How The Carry Trade is Hurting Banks

For decades community banks bolstered ROA/ROE by booking 5-year fixed-rate term loans funded with short-term deposits – called a carry trade. The carry trade has historically worked for banks because interest rates were in a long-term pattern (approximately 40yrs) of decline prior to the pandemic, resulting in improving NIM for most banks. What some bankers may not realize is that this same carry trade is now eroding NIM and ROA/ROE, and performance needs to be fortified through other sources of income – one of which is described in this article.

Historical Perspective on the Carry Trade

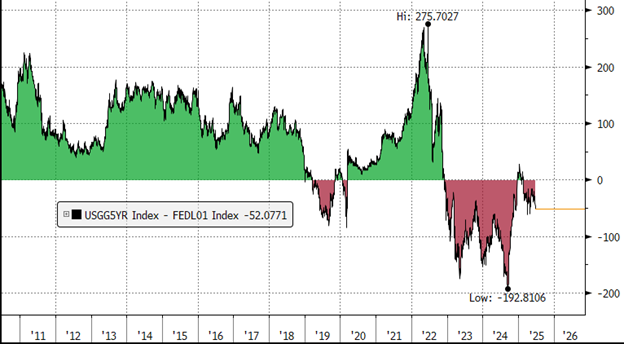

The graph below shows the difference between the 5-year Treasury and Fed Funds yield from 2010 to the present. This graph represents the benefit of a carry trade – a bank’s additional income gained by making 5-year loans and funding with organic deposits (vs. matched-funding). Historically, this carry trade earned banks an average of 93bps additional yield. Today this trade earns banks a negative 47bps in yield. The carry trade has been an earnings drag for banks for the last three years. There is no benefit to adding loan duration to the balance sheet because banks are taking liquidity and interest rate risk for a lower yield – a poor risk/return tradeoff for lenders as witnessed by the failure of certain banks in the last few years who misunderstood the carry trade risk profile and the certainty of their funding sources.

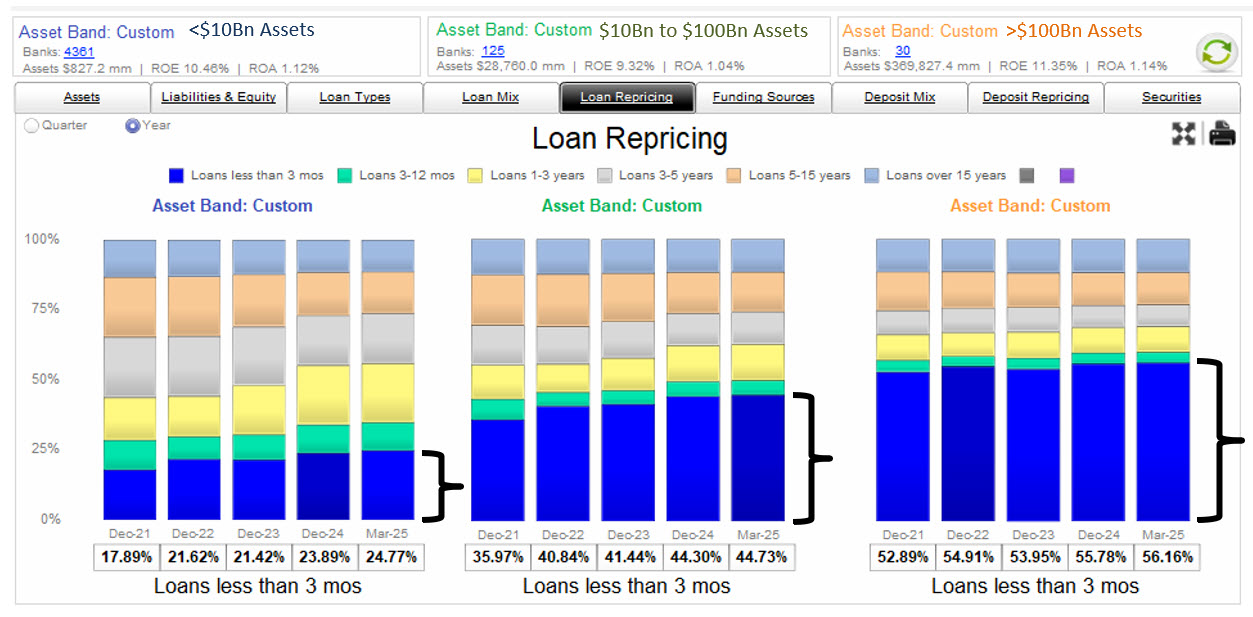

Many banks are intuitively familiar with this change in the market and have decreased their loan duration as a result. The graph below shows loan repricing buckets for three asset sizes of banks: under $10Bn, between $10Bn and $100Bn, and over $100Bn. All three groups of banks have been decreasing loan duration since 2021 (and increasing their floating rate loans). However, community banks (under $10Bn in assets) still demonstrate much longer loan duration. This continued reliance on the carry trade, in many instances, is hurting bank performance. The brackets in the graph below highlight the floating rate loan buckets for each of the three groups – note how smaller banks are still relying on the carry trade compared to larger banks.

Fixing This Issue

We believe that community banks have an excellent opportunity to augment performance through an increase in fee income. Larger banks have historically generated more fee income than community banks (by almost 50bps as measured to earning assets). The majority of fees generated by larger banks are related to deposit and loans – business lines that community banks already maintain. Community banks do not need to buy new businesses to increase fee income; instead, we believe that additional fee income exists at most community banks by focusing on certain customers, and slight changes to loan, deposit, and treasury management products.

If your bank’s fee income is less than 1.0% of earning assets, we believe that your bank’s primary goal should be to increase sources and depth of fee income. There are certain advantages to fee income, over margin income. This includes the following:

- Some fee income may be recognized immediately in the period received, boosting ROA/ROE.

- Many sources of fee income may be recurring.

- Some sources of fee income is not paid out of pocket by clients (the case of hedge fee income).

- Fee income is typically retained even if the margin business leaves the bank with asset prepayment.

- Certain forms of fee income are multiplied by the contractual life of the asset (such as hedge fee income). This magnifies the ROA/ROE benefit to the bank.

- Fee income is a direct contribution to performance after overhead costs (a mathematical link to accelerating ROA/ROE).

- When the carry trade is not effective, or it reduces income, fee income is a viable option to boost performance.

Conclusion

Over the last 40 years, community banks retained fixed-rate loan maturities of up to 5 (or sometimes longer) and while the revenue did not fully compensate for the risk, there was a carry trade to generate some profit, especially as interest rates declined. However, that strategy is especially painful for banks when the yield curve is flat or inverted. While every community bank’s balance sheet composition varies, the market and current interest rate projections create a poor environment for a carry trade. However, generating additional fee income may be a great substitute for some community banks. Community banks that earn less than 1.0% fee income to earning assets have an opportunity to improve fee generating through various add-on products and cross-sell opportunities.