Reduce Credit Spreads to Increase Return

In last week’s article (here), we discussed why category and geographic diversification may be unfeasible for many community banks. We concluded that after a community bank sets limits on loan categories, the added benefit of geographic or loan category diversification is nullified. We discussed three main reasons why community bank diversification by geography and loan category does not enhance community banks’ resilience or performance. However, community banks can still effectively diversify by one important criterion – credit quality. In this article, we look at how reducing credit spreads is a better way to diversify in any business environment and good way to increase return at the end of an expansion period.

Community banks should always strive for credit quality diversification in their loan portfolios and aim to shift to a higher credit quality concentration later in the business cycle. As we get closer to the end of the cycle, banks should increase their credit quality more. While counterintuitive to many bankers, this means to improve the risk-adjusted return on a loan portfolio, bankers should decrease, not increase credit spreads.

How Banks Price Loans

There are three ways that banks price their loans (or any product or service for that matter):

- Price to competition: Banks determine what competitors are charging for similar loans in the marketplace and price accordingly.

- Cost-plus pricing: Here banks calculate their cost of capital, funding costs, all direct and indirect costs and add a margin to determine the price.

- Perceived value to the customer: While more subjective, the bank determines the maximum a borrower will pay for the perceived value of the banker’s expertise and problem that the bank is solving. This is the optimal way for banks to price their loans to increase return on equity (ROE).

Based on our observations, we estimate that about 75% of community banks price to competition by setting minimum yield or credit spreads for their newly originated commercial loans. The strategy requiring minimum commercial credit spreads may be well-intentioned, but the results for banks are suboptimal.

Minimum Credit Spreads

In a rising interest rate environment and uncertainty around various CRE categories, as is the case today, bankers scramble to enhance profitability. It may appear that the easiest way for bankers to attempt to increase profit margin or ROE is to increase loan yield – it is quite easy to implement this strategy on paper, but the results are not positive.

Despite management’s best efforts, lenders interpret the minimum spread as the only spread available to their customers. Even as management underscores that the minimum spread is for the best, most profitable bank relationship, most lenders believe that each one of their customers has the highest credit quality, is most loyal to the bank and demonstrates the greatest cross-sell relationship opportunities for the bank. The starting point which is meant to be a floor (the minimum credit spread), inadvertently becomes the pricing ceiling or cap. In the longer term, this strategy decreases the average credit spread for the bank instead of enhancing it.

Further, when banks institute a minimum credit spread strategy, typically that minimum spread is based on what the competition is pricing. Managers look at the average spreads in the market and set their minimum spread relative to that industry average. However, pricing to competition is the worst pricing choice for banks. Minimum credit spread effectively transfers an important corporate power to the competition. While bankers should be aware of the prevailing pricing in their market, that information is effectively used to make a buy-or-sell decision (make a loan or buy a security), not to match or follow competition. The above is true in most industries, but in banking, pricing to competition is even more derelict because the decision is not just about revenue, it is also the extension of credit.

Finally, minimum credit spread strategy magnifies survivorship bias in banking. Survivorship bias is the logical error of concentrating on outcomes that made it past some selection process and overlooking outcomes that do not make the selection process. The issue for many banks is this: the performance of all loans is measured over years each quarter looking backwards. But the profitability of an individual loan going into the portfolio is not measured at inception, because minimum credit spreads are not a measure of profitability and minimum credit spread has no actual causal relationship to profitability. Survivorship bias is occurring at banks using minimum credit spread because the more profitable loans (paradoxically the ones with the lower credit spread) are heavily underrepresented in that bank’s portfolio. Managers are then challenged to increase the bank’s ROE, and choose loans with even higher yield, but, unfortunately, lower collective ROE. The profitable loans are not just absent, they are not even seen by management because lenders are following the minimum credit spread guidelines.

Selective Migration to Diversify Loan Portfolios

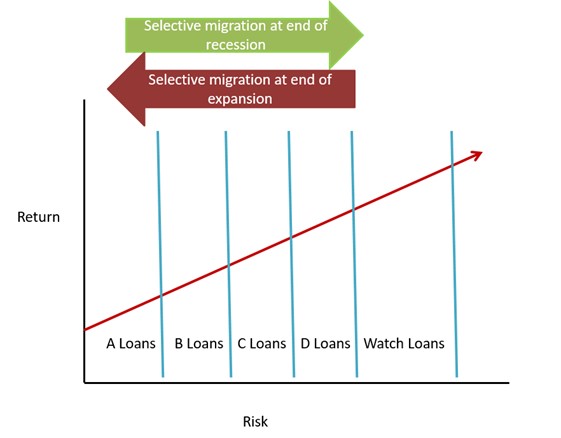

To optimize loan portfolio profitability, community banks must recognize how to migrate through the credit spectrum (see example of the concept in the graph below). During prolonged periods of expansion, banks misprice credit risk more severely. In a recession, better credit quality loans have a higher risk-adjusted ROE. When the economy slows, many banks want to capture the better credit quality loans (reactively migrating credit quality). However, by the time these banks get around to it, more forward-thinking banks have already started rotating their credit quality in anticipation of the change in the business cycle, thereby crowding out the reactive banks. By selecting the correct credit quality in anticipation of the change in the economy, banks can avoid negative selection bias. For example, if a bank is not anticipating changing economic conditions and generates credit quality across the spectrum, in a downturn the competition will scramble to steal high credit quality loans and avoid the lower credit quality loans, naturally decreasing the average credit quality of the portfolio. A minimum credit spread strategy is inherently set up to capture lower credit quality credits because management typically sets the minimum spread to capture more yield, not to funnel high-credit quality at lower yield.

Cutting Credit Spreads – A Pricing Example

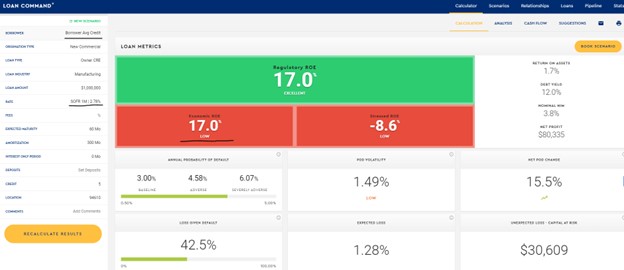

We can demonstrate a concrete example of this migration strategy using a risk-adjusted return on capital (RAROC) model and two identical loans except for credit quality. We priced an average credit quality, five-year, $1mm owner-occupied commercial real estate (OOCRE) loan, to achieve a 17% economic ROE. This average credit quality loan (1.2X debt service coverage ratio (DSCR), and 75% loan-to-value (LTV)) needed to be priced at 2.78% credit spread to achieve a 17% economic ROE – as shown below.

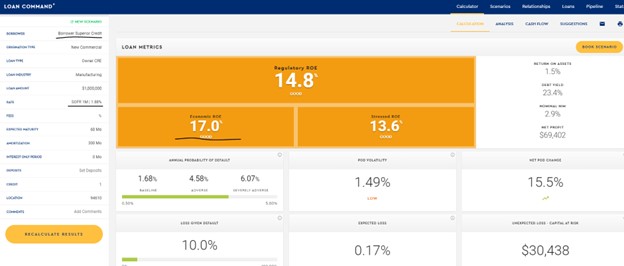

We then priced a superior credit quality loan, but otherwise identical to the first. This superior credit quality loan (2.5X DSCR, and 50% LTV) needed to be priced at 1.88% credit spread to achieve a 17% economic ROE – as shown below. In other words, this higher quality credit can generate the same ROE for a bank at a 90 bps lower credit spread. By using selective migration and focusing on higher credit quality loans, community banks can achieve the same returns with lower credit spreads.

How can this happen? Better credit quality means the probability of default is less, your reserves/capital are lower and your maintenance cost is less. It also means that your bank’s profitability and cash flow are likely to be more stable. Fewer bad loans also mean that lenders and credit personnel spend less time on problems and more time on developing relationships. While a single loan may not make a difference, multiple this over a portfolio of loans and banks with a higher risk-adjusted return should perform better in all credit cycles.

Conclusion

Adopting minimum credit spreads misdirects bankers’ attention from what should matter in loan pricing: credit quality, loan size, relationship cross-selling, and lifetime value of the customer. Bank managers are well advised to diversify into better credit quality loans that have equal or higher risk-adjusted ROE (but lower spreads). Especially when the economy slows, or when certain loan categories are stressed, community banks that diversify into higher credit quality loans outperform the market.