Yield Curve Impact on Bank Profits

The bigger risk to community banks’ business model is not a moderate recession induced by aggressive interest rate increases by the Federal Reserve. Instead, the more painful scenario for the banking industry is the following: no recession, short-term interest rates holding steady in anticipation of inflation reaching target rates, and a prolonged inverted yield curve. The yield curve impact is having a negative effect on bank profits. The Fed may be nearing the end of its hiking cycle, but given the high threshold for interest rate cuts, there may be no changes in the Fed Funds rate until well after 2024. The Atlanta Fed GDPNow forecast is for Q2 GDP to be just under 2.50%, and the Fed Funds futures market continues to push out the start of the interest rate cuts. The market currently does not see, on the balance of probability, interest rate cuts until Q2’24.

The issue for banks is that the yield curve is currently inverted, and if the Fed stops raising short-term interest rates, the long end of the yield curve will most likely decrease – as it has done so in the past in similar scenarios. This article will discuss community banks’ strategies and tactics to mitigate a prolonged and profoundly inverted yield curve.

Historical Lessons

Historically, once the Fed stops raising interest rates, intermediate and longer-term yields decrease. In the graph below, LPL Research shows that of the five most recent Fed rate hiking campaigns, the 10yr Treasury yields were lower, on average, by 1% a year after the Fed stopped raising rates. Banks must have a strategy to deal with the anticipated increasing cost of funding (COF) and a deeply inverted yield curve through the end of 2024.

The Yield Curve Impact

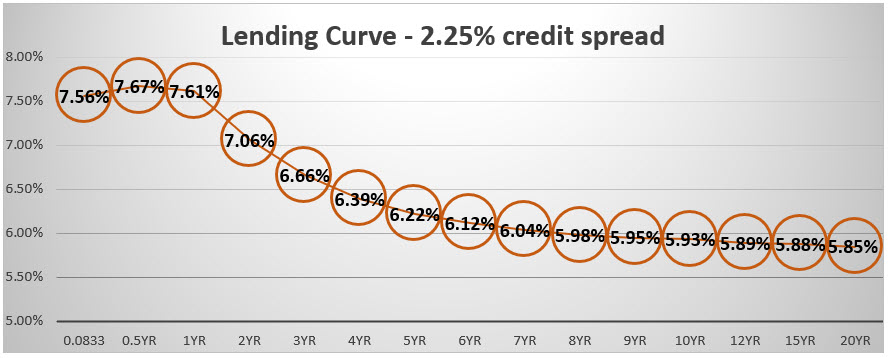

The graph below shows the current lending curve from one month to 20 years and demonstrates the average commercial loan rates for different repricing terms. The chart uses the average credit spread (2.25%) to achieve a 15% ROE for a bankable loan, $1mm size, with cross-sell opportunity and an overall relationship.

If the Fed stops its hiking cycle and the yield curve remains inverted in 2023 and 2024, community banks need to consider the following obstacles to their business models:

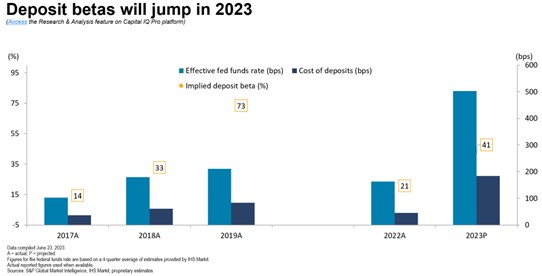

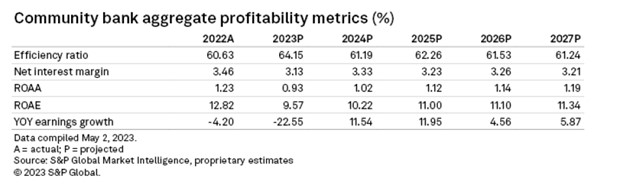

- The industry’s COF will continue to increase as deposit betas increase, but loan yields on floating and adjustable indexes plateau. Banks’ NIM will be under severe pressure. Below is information from S&P Global Market Intelligence showing projected COF, deposit betas, and NIM. These projections make intuitive sense. As the Fed pauses interest rate hikes, loan yields plateau; however, the cost of funds (COF) continues to increase because of the lagging effect. This increase in COF will also be driven by competition, as the Fed’s balance sheet is shrinking by $90Bn each month, and banks will raise rates to replace the lost liquidity.

- The carry trade for banks (fund short and lend long), which historically generated approximately 1.50% of NIM boost, is now subtracting 1.50% to 1.75% in NIM.

- Short-term, fixed-rate loans are not attractive to borrowers because longer-term commitments are up to 1.76% cheaper.

To overcome these obstacles, banks that can offer loans further on the curve, and eliminate their interest rate risk, hold a competitive advantage. Banks reluctant to commit to fixed-rate terms beyond two or three years are disadvantaged.

Opportunities for Community Banks

Community banks have a few solutions that can help increase yield, decrease funding costs, and generate additional fee income despite an inverted yield curve. There are several opportunities for community banks, as follows:

- Refinance existing relationships. Bankers should focus on refinancing existing loans with one to three years to maturity. This strategy does not pressure COF but allows banks to offer enticingly lower fixed-rate loans. This makes particular sense for deposit-rich customers willing to hold low-cost deposits in return for favorable loan terms.

- Bankers can provide borrowers with trusted advice. While no one can predict the future path of interest rates, lenders do not need a crystal ball to be valuable, trusted advisors to their customers. Lenders can allow borrowers to take advantage of an inverted yield curve, lower their monthly loan costs, and increase free cash flow. Further, lenders should recommend that borrowers not wait for interest rates to fall to refinance their debt for many reasons: loan rates may not be lower during a recession (even if the Fed Funds rate decreases), liquidity may not be abundant, and the borrower’s business may not be as bankable.

- Bankers can provide appropriate asset/liability structures. Borrowers should have loan structures that match their asset-liability position. Bankers must provide structure, payment terms, conditions, and maturities based on the borrower’s personal situation and business needs. An inverted yield curve provides a natural fit for many borrowers who want longer interest rate certainty and are financing long-term assets. For example, real estate is a longer-term asset with net operating income (NOI) primarily insensitive to interest rate movement. Therefore, CRE loans are best structured with fixed-rate for longer terms.

- Yield pickup. In an inverted yield curve, community banks can use hedging products to convert a lower fixed-rate loan for the borrower to a higher floating rate yield for the bank with a 1.50% to 1.75% pickup in NIM. This strategy includes the following advantages for the bank: enhance credit quality by eliminating repricing risk, lengthen and deepen relationships, differentiate from the competition, and increase the borrower’s profitability by decreasing loan payments.

- Fee generation. The inverted yield curve allows banks to generate additional fee income through loan and hedge fees. Longer fixed-rate loans can generate hedged fees between 1% and 3% of the loan amount – this fee income is recognized upfront and is a large boost to community bank income.

Conclusion

The current inverted yield curve does present many challenges to the standard community bank business model. However, that exact inversion also creates many opportunities for community banks to refinance existing clients, obtain higher floating yields, stabilize the borrower’s DSCR and free cash flow, and generate substantial hedge fee income. Community bank management teams must utilize the correct product for the specific market environment. While an inverted yield curve is an unusual phenomenon, it may be one that we face in the industry for the next few years.