Should You Adjust Loan Pricing Due To Rising Funding Costs?

Rising funding costs and decreasing liquidity at community banks are causing managers to change pricing methodology for new credits. This makes some sense, as in other industries, if your input pricing goes up, you often adjust your end pricing. We estimate that 25% to 50% of community banks have a policy requiring minimum yield or credit spreads for new commercial loans. The strategy requiring minimum commercial credit spreads may be well-intentioned, but the results for banks may be unintended. We are proponents of pricing discipline and optimizing returns for credit-intensive products, but a pricing methodology requiring minimum credit spreads is arguably profitability-reducing and relationship-destructive.

Liquidity Pressures on Rising Funding Costs

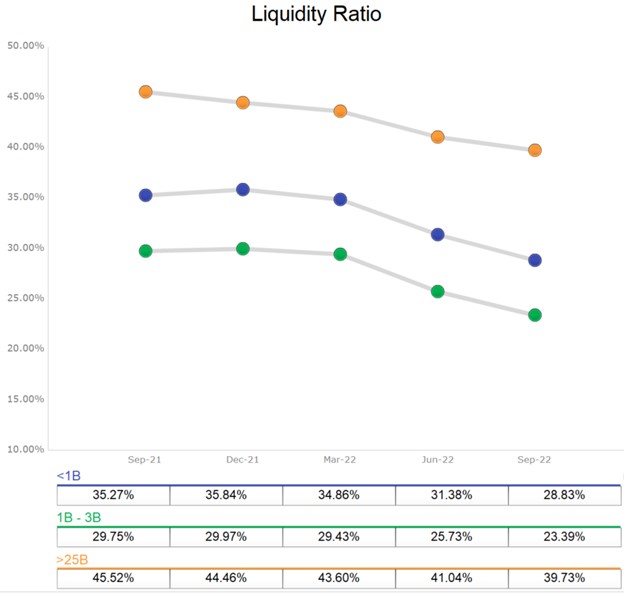

Excess bank liquidity gathered during the pandemic is now waning as depositors become more active in moving funds to higher-yielding alternatives like Treasuries and money markets. The graph below shows liquidity ratios for all banks under $1B in assets, $1-3B in assets, and over $25B in assets. The drop in liquidity ratios is expected to accelerate through 2023.

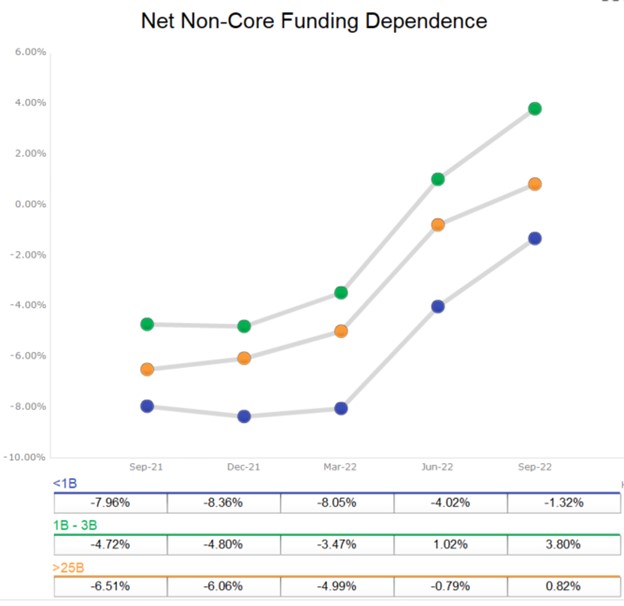

Community banks have responded to this decreasing liquidity ratio by increasing reliance on FHLB borrowing, brokered deposits, and certificates of deposit (CDs) for funding. The net non-core funding dependence ratio is shown in the graph below. We expect this ratio to continue to increase through 2023 as the Fed drains liquidity and the impact of previous rate increases works through the banking system.

As community banks rely on increases in CDs, brokered deposits, and Home Loan borrowings to fund loan growth, more community banks are considering minimum credit spreads to control loan growth and minimize net interest margin (NIM) erosion.

Objectives of Loan Pricing

Banks use loan pricing strategies to achieve dozens of different goals, but the most common are as follows:

- Increase granularity of credit pricing,

- Accurately allocate capital,

- Maintain market discipline,

- Educate management and lenders,

- Become more attuned to prevailing market conditions,

- Standardize pricing across divisions, product lines, and relationships,

- Increase profitability,

- Decrease risk,

- Manage customer relationships, and

- Enhance reporting, control, and governance.

Minimum Credit Spreads to Offset Rising Funding Costs

In a period of declining bank liquidity or when credit quality is facing uncertainty, as is the case today, banks face pressure to retain NIM and stabilize credit quality – this is an understandable reaction to market pressures. It would appear that the easiest way for bankers to maintain NIM is to increase loan yield – it is straightforward to implement this strategy on paper, but the results are not favorable.

Requiring minimum credit spreads for commercial loans has the following unintended consequences:

- Despite management’s best efforts, lenders interpret the minimum spread as the only spread available to their customers. Even as management underscores that the minimum spread is to offset rising funding costs, most lenders believe that each of their customers has the highest credit quality, is most loyal to the bank, and demonstrates the greatest cross-sell relationship opportunities for the bank. The starting point that is meant to be a floor (the minimum credit spread) inadvertently becomes the pricing ceiling or cap. In the long term, this strategy may decrease the average credit spread for the bank instead of enhancing it.

- There are three ways that managers can price their loans (or any product or service, for that matter):

- Price to the competition – Banks determine where competitors are charging for similar loans in the marketplace and price accordingly.

- Cost-plus pricing – Here, banks calculate their cost of capital, funding costs, and all direct and indirect costs and add a margin to determine the price.

- Perceived value to the customer – While more subjective, the bank determines the maximum a borrower will pay for the perceived value of the banker’s expertise and the problem that the bank is solving. This is the optimal way for banks to price their loans to increase return on equity (ROE).

But when banks institute a minimum credit spread strategy to offset rising funding costs, that minimum spread is typically based on what the competition is pricing (or above if the bank wants to minimize loan growth). Managers look at the average spreads in the market and set their minimum spread relative to that industry average. However, pricing to the competition is the worst pricing choice for banks. Pricing to the competition is an abdication of management’s duties because it effectively transfers an important corporate power to the competition. While bankers should be aware of the prevailing pricing in their market, that information is used correctly to make a buy-or-sell decision (make a loan or buy a security), not to match or follow the competition. The above is true in most industries, but in banking, pricing to the competition is even more derelict because the decision is not just about revenue but also the extension of credit. The better way for banks to price loans is based on perceived value to the customer, and minimum credit spreads force bankers away from that pricing principle.

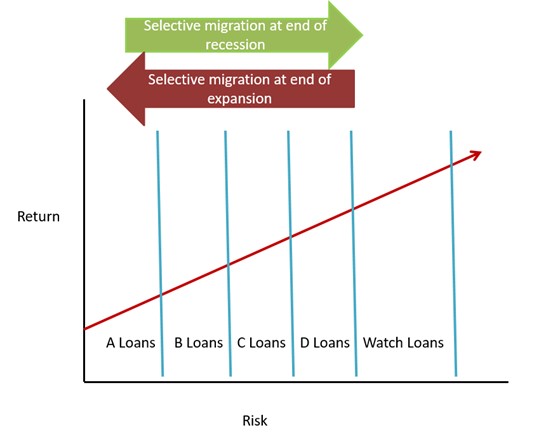

- To optimize loan portfolio profitability, community banks must recognize how to migrate through the credit spectrum (see an example of the concept in the graph below). During long periods of expansion, banks misprice credit risk more severely. In a recession, better credit-quality loans have a higher risk-adjusted ROE. When the economy is expected to slow and liquidity to decrease (as is the case today), banks want to capture better credit-quality loans. By selecting the correct credit quality in anticipation of the change in the economy, banks can avoid negative selection bias. For example, suppose a bank is not anticipating changing economic conditions and generates credit quality across the spectrum in a downturn. In that case, the competition will scramble to steal high-credit quality loans and avoid the lower credit quality loans, naturally decreasing the average credit quality of the portfolio for that bank. A minimum credit spread strategy is inherently set up to capture lower credit quality credits because management typically sets the minimum spread to capture more yield, not to funnel high-credit quality at a lower yield.

- The minimum credit spread strategy magnifies survivorship bias in banking. Survivorship bias is the logical error of concentrating on outcomes that made it past some selection process and overlooking outcomes that do not make the selection process. The issue for many banks is this: the performance of all loans should be measured over the life of those credits, but most banks only measure performance quarterly on financial statements looking backward. But the profitability of an individual loan going into the portfolio is not measured at inception because minimum credit spreads are not a measure of profitability and minimum credit spread has no actual causal relationship to profitability.

Survivorship bias occurs at banks using minimum credit spread because the more profitable loans (the ones with the lower credit spread and better credit quality) are heavily underrepresented in that bank’s portfolio. Managers are then challenged to increase the bank’s ROE and choose loans with an even higher yield but, unfortunately, lower collective ROE. The profitable/lower-risk loans are not even vetted by management because lenders follow minimum credit spread guidelines.

Conclusion

Adopting minimum credit spreads misdirects bankers’ attention from what should matter in loan pricing: credit quality, loan size, relationship cross-selling, and lifetime value of the customer. Rising funding costs is a factor but a small factor comparatively. We advise managers to measure upfront the criteria of a commercial loan that drives bank performance – which is generally not credit spread.