Marketing Deposits Like Barbie

Maybe you saw Oppenheimer over the weekend, maybe it was Barbie, or perhaps you did the “Barbenheimer” thing and did both. Maybe you opted for Mission Impossible – Dead Reckoning, Part I. No matter your choice, there was a clear winner: Barbie. Film quality aside, there have been few movies in the history of the World that have done a better job at marketing than Barbie. We studied the movie’s playbook and uncovered some lessons banks can use. This article highlights these lessons and applies them to marketing deposits.

Setting The Context

We will stipulate that your bank isn’t as iconic as the Mattel fashion doll that was introduced in 1959. We will also stipulate that you don’t have $100mm to spend on a marketing budget. However, these facts matter little. Banks don’t need to pull off one of the biggest box office openings in recent times, and much of the Barbie marketing machine is either well within a bank’s budget or can be scaled down to fit any budget. No movie in the history of filmmaking has had more partnerships clocked in at over 100. This facet alone is worth the analysis to uncover what worked and what didn’t. Several months ago, there was no such thing as “Ken-ergy” or “Barbicore.” Pantone 219-C pink wasn’t a fashion trend. Marketing made it so. These trends were invented with creativity, and banks can do the same. Applying marketing efforts to deposits is much better than increasing deposit rates above 5%. Not only is it cheaper but long-term performance will be enhanced.

Fun vs. Nostalgia

Warner Brothers Discovery (WBD), the film’s studio, set the stage early by creating a marketing message for the movie around fun and excitement instead of nostalgia. As bank marketers know, marketing around nostalgia is one of the safest tactics in marketing; it seldom fails. WBD could have easily marketed the movie to female Baby Boomers calling upon feelings from their childhood. This worked for films like Jumanji, G.I. Joe, and Transformers. For that matter, they could have marketed the movie to kids. However, they wanted to go bigger. They took a page from the Lego Movie and focused on creating a new customer segment for their product. Marketing around fun and excitement allowed Warner Brothers Discovery to cross-demographic lines and appeal to a person’s intent to see a fun summer movie.

Bank Lesson: Don’t market to the deposit customers you have, market to the customers you want. Instead of targeting demographic stereotypes, figure out the intent of what your customers are trying to do and tap into that energy. Right now, customers are concerned with savings and cash flow. As layoff numbers increase, marketing more around building emergency savings, increasing the balances in an HSA account, and putting more money away for retirement plays well.

Citizen’s Bank recently introduced multiple products to build deposits, such as early access to your paycheck and a 24-hour grace period for their overdraft fees. When you open a transaction account, you can automatically move over your direct deposit paycheck thanks to third-party integrations. While these are not new features in the banking world, they are still rare for traditional banks. Similar to the Barbie movie, Citizens focused on the intent instead of demographics and targeted innovative features at households that didn’t use Citizens as their primary bank. As a result, Citizens was able to gain double-digit returns on these technology and marketing investments by increasing transaction account primacy. Deposit balances followed.

Pink as a Signature Color

The Barbie movie marketing machine leaned into the doll’s signature pink. It was everywhere. The brand amplified its marketing spend by creating a consistent theme of products and partnerships that reinforced themselves. Almost every partnership was built around the color –clothing, houses, luggage, yogurt, hamburgers, appliances, and Malibu Barbie pop-up cafes – all amplified the color. Some of these partnerships worked (Gap sold out of most of their product line), and some didn’t (i.e., Barbie Xbox).

Bank Lesson: Banks should consider developing and amplifying a signature brand element through their marketing. It will be their color for some banks, but it can also be a logo or a single theme. Walk into the average branch, and it’s usually hard to discern a bank’s brand. Google “bank deposit advertising,” and you will see that most banks fail to leverage their brand elements in their digital collateral. The notable exception is Ally Bank, which uses its unique purple to its advantage. Having a clear “look & feel” will tie marketing efforts together, providing synergies in the process.

Consider this thought experiment – If Apple opened a hotel, you can imagine almost exactly what it would be like. If Marriott produced a phone, it would be difficult to conceive the look of the product. Apple owns a brand, while Marriott runs hotels. While banks don’t have to be like Apple, they can likely improve their brand, which will lower their deposit cost. Instead of rate, banks should focus on marketing BPSS – Brand, Product, Safety, and Service.

It’s All About Engagement

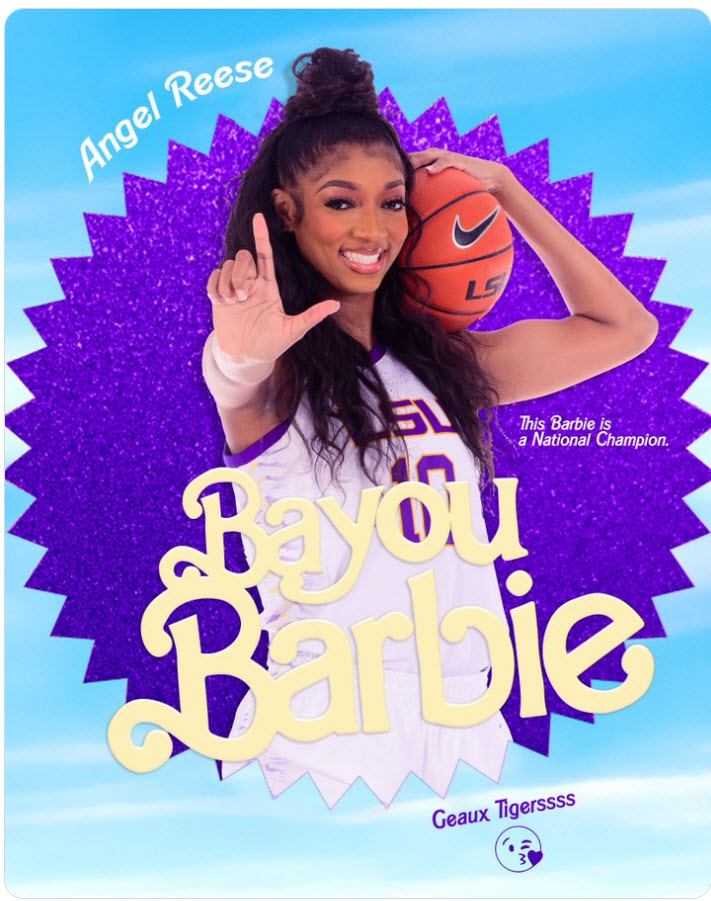

WBD partnered with Photoroom to create Barbie’s Selfie Generator. Playing into the generative AI craze, the app was near-costless for the movie. The app created a point of interaction and made it easy to publish on social media, thereby further amplifying the brand. As a result, it was used 13 million times in the first couple of months and created consistent virality across social media. The brand then paid a variety of stars such as “Bayou Barbie” Angel Reese of the LSU Tigers, All-Pro Quinnen Williams of the New York Jets, Formula 1 stars, and others to post, and the app took off.

Bank Lesson: Banks can steal this playbook almost directly. Creating a custom virtual photobooth is now inexpensive (for example, HERE) and could allow the public to sit on stacks of money in a vault, be seen next to your bank’s CEO, become a teller, or show customers in a variety of clothing styles. Add some wisdom about savings and wealth and then leverage some local Name Image Likeness (NIL) athletes, and you have the makings of a mini-campaign to attract attention to your transaction accounts. The key concept here is to create engagement tools to increase interaction and gather contact information to further market. Looking to gather small business deposits? Provide one of the many valuation tools available. Find ways to interact with your customers with positivity, and deposits will follow.

Marketing Deposits By Getting the Conversation Going

WBD’s marketing team found various ways to keep the conversation going and keep the Barbie movie at the forefront of everyone’s conversation. Playing up the simultaneous opening with Oppenheimer was brilliant. The conversation lasted months as social media defined people by which movie they would go see or what order they would go see them in. When that was lacking, director Greta Gerwig did an interview where she released her “Official Barbie Watchlist,” where she discussed the influential films that led her to Barbie. WBD worked on stories about Barbie’s relationship to power, hyper femininity, Ken, the Kardashians, and Barbie’s history. According to Axios, more than a half-million content pieces have been generated, the most for any film.

Bank Lesson: When marketing deposits, banks need to get innovative around generating conversations about money and banking products. Similar to Barbie, there are many angles to play up. Maybe it’s the top things customers use their debit cards for, the top goals of savings, or how different couples manage their accounts (one account vs. two accounts vs three). Whatever it is, providing content for reporters and bloggers generates brand recognition and deposit product interest.

Marketing Deposits with Search

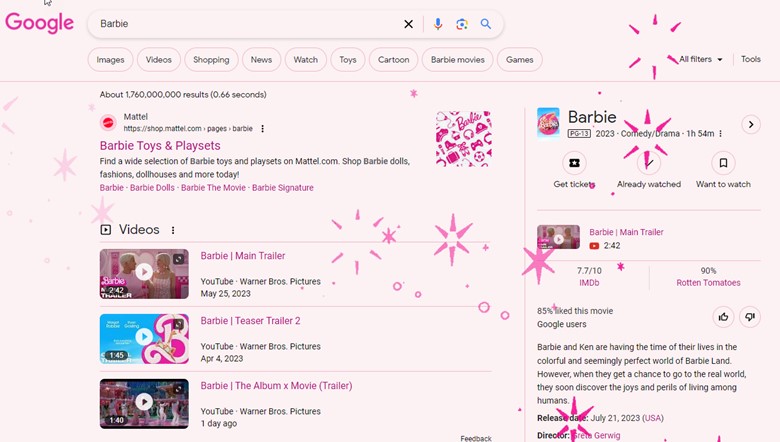

Barbie took the search to the next level. Type in “Barbie,” “Margot Robbie,” “Ryan Gosling,” or other related terms, and Google’s search engine page turns pink with visual sparkles. Fans found it cute, and that went viral.

Bank Lesson: While banks could pull off these special effects, or “Easter Eggs” with Google, Siri, Alexa, or other search channels, the simple point here is that banks don’t use paid and unpaid search enough when it comes to marketing deposits. One of the most popular search terms when a small business looks for a new bank is – “best bank for small business.” Yet, except for US Bank, few banks build their web pages around popular search terms (free), and fewer still pay for the keyword (about $4 per click). This is a shame as 8,600 people last week looked for a new bank in this manner. “Treasury management,” “interest checking,” “preventing cash management fraud,” “free checking near me,” and hundreds of other popular searches are done daily where your bank can be the number one choice in your geography, either free or for relatively little money. Like the Barbie movie, With very little work and cost, banks should be harnessing the power of search to generate new customers and increase deposit balances instead of paying higher interest rates.

Be Bold and Grand in Partnerships

The flagship move in Barbie marketing was the creation of the real-life Barbie Dreamhouse in Malibu in collaboration with AirBnB. A promotional drawing allowed a handful of lucky fans to live their Barbie fandom and stay in the house. Guests could try on Barbie’s wardrobe, use the dance floor, or play with a variety of Barbie toys (roller blades, guitar, etc.). WBD set up star Margot Robbie for an exclusive walk-thru with Architectural Digest to keep the conversation going. The press and social media exploded.

Other bold partnership moves included dating advice and compliments on the dating app Bumble and the commercial cast of Progressive Life talking about their “Secret Client” with the tagline, “I would like to tell you, but I don’t think I Ken” – truly sublime marketing.

Bank Lesson: Banks should consider more local marketing partnerships. Local social media influencers, community leaders, and celebrities are just the start. Partnering with community businesses for promotions, such as realtors and accountants, isn’t done enough. Getting creative in the production of social media events such as a bank-branded exotic car to drive, Airbnb, or resort hotel suite can all be used to raise brand awareness.

If You Were Ever Serious About Marketing, The Time Is Now

WBS unleashed every trick in the book, plus came up with dozens of new ideas to successfully promote Barbie. While some ideas didn’t work out, many did. The movie’s efforts should hopefully fuel motivation for banks to get better at marketing deposits.

So far, for 2Q, it looks like banks increased their interest-bearing cost of funds by some 200 basis points while increasing their interest-bearing volume away from non-interest-bearing volume by over 35%. The industry’s interest-bearing deposit beta is over 100% quarter-over-quarter – a historical first. The combination of raising rates and cannibalization of volume resulting in a deposit mix change is destroying value at a record clip for many banks that is geometric in nature. Compare that to the tactics of WestAmerica Bank, which is hardly raising rates. They are destroying value as interest rate-sensitive customers run to other banks. But here is the thing – that destruction is linear, not geometric. They lost around 3% of their deposits last quarter as they had to shrink. While there are fewer dollars to the bottom line, they became more profitable by doing so. Not only more profitable now but have set themselves up to be more profitable in the future.

Shrinking for any bank isn’t ideal, but it preserves the integrity of the customer and the employee base, plus trains them that service, not rate, is essential. Few banks can have the discipline of a WestAmerica, but they can put more money into product development and marketing. While you can debate the entertainment value of Barbie, there is little denying that it was one of the best-executed movie marketing campaigns in history. Bank marketers, and their management, can take a page or two out of their playbook to drive lower-cost deposit balances. If they can, as Barbie says – “It’s the best day ever, just like yesterday, tomorrow, and every day from now until forever.”