Labeling Customers To Boost Bank Marketing

If you are reading this, you are likely a high-performing banker. Like us, you are likely passionate about banking, looking to improve, and you are more quantitative than the average non-reader. While we suspect that supposition to be true, we really have no idea. Regardless of how you perform, the fact that we labeled you as a high-performing banker means that you are more likely to finish this article, more likely to self-identify with being a top performance, and, as a result, you are more likely to become a top performer. In this article, we explore the tactic of labeling customers and what happens when you do.

Invoking a Sense of Self by Labeling Customers

No surprise, people want to become better, and that need for self-improvement can play a critical role in shaping bank customer behavior for the benefit of both the bank and customer. Bank retail and commercial customers want to see themselves as sophisticated, intelligent, diligent, responsible and competent. They want to be worthy of approval both in their own eyes and in the eyes of others. That need can be directed, through both subtle and overt means, to be the catalyst to drive important behavior.

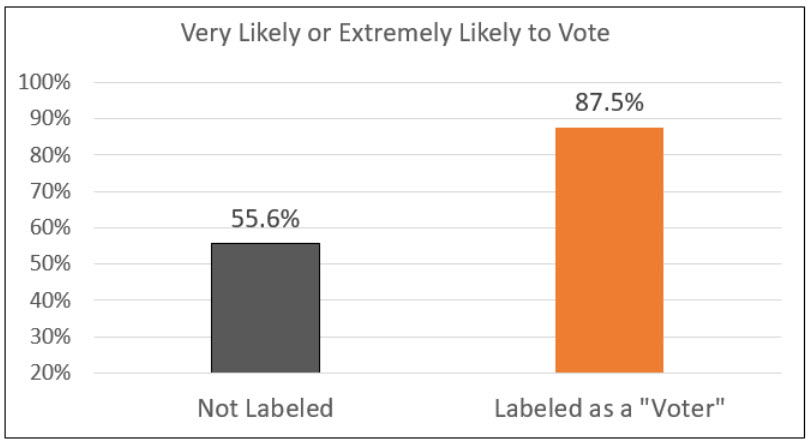

A 2011 joint psychological study by Stanford and Harvard (HERE) universities conducted three experiments and found that subtle linguistic cues materially influenced voting and related behavior. Researchers found (below) that labeling someone with a noun, such as “being a voter” increased the probability of that person registering to vote than if they used a verb and simply discussed if they will be “voting.” In one study, participants were 32% to be very likely or extremely likely to register to vote if they were labeled by the interviewer before the question.

In other studies, students that were labeled as “studious” did better on standardized tests, kids that were marked as “carrot eaters” ate more carrots, and adults that were “Shakespeare readers” were more likely to read Shakespeare than if you just had them check a box that said, “I like to read Shakespeare.” Self-identification drives behavior.

Increasing Bank Product Usage by Labeling Customers

Labeling customers is a powerful tactic to use in banking and should be a must for every community bank’s marketing arsenal. Send an email and tell the recipient that they are getting the email because their balances indicate that they are a “saver” and that account is more likely to build balances. Praise an account for being “financially savvy” for opening up a health savings account and they are more likely to use that account. Tell a business owner that they have proven to be a “good steward of their business,” and they are more likely to open up a line of credit with your bank.

One bank issued limited edition “Owner Customer” hats to shareholders that also had an account at the bank. Not only did the bank find that those that received the hats did more business and gave the bank more referrals, but the campaign caused some shareholders to become customers and some customers to become shareholders.

Bestowing The VIP Treatment

This tactic also works in a general sense. If your bank is trying to get relationships to produce a 15% return on equity (ROE), then take your 13% ROE clients and make them feel special. Put the number of years they have been with the bank prominently on their statements, give them a “gold status” account, or give them special VIP helpline access and we have found that those labeled customers are about 30% more likely to give your bank a higher satisfaction rating and almost 15% more likely to use an additional product after labeling. While most banks put only their loyal customers into the program, for a majority of the accounts, if you label them “loyal” and bestow that badge of honor on them, they will, in fact, become loyal accounts and increase their profitability almost as a self-fulfilling prophecy.

No matter how you do it, by labeling customers banks end up causing customers to self-identify with that very label. Whether you call someone “loyal,” “financially astute” or a “creditworthy business owner,” these labels do make a difference and should be considered when designing a bank marketing program. While you may or may not be a high-performing banker, the fact that you made it to the end of this article indicates that most likely you are or are on your way. That label has to give you at least a certain amount of pride.