How a Loan Hedge Leverages The Yield Curve – Part II

In a previous article, we discussed the three generic shapes of the yield curve: normal, inverted, and flat. We also pointed out that the current inverted yield curve is unusual and is expected to last for the near term. The average community bank’s cost of funding is highly correlated to Fed Funds and SOFR (for the industry, the correlation has been 94% with a six-month lag over the last 20 years). Banks should now be prepared to actively manage liquidity levels and deposit betas for the next few years as the recent rise in short-term rates and the Fed’s liquidity drain pressures banks’ funding. However, despite the challenges of the current interest rate environment, the yield curve creates a tremendous opportunity for top-performing banks to earn outsized fees and higher interest margins in the commercial loan market by using a loan hedge.

Lending Habitats

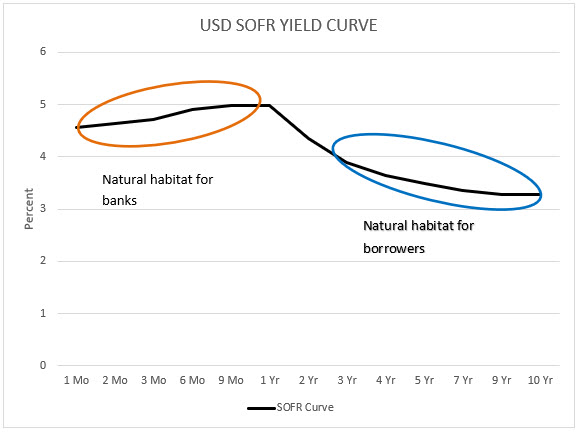

Banks’ cost of funding is best correlated to shorter-term rates, and banks generally want to generate loans with shorter interest rate duration – fixed rates of up to one to two years. This is where the banks take minimal interest rate risk. Going out to the five-year portion of the yield curve may make sense if banks can generate additional yield – this is called a carry trade. Traditionally, the carry trade offered banks over 1.00% pickup in yield between the cost of funds (COF) and the five-year term (approximately 1.12% over the last 30 years and up to 2.00% during some periods). However, with the current shape of the yield curve, banks are disadvantaged in extending duration because the carry trade is negatively yielding. The five-year yield is currently 86bps lower than the one-month yield. Therefore, banks maximize yield and profit by keeping loan duration short.

While banks may want to keep the duration short in this interest rate environment, borrowers are often better served with longer-duration loans to help stabilize cash flow, minimize refinance risk, and reduce loan origination costs. The sophisticated borrowers know that five-year fixed rate loans are cheaper than three-year loans, and ten-years are cheaper than five. Therefore, given a choice, many borrowers are looking for a longer duration, and lenders are pressured to accommodate.

The graph below shows the current shape of the yield curve and the natural habitat for borrowers and lenders.

A Solution – A Loan Hedge

How should banks respond to this pressure and achieve an optimized solution? There are a few solutions, but a loan hedge program is an easy and efficient way to increase yield and help borrowers.

Customer Segmentation: Banks can target clients that self-select shorter-term loans (builder lines, construction loans, and similar). This strategy may create some other strategic and credit risks.

Liability Duration: Banks can extend the duration of deposits to shift the bank’s preferred habitat further out on the yield curve. This can be accomplished with goal-oriented accounts, CDs, hedges, brokered deposits, or FHLB advances. Unfortunately, this strategy can get expensive because longer-duration liability has a significant liquidity premium.

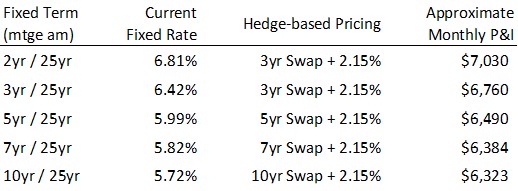

Use Loan Hedges to Manage Asset Duration: Banks can use loan-level hedges to decrease the duration of the loans through hedging or allow borrowers to manage their interest rate risk elsewhere. We want to highlight this option with a case study. We recently provided a term sheet to an owner-occupied CRE borrower who requested a $1.75mm term credit facility and whose operating account had balances of $100 to $200k. Our bank showed the borrower a term sheet that had the options below.

In each of the options above, the bank’s starting hedged yield would equal 6.71% (one-month term SOFR plus 2.15% credit spread). However, the borrower’s rate is dictated by the shape of the yield curve. Longer loan maturities are cheaper for the borrower.

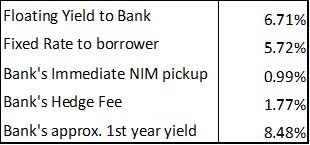

The borrower chose the ten-year fixed-rate option, and the economic comparisons for the lender and borrower are outlined below.

By using this loan hedge strategy, with the current inverted yield curve, the bank was able to win a profitable OOCRE relationship with an operating account, stabilize the borrower’s cash flow, reduce credit risk, and generate an 8.48% yield in the first year. This specific community bank uses a hedging program as a proactive tool to win new business and not just to react when a customer threatens to leave for a competitor.

Some bankers point out that the hedge fee is a one-time fee that would not be replicated for the life of the loan (ten years). However, we have experienced that commercial borrowers, especially growing businesses, are frequently amending loan terms, substituting collateral, or modifying principal amounts and amortization periods. Each episode creates another opportunity for the community bank to generate additional hedge fee income.

Conclusion

The current inverted yield curve creates an excellent opportunity for banks to meet customer demand for longer-duration loans and generate substantial pickup in yield and fee income by using a loan hedge program. This yield inversion is expected to remain for some time, and bankers should consider loan hedging a viable tool in their commercial loan arsenal.