Current Loan Pricing Trends for 1Q 2025

In the 4th quarter of 2024, commercial loan pricing has materially changed. The new administration with its lighter regulatory stance, the potential for tax relief and threat of higher inflationary has generated new optimism for credit, and new risk of higher rates. In this article, we quantify commercial loan pricing trends from our Loan Command data that will hopefully help community banks price more effectively and win more profitable business.

The Big Picture of Current Loan Pricing Trends

The average credit spread last quarter that has carried through to the first part of 1Q 2025 is 2.63%. This average spread is up 8 bps from last quarter but part of that is due to a mix of fewer fixed rate loans and slightly risker loans. Holding credit, mix and structure the same, loan pricing was tighter by approximately four (0.04%) basis points (bps) on recognition of a better future credit outlook and more competition.

In similar fashion, upfront loan fees decreased five basis points to an average of 27 basis points.

On a risk-adjusted return on equity basis, banks moved their target from 16% that held for most of last year, to now looking at a 20% risk-adjusted return on capital (RAROC). Countering this trend is more competitive lending than we have seen in 2024 that manifests in more price concessions and less than expected margin relief. Why many banks assumed four rate cuts at the end of 2024 and start of 2025, the market, and hence most banks) are now assuming zero to two. This has hurt future expected loan profitability.

However, supporting a higher RAROC target is more of a “risk on” mentality. Less fear of a recession and a greater outlook on the economy has boosted credit supply from 3Q of last year and has allowed banks to go after higher risk loans. Tight supply in most commercial credit sectors such as office and retail, has helped improve both the probability of default and the loss given default in most markets. An improving credit outlook as decreased credit risk, and while partially offset by tighter pricing, has resulted in a net increase in RAROC targets.

On the interest rate risk side, banks put more fixed rates on their books in 2024 compared to 2023. In 2023, approximately 10% of new loans were fixed rates. In 2024, approximately 16% were fixed rates. Now, with a positively sloping yield curve and less of a probability of lower rates, banks are moving back to less fixed rate loans unless they are hedged.

Current Loan Pricing Trends by Sector

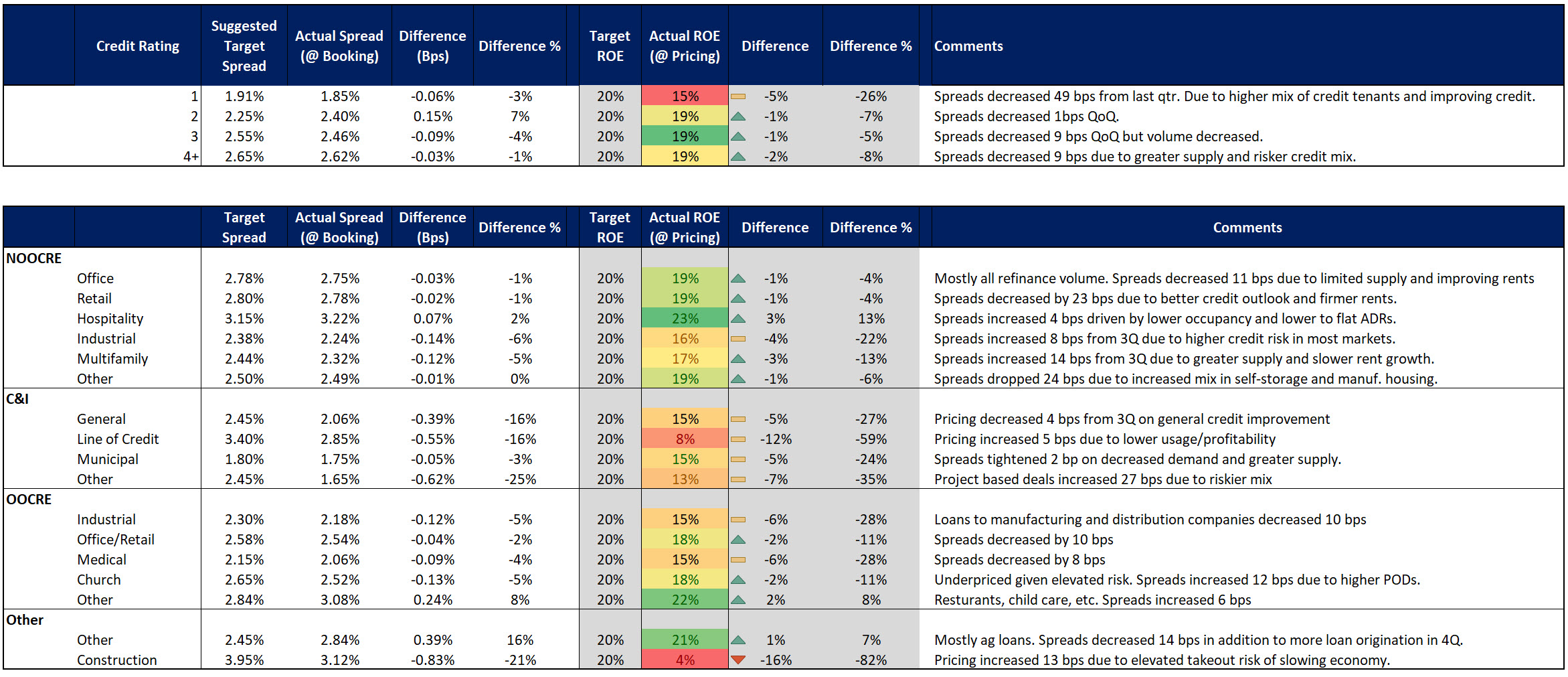

Below is a chart and commentary of loan pricing trends broken down by internal credit rating and by sector. We provide our suggested target spread and the average spread of where commercial loans are being currently priced.

C&I was the big story as business picked up and companies started to think about taking on more debt. Pricing tightened some four basis points to an average of a 2.06% credit spread. Most of these opportunities came with deposits thereby justifying the lower RAROC.

Line of credit were paid down hurting profitability and continue to be underpriced vs. the risk. While banks are limited by competition to what they can charge for lines, they are often not limited to how these lines are structured or what other cross-sell opportunities take place. Using credit lines to protect a term loan or getting additional deposits are two common tactics used to right size profitability.

Office and Retail was the next big story as, credit spreads tightened 11 and 23 bps from last quarter. Along with the increase in the economic outlook, few markets nationwide had any new supply in either product. As such, unless a bank thinks a recession lies ahead, the risk/reward profile is likely going to be the best community banks have seen. Without new supply on the horizon, low rents, high vacancies, and increasing foot traffic present more upside than downside thereby justifying the tighter spreads and 19% RAROC.

Church credit deteriorated slightly hurting profitability and caused a widening of pricing by 12 bps, to an average 2.52% credit spread.

Multifamily, that did contribute to some credit concern last quarter, is starting to stabilize. Credit quality for this product is extremely local but there has been a drop in future building permits due to ample supply in many markets and higher rates. As such, the outlook is improving. That said, credit quality remains strong and better than the sector’s long-term mean.

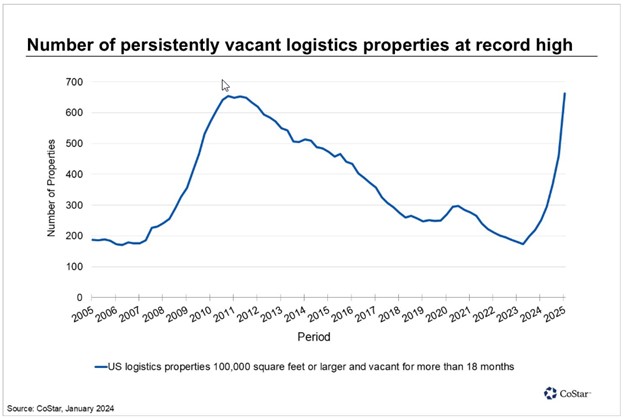

Similar to multifamily, the industrial sector continues to slide in credit quality but from a position of extremely higher performance. Spreads increased in investor properties due to increased supply but decreased in owner-occupied due to C&I competition. Hurting performance in this sector is the glut of new supply in many markets for logistical centers (below).

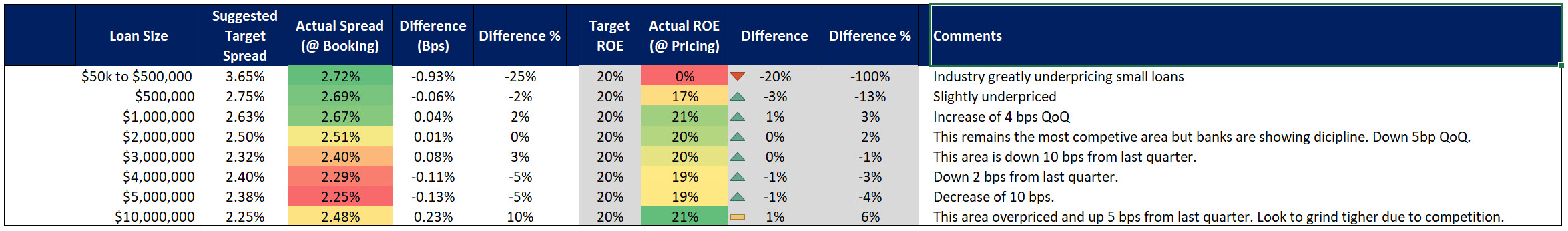

Pricing by Loan Size

The banking industry still does not have an appreciation for funds transfer pricing when it comes to loan origination and often misallocate capital. Like almost every quarter we have seen in banking, banks usually underprice commercial loans below $500,000 and ironically overprice larger sized loans. We start to see this in loans above $5mm, acutely see this in the $10mm loan size range and then moderate as loan size approaches $25mm.

Coming Soon

In the next couple of weeks, we will update credit trends and what the future of bank credit holds under the new administration. This will help banks further add context to the above loan pricing trends and better allocate capital.

Overall, the current loan pricing trends indicate a dynamic landscape with varying performance across sectors. While commercial and industrial loans show promising potential with tightened spreads, sectors like office, retail, and multifamily present a mixed but improving outlook. The challenges in church and industrial credit highlight areas needing careful risk assessment. Banks must continue to navigate the intricate balance of competitive pricing, strategic structuring, and profitability management to optimize their loan portfolios effectively.