Recap of Money 20/20 USA 2023 and 10 Banking Thoughts

Money 20/20 (M2020) is the only conference in the industry where it is both possible and expected to pull off two breakfasts, two lunches, three cocktail parties, and two dinners PER DAY. It’s a whirlwind of education, deal-making, eating, and hugging. In this article, we detail our thoughts and the trends we saw last week in Las Vegas from a banking perspective in hopes of giving you the flavor and insight from the conference without you having to walk 10 miles per day and listen to endless vendor pitches.

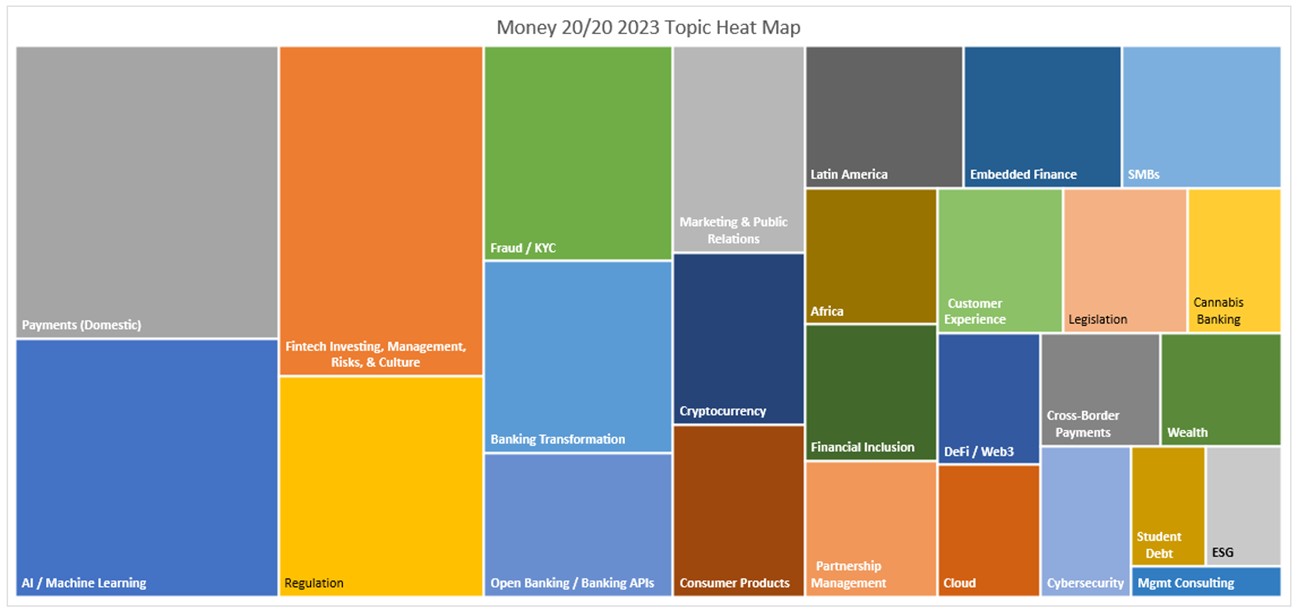

Below is a breakdown of all 300 sessions, less the demos and sales pitches. As can be seen, the conference largely revolved around payments, artificial intelligence, fintech partnerships/management, regulation, and fraud/identity in its various forms.

Our Top 10 Insights From Money 20/20

From these sessions and announcements, we pulled out ten of our most important takeaways, each having an impact on bank operations in the coming year. In order of our perceived importance, here is our breakdown:

10. No Recession: The sponsorship and entertainment money spent this year signals we are a ways from a recession. The entire town of Vegas, with its 156,000 rooms, was sold out for a few nights. AirBnBs were going for $9k per night, and that was in Laughlin. The 3,000+ vendors covered the floor, many with additional suites upstairs to host after-hour meetups. Money 20/20 cocktail parties started at noon, and events from sponsored race car driving to helicopter tours were common. Almost every venue was taken by a vendor at the average price of $150k to host a cocktail party. JP Morgan took over the centrally located Delmonico’s steakhouse for the entire event, which must have been a seven-figure investment. If this conference is any indication of the economy, businesses are spending, and the economy remains strong.

9. Crypto: Crypto was back in its rightful place at Money 20/20, being representative but not dominating the conference like in years past. The discussions were healthier, more compliance-focused, and with little expectations that banks were going to offer crypto to their customers any time soon.

8. Sunday Programming: consisted of a federal lobbying track, AI Summit, Small Business, Fraud, running a fintech, cannabis banking, and modernizing the banking core system. The topics were perfect, and there were some great case studies, but the substance was standard, bordering on underwhelming. We need to spend more time talking to our regulators/legislators; AI is changing everything, but we should be cautious; small businesses are an untapped and underserved market (but Rule 1071 is more significant than you think); criminals are getting smarter, but technology will be our savior; running a fintech is hard and going to get more challenging in the next year; cannabis banking will be a grind until weed comes off being a Schedule 1 drug; and, you are going to need a more modern core.

7. ChatGPT For Underwriting: For some reason, using ChatGPT for underwriting was a discussion. This wasn’t the right time to have this discussion, and it was not the right place. The catalyst was likely a panel led by the CEO of Taktile (AI Underwriting), a Partner from Bain Capital, a partner for Andreessen Horowitz, the chief data scientist from Branch International (digital banking fintech for India and Africa), and a tech correspondent for CNBC. You have never heard so many intelligent people sound not so smart. They either didn’t understand generative AI (it would not be the right tool for credit underwriting) or didn’t understand credit underwriting. In every discussion we participated in or overheard, everyone talked like borrowers have homogenous financial information, not realizing how messy small business underwriting is. “Experts” also talked like A/B testing credit scorecards happens quickly, not having a grasp of the length of time credit takes to go into default (27 months usually at a minimum unless there was fraud) and how long it takes to reach an outcome (12+ months). Our only point here is that if you are in credit underwriting at a bank, your job is safe for another couple of years.

6. FedNow: Along with lots of sessions and talk around instant payments and its various use cases. Say what you want about bureaucrats, but the Fed was out there hustling their FedNow capabilities and spoke on no less than four stages, plus worked their booth hard. They were proud of the fact that they now have 153 banks live and gaining more every day on their march to dominance.

5. Fraud & Identity: By far, the largest number of vendors and conversations were over fraud and identity. Clear introduced its reusable identity from its Sora ID acquisition and presented it at the conference for the first time to financial services companies. The near-frictionless Know Your Customer (KYC) solution merits a look from banks. Identity management, ID proofing, preventing account takeovers, limiting card-not-present risk, the rise of social engineering on remote workers, and more cyber-crime-as-a-service offerings had most of the buzz.

4. Generative AI: Traditional AI was ever-present in touted solutions regarding fraud, risk management, and the customer experience. However, of course, it was generative AI that remained at the peak of the hype cycle. Microsoft, NVIDIA, and AWS dominated, and about 20 other ChatGPT-like startups pitched their products and spoke on various aspects of the application of their wares. Use cases abounded, and the central thought is that gen AI will boost productivity and be the dominant way you interact with your financial institutions. That means fewer web pages and fewer humans but more interaction. While the risks were well represented, the noticeably missing piece in the M2020 conversation was the effort needed to get gen AI agents accurate. Few speakers or vendors had solutions for how banks are going to efficiently index, manage, and optimize their knowledge base, not to mention customer data. Maybe a topic for next year?

3. 1033: Along with collecting small business data under Rule 1071, the Consumer Financial Protection Bureau’s Section 1033 of Title X was recently proposed and is out for (short) comment generated deep discussions. This bill of “personal financial data rights” is similar to the California Privacy Protection Act that is already in force for banks doing business in CA. The difference is that 1033 is more product-focused and pertains to just certain types of information, such as transaction and balance data. 1033 requires that the consumer know what data is being collected, be able to control that data to some extent and be allowed to export that data in human readable form.

The regulation will present a challenge for banks that have their customer’s consumer data in a variety of places, don’t have the ability to allow the customer to manage that data, and don’t have an API infrastructure to support the open banking standards for consumer platforms to access that data. In addition to the technology hurdles, banks at M2020 fretted about making loan pricing and fees public, as other banks and fintechs will be able to reverse engineer every bank’s pricing and credit model. Under the Section, authorized third parties can request the desired data elements.

What got lost in the presentations and conference conversation is that 1033 is unique compared to past regulatory data efforts as it targets just certain products, like cards (Reg Z) and deposits (Reg E), and has a very narrow view of what it constitutes as data. Also different is the fact that banks need to tell the consumer what they are using the data for. Banks will need annual authorization to use the data and will need to “minimize” the data that is being used to just the essential elements, thereby putting a crimp in future bank marketing efforts.

The other aspect that caused deep conversations was over the requirement to provide the consumer information “as soon as it has it.” Thus, this data relationship isn’t a one-time event or cannot be handled in batch on an ongoing basis. This will present some customer experience and technological hurdles for many financial institutions.

One bit of good news to come out of the Money 20/20 conference was that most banks are coalescing around the FDX API standard, thereby helping future interoperability.

2. Banking-as-Service (Baas): Last year’s Money 20/20 mantra that “every bank should be in BaaS” has given way to a giant slug of caution. There is a rash of bank consent orders that either were just made public or are about to become public that everyone is talking about and have noticeably put a damper on community banks’ enthusiasm for BaaS. Banks finally figured out that the middleware platforms that either take over a bank’s customers or provide a layer of opacity between a bank and their newly introduced customers are problematic for economic, customer service, and regulatory reasons. The news about the downsizing and restructuring of Synapse, Sendwave violations, and others have left many fintechs out in the cold and others looking around for larger banks that are not under orders. The big takeaway from Money 2020 is that banks need to do a better job at policing themselves and that BaaS is not as scalable as once thought. Regulators will want more compliance bodies, more compliance/risk technology, or both out of almost every BaaS bank.

1. Instant Payments – The Next Evolution: While there were many sessions and discussions around instant payments, the conversation was more evolved this year with a focus on utility. Request-for-payments was no longer talked about in theory as many banks and companies touted their own case studies.

One of the most surprising aspects of Money 20/20 was the two sessions and discussions around Pay-by-Bank. Mastercard, ironically, had a major announcement in conjunction with JP Morgan that allows billers with recurring payments to use their rails and will combine the card rails with ACH and the instant payment rails. This is the first time that we have heard a public discussion about challenging the Visa/Mastercard duopoly, and the picture that it painted was optimistic for merchants and banks.

Other evolutionary discussions took place around the popularity of embedded finance and banks getting connected to the accounting and enterprise systems of commercial customers. This topic was extended as new applications built on instant payments targeting specific industries such as real estate managers, healthcare, non-profits, law firms, insurance companies, municipalities, and shippers. Instant access to earned wages was also a popular theme, with several banks showcasing their wares.

Other: Outside of our Top 10 takeaways from M2020, there was also talk about climate change and sustainability in banking and fintech but very little talk about California’s new Climate Accountability package (Senate Bills 253 and 261) that were signed into law and go into effect starting in 2026 that will require any super community bank or larger that has employees or does business in California to disclose greenhouse gas emissions. Given that the SEC is not far behind, environmental reporting was also common cocktail party content.