Managing CDs – Why Banks Should Limit Their Offerings

As a general statement, banks offer too many options for certificates of deposits (CDs). Consider that the average bank offers 12 different maturities, some “specials,” plus several different tiers of pricing within each maturity. We have seen banks with as many as 42 different CD options which is inefficient for every party. The problem is too many CD offerings can increase a bank’s cost, confuse customers, confuse employees and, worst of all – damage its overall deposit performance. In this article, we look at a counterintuitive strategy when managing CDs to increase deposit performance.

Simplify When Managing CDs

A couple weeks ago, we discussed how best to leverage odd-month CDs and how best to use “specials” effectively (HERE). We received plenty of feedback and in this article wanted to further elaborate on a couple points that we made in passing.

As a general concept, we beleive that every deposit product, and every CD, should have a clear purpose. A bank’s products should be working to improve the lives of the customer and/or the profitability of the bank. One idea is to reduce CD offerings for terms that don’t have a purpose in order to increase performance on other deposit products and CD maturities.

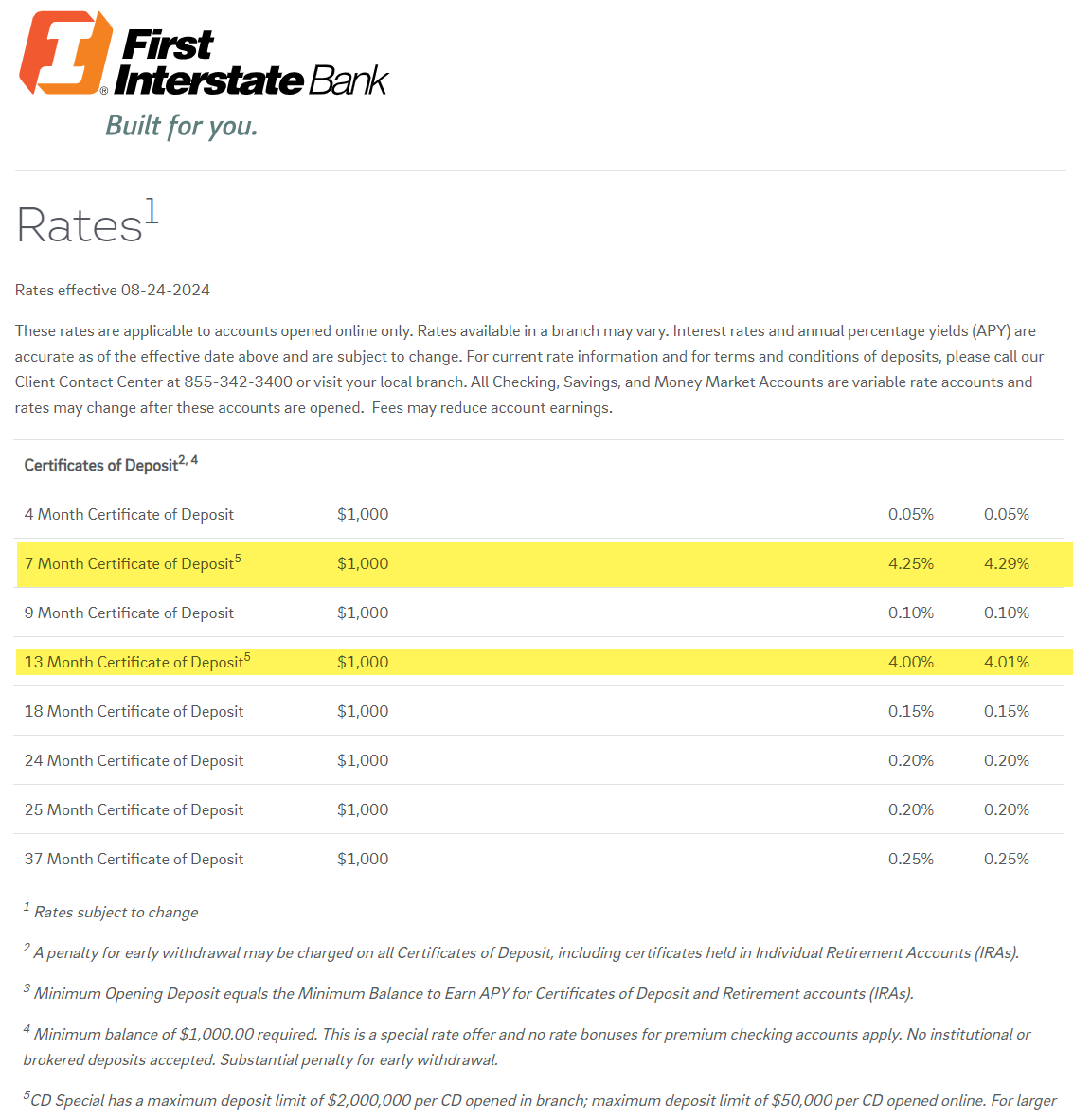

First Interstate Bank, for example, offers essentially a limited assortment of CDs, (below). When managing CDs, this limited number of offerings presents essentially two choices for customers: a seven-month option and a 13-month option. First Interstate knows that these CDs cover the bulk of customer desires. It is also no suprise, the First Interstate enjoys one of the lowest interest-bearing cost of funds in the market. Their deposit performance is in the top 10% of all banks.

The Customer’s Point of View

Ask a bank why they offer so many CD options, and you either get, “That is how we have always done it,” which is never a good answer, or you get, “Because the customer wants choices.”

The reality is few customers need to build a “cash flow ladder,” or need to structure their CD investments to achieve a certain duration. In no focus group or customer survey have we ever heard that a bank was chosen because of their breadth of CD offerings. It is exceedingly rare that a bank receives a complaint about the customer wanting a five-year or a nine-month CD and the bank didn’t have it.

Usually, it is a digital thought process – the customer either wants their money liquid or they don’t. Few customers know or care about the term structure of interest rates and where they would like interest rate exposure. A customer that cares that much about the shape of the yield curve either keeps their investment in bonds or demands such a high rate on their CDs that they are likely one of your worst deposit customers due to their interest rate sensitivity.

Left to their own devices, bank customers naturally gravitate to the one-to-three-year part of the yield curve. This is usually the time horizon that most households and business plan when it comes to thinking about their bank-kept liquidity. For customers to go out longer than three years they often need to be enticed with a higher rate which is why you see much greater premiums for longer maturities.

Very few banks have a customer base that will naturally want to invest their money for four years or longer unless there is a premium to the rate. Conversely, bank customers are often satisfied with a money market account for periods less than a year.

The Problem with Longer Maturity CDs

Unless a CD is priced correctly, or a bank is confident in their profitable product cross-sell ability from a CD, which few banks are, driving franchise value from CDs is extremely difficult. To create value, CDs usually need to be priced below SOFR/swap rates, or at least wholesale liability rates (brokered CDs, FHLB advances, etc.).

Banks that pay above wholesale rates are better off using wholesale money temporarily as that is a less expensive option; not only because of the stated interest expense but also because of the lack of cannibalization. Offering a higher-priced five-year CD in your service area, for example, makes the entire deposit base more interest rate sensitive (price elastic). Every time a CD comes to maturity, the customer will look around for various options and usually make a decision based on the rate. The more choices you have, the greater the tendency there is to teach your customers and your employees that the rate is important.

This also explains why banks with a higher percentage of CD liabilities compared to the industry average trade at lower multiples and generally underperform vs. bank performance indices.

Managing CDs – Adding Value

It is not that time deposits are inherently bad for bank performance it is just that few banks take the time to create value in time deposits and the outcome is usually results around competing on rate. Competing on rate is one of the surest ways to destroy franchise value when managing CDs.

However, for a bank that wants to put the energy into managing CDs, then we suggest leaning in and creating a variety of value points.

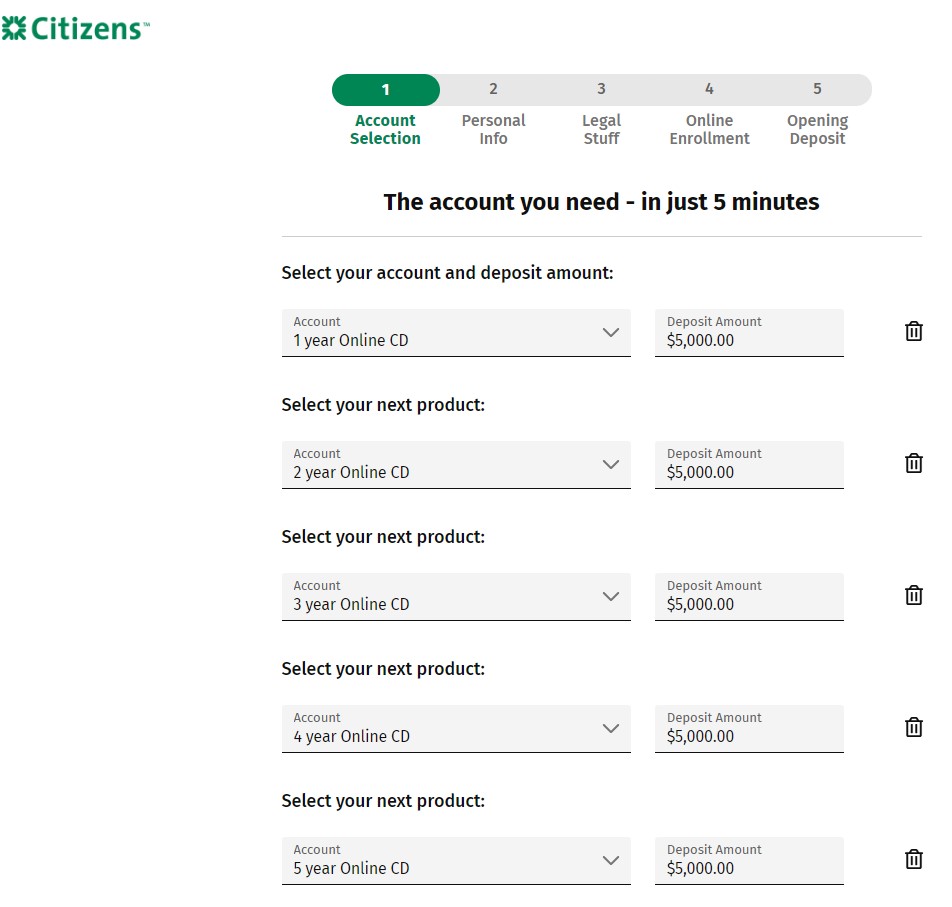

For example, some banks, such as Citizens, provide the functionality for the creation of a “CD Ladder” that allows the customer to purchase a variety of CDs all at once covering different maturities. This saves the customer time and provides the customer with some simple investment analytics (below).

Other ideas include specialized commercial CD issuance targeting only specific industries such as healthcare, insurance, non-profits or manufacturing. In similar fashion, banks can issue “community first deposits” that target specific areas for community development or for households that meet specific criteria such as saving for a child’s college or for community service.

Some banks may want to add structure to their CDs to increase liability performance such as the ability to call a longer-maturity CD to provide the customer more rate but the bank with more optionality. While this does serve to increase rate sensitivity, when used correctly, it can decrease a bank’s deposit beta.

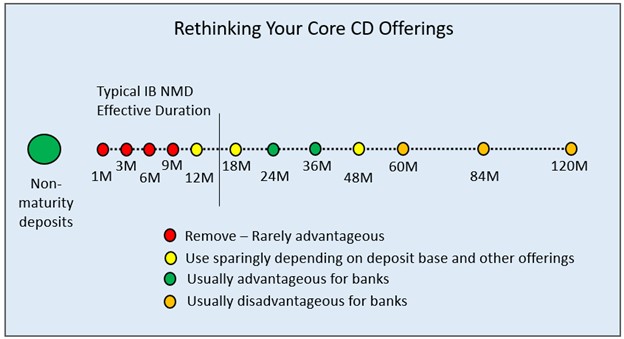

The Problem With Shorter Maturity CDs

For shorter CD maturities, the pricing equation gets complicated and banks often create greater interest rate sensitivity than needed. By offering a CD shorter than a year, a bank almost always cannibalizes their money market accounts. As such, the mere presence of having a shorter maturity CD impacts both the price and the interest sensitivity across multiple products. Remove the CDs that are shorter than a year and a bank will often not only be able to lower the cost of their money market accounts, but also find that more customers will park money there for longer increasing the duration and decreasing price elasticity.

Simplify Your CD Offerings

By reducing your shorter- and longer-term CDs, banks can reduce cost by not having to manage various maturities each with their different pricing tiers based on account balance or cross-product use. Explaining CD options, opening the CD account, managing the core system, contacting customers, dealing with rollovers and solving problems cost banks an average of $67 per year per CD account.

Reduce the number of CD accounts outstanding, and you will reduce the cost. While not a huge cost reduction for most banks, it does help on the margin, particularly given the fact that most banks pay this extra cost to achieve WORSE liability performance with their CD offerings.

Putting This Into Action

While every bank has a different customer base and set of liability goals, most banks would benefit by reducing the number of CD offerings to two or three different maturities. The active management of a liability portfolio is one of the underutilized ways that banks can quickly enhance their bottom line and improve franchise value.

Banks should decide what their strategy is for each section of their deposit base and proactively set goals for their CD offerings. It is important to know if your bank wants to be offensive or defensive with its time deposits and where it wants to create value.

Don’t take our word for it, take a branch or your online effort and test market a simplified CD structure and some specialty CD offerings. A falling rate environment is an excellent time to train customers to be less interest rate sensitive and to improve overall deposit performance. Even if rates fall, deposits will remain under pressure due to the Fed’s quantitative tightening. This continued pressure will force some banks to make a greater number of deposit mistakes that they will have to live with for years to come.

When yields were low, few customers and few banks paid attention to their liability structure as mistakes didn’t matter much; now, given higher relative rates compared to several years ago, mistakes can have far-reaching consequences.