The Problem with Floating and Adjustable Rate Loans

A typical current strategy for community banks when originating commercial real estate loans is to offer floating-rate loans or shorter-term adjustable structures. Borrowers are waiting for the Fed to lower short-term interest rates, hopefully translating into a refinancing opportunity for the borrower at a lower loan rate. Unfortunately, this strategy has all the underpinnings of a credit problem case study, and we do not have to search for a hypothetical example. Adam Neumann’s (creator of WeWork) apartment startup (called Flow) has a $60MM floating-rate mortgage. While the property was reported to be performing well (net operating income (NOI) above projections) and had lease increases of up to 10%, the property’s debt service coverage (DSCR) was reported to be just north of 0.80X. The culprit is increasing interest rates on the loan. Adjustable-rate loans face the same issue, causing cash flow squeezes for borrowers.

The Issue

Adjustable and floating term loans on commercial real estate have several drawbacks for banks and borrowers, especially in a rising interest rate environment. There are five main problems with loans that are fixed for a period and then adjusted on a contractual spread over a predetermined index.

Prepayment Risk in an Adjustable Loan

No other bank risk is so patently without compensation as loan prepayment risk. Most banks are unable to charge a prepayment on adjustable-rate loans. On an adjustable fixed-rate loan, the bank will suffer the NIM pressure and the lower prepayment speed if rates increase. If rates decrease, the bank must be compensated for replacing a higher-yielding asset with a lower-yielding one. However, convincing the borrower to pay this cost as a prepayment penalty is very difficult because most banks cannot quantify that risk and cannot show in a tangible way why borrowers must sign up for that cost. Therefore, the prepayment risk on adjustable fixed-rate loans falls squarely on the bank without compensation. Suppose a community bank does not hedge or match fund 5-year adjustable loans. In that case, the lender cannot tie the prepayment penalty to any actual cost of unwinding for the bank, making it much more challenging to transfer the cost of that prepayment risk to the borrower.

Sales Risk

Sales risk entails the bank not obtaining the loans it wants or being forced to book the loans it does not want. Most short-term adjustable loans are a poor compromise for both the bank and the borrower – the bank would prefer a 1-year or shorter repricing index, and both the bank and the borrower would prefer a 10-year or longer fixed-rate certainty for the borrower (see credit risk discussion below).

Credit Risk

The short-term adjustable-rate loan is a poor credit bet. If rates are higher in the future, the borrower’s DSC ratio may not meet the bank’s underwriting criteria, or the ratio may be below 1.0X. Further, on a 25-year amortization schedule, the principal repayment in the first 5 years is less than 6% of the starting balance – the loan has not seasoned enough to reduce the loan-to-value (LTV) sufficiently to compensate for the rate reset risk.

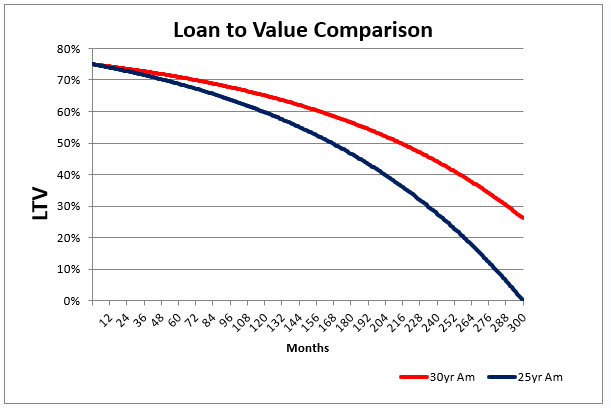

Below is a graph showing the LTV of two loans, one on a 25-year amortization and one on a 30-year amortization, and assumes no change in collateral value. Both loans start at 75% LTV. The critical point is that on a 25-year mortgage-style amortization, the loan principal reduction is very modest over the first few years – about 1% of the loan prepays each year over the first five years. The credit risk is even worse on a 30-year am. Therefore, on an adjustable-rate loan, banks set a repricing feature that stresses the primary repayment capacity when the secondary source of repayment has not yet markedly improved. Furthermore, one standard deviation of commercial real estate value is around 30%, underscoring that if valuations drop (cap rates increase or cash flow decreases), LTV can easily break 100%. On the other hand, after 10 years, that 25-year amortizing loan is reduced from 75% to 60% LTV (assuming no change in collateral value) – offering substantially more equity cushion for the lender.

The other issue is cumulative credit risk. As we diagramed HERE in our last review of adjustable loans, credit risk is not uniform each year and grows during the first five years. As such, floating rate and adjustable rate loans are at greater risk in a rising rate environment as not only is debt service coverage decreasing due to higher rates, but credit risk often increases. When you underwrite a loan, credit risk is fairly certain the first year and then gets less certain the farther out you look. Usually, between years four and six, the appreciation of the property or business combined with amortization, starts moving incremental credit risk down.

Pricing Risk in an Adjustable Loan

One perplexing issue with short-term adjustable-rate loans is that banks price the first segment at a lower equivalent spread than the future resetting segment. There are two reasons for this: First, it appears that banks are pricing to compete and win the business, and to do so, they price the initial rate aggressively. On the other hand, the borrower believes the loan will be renegotiated or refinanced on the reset date. Second, some lenders play games with loan pricing models to obtain the desired return on equity (ROE) by increasing the spread on the back end of the loan, knowing that the borrower is free to renegotiate the pricing on the reset date. Regardless of how the loan is priced, we do not know the lending environment in two years, never mind in five years. Therefore, the bank is taking the risk that the loan is mispriced to the borrower’s advantage in the future (if the loan is mispriced to the bank’s advantage, most borrowers will ask the bank to re-write the terms and rate of the note or find an alternative financing option).

Free Borrower Option

We feel a borrower option at the bank’s expense is a significant risk of adjustable-rate loans. The structure creates a credit option for borrowers that banks give away for free. Suppose the borrower’s credit deteriorates over the initial fixed-rate period or pricing for similar credits is below market in five years. In that case, the borrower will renew the loan at the contractual spread over the index. The borrower will have no better options in the market.

Conversely, if the credit improves or pricing is above market, the borrower will attempt to renegotiate terms and pricing or refinance the loan with a competitor. This scenario creates higher prepayment speeds, lower bank relationship value, and adverse selection bias. The bank loses on almost every outcome.

Conclusion

The short-term adjustable-rate loan structure could be the perfect fit for a borrower who can take interest rate risk and has an asset-liability position that has a short duration. However, the structure, for most customers, suffers from several shortcomings. This structure is often the result of banks inadvertently creating an array of risks to appease the borrower’s gamble on a bet that future loan rates will be lower