write in the first person to aid in accountability.

A bank recently learned this lesson when they started to brainstorm how to be more innovative. Managers sat around saying, “Our employees are not motivated to innovate,” and “our people don’t have the right skills.” If the meeting facilitator stopped collecting the data, the wrong conclusions would have been reached, leading to the wrong solutions. Upon surveying the employees, you received comments such as “I am not empowered to effect change,” “I don’t have a mechanism for providing new ideas,” and “Every time I make a new suggestion, nothing happens.”

The first-person perspective carries more weight. This problem becomes even more acute when bankers try to speak for the customer. If the customer view is important to the problem (and it should be), then be sure to get customer input. This also speaks to a gathering a diversity of views.

Getting input in writing allows more of an unfiltered view and allows the critical nuance of the problem to be captured.

Expand Participant’s Views: Another pre-meeting exercise is to ask people to come to the problem definition meeting with an opinion on the following topics:

- Is this an incentive problem?

- Is this an expectations problem?

- What role does training play in the problem?

- Is this a problem in our process?

- How can technology help?

- How can education help?

- What data is needed to better understand the problem?

A bank rolled out a new digital account opening platform only to find customers were still complaining about the time it took to open an account. The bank calculated that it would take less than five minutes to open a new account, but customers complained that it was taking more than 20. After looking into the issue, the problem was that the bank didn’t tell the customers what documents would be required until they already started the process. By moving the education piece to before the customer started the process, processing times, and complaints were dramatically reduced.

By asking the above standard questions before the meeting, participants will be prompted to think along other avenues.

Include the positive, not just the negative: During the problem analysis phase, it is always instructive to break down the instance where the problem didn’t occur. Analyzing what works can help uncover factors that might be missing in the negative case, where the problem occurred.

A bank recently wanted to know why they felt they were never going anywhere with their strategic plan. After defining the problem and looking at those initiatives that worked right, one common factor was that there was a full-time project manager assigned to the successful task. Initiatives often languished at the bank when line operators, those with a full workload already from “day jobs,” took on additional projects. By looking at the successes, the bank was able to solve the problem.

Clarify each participant’s objectives when solving the problem: While all parties in the room may want the problem solved, each party may want the problem solved for different reasons. In some cases, the reason doesn’t matter, but in some cases, it does. While many bankers want online lending, the banker that wants to reduce cost will reach a different solution set than the banker that wants to improve the customer experience. Before challenging anyone’s objectives, first, seek to understand. Question the various factions about their perception of the problem and what should be the objectives of what a solution looks like.

Putting This Into Action

The next time your bank attempts to solve a problem, step back and work on defining the problem first. As Peter Drucker used to say, “There is nothing more dangerous than the right answer to the wrong question.”

Validate the underlying assumptions, gather data, and then practice reframing the problem. Reframing problems take a heavy dose of creativity which is the same muscle many banks need to build to increase their rate of innovation. Practice defining and reframing problems, and you will find that innovative solutions start to come a whole lot easier.