How to Increase Commercial Loan Retention

Community bankers need actionable recommendations. For example, if your bank has a higher efficiency ratio, lower fee income, or higher loan prepayment speeds than its competitors, then advising management to decrease efficiency ratio, increase fee income, or reduce loan prepayment speeds is not actionable. How does management achieve those recommendations? We are big proponents of delivering actionable advice. If one of your bank’s goals is to retain its most profitable commercial clients for as long as possible – which normally lowers efficiency ratio and increases return on assets (ROA) / return on equity (ROE) – we have an actionable recommendation to improve commercial loan retention based on empirical evidence.

Why Commercial Loan Retention Matters

We will reiterate that banks are in the business of keeping loans, not making loans. First, there is a strong connection between longer expected credit and the expected term of a commercial relationship. Stated another way, longer loans lead to longer client relationships. Some say this is self-evident, but various bank models favor shorter expected credit term commitments and re-compete for the business upon renewal or expiration of a commitment. Unfortunately, this strategy may lead to lower margin, weaker structure, and loss of clients.

There are four major reasons why a longer expected credit relationship leads to more profitability for banks, as follows:

- Cost: Commercial loan underwriting has a high upfront cost. The cost to source, underwrite, approve, document, and fund a loan is large compared to the expected profit margin of that loan. Because of thin margins and high origination cost, a loan ROE turns positive for a bank after substantial amount of seasoning. While the cost to book a loan is high, the ongoing maintenance cost is low and as the loan continues to pay, the profitability to the bank increases.

- Amortization: As a loan seasons, the borrower continues to make principal payments increasing the equity in the collateral. In the first year of a commercial loan based on a mortgage-style amortization the borrower increases equity in the collateral (through principal payment) by less than 1%. In the second year that equity increase is only 2.11%. However, by year 10 that equity increase is 15%, and by year 15 it is 28%. Mortgage style amortization results in little principal reduction in the first few years of the credit. Longer term loans increase collateral cushion and reduce credit risk.

- Products Per Customer: Cross-sell and upsell, in the form of additional credit, deposit, or fee-based business is the major driver of bank performance. To obtain those cross-sell and upsell opportunities, the bank needs time to establish a trusted relationship, understand the client’s needs, and, most importantly, stay connected to the customer while the business grows, and banking needs expand. Longer loans create a longer runway for cross-sell opportunities and tend to establish longer customer relationships.

- Prepayments: Commercial loans do not tend to prepay equally over time. Borrowers accelerate prepayments and switch banks more readily as credit commitments approach 12 to 24 months to maturity. If the initial loan term is three years, a bank is again in competition with the market for that customer within one or two years of originating that three-year loan commitment – this is not enough time to generate to maximize ROA/ROE. Borrowers are much more reluctant to prepay a commercial loan with 8 or 13 years remaining, as an example, on a credit commitment priced at market rates (assuming two years into a 10 or 15-year commitment). Borrowers value the long tail remaining on the credit facility and tend to avoid the burden of switching costs (especially with the appropriate prepayment provision). Prepayment propensity for short-term commitments converts relationship clients into transaction clients – leading to high loan churn and placing community banks in competition more often than necessary.

Our Analysis

We analyzed two community banks’ portfolio of hedged commercial loans to measure general loan makeup, credit quality, and prepayment speeds. The average community bank’s commercial loan portfolios prepay at 20 to 40% per annum. As an example, the average community bank that does not replace its commercial loans will witness its loan portfolio of $1Bn shrink to $600mm to 800mm the next year. We have noticed that hedged loans have a substantially lower prepayment speeds, helping community banks achieve many profitability goals. We analyzed a portfolio of hedged loans at two community banks to measure prepayment speeds.

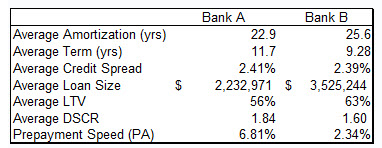

Both community banks were between $1Bn and $2Bn in assets through the course of our analysis. We followed and measured the two banks’ hedge loan portfolio for prepayments. The hedged loans structures and credit parameters are summarized below.

The table above shows that the hedged loans were larger than the average community bank commercial loan with lower LTV and higher DSCR. Coincidentally, the credit spreads for both banks were similar. Commercial loan retention results in a longer set of profitable cash flows for the bank.

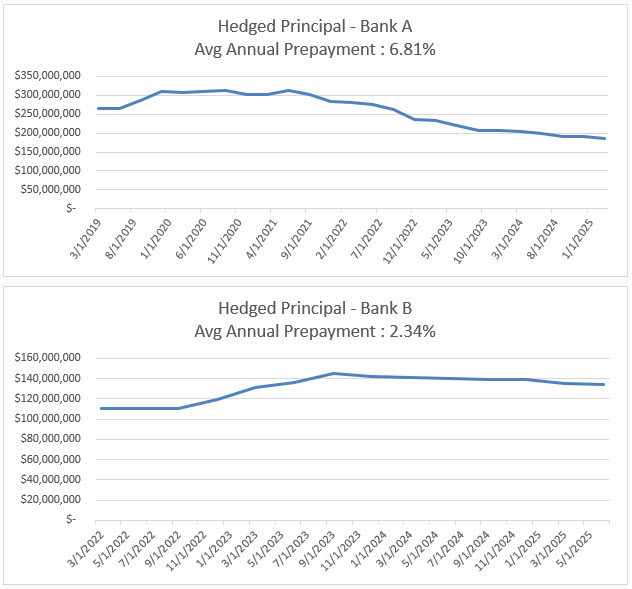

Both banks grew their hedged commercial loan portfolios over approximately two to four years and we measured the prepayment speeds of these portfolios (over and above contractual amortization). The principal outstanding of these loans are shown in the two graphs below.

Bank A started hedging commercial loans in 2015 and reached a hedged portfolio of $315mm. That portfolio demonstrated an average prepayment speed of 6.81% over a six year period. Bank B started hedging commercial loans in 2020 and reached a hedged portfolio of $145mm. That portfolio demonstrated an average prepayment speed of 2.34% over a three year period.

The average prepayment speed of hedged commercial loans is approximately six times slower than a community bank’s average commercial loan. Therefore, while the average commercial loan is expected to remain at a community bank for two to three years, a hedged loan may have an expected average life of about of eight to twelve years. However, because hedged loans extend the relationship with the commercial client, banks need to choose their clients carefully – a long unwanted relationship can be painful for both lender and borrower. Our two banks targeted owner occupied CRE loans and certain category investor CRE with strong cash flow and potential future cross-sell opportunities.

Conclusion

Community banks that are targeting the benefits of longer relationship should consider extending the expected life of commercial loans through a hedging program. Community banks that use hedging programs can reduce commercial loan prepayment speeds to about 5% or less per annum depending on the economy, type of borrower, and initial terms. This compares to 20 to 40% per annum prepayment speeds for the average commercial loan. Hedging imposes a discipline that results in commercial loan retention. With lower prepayment speeds and higher cross-sell, these loans on average earn between 18 and 21% risk adjusted return on capital.