Derivatives Usage By Community Banks

Our previous article discussed how the banking industry is taking advantage of interest rate swaps to offer borrowers lower rates, allowing banks to earn higher yields, generate substantial fee income, and protect deposit relationships. Of the largest 250 banks, 90% are using interest rate swaps, and because these largest 250 banks hold 83% of all loans, interest rate hedging tools are widely used in approximately 75% of the loan marketplace. However, the adoption of interest rate swaps is much lower at community banks (banks with under $10B in assets), with only a few hundred banks showing interest rate swap volume. In this article, we discuss derivatives usage by community banks, the concerns, some ways to overcome them, and why interest rate swaps are particularly powerful when the yield curve is inverted.

Specific Market Dynamics of Derivatives Usage

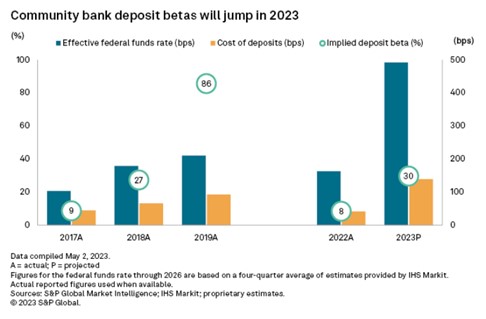

For the remainder of this year and into 2024, we believe that increasingly rate-conscious depositors will continue to drive the cost of funds (COF) higher, and as the Federal Reserve approaches the end of its tightening cycle, net interest margin at community banks will be under pressure. The market expects deposit betas to increase through 2023 and 2024. S&P projected COF and betas are shown in the graph below.

Community banks that can maintain margins, increase fee income, and retain deposit-rich relationships will have a tremendous competitive advantage in the near term. This is why the current inverted yield curve makes loan hedging especially attractive to community banks. In an inverted yield curve, a bank can use an interest rate swap to increase yield by 0.75% to 1.50% and earn 1% to 3% of hedge fee income.

Derivative Usage

An inverted yield curve makes competition challenging for banks that do not use interest rate swaps in conjunction with their lending. This is why community banks need to consider if they need a loan hedging program and find the solution that best fits their needs.

There are several reasons why community banks are reluctant to offer interest rate swaps for commercial borrowers. Some of those reasons are as follows:

- The standard derivative documentation is lengthy (45 to 60 pages) and cumbersome (multiple agreements written in dense legalese). Integrating loan and swap documents requires substantial legal expertise.

- Regulatory compliance and reporting can be complex and confusing.

- The accounting for both lender and borrower is complex and typically requires outside consultants.

- The overhead costs are high for banks that use derivatives only sparingly (less than a few deals per month). Since most community banks do not want to commit to a significant upfront expense, not knowing the adoption of the product, most managers prefer to avoid adopting the product.

- The marketing of the product is a challenge – lenders cannot easily explain the documentation, the mechanics, or the risks of the product, which means that borrowers choose alternative structures.

- Education is key, and many community banks need both the product and the consulting service to help with marketing, compliance, underwriting, pricing, and documenting interest rate swaps.

We believe that to offer a viable interest rate swap product, an average commercial banker should be able to explain the product to an average client in 5 minutes with a few simple diagrams or tables. We developed a program 16 years ago (ARC, the Assumable Rate Conversion program) that we offer to our commercial borrowers, and the program provides the following advantages to the lender and borrower:

- Instead of 60 pages of dense legalese, it uses a short (4-page) and simple addendum to the promissory note as additional documentation. The document clearly defines the prepayment scenario and the calculation and includes a sample prepayment table.

- There is no additional reporting or regulatory compliance for the lender or the borrower.

- There is no derivative accounting for the lender or the borrower.

- There are no ongoing or upfront costs. Ongoing costs can drain bank earnings considerably since some hedged commercial loans have 20 years (or longer) commitment terms.

- We make our hedge desk at SouthState Bank available to community lenders nationwide so that any community bank can access a hedge consultant. The ARC program provides lenders with education and marketing support to sell the bank’s commercial loan products.

Key Takeaways

In the next 12 to 24 months, community banks will face pressures on net interest margins as deposit betas increase and deposit outflows accelerate with continued Fed balance sheet tightening. Community banks that can retain and increase liquidity-rich customers, increase margins and fee income through interest rate swaps will have a competitive advantage. If your bank has considered and passed on interest rate swaps in another yield curve environment, the current shape of the yield curve begs another consideration.