What Every Check is Costing Your Bank

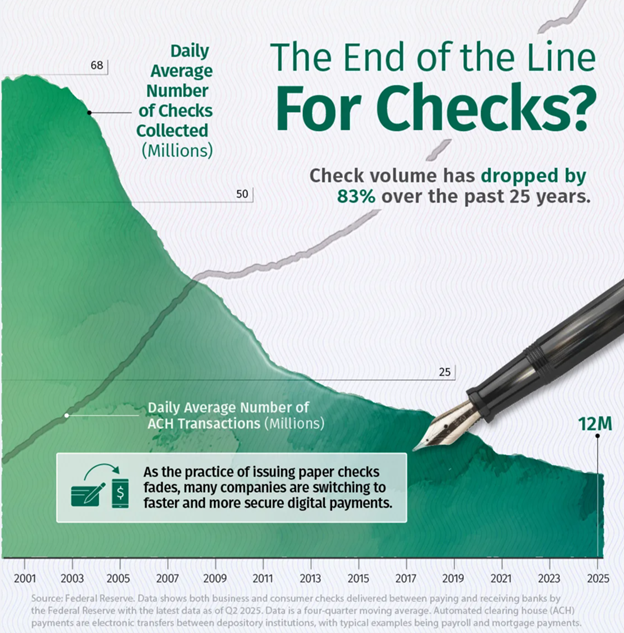

For the second quarter of 2025, there were 11mm checks written every day totaling $34B, according to the latest Federal Reserve data. While the number of checks decline by about 8% every year, the fact that we still have the check is an embarrassment to banking. In this article, we explore what each check likely costs you, what the future of checks hold and what that future means for the bank business model.

The Ridiculousness of Checks

We write notations on a piece of paper that contains our name, the payee’s name, address, routing number, account number, a sample of our writing and our signature to then release it into the wild. Checks can be intercepted in transit for days without anyone knowing about it or raising suspicion. Its ironic that every banker is taught not to make public account names and account numbers yet we allow this instrument to do it more than 12 million times per day. It is as if we are asking bad actors to steal from us.

It is no surprise that there is more than $21B stolen from banks, businesses, and households every year through check fraud despite increasing fraud mitigation investment by most banks. That is about $4.79 dollars per check before recoveries.

Of all the payment methods, checks reign supreme when it comes to the frequency of fraud. 63% of organizations reporting that they faced check fraud in 2024, according to the most recent 2025 Association for Financial Professionals (AFP) study.

Check fraud often starts with mail theft and ends with either a forged identity and/or washing the ink from the check and replacing it with false information. On the other hand, some criminals just find it easier to forge the entire check and hire people to try to cash it. Even easier is the tactic that criminals can put it through remote deposit capture machines given out by many banks after establishing an account under a false identity.

The Cost of Writing a Check

Businesses need to manage check stock supplies, generate checks, reconcile and track uncashed checks. Without fraud, each check cost a business about $4 to process. From a businesses standpoint, it is the most expensive payment channel for the customer.

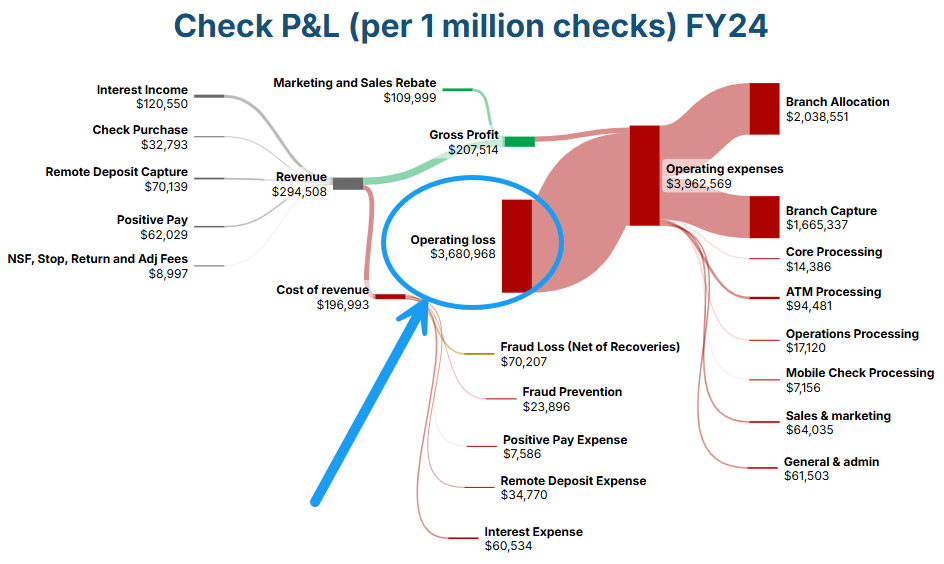

Conversely, it is also the most expensive absolute channel for a bank. It cost the average large community bank about $3.68 per check not including the cost of recoveries. For a smaller bank that doesn’t have scale in their check processing, that number could be closer to $10 per check depending on their branch cost and fraud levels. Below is likely the most comprehensive breakdown of check profitability that you have seen.

For every one million checks processed, banks lose approximately $3.7 million (in the middle of the above graphic) in processing cost to include revenue, rebates, labor, equipment and facilities cost. We are in essence, subsidizing customers to promote their most costly payment channel while also subsidizing criminals with an easy vector to commit crimes.

Banks are complacent in enabling checks.

Bank Accountability in Check Fraud

We have this Romanized notion in banking that the “customer is always right” and that we need to serve the customer in an “omni-channel” manner so that the customer gets to choose how they interact with banks. This passive strategy does the customer a disservice.

As bankers, we are the financial experts. We need to take more of a leadership role in helping the customer move away from this archaic payment channel while spending less of our shareholder’s capital. This is capital that could be used for: hiring more treasury management sales people; an investment in technology to make the bank more efficient; or capital for our retail and business clients to further their growth. Banks have literally tens of thousands of immediate investments that would provide a higher return than losing money on every check.

Often, the customer doesn’t understand the risk of writing a check nor their alternatives of instant payments and ACH. Other than putting a “5 Helpful Hints To Prevent Check Fraud” on their website, many banks lack a concerted educational program to retrain households and businesses to move them to safer payment channels.

Instant payments and ACH are closed payment channels that are fully encrypted and done between two known parties. If you put biometric and device authentication on a closed payment channel and combine this identity verification with standard telemetry and fraud operations (anomaly detection, etc.), banks could stop an estimated 60% of all fraud and 80% to 95% of all account takeover (ATO) and credential abuse. This would dramatically drive down the cost of payment processing, making it safer for all parties and do a better job at fighting crime in America.

What Should a Bank Do?

It is time for every bank to have a plan to phase out checks. The plan starts with marketing alternative payment channels and investing in product functionality that allows for convenience and safety.

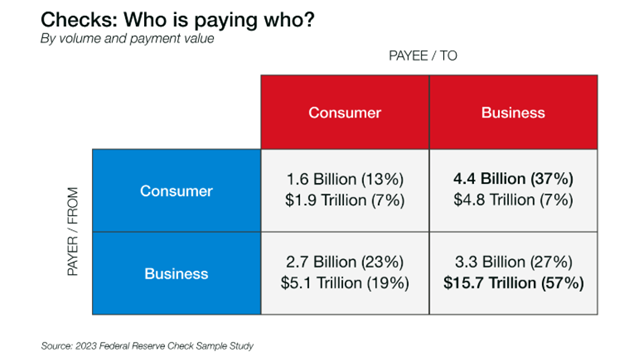

The consumer and banks are doing well. According to the Federal Reserve, consumer check transactions have been declining at a rate of 7.2% annually since 2018. In 2024, consumer check payments accounted for only 7% of all bills paid, down from 19% in 2020. Businesses, non-profits and municipalities, are the problem.

Luckily, the U.S. government is taking the lead and actively working to phase out paper checks, viewing them as inefficient and costly compared to electronic payments. Other entities will follow.

In 2004, 81% of business-to-business payments involved paper checks, according the Association for Financial Professionals (AFP) Digital Payments Survey. Today, that number is down to 26%, a new low.

Now its time for banks to do their part.

For starters, banks don’t need to charge for instant payments as that will only inhibit adoption. More instant payments means more balances, more engagement and more profitability. Sure, you give up the revenue of checks, but you give up the cost which is more important. Banks make money on ACH, they don’t on checks.

Households and businesses need to be shown how being able to set the payment dates and then have the payment settle instantly can increase their interest earnings. They need to be shown that, like checks, you can put the invoice, receipt or remittance notice together with a payment and electronically send both so that all their payment details are in one place.

Companies need to learn that you can now request a payment from a customer instantly making it not only more convenient to respond, but more likely to pay the outstanding amount on time.

Instant payments and ACH are two of our safest and most convenient payment channels for both the bank and the customer, yet we do not market those channels enough. It is time to increase the education and marketing to move customers away from checks and into safer channels.

Every bank will likely want to start monitoring check activity and other payment channels so it can monitor the risks. Banks should proactively decide at what point does it announce the end of check processing. How much capital will it spend to keep the check alive?

Check activity also composes a significant portion of branch and ATM activity. As checks continue to decline, at what point will banks reduce its branch and ATM footprint?

These are some strategic questions that banks should prepare to answer before its too late.

Putting This Into Action

You do not want to be the last institution still processing checks. As instant payments become more common place and request for payment (RFP) shows up at more banks, checks will continue to die a slow and painful death. Stablecoin and tokenized deposits will only hasten the check’s demise.

It will only be a matter of time before the amount of fraud and processing cost makes handling checks cost prohibitive for both banks and businesses. In the coming years, you will start to see some banks charging for check processing just like they had to do with paper statements.

Checks are an idea whose time has come and gone. Its time to plan to move on to more modern payment methods.