Bank Product Design – Harnessing the Ikea Effect

We often talk about “frictionless banking,” making it easy for the customer to open an account or add deposit balances. However, as banks design future products, they should consider taking into account the “Ikea Effect” to help increase customer lifetime value. In this article, we explain what the Ikea Effect is and how to apply it to banking product design.

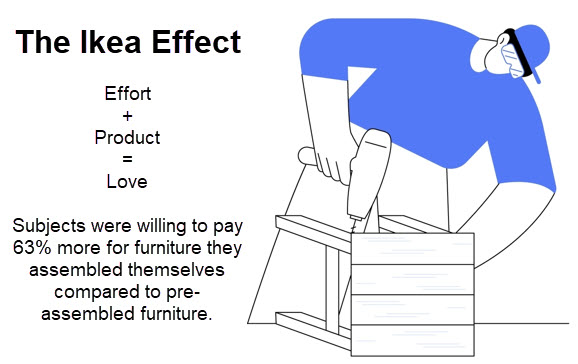

The Ikea Effect

Building furniture is no fun. However, the critical factor to Ikea’s success in furniture sales was the fact that by packaging furniture flat, Ikea could save cost on shipping and storage, while making it easier for the customer to take the furniture home. Part of the cost savings was passed onto the customer. The equation of lower cost and physically manageable furniture offset the hassle of putting the furniture together. Business schools have often lauded this equation as being the fuel behind Ikea’s rocket growth.

However, the equation is incomplete.

Business psychologist Michael Norton, Danieal Mochon and Dan Ariely, conducted a study around customer satisfaction using, in part, Ikea assembled furniture. What they found was that when you assemble your own furniture, you overestimate the value of the final piece and your satisfaction in the product increases. This helps explain why people love their Poang Armchair.

The Ikea Effect in the Wild

Inventors thought they were brilliant when they introduced the instant cake mix to America in the 1950’s. All you must do is add water and stir and poof – instant cake batter. The powdered milk, eggs and fats were already in the mixture to be reconstituted with water. The product was a flop.

When surveyed, homemakers felt that they were “cheating” and that the mix could not be “fresh.” P. Duff and Sons solved this problem by removing the powered egg and forcing customers to add their own egg. Bam! The product took off. Adding that counterintuitive extra step created just enough effort in the process to make instant cake users proud of their work.

When Pinterest or Spotify force you to configure your page or channel, they are tapping into the same Ikea Effect. Food delivery services such as Blue Apron or Hello Fresh do the same thing except they are able to charge a premium for the ingredients compared to if you purchased them separately yourself.

How can bank’s leverage the Ikea Effect?

Let Customers “Assemble” or Influence Their Own Account

Banks can create or choose vendors that provide products where user inputs allow for a customized experience. Here are some examples of where other banks have offered modular, build-your-own account features when it comes to deposit products:

- Pick Your Perks: The user interface allows customers to choose the benefits of their deposit account or treasury management package to include loyalty points, foreign ATM fee refunds, overdraft protection or cash back options.

- Tiered interest/rewards boosts: Let users unlock higher yields by adding direct deposit payments, using additional products, maintaining balances, providing referrals or for longevity.

- Setting Goals: The act of setting deposit goals usually locks the customer to the bank for the duration of that goal. Goal setting helps increase deposit duration and boosting deposit performance.

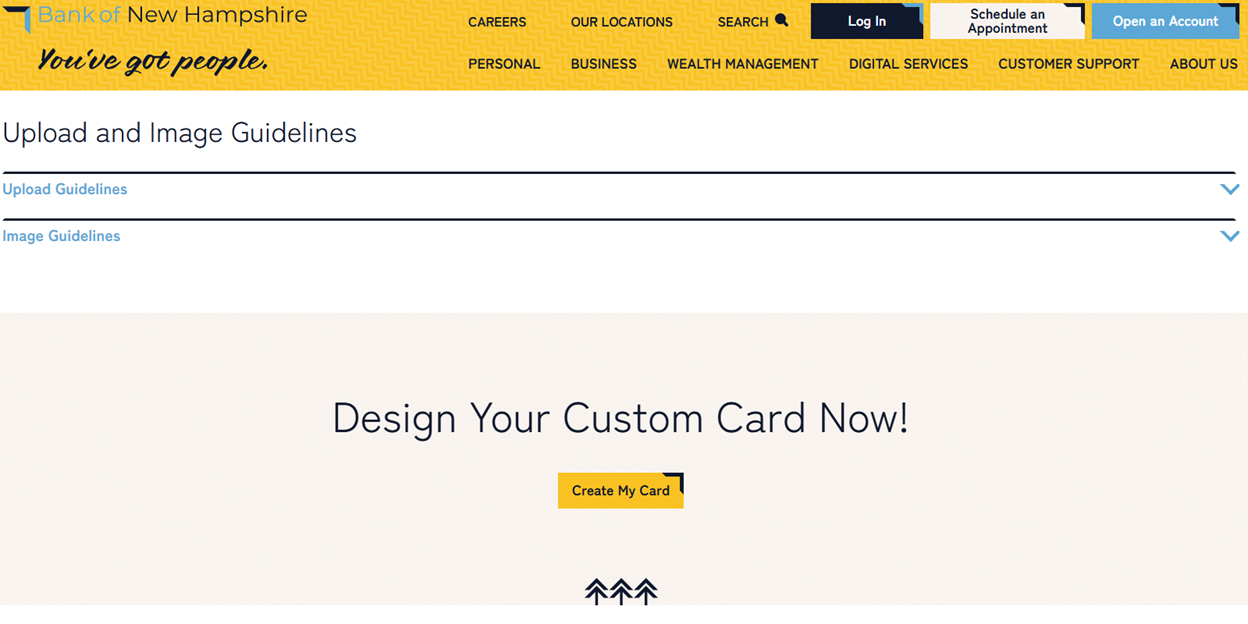

- Debit Card Design: This is a common, but an easy solution to allow your customers to choose their own card design.

Performance Hack: The more time and thought the customer puts into building the account, the more ownership and satisfaction they feel, making them less likely to go dormant or churn.

Gamify the Onboarding Flow

Instead of a static form, turn onboarding into a step-by-step “progress builder”:

- Show a visual tracker: Visualization of progress not only provides feedback on where customers are in the onboarding process but also provides a sense of accomplishment – “You’re 60% of the way to customizing your perfect savings account!”

- Use achievement language: Offer notifications and rewards to support desired behavior – “You just unlocked your first interest boost!”

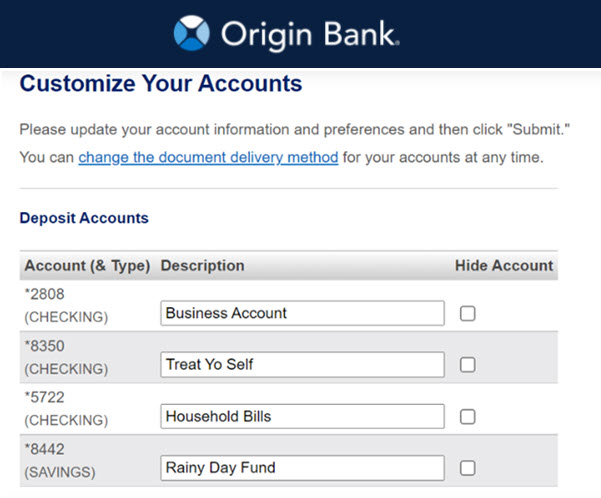

- Let users name their account: Naming creates organization and ownership – “Equipment Reserve Fund.”

- Link and Refer Accounts: Provide fee discounts and attribute additions (like free foreign ATM fees) to add or refer other accounts.

Performance Hack: Completion feels like an accomplishment. When the customer’s effort is acknowledged and visible, they value the result more and satisfaction increases. Each act of customer input builds attachment. The more a customer “invests” effort in setup and usage, the more loyal they become, the longer their customer life which means the greater their lifetime value.

Introduce a “Starter Pack” Bundled Product Concept

Instead of selling single accounts, sell bundles of products such as a transaction account, savings account, health savings account and IRA. Provide a base “starter bundle” and then add incentives to expand to additional products and services. Frame initial funding as part of a self-started success journey:

- “Add a health savings account to lower your medical costs and receive an additional interest boost.”

- “Let’s get your Starter Bundle funded – choose how much to kick things off with.”

- “Your first $1,000 deposit unlocks your first bonus milestone!

Performance Hack: Avoid making funding feel like a demand. Instead, make it feel like the final step of something they have built themselves.

Use Post-Open Personalization Nudges

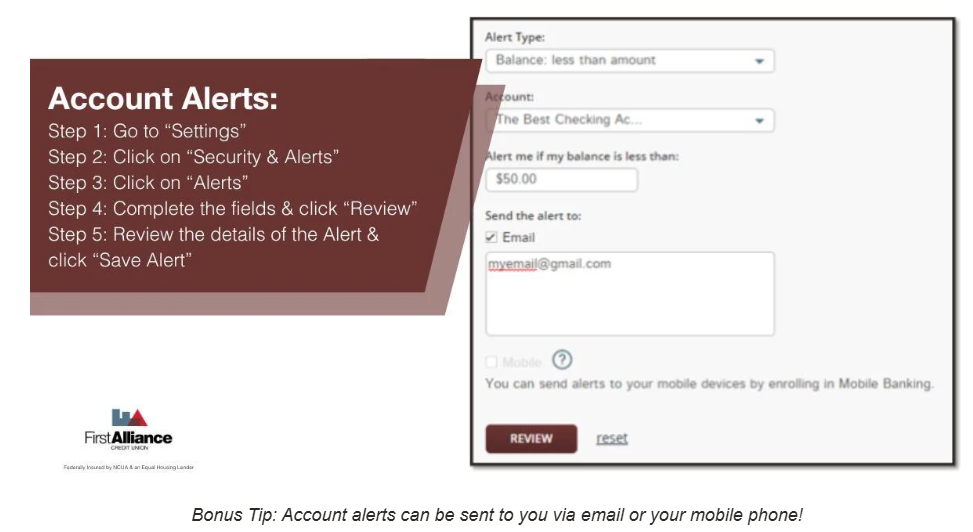

After the account is opened, keep the IKEA momentum going:

- “Do you want to add balances above $250,000? No worries, we can help you gain additional FDIC coverage” (If you use a reciprocal deposit program such as NBID).

- “Add a photo or emoji to personalize your account tile.”

- “Set up your ideal savings schedule – how often would you like to contribute?”

- “Rename your Money Market to match your goal.”

- Customize your alerts (like below).

Performance Hack: This continues the illusion of co-creation, making the product feel more like theirs.

Putting The Ikea Effect into Action

The next time your bank design or moves to choose a product from a vendor, consider the role of personalization and gamification play in the customer experience and engagement.

Look for ways to be relevant to customers in the process of onboarding and account usage by making it feel like a collaborative and personalized experience. Banks need tools to change customer behavior and the Ikea Effect is a good place to start.

Allowing your customer more say in how they use the product will produce greater cross-sell, higher balances, and more engagement. If banks can do this successfully, they may just be able to follow the trajectory of Ikea itself.