5 Variables That Help Commercial Relationship Profitability

In our previous articles (here and here and here) we discussed some of the drivers of commercial relationship profitability. In this article, we consider and define relationship banking and how relationship banking can increase commercial loan profitability.

What is Relationship Banking

We define relationship banking as a model focused on a consultative banking approach. Bankers provide advice based on the customer’s particular situation and needs, as those needs change and evolve over the customer’s lifetime and as the market changes. The bank is compensated by selling products, services, and especially insightful and targeted advice. Some banks state that they are relationship driven but inadvertently deliver risk-for-pay products. Other banks attempt to provide relationship banking but fail because they may not understand what is involved and how to differentiate from competitors effectively.

Many community banks state that they embrace and promote relationship banking, but the model is not easy to deliver effectively, and its implementation is not as intuitive as some bankers may believe. To implement the relationship business model, bankers must focus on the right talent, education, product mix, targeted clients, and executive support. Banks developing and delivering a relationship banking model can outperform the industry but community banks must attract, develop, and retain commercial bankers who can offer insightful financial advice.

Relationship Banking and Commercial Loan Profitability

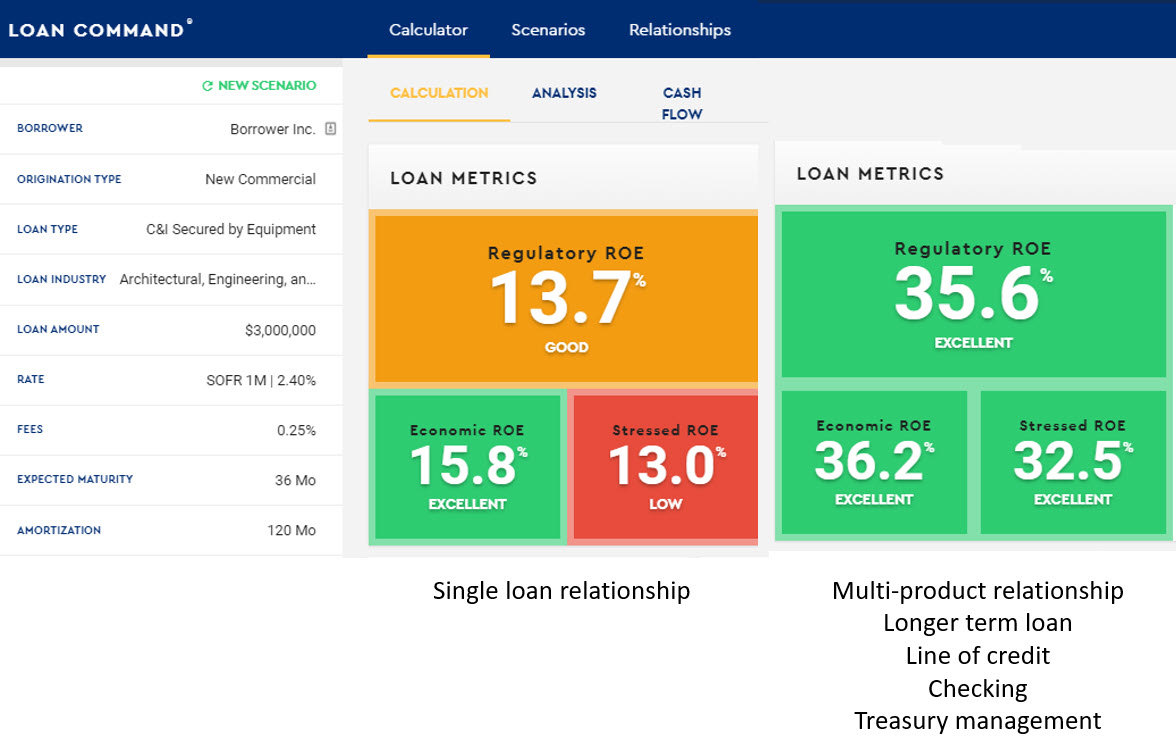

Most bankers understand that they are in the primary business of keeping loans versus making loans. There are five variables that help explain the connection between relationship banking and loan profitability and they all center around extending the commercial relationship for as long as possible.

- Existing customers are more profitable than new customers. New customers drain bank resources with acquisition, processing, and onboarding costs. New customers are also not as well known to the bank as existing customers (increasing credit risk), and these new customers typically have existing banking relationships elsewhere, thereby decreasing the share of wallet for the new bank relationship. Therefore, the goal of relationship banking is to keep and grow the relationship for as long as possible. Longer loan commitments lead to more relationship opportunities.

- Identifying the right customer at inception. Community banks must be honest about their target relationship account. A small rural bank cannot provide trusted advice and needed products to General Motors (as an example). Likewise, a local borrower with only one credit requirement and who is close to retirement age may not be a relationship candidate for a community bank. Community banks must identify clients that present the right opportunity given that bank’s product suite and their lenders’ expertise. Therefore, choosing the right client opportunity at inception is crucial.

- Short-term loan commitments decrease relationship banking opportunities. There are various reasons why borrowers may need commercial mortgages for two or three years. However, shorter commitments lead to lower switching costs for borrowers, more opportunity for competitive loan bids in the future, and shorter client relationships. All else equal, longer loan commitments lead to longer client relationships and more profit for the bank.

- Longer loan commitments increase cross-sell opportunities for deposits. Banks should look for relationship clients that offer both credit and deposit opportunities. Why would a commercial account that generates excess free cash flow want to retain debt and leave deposits with a bank? One reason is a requirement for cash flow management and treasury float, but another important reason is that a borrower values the terms, conditions, pricing, and optionality in a credit facility and prefers to retain that facility than to pay it off with excess cash flow. A three-year loan commitment has an average life of under two years, especially because most astute borrowers do not let debt become current. Credit commitments with short remaining life have less value for borrowers and borrowers are more likely to extinguish this debt with business cash flow versus retain the commitment term. On the other hand, a borrower with free cash flow is less likely to pay off a loan with 8 years to maturity if that loan is properly priced and structure – leading to deposit opportunities for the bank.

- A correctly structured commercial loan can lead to a longer relationship. Unfortunately, some banks offer loans with planned obsolescence – making those loans shorter and less valuable to borrowers. Consider the difference between balance sheet financing versus collateral financing. On a typical collateral-financed loan, the loan is callable when the borrower sells the collateral, asks for modification of the security, the term, or the pricing. On the other hand, for a balance sheet-financed loan the bank makes the loan based on the strength of the borrower’s balance sheet and business model (the loan can still be secured by collateral). This balance sheet loan can be retained by the borrower with changes to collateral, term, pricing, even borrower entity if the bank can underwrite the credit. Balance sheet loans lead to longer relationships and more profit for the bank. At our bank we use various loan products to create balance sheet loans, but one such product is our Assumable Rate Conversion program (more information can be found here).

Conclusion

Lenders typically are thrilled when they bring new customers to the bank. However, bank profitability is maximized with longer relationships and retaining rather than making new loans. At our bank we emphasize clients, products, and lenders that can increase the lifespan of our existing relationships and grow our share of wallet with existing customers. Most community banks can be profitable with just two best-of-class products – deposits and (properly structured) loans.