6 Bank Stablecoin Use Cases and Reserve Management Options

I am not sure if the hype around stablecoin is real or not, but my position is that this could be a dramatic shift in banking, and it is worth spending time and effort to see if just 25% of the hype is true. In this article, we provide the algorithm to see if a stablecoin makes sense for your bank and then allow you to sign up for a webinar to learn more about both stablecoin and what a bank consortium might look like.

The Promise of a Bank Stablecoin

It is often said that stablecoin is overhyped and that it is a great solution looking for a problem that we do not have. I do not see it that way.

The ability to hold clear, digitized legal claim to value, separate from the banking system, has some distinct advantages.

Up to this point in banking’s evolution, customers relied on the bank to validate their balances and to move value for them. Because of batch processing, banks do not know the exact balance in customers’ accounts except at the end of core system processing. This changes with stablecoin as customers always know their exact balance.

Moving money also requires banks to rely on third-party systems such as the Federal Reserve, Visa, or a multitude of other systems.

A stablecoin token provides clear title and an exact balance with the ability to access and move value within seconds 24/7/365 on either a public or private blockchain. While instant payment is comparable domestically, there is no equivalent for international money movement. Currently, international money movement requires at least one other respondent bank and takes a minimum of two days for commercial payments.

A stablecoin solves the international movement of funds as no respondent bank is needed to move value.

Agentic Payments and Bank Stablecoin

The other characteristic of a stablecoin token is that it does not require a bank account to hold its value, only a wallet. This becomes critical as you move into agentic payments as now you can imbue agents with the ability to hold a monetary balance to enable transactions.

Up to this point, you would have had to give access to either a bank account or a form of payment with authorization. Now, there is no longer a need to provide a third-party or agent access to account information as you can load the agent with a set amount of value via a stablecoin.

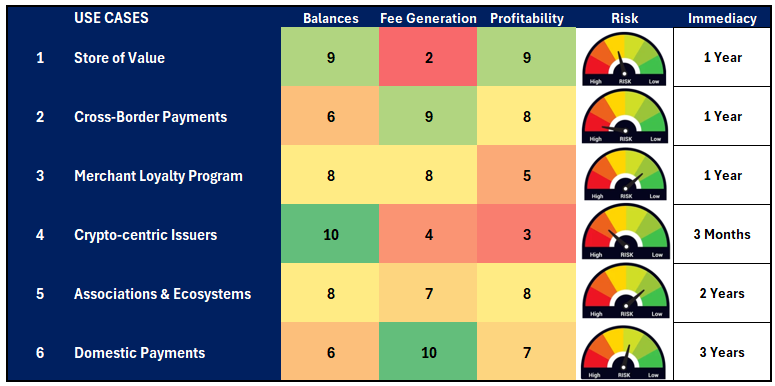

Below, I rank the top six use cases, as we see them, plus give priority of when you should move. I rated each use case on a scale of one to ten, with ten being the greatest relative potential. I also provided a risk rating and an immediacy term which is a prediction of when a developed market will occur.

Use Case 1: The Corporate Store of Value Bank Stablecoin Use Case

This is likely the largest driver of balances for banks and is all net new money. As such, this is the largest and most profitable opportunity for banks to consider.

This use case includes any U.S.-based customer with a foreign subsidiary that wants to hold value offshore in USD. By holding value in a USD stablecoin, the company can limit their foreign exchange cost and exposure. That is, they keep their reserves in USD and move funds to fiat as needed.

While this use case overlaps with cross-border payments (our next use case), it is not the same. This use case provides the ability to offer extended treasury management services to non-U.S. subsidiaries of U.S. headquartered customers. These funds are likely currently held in other currencies as there is no easy and inexpensive option to hold money offshore in USD.

The more volatile the currency is, the more of a need to store value in a USD stablecoin. Companies with operations in Canada, Australia, New Zealand, and the UK are all prime candidates due to the currency pair volatility to the U.S. Dollar. Any currency that is heavily influenced by commodity prices or dynamic trade policies are good candidates.

In addition, any company where the local currency could be subject to high inflation is also a prime candidate. These countries include Argentina, Turkey, Japan, and the Euro.

Use Case 2: Cross-Border Payments

This use case is similar to the above but is more focused on payments. Where the store of value drives balances, this use case drives fee income.

Any U.S. company that either has a material amount of revenue or expenses in a foreign currency would be a good candidate for a USD stablecoin. Companies often move funds from USD to their local currency and back again in an inefficient process.

A set of stablecoins denominated in various currencies makes this much more efficient as you can provide fee-free currency exchanges for the price of the institutional bid/ask difference between the currencies. This is dramatically cheaper than moving funds from USD to the local currency and back again.

This structure also provides a more direct path to “off ramping” funds to local currencies. A stablecoin acts almost identical to the traveler’s check. Back in the 80’s the traveler check concept put American Express on the map. Every bank and hotel loved to take the traveler check because of the foreign exchange fees it used to generate. The same is now true for a stablecoin just in a more efficient, digital formfactor.

Use Case 3: Merchant Loyalty Programs

When it comes to storing domestic value, the customer loyalty use case reigns supreme for banks. Any bank customer that would benefit from issuing their own stablecoin for the purpose of retaining customer balances while incentivizing loyalty purchases is a candidate for this stablecoin use case.

The best example of this is Starbucks. Now, any company can emulate the Starbucks program in a more cost efficient and lower risk way. Where customers that keep money on their Starbucks card are taking operational and counterparty risk, a stablecoin version of this allows customers to know that each dollar is not only backed by the sponsoring bank, but with a U.S. dollar held in reserve.

While the public does not worry much about Starbucks, it might worry about a CVS, Walgreens, or sub-investment grade credit. Further, the public may not know the credit worthiness of a small or private company. A stablecoin dramatically reduces the potential credit exposure of holding money with a merchant or retailer.

For this use case, the merchant gets the benefit of balances, potentially saves on card charges as pay-by-bank becomes the default and is able to provide discounts on customers that keep balances thereby driving sales.

Use Case 4: Servicing Existing Crypto-centric Stablecoin Issuers

The GENIUS Act requires stablecoin reserves to be held by a certified bank. There are currently 30+ smaller existing stablecoin issuers that do not have bank charters and will likely not get bank charters and thus will move their reserves to a bank. There will be thousands more customers for this use case. These issuers are issuing for the sake of being in the crypto business and not for some other purpose such as supporting an existing payments platform.

A bank may want to be able to capture this business, particularly those with a banking-as-a-service vertical.

This is the most immediate use case as these partnerships will likely all be formed in the next several months.

Use Case 5: Associations & Ecosystems

This case includes any fintech or organization that has, or desires to have, an ecosystem that could benefit from having a stablecoin. Banking-as-a-service payment providers, non-profits, trade associations, homeowner associations and municipalities all fall into this category.

Use Case 6: Domestic Payments – Programmable Money

Part of the benefit from being able to build tokens on a blockchain is that you can also include a layer a programing with each token. Payments that are escrowed until certain conditions that are met, payments that KYC themselves or payments that require multiple signatures are all examples of this use case. Any entity that could benefit by leveraging smart contracts on a blockchain could benefit from this use case.

This is potentially the largest future use case as it also includes agentic payments such as those leveraging Google’s Popular AP2 protocol.

What is a Stablecoin Consortium?

One of the gaps in the emerging stablecoin marketplace we see is giving banks an easy way to handle stablecoin reserves, issue a generic interoperable stablecoin in the future plus share in the economics.

What might be ideal is a structure whereby each bank can join on a cost-free basis to maintain the option of issuance and then fully participate in the economics, the deposits, and fees by the issuers that they bring to the table that includes their own bank and any customers.

By pooling banks together, banks cannot only gain control of a stablecoin structure instead of using a third-party coin, but can enjoy scale and liquidity.

Is a Bank Stablecoin Consortium for You?

The answer to that question lies in if you have customers that could benefit from a stablecoin use case. To that end, if you have five or more customers that fall into one of the above use cases, issuing a stablecoin might be worth your effort.

The more customers you have, the more the economics tilt in the favor of either issuing your own stablecoin or participating in a consortium.

Next Step: Registration

For financial institutions that are interested in discussing the various options for stablecoin, tokenized deposit issuance and reserve management, register your interest below and we will reach out and provide more information around upcoming webinars, meetings, and structure.

Stablecoin, and the companion tokenized deposits, has the potential to change the face of banking. For banks considering participating in this potential revolution, understanding the options, side-by-side, to include the economics, risk and effort, is likely worthy of your time to explore.

In the next year, more regulation and demand will emerge that will catch many bankers off guard. We want to find a group of like-minded institutions that can help us think through this potential new era and figure out interoperability, liquidity and the ability to build both deposits and fees.

Register your interest today HERE.