Converting Libor To SOFR On Your Existing Hedged Loans – A Guide

Banks have ceased using LIBOR to price assets and liabilities after 2021. The remaining LIBOR cash and derivative instruments will continue until June 30, 2023. At that point, all LIBOR settings are expected to be discontinued, and most legacy LIBOR contracts will be converted to a Fallback Rate (effectively, compounding daily SOFR plus a spread adjustment). This article will discuss banks’ options for converting LIBOR loans to SOFR that were done through our ARC hedge program instead of the more operationally challenging Fallback Rate.

Considerations for Converting Libor Loans to SOFR

There are several parameters that community banks need to consider when choosing an alternative index to Libor, as follows:

- Transparency – The index needs to be published broadly, and its composition and pricing mechanism must be transparent and understood.

- Robustness/Volume – The more entities that use the index, the more likely they will survive stress in the market and the less likely it is to be unavailable when needed in a market meltdown.

- Depth – An index that has more trades and observations is preferred. More trades and contracts create rate validity and accommodate more terms. An index representing overnight rates and term structures is fundamental to community banks that sell products with multiple payment periodicities.

- Validity – An index should be observable and not easily manipulated by market participants.

- Representative – Banks prefer an index that follows their cost of funding. While no public index will move in lockstep with any single bank’s COF, a high correlation coefficient is preferred.

Term SOFR

In 2021, the Alternative Reference Rate Committee (ARRC) endorsed term SOFR, which is now administered by the CME Group Inc. ARRC also recommended the use of term SOFR for commercial cash products (such as loans). Term SOFR was later included as a benchmark index in the LIBOR cessation process because many banks preferred a term rate over a daily compounding rate like SOFR. Term SOFR has become a deep, transparent, valid, and representative index with substantial transactional volumes.

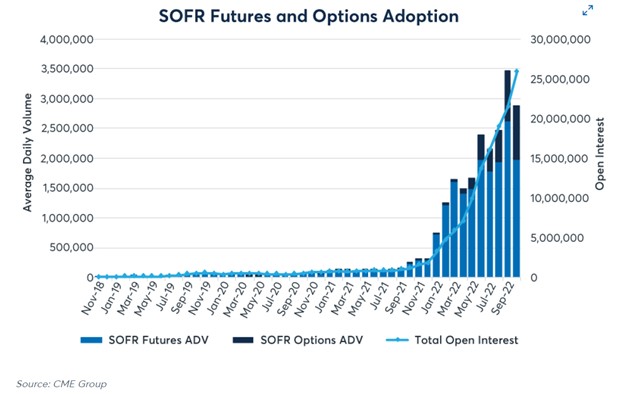

When converting Libor loans to SOFR, term SOFR appears to be a suitable index consideration. The CME Group estimates that as of September 2022, $2.3T of loans and almost $491B in hedges referenced term SOFR, and more than 1,600 firms are using this index. Total term SOFR futures and option open interest contracts are shown in the graph below and represent a substantial volume of trading. This market is now one of the largest interest rate markets in the country.

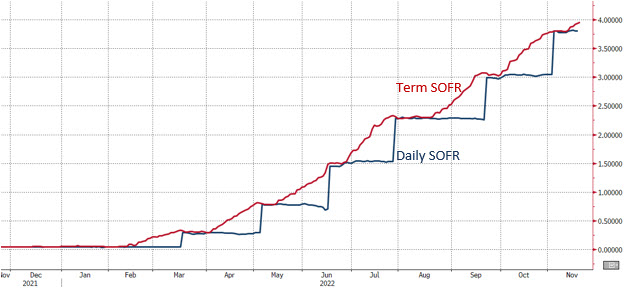

Term SOFR can be referenced on the CME website here: https://www.cmegroup.com/market-data/cme-group-benchmark-administration/term-sofr.html#. The relationship between daily SOFR and 1-month term SOFR is shown in the graph below.

Term SOFR is a forward-looking rate representing the market’s expectation of the average daily SOFR for that term. For example, 1-month term SOFR is the market’s expectation as measured by SOFR futures contracts of the average daily SOFR for the next month. As shown in the graph above, the market has tracked 1-month term SOFR very closely based on expected daily SOFR. Based on the market behavior and historical levels, banks should be indifferent between earning daily SOFR vs. 1-month term SOFR.

Term SOFR vs. Daily SOFR

After June 30, 2023, all LIBOR contracts will need to transition to another benchmark index. ARRC has provided that for LIBOR contracts subject to the ISDA Protocol, the index will transition to a Fallback Rate (an index calculated by using daily compounding SOFR). There are two fundamental issues that community banks should consider when adopting the Fallback Rate. First, most community banks do not have systems to calculate or validate a daily compounding index. Second, the Fallback Rate cannot be determined until the end of the interest period. Therefore, banks will have only two business days to verify and bill customers using the Fallback Rate. These resulting nuances for the Fallback Rate are new for most banks.

The advantage of using term SOFR for community banks is as follows: First, the rate is set in advance and paid in arrears. This allows for an entire month for banks to verify and bill customers. Second, the rate is simple interest without any compounding features. Third, the rate setting, accrual calculations, and billing process are identical to LIBOR. Most community banks have some LIBOR cash contracts (loans or deposits).

The net result is converting Libor to term SOFR on your commercial loans simplifies operations and reduces net processing costs. As such, risk is reduced.

Next Steps for Converting Libor to SOFR

SouthState Bank can help customers convert LIBOR-based ARC loan/hedge combinations from LIBOR to 1-month term SOFR. The advantages include avoiding a rush to conversion in June of 2023 and moving to a more straightforward index that avoids some operational challenges of daily compounding SOFR. Contact us at ARC@southtatebank.com to learn more.