Loan Performance Analysis – Hedged vs. Unhedged Loans

We analyzed the loan performance (return on equity, loan yield, fee income, and loan size) of hedged borrowings in a large group of community banks and compared this to the community bank industry averages. We conclude that loan-level hedging offers community banks a strong competitive advantage in the current interest rate and competitive commercial loan and deposit environment. In this article, we provide a quantitative analysis to support this conclusion.

Universe of Banks Analyzed

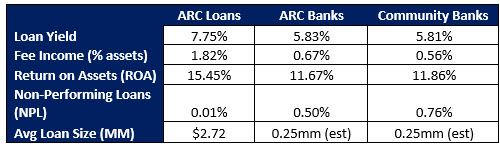

We reviewed the performance of just over 4,000 hedged loans at community banks with a total principal of approximately $11B. We looked at instrument-level details of these loans at over 300 community banks and calculated various performance parameters to compare them to industry averages. The conclusions are not surprising but are striking. The table below shows a summary of our analysis (community banks are defined as banks under $10B in assets).

A few observations are appropriate:

- Because of the inverted yield curve, hedged loans demonstrate yields approximately 1.90% higher than the average community bank loan. This loan performance is a significant driver of profitability for this group of banks.

- The average fee generated for hedged loans is 1.82% of the loan amount, which is substantially higher than the average fee income for earning assets at community banks. This hedge fee is a one-time upfront source of income. However, as with many commercial loans, future amendments, modifications, upsizes, and re-amortization afford banks additional fee-generation opportunities. Because of this fee generation, hedged loans can be critical to loan performance, especially for banks looking to boost non-interest income levels in order to improve equity performance.

- The ROA for the average hedged loan is 3.59 percentage points higher than the industry average. This is explained by the higher yield on hedged loans, higher fee income, lower efficiency ratio, and better asset quality.

- Virtually all hedged loans are current. This is a reflection of both current economic strength and self-selection. Banks favor higher credit quality obligors for a hedge program. We also found that during recessions, hedged loans outperform average unhedged loans.

- Finally, the average loan size of a hedged loan is almost ten times larger than the average non-hedged commercial loan. This improves the bank’s efficiency and allows better servicing of larger and more profitable relationships.

The average loan term in the hedge program is 9.2 years, but these hedged loans are as short as two years and as long as 26 years. Many bankers believe that in order to win a hedged loan, credit spreads must be lower; however, the average credit spread for hedged loans is 2.39% and ranges from a low of 1.00% to a high of 4.62%.

A Few Additional Loan Performance Observations

Aside from the analytics and the numbers, we would like to share some other, more qualitative, reasons why community banks decide to use a loan hedging program.

- Mitigate Interest Rate Risk: Banks’ cost of funding and liquidity can change rapidly, and offering fixed-rate loans beyond a few years, when the average cost of funding is increasing, may be dangerous. A loan hedging program can mitigate that risk.

- Improve Credit Quality: Bankers are aware that any commercial real estate (CRE) borrower repricing in the next two years, may be subject to roll-over risk. Certain loan categories may be under credit pressure, and no one can predict where future loan rates may be. Locking a borrower now with a comfortable debt service coverage ratio (DSCR) cushion may be the bank’s safest bet, and a hedging program can both lower the borrower’s rate and bridge the borrower’s credit facility well beyond the risk horizon.

- Protect Existing Loans: Most community banks are not aggressively growing loans, but it is especially painful to lose an existing, large, and profitable relationship. Existing borrowers can be highly profitable clients for community banks. We observe that a large percentage of community banks are offering hedges to their best existing customers. Community banks approach current borrowers with 6 to 24 months remaining on their existing credit commitments and offer longer-term fixed-rate hedged loans, sometimes at rates that are lower than the borrower’s existing coupon. Losing a new loan to a competitor may be a positive or negative return on equity ROE event for the bank (depending on the winning price/structure), but losing an existing loan to a competitor is almost always a highly negative ROE event for a community bank.

- Instilling Lending Discipline: Community banks face pressure to train lenders, maintain consistent underwriting standards, and instill sensible pricing methodology when the cost of funding continues to be under pressure. One positive aspect of a well-designed loan hedging program is that it highlights the importance of pricing loans to credit, interest rate risk, and the term structure of rates. Lenders who are taught to use hedging programs quickly appreciate the importance of disciplined pricing.

- Decrease Loan Prepayment Speeds: One of the most significant determinants of loan profitability is the prepayment rate. More stable loans with longer maturities are more profitable for banks. The amount of resources banks expend in sourcing, originating, and underwriting credits makes the initial day the loan is booked to be the least profitable in the life of that credit. Every periodic interest payment that the borrower makes increases that loan’s value to the bank. The prepayment rates on hedged loans are much lower than the average at community banks (some banks experience 25% to 35% loan prepayments per annum).

- Generate Fee Income: Net interest margin (NIM ) will continue to be under pressure for banks for the foreseeable future as deposit betas rise, but loans do not reprice higher. Additional hedge fee income is a great way for banks to generate substantial non-interest income and offset contracting NIM.

Conclusion

It is no surprise that more community banks are finding loan hedging programs an important tool in not just managing risk but generating additional income and meeting their loan structuring and pricing strategies. Hedged loan performance can banks achieve an above-average ROE. Loan hedging is not typically a solution for every community bank customer. However, not having a loan hedging solution like the ARC Program and not having experienced lenders trained in such a program can be a competitive disadvantage for a community bank.