Filtering Risk With a Bank Hedge Strategy

In our previous article (here), we made the argument that the next administration’s agenda is highly inflationary, will likely lead to higher interest rates and more volatility. We estimate a high probability that after this current interest rate cutting cycle, which may end sometime in 2025, that higher inflation will result in the Federal Reserve having to move interest rates higher. While no one could have predicted the Covid pandemic, the ensuing inflation and higher interest rates were clear results (we were not in the transitory inflation camp from the beginning). The current policy directions from the new administration are largely inflationary, and community banks should be paying attention and consider a loan-level hedge strategy.

In the last rate hiking cycle, banks that used loan-level interest rate hedges to mitigate risk, increase fee income, and extend customer lifetime value to help cross-sell and upsell, outperformed banks that shunned these instruments. It was not just Silicon Valley Bank, First Republic Bank and some other spectacular failures that were caught unprepared for the severity of interest rate movements. Many banks that survived the rapid interest rate hikes still struggled with net interest margin (NIM) compression caused by fixed-rate loans and securities. This time, we have more than a hint – we have a megaphone announcement – and community banks should be prepared for the possibility of higher interest rates over the next four years.

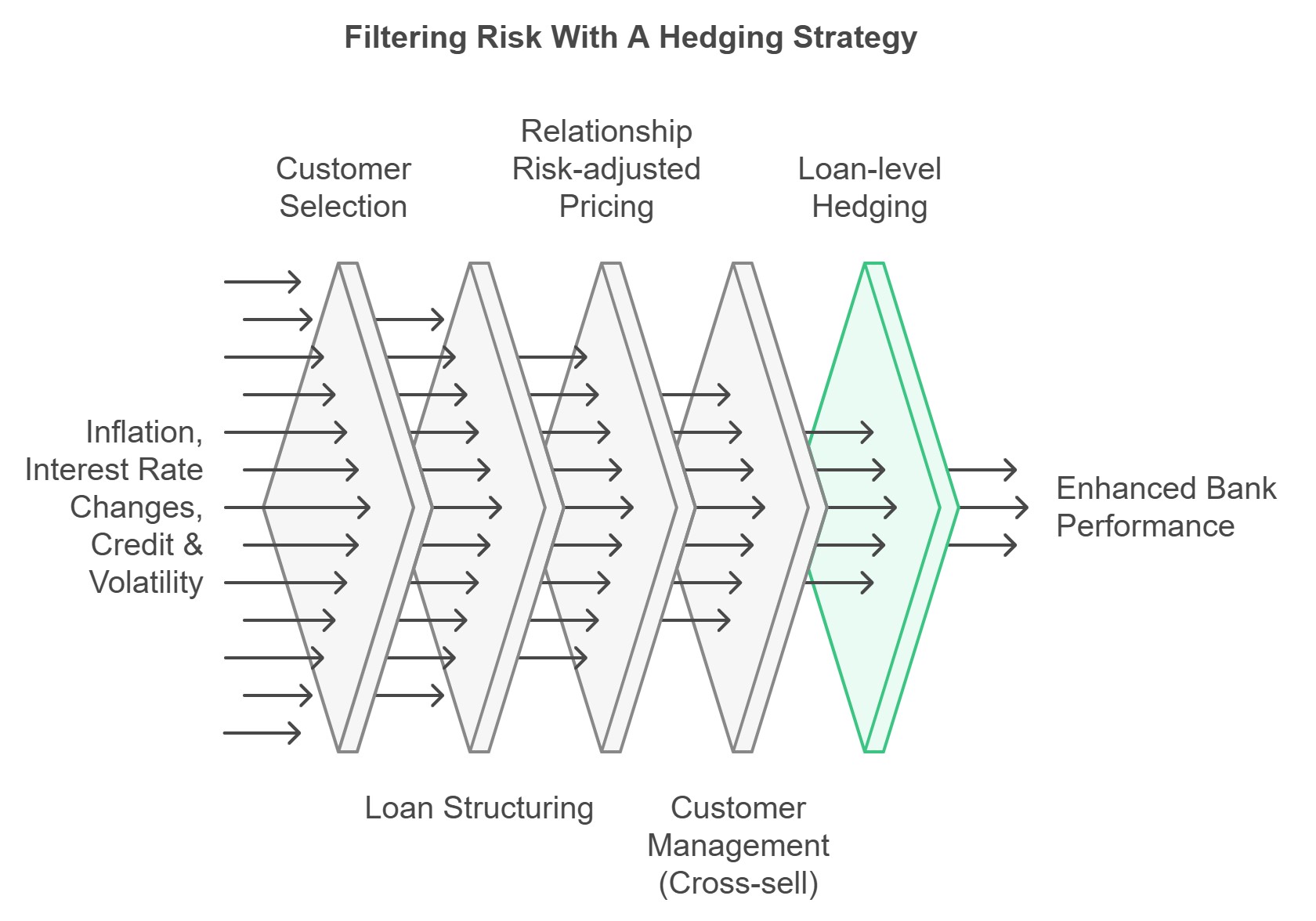

Mitigating the risk from the potential of higher interest rates, inflation, credit shocks as a result of higher rates and more volatility comes down to five layers of protection. Mitigating market risk comes from proper customer selection, structuring the loan as to not acerbate a bank’s risk, pricing the relationship correctly taking into account cost and risk through the loan lifetime, actively managing that customer (monitoring credit, building deposit balances, increasing engagement, enhancing fee income, etc.) and straining out the interest rate risk. In this manner, banks can enjoy customer profitability through all types of market conditions and can simplify their process. Leveraging these five layers leave the bank to focus on what is important – the customer.

Hedge Strategy Adoption

Community banks’ use of swaps (banks’ primary tool to hedge interest rate risk on loans) has increased over the last ten years. As of Q3/24, there were almost 4.5k FDIC-reporting institutions but only 319 of those institutions (or 7.1% of the total) used swaps directly. We estimate that another 600 banks use hedging programs that keep the derivative off balance sheet (thus not reportable by FDIC). Therefore, a total of 20% of US lending institutions utilize some form of interest rate hedging, and most are using those instruments in conjunction with loans made to borrowers. However, this 20% number is a misrepresentation. When adjusted for each bank’s domestic loan portfolio size, approximately 70% of banks offer loan swaps to their customers. Out of a total of $12.7T in domestic loans, approximately seven in ten of those loans are held by banks that use a loan hedging program. Therefore, if your bank does not offer a loan hedging solution to your borrowers, your bank is a minority in the domestic bank market, and you may want to consider such a program considering the inflation-warning signs flashing red for the next four years.

Benefits of a Loan Hedge Strategy in 2025

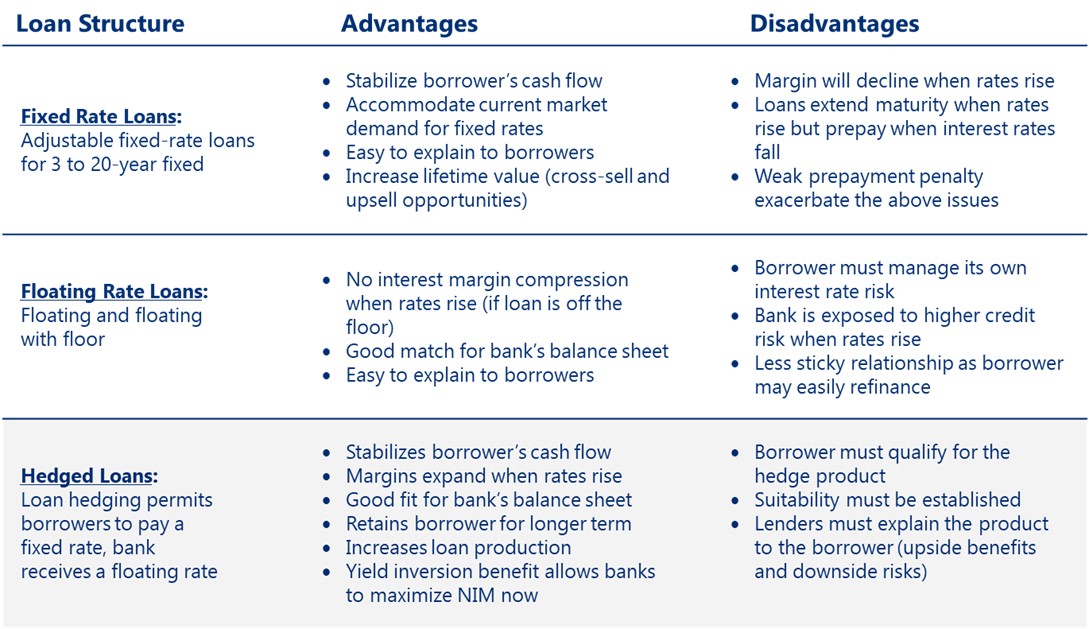

The market is currently pricing two to three interest rate cuts in 2025. If new policies are enacted that reignite inflation, interest rates are likely to rise swiftly. There are multiple good reasons why national, regional, and community banks continue offer fixed-rate loans to borrowers only via a loan hedging program, regardless of the interest rate cycle. The table below shows the pros and cons of various loan structures for borrowers financing long-term assets.

Community banks should also consider the inherent benefits of interest rate hedges from their own balance sheet, income statement, and ALCO perspective, as follows:

- Economists’, the FOMC’s, and the market’s forecasts are often incorrect, and the precision of projections falls dramatically beyond one quarter. Interest rate hedging eliminates this balance sheet and income risk to the bank.

- Banks can earn a substantial hedge fee income equal to 1.0% to 2.5% of the loan amount. This income can dramatically boost current return on equity (ROE)/return on assets (ROA) and is retained by the bank even if the borrower prepays or refinances the loan before the contractual term.

- A fixed-rate loan without a hedge does not result in a yield most banks expect when rates decrease. For on-balance sheet fixed-rate loans, most banks will either not include a prepayment provision, have a soft prepayment provision, or waive that provision when pushed by an important client. Therefore, these on-balance sheet fixed-rate loans tend to prepay if interest rates drop and extend if interest rates rise.

Conclusion

We believe that 2025 may be another volatile year for the banking industry, a year that could see interest rates substantially higher. Community banks should seek every advantage available to them in the market – one such advantage is to have a hedge strategy using a loan-level hedging program, which can provide additional margins, fee income, and credit stability. For banks that do not want to trade derivatives directly, the ARC Program used by SouthState Bank, and offered to banks throughout the country, offers all the benefits of a loan hedge without complex derivative documentation, derivative accounting, or monthly borrower settlements.