Calculating Loan Prepay Speeds (Part II)

In a recent article (HERE) we discussed the importance of loan prepay speeds. We explained why loan prepayment speed is a major factor influencing a bank’s profitability, how national banks use historical analysis, quantitative modeling, and predictive analytics to structure loans to increase loan retention (decrease loan prepayments). We introduced the crucial factors influencing commercial loan prepayments and explained the complexities of how these factors are interrelated, and probabilistic in nature. For those banks that do not have access to a commercial loan prepayment model or have not used AI to generate that predictive analysis, in this article we will explain how community bankers should structure commercial loans to decrease prepayment speeds and increase profitability.

Loan Prepay Speed Input Variables

As a recap, there are many factors that explain commercial loan prepayments speeds, and not all are financial. One factor that will be excluded from our sensitivity analysis is loan term – because shorter loans, by their contractual nature, have shorter expected lives. Our modeling assumes that the maximum possible life of a loan is the contractual maturity, and predicting refinancing is a separate exercise with another set of inputs. Our modeling applies prepayment probabilities to the full contractual maturity as the initial horizon. Prepayment risk is cumulative, and every year of a loan compounds the chance of early prepayment. Our modeling aims to identify which factors, or combination of factors, compress or lengthen the expected life of a loan.

Once contractual maturity is established, the input factors that we will analyze influencing prepayment speeds are the following:

- Loan size.

- Non-economic/personal factors (these are assumed constant unless otherwise noted).

- Vintage and business cycle.

- The shape of the yield curve.

- The type of prepayment provision.

- Loan category.

- Debt service coverage and LTV.

- The index used to price the loan.

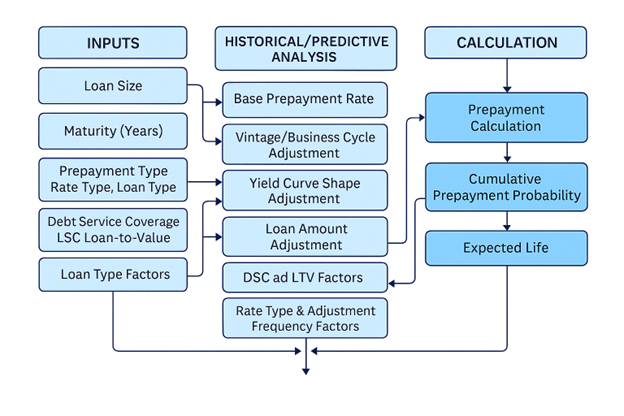

A flowchart of the model showing the interplay of inputs, analysis, and calculations is shown below.

In Simple Terms

In summary, our model (and most similar loan prepayment models) start with the loan’s contractual term, and then estimate how likely the borrower is to prepay each year, based on market conditions (business cycle, yield curve), loan characteristics (size, type, DSC, LTV), rate structure (fixed vs. floating), and prepayment penalties (lockouts, yield maintenance, etc.). These factors are combined into cumulative prepayment probability. The prepayment probability is then converted into an expected life (average time before payoff). The output is a single number representing the expected life of the loan.

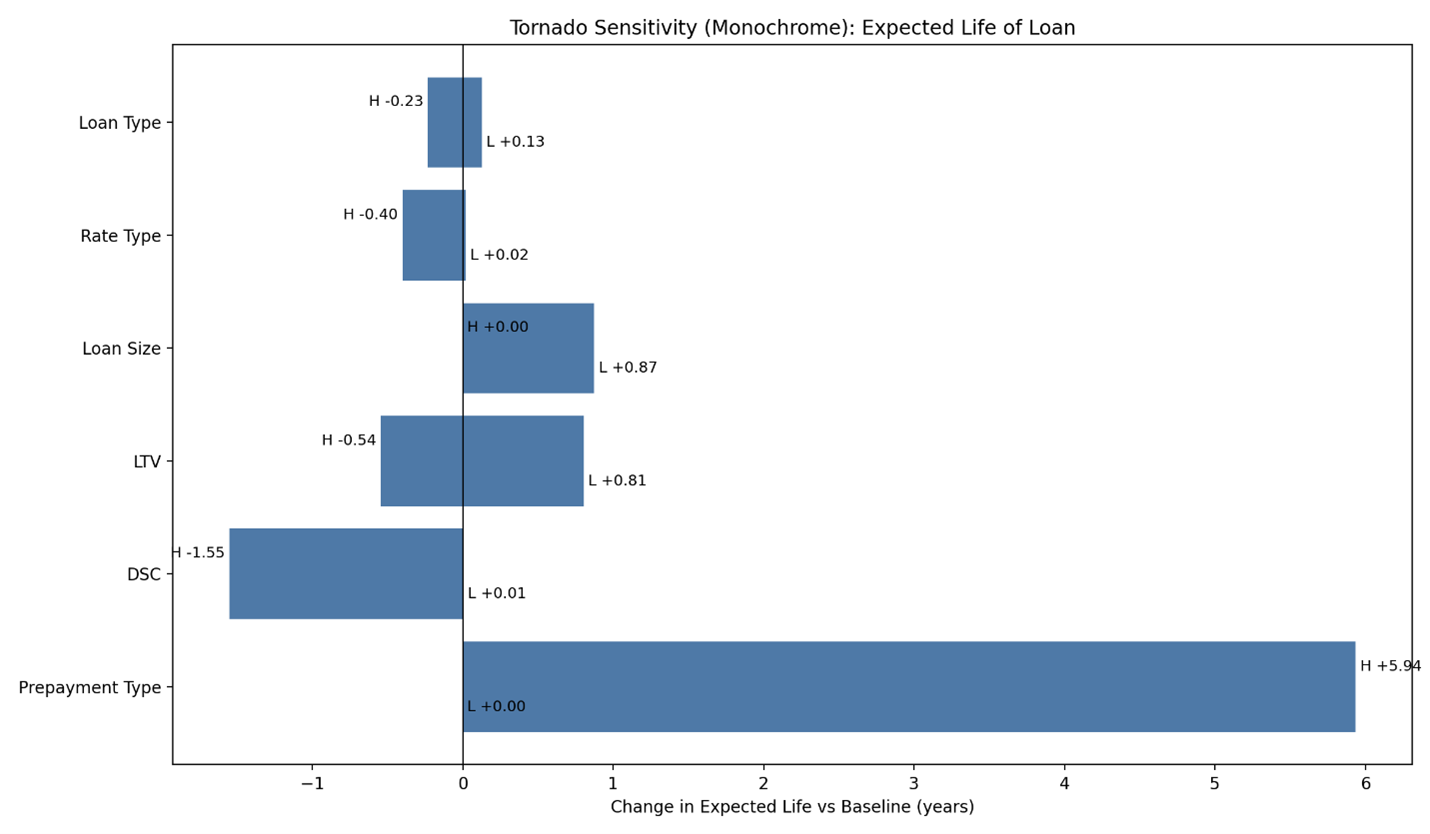

For example, a certain 10-year fixed rate loan with no prepayment penalty has an expected life of 3.31 years, and that same loan with a 5% prepayment provision for the entire term has an expected life of 7.79 years. Adjustments are made for all input variables (market conditions, loan characteristics, and prepayment provisions). A graphical sensitivity analysis for the input variables is shown below.

Our sensitivity analysis shows that the biggest factor affecting loan prepay speeds is the specific loan prepayment provision. The strongest prepayment provisions (e.g., yield maintenance, lockout, or declining balance for full loan term) increase expected loan life. After the prepayment provision, DSC ratio is the next most important variable for the expected life, with high coverage reducing life (affording borrowers more opportunity to select alternative financing options). LTV is next and can both increase or decrease expected life depending on the LTV level and seasoning of the loan. Higher loan size increases borrower’s sensitivity to refinance and larger loans have shorter expected life. The rate type (adjustable, fixed, or floating) can also affect prepayments. Finally, the loan type is a natural self-selecting category driving prepayments – development/raw land loans exhibit faster prepayments than multifamily, as an example.

Conclusion and Applicability

Understanding loan prepay speeds is critical when structuring a loan. What our loan prepayment modeling and sensitivity analysis shows is that community banks have a clear path to improve commercial loan profitability by following a few simple loan structuring steps. First, fixed-rate loans have longer expected lives. Second, certain loan types are better suited to not prepay early. Third, and most importantly, strong prepayment provisions are paramount to longer expected loan life. Another important variable to consider is structuring loans to permit collateral substitution and assumability – this is beyond the complexity of most models, but the ability to substitute borrowers or collateral can greatly increase expected loan life. Community banks can increase loan profitability through smart structuring and covenants, without having to pass any costs or additional fees to commercial borrowers.