Improving the One-on-One in Banking [Template]

Many bankers have one-on-one meetings with their direct reports, and they are painful to observe when it comes to effectiveness and efficiency. They either turn into a status update or a therapy session. The problem is few bankers were taught how to conduct an effective one-on-one. After talking with more than 20 top performing banks, we have distilled our lessons learned for what makes an effective one-on-one meeting with the goal of improving culture and promoting productivity. In addition, we will provide our template that will make any manager an expert when it comes to individual coaching.

The Problem with Most One-on-One Meetings

Many bankers consider a one-on-one meeting with their staff a necessary evil. It is often a checkbox wrapped in a status update and disguised as “staff development.” The truth is that one-on-one meetings with employees that report to you are critically important if done right. They not only build a foundation of trust while facilitating an information exchange, but they are the central point of coaching and can be an early warning system for problems.

A good one-on-one meeting should accomplish the five goals below.

It’s Not Your Meeting

Step one to a better meeting is understanding that the meeting isn’t for you to manage the employee but for the employee to help you manage them. If you just want a status update on what they are working on, then that is likely an email or Teams message. The core of the meeting is to listen, uncover unspoken meaning, and find ways to help.

Here is the before:

Me: “How’s the onboarding project going?”

Employee: “Good, should be done next month.”

Me: “Cool. Any issues you are having?”

Employee: “No. We good.”

Me: “Great. So… what else?”

Employee: “It’s all humming along.”

That is a short, worthless opening discussion.

However, shifting the mindset, you get something like:

Me: “Last time we talked, you mentioned you were frustrated with Compliance’s role in the project and that they were making us have the customer sign a pdf for FINCEN beneficial owner certificate instead of allowing us to use an online form. How’s that been this week?”

Employee: “Honestly, still frustrating. I feel like Compliance is interpreting the regulation wrong and they don’t appreciate the hurtful customer experience that their view is causing.”

Me: “Tell me more about that. What do you think we need to do?”

Employee: “I think we need to seek clarification and help make a case to change the minds of Compliance

Me: “Let’s talk about how we can make that happen. What if we set a meeting with Compliance and Legal to work through this issue?”

This is the same person and the same meeting but a completely different outcome. The better outcome is a result of better listening and asking deeper questions.

Experienced Bankers Know Continuity is The Key Element

This is what separates the new from the experienced bank manager – It is not the meeting that is valuable, but the series of related meetings that are valuable.

When you reference something, the employee mentioned four meetings ago, they know you’re listening and caring.

When you follow up on a career goal they mentioned last month, they get the point that you are not just having a meeting to foster communication, but you are helping them build a skill set and a career path forward.

“How was the week?” is surface level, while “How did that conversation go with Compliance?” equates to continuity and relationship building.

Like chapters in a book, one-on-ones should paint a historical picture of progress forward.

Take Good Notes

Every now and then we run across a banker with an amazing memory. That is not most of us, and if that is you, then quality notetaking is the foundation for good employee development meetings. To clarify, for those bankers that do take notes, it is often the case of not finding them or not utilizing them to the fullest.

Most bank managers scramble right before a one-on-one instead of taking at least 15 minutes to prepare.

OneNote, AINote, Evernote, Notion and many others are all fantastic at helping bankers gather a combination of notes during the week to include emails, Slack/Team’s messages, and texts. Bank managers should be diligent about collecting and organizing data throughout the week in preparation for a one-on-one.

Instead of asking the same questions over and over again, forgetting key teaching moments that occurred five days earlier, or losing track of career goals, the data is now in one place ready to review. For banks that have moved to Microsoft 365 Copilot, an AI agent can now be created to collect all communication and place it in OneNote for easy review. AI has become a Godsend here. Even if you have to cut and paste into a Word doc for each employee, it is still better and more efficient than missing those points at the one-on-one.

Reference the Last Conversation with Structure

By forcing yourself to figure out how to reference the last conversation, you automatically build continuity, which builds trust and coherence.

By building on this meeting hack, we can expand this point into a simple, repeatable process.

10 Steps to Better One-on-Ones

Meeting Prep

- Set a Shared Agenda

Setting an agenda beforehand forces you and your team member to come prepared. It also sends a message that this is their meeting, and they are responsible for adding items that they want to discuss.

If you are a Microsoft bank, you can use the To Do or Planner app to keep a running log of agenda items that both you and your employee can access. They can add items throughout the week, and you both can review the list before the meeting.

This is also a health flag. If they consistently show up without adding anything to the agenda, that’s a signal that either they don’t see the value in the meeting or they don’t feel safe discussing a topic. Either way, bank managers need to explore and discuss.

- Review Your Notes

As alluded to, this seems like common sense, but it is not done enough. By doing this, reviewing, and amplifying your notes will dramatically improve the quality of the meeting.

Set aside 15 minutes before the one-on-one, get organized, review your notes, and answer the following questions for yourself:

- What did we talk about over the last three meetings with a focus on last time?

- What action items did I commit to?

- What actions did they commit to?

- What were they worried about or excited about?

Then start the meeting by following up on those things.

During the Meeting

- Start with a Personal Check-In

Build the relationship first before jumping to banking. Ask about how they are, their kids, their outside-of-work activities. This isn’t small talk, but an effort to understand them as a person beyond work.

You might have to delve deeper.

Me: “You seem stressed. Everything okay?”

Employee: “Yeah, just been a long week.”

Me: “Want to talk about it?”

Sometimes they’ll open up. Sometimes they won’t but at least you try and set the stage for next time. Over time, chances are they will open up.

- Let Them Lead

As a bank manager, you lead best by letting them lead and work through the issues. Get their thoughts, concerns, and items on the table first. Your input should come second.

Be prepared to get them to talk by asking open-ended questions. Prodding like:

- What happened there?

- Tell me more about that.

- What was your reaction?

- Could that person have done that better?

- What is the ideal outcome for you?

- What do you need from me to make this happen?

Get them talking and as they do, ask yourself, are they highlighting the real issue or is the real issue something else? Oftentimes, it is what isn’t said that it is important.

By asking the above questions and listening, often you can uncover unstated problems that they don’t realize.

- Refocus on the Vision Not the Tactics

Getting updates on projects are fine, but that is not where the value is. The magic happens when you can help frame their effort in terms of their goals, challenges, and growth. Place their effort in a larger context making sure they are often reminded of the importance of their contribution to the larger vision.

In addition to helping the employee get the right resources, network and acquire higher level skills, you are also trying to divine:

- What are they proud of?

- What are they embarrassed of?

- Where they are frustrated.

- How to make their job easier and more meaningful.

- What skills should they be working on next?

- How do they feel about the level of support the bank is giving them?

By asking and listening, you strive to unearth items that matter for the long run and not just for last week.

Last week, a bank marketer felt they wanted to “play a larger part in the organization.” Many a bank manager would have brushed this off as a “problem with the younger generation” and put the concern in the context of wanting a promotion.

However, by asking probing questions, it turned out they the employee was not being challenged. The key question was, “What kind of work would make you not bored?”

The solution was the conclusion that the team was not experimenting enough. We then allowed this employee to test some new bank marketing ideas which uncovered some new directions for us. After adjusting the direction, this staff member is one of the most engaged people on the team.

This might have been missed with the basic, “How is the week going?”

- Take Visible Notes

In addition to helping with continuity, taking notes has another attribute. It shows that you are engaged and that you value what they’re saying. As part of the notes, keep a running list of all the action items that you, and the employee, are responsible for. This level of accountability is often lost but helps keep the tone of momentum going during the week.

- Be Vulnerable

One lesson that experienced bank managers know is that it helps to be helpful. Letting the employee know what you are working on, where your shortcomings are and where you need help provides the employee with insight into you as a person in addition to being a manager. Admitting mistakes and highlighting areas of your improvement not only helps them understand you but helps you formalize your personal growth in a transparent way.

If you want to teach authentic leadership, model it.

After the Meeting

- Recap Key Takeaways

In addition to action items, as you take motes, star the main points of the meeting and then spend two minutes summarizing. This ensures alignment and that nothing is being left out by either of you. The goal is to have two to three main points. Any fewer than that and something is wrong. Either you meet too frequently, there is a lack of engagement, or you are not probing enough.

- Follow Through

Follow up is where most managers fail. Within follow-through rests your entire credibility as a bank manager. If you commit to an introduction, information research or other action item and don’t do it, your staff will stop bringing up items.

One key skill is to give an indication of what help you can bring and what help you can’t. Detailing the potential rate of change is a critical skill. Somethings you can fix immediately and some will take time. As a manager, no matter how lofty your title is, desired change sometimes takes time. It’s the manager’s job to help the employee understand the effort and priority of the potential change.

10. Cadence and Mixing It Up

How frequently you hold the meetings depends on the employee and their effort. The more critical the employee’s task and the newer the bank or the employee is to the position/task, the more frequently the one-on-one should be had. Meeting weekly is common. However, for other employees and job positions, semi-weekly, monthly or quarterly is sufficient.

To keep the meeting fresh, mix up all of our suggestions so that you are not using the template and our recommendations every time. Sometimes spend 100% of the time on career development (maybe quarterly), and other times spending 100% of the time on the personal life of the employee is preferred. Sometimes focus on the past, and sometimes spend more time on the future.

The following template is meant only to be a baseline starting point to develop your variations of the meeting around. The questions provided are to be mixed and matched as the bank managers sees fit and not to be asked every time.

Steal Our One-on-One Template

You don’t need a fancy app for a template, but they do exist. A simple shared OneNote, Loop, Google Doc, or Word doc is all you need.

Here’s a template that you can use:

Name

Date

Type: Personal or virtual

PERSONAL CHECK-IN

- What events or activities do they bring up – vacations, family events, etc.

- How is their vibe, their energy or attitude?

- Any personal issues?

THEIR AGENDA ITEMS

- Items they wanted to cover.

YOUR AGENDA ITEMS

- Items you want to cover.

GROWTH & GOAL TRACKING

- How are they tracking towards any stated goals?

- How are they doing on learning new skills directly applicable for the current position?

- How are they doing on skills that they want to learn for fun or for their next position?

- What did they bring up that they want to learn?

FEEDBACK FOR ME

- How can I do a better job and be a better manager for you?

- What should we consider stopping or starting?

ACTION ITEMS FROM LAST TIME

- What outstanding action items were completed?

- What items were updated?

NEW ACTION ITEMS

[Manager]

[Name]

Beyond that, you need a system to quickly review past meeting notes. This is why applications like OneNote, Evernote or Notion are perfect for keeping track of staff performance.

Within the Microsoft ecosystem, you can also use Power Automate to pull action items and to dos into your To Do app or other task list to keep task items globally synced. In this manner, you can reference employee items in the notes and items for all employees on your task list. Checking one off updates the others.

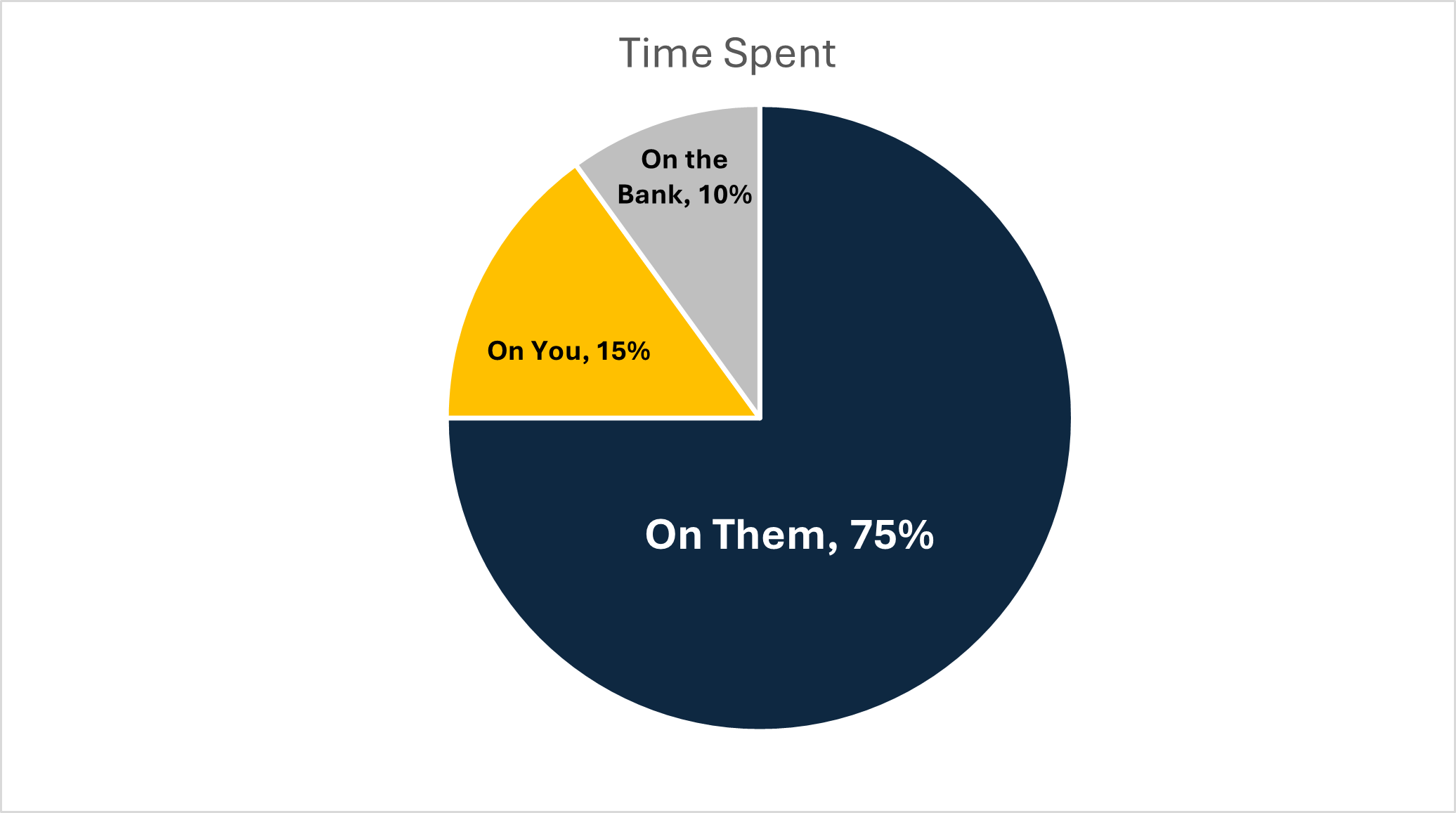

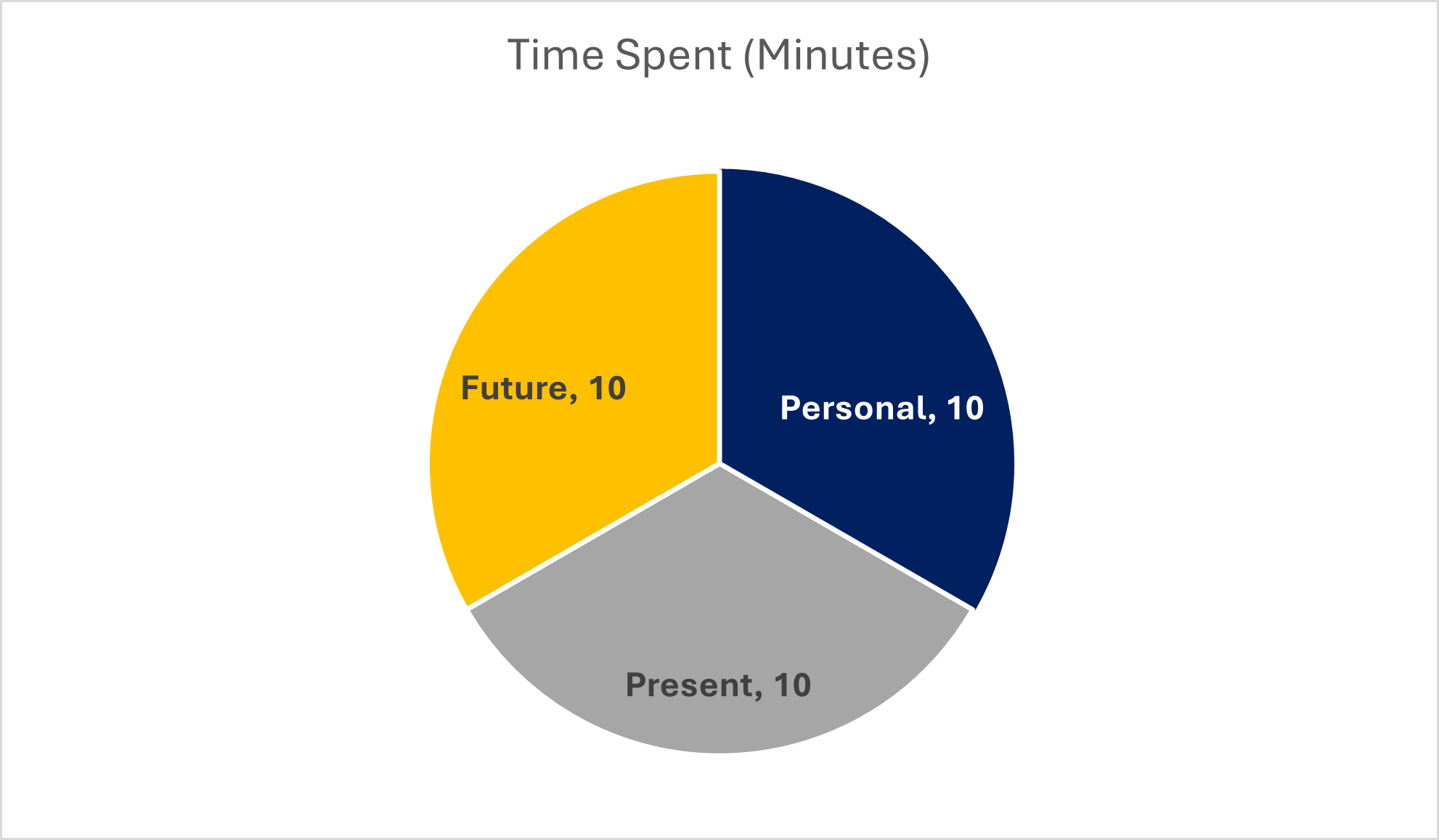

Balance your time so it looks like approximately ten minutes on personal items, ten minutes on present actions and ten minutes on the future.

Putting This Into Action

A good one-on-one starts with a thoughtful process and approach. Shifting the mindset away from having a status update to support the productivity and career development of the employee is the first step. There are a variety of better ways to handle status updates.

For a one-on-one, the goal is to get to how the employee is feeling, what unspoken conflicts exist and how big picture development is going.

As a rule of thumb, great bank managers strive to do no more than 30% of the talking. The job of the manager in a one-on-one is to listen, confirm thoughts and provide insightful input.

Finally, providing consistency and earning trust across multiple one-on-ones is the key to building culture. The more the employee provides input and brings up uncomfortable topics the more trust is built and the meetings are working. When you find yourself being asked for advice or discussing things that you would not normally discuss, you are doing it right.

Spend five minutes reviewing notes and another five minutes mentally developing a plan for each one-on-one session and superior success will follow so these meetings become 10x more effective.

Running effective 1-on-1s is a perishable skill, and like any skill, it takes training and constant practice. Unfortunately, few banks teach how to have a proper one-on-one.

Not every meeting or conversation goes smoothly, and that’s normal. Using this framework, referencing previous talks, letting others lead, focusing on the big picture, and following through, will help you foster meaningful discussions and ensure you have the process right.

Ultimately, that’s the essence of being a manager.