Why You Need Bank Product Management

Banks don’t have enough product managers. A bank has a leader for a business line but usually only caretakers for products. A manager may oversee the operation of a product, but few banks have product managers who drive product development and performance. As a result, bank performance suffers. The magical equation is more profitable products to more profitable customers, and one way to positively influence this formula is to make more profitable products. This article further explores what it means to be a bank product manager.

What is Bank Product Management?

Bank product management is the art and science of strategically driving the introduction, development, growth, and continual support of a bank product or suite. If banks do have a product manager, it is most likely in treasury services. Outside of that, most banks have only a few people driving product-led growth.

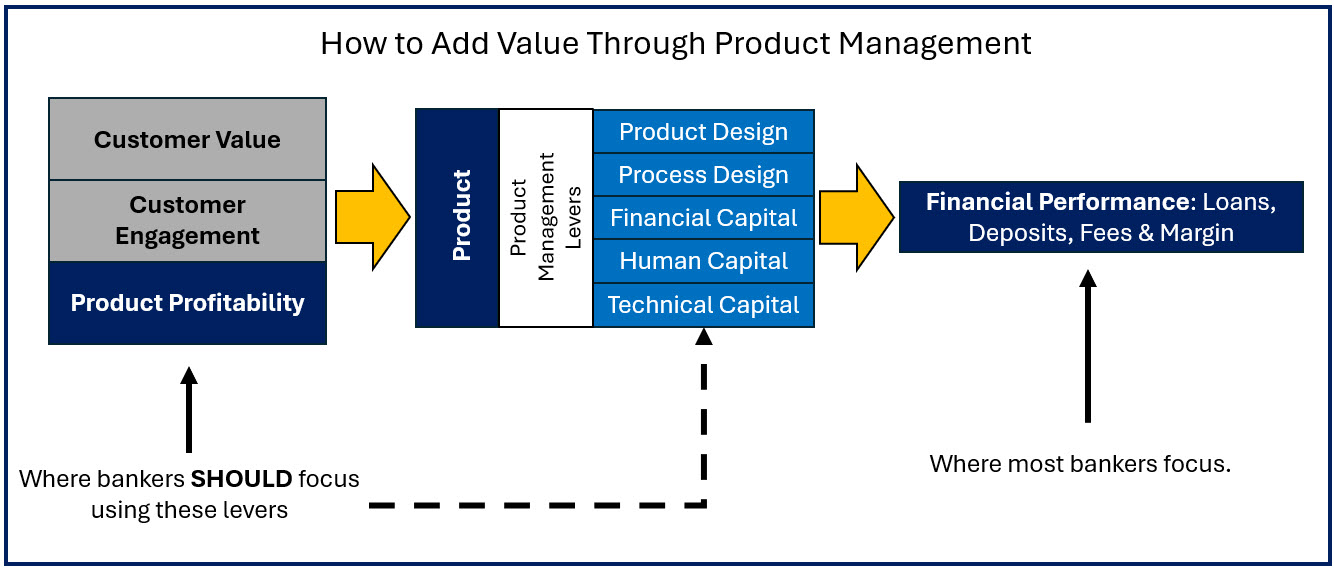

When bankers are put in charge of a product, they tend to focus on traditional financial metrics such as the production of loans, deposits, fees and operating margins. However, a bank product manager should focus on engaging the customer by driving value while managing product-level profitability. If bankers focus on improving the design of the product, the process of the product, the investment into the product, the quality of the staff around the product and the stability,security and effectiveness of the technology, successful financial performance will be a natural byproduct. The critical point here is that unless you focus on optimizing the product for the benefit of the customer and the bank, all the loans, deposits and fees that you generate will be suboptimal. Have a bad product and underperforming loans, deposits and operating margins will be the result.

A telling sign of product managment maturity at a bank is if each product or product suite has its own profit and loss (P&L) accounting. A hallmark of quality product mangement revolves around tracking key performance indicators, and seperate financial report is critical. A bank can record profitability a number of ways, however product level reporting is one of the most important. While a geographical P&L is interesting, it is not as actionable as product level profitability.

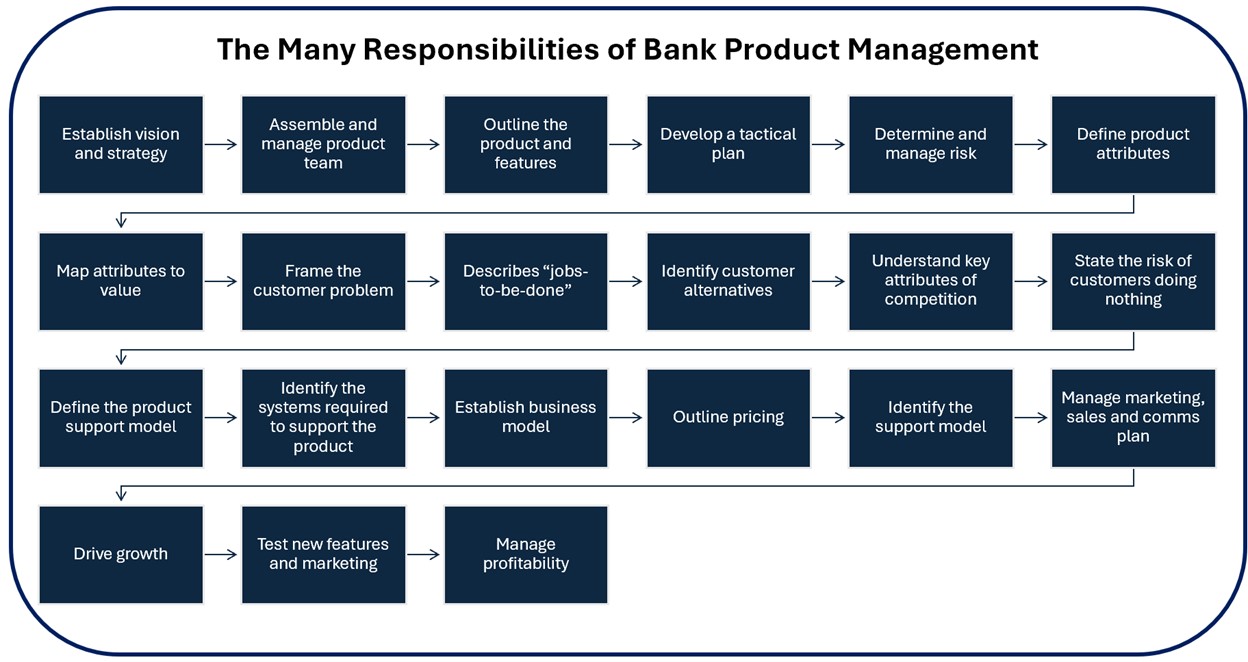

The bank product manager’s responsibilities combine strategic and tactical efforts and allow one person to be held accountable for the profitability and total experience of a product.

Bank Product Management is about having the right strategy, using the right tactic in the right channel for the right product at the right time for the right customer, and being serviced by the right employee support. While there are many things to get right, banks that try at each item will find that they improve the performance of their product and, therefore, the bank.

Bank Product Management – Strategic Responsibilities

Bank product management can entail some of the following strategic responsibilities:

Building a Product Team: Of course, nothing happens without people. The first step in building product management into a bank’s DNA is to ensure the bank has a framework for what a sound product team looks like. While a product like a certificate of deposit might only have a part-time product manager, a product like treasury management will likely have many. A mature product team may include a product manager, a customer experience manager, an operations specialist, an analyst, an embedded marketing specialist, some technical development staff, a quality assurance person or two, and maybe customer support if the product is specialized enough. In addition to assembling the team, the product manager needs to take responsibility for the continued training around the problems, the environment, and related solutions.

A great example is how the new Section 1071 rule that requires data collection and management impacts every small business credit product a bank has. Here, product managers across the organization must work with compliance and data teams to understand how to incorporate these new requirements into each product’s workflow.

Understanding and Establishing the Product: Few bankers have taken the time to understand their products. They may be able to describe the product and understand its fundamental nature, but few that we have met have a comprehensive view of the product’s true nature and where it fits into the customer’s life.

Pricing strategy, for example, is either what has always been done or what the competition does. Understanding the cost of the product, determining if there is a better business model to charge for the product, and deciding where to set pricing are areas of banking that are often overlooked. Advanced product managers not only understand how to optimize pricing and customer-level price sensitivities but also how a product’s pricing impacts related products. Change the price for CDs, for example, and money market, savings, and transaction accounts get impacted.

Understanding a product also means understanding the problem the product solves, the attributes of the product, how those attributes map to a value proposition, what the alternatives are to the product (both competition and substitutes), and what the risk is of a customer not choosing the product.

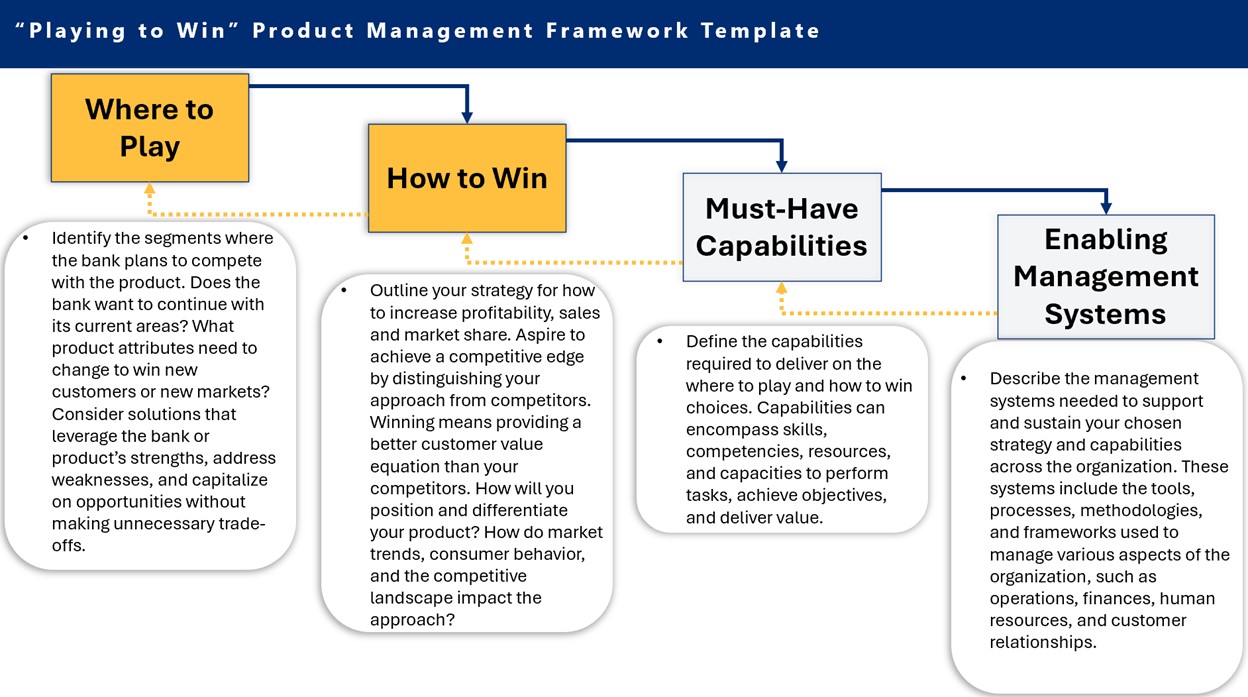

Developing Strategy: Here, bank product managers determine where they want to position a given product, given the competitive landscape, objectives, and goals of the bank. A product manager needs to think long-term. Development takes time, and investments can take many years. A product strategy should look out for at least five years and preferably ten.

A bank product management strategy framework can look like the popular “Playing to Win” approach made famous by Alan Lafley and Roger Martin (an excellent bank strategy intro book HERE).

Product Development: One current problem in banking is that vendors and banks introduce a product and then forget about it. Product development means having a vision and a roadmap. While innovation around a certificate of deposit might be limited, innovation around payments, wealth, transaction accounts, or analytics is likely rapid. Fast-growing products likely need a detailed roadmap for product improvements and development. A bank product manager combines the vision with strategy and lays out a development plan.

Every bank product manager is trying to figure out how to leverage data, analytics, and artificial intelligence (AI) into their product. If not for the bank product manager, who else is going to be thinking about how to work these tools into transaction accounts, debit cards, lines of credit, mortgage, wealth, or hundreds of other bank products?

Marketing Plan: Every product needs a marketing plan to be successful. While a bank’s marketing team may help in this, they get pulled in so many directions the product manager must drive since they understand the value proposition and the customer journey better than anyone. Bank product managers need to lead the message, the cadence, the intent, and the objectives of the product, while Marketing can help with the channel and execution.

Sales, Communication, and Training: In addition to the “hard skills” of product development, there are the “soft skills” of selling and communicating. Product managers need to oversee the messaging points, the internal communication, and the sales plan around a given product.

Support Model: The product manager is responsible for ensuring the customers and stakeholders of the product are well supported. A support model will likely include online, chat, email, call center, and in-person support. Some products, like treasury management, likely require a dedicated team, while other products, like savings accounts, will likely leverage generalized support. Regardless of the support delivery model, it is the bank product manager’s responsibility to ensure the proper internal training occurs, that authority to solve problems is thought through, and that external training content is developed.

Risk Management: Part and parcel with profitability, the job of the bank product manager is to manage risk. While product managers outside of banking also manage risk, the bank product manager must devote an above-average amount of resources to this area due to regulatory oversight, public trust, brand, and leverage. Few other industries employ anywhere close to eight times leverage, so product managers who have products that are an asset or liability have an outsized impact on the bottom line. Mistakes get amplified.

Further, the average bank product has an average life of about six years, or much longer than the average widget. As such, decisions end up staying with the bank longer than in most other industries.

In judging the risk, bank product managers need to understand not only the residual risk of the product’s impact on the bank but how it impacts other products as well. For example, the product manager for CDs needs to structure prepayment penalties to meet the bank’s duration targets. However, in doing so, the CD structure impacts the duration of other products, such as money market and transaction accounts.

Depending on the product, this includes operations, credit, interest rate, market risk, liquidity, compliance, strategic and reputational risk.

Bank Product Management – Tactical Responsibilities

Within the realm of product management, once the strategic priorities and plans are set, there are a host of tactical responsibilities.

Introduction: There is a whole art form in delivering a product to marketing in banking, which includes working through the new product approval process and everything that portends, including a business plan, profitability, risk, compliance, and support. One item that often gets overlooked is a termination plan. Not only is it essential to have business plan metrics (revenue, number of customers, profitability, etc.) around the introductory ramp, but it is also important to clear metrics hurdles when the product gets terminated. A business plan should also detail the metrics and plan around a pilot program as banks learn what they don’t know about a product under real-world stress.

As a side note, not every banker has the skill set to introduce a new product, as this tactical area is a separate skill in itself. In these cases, a team-of-teams approach is acceptable, and a different banker may just handle the introduction and pilot phase of the product.

Acquisition: The product manager is responsible for figuring out who the customer is and then filling the top of the sales funnel with the right prospects. Once in the funnel, the product manager then converts the prospects to users. The basic rule of thumb for bank products is to grow at least 10% per year on a net customer or production basis unless there are other strategic constraints (like credit or capital).

Acquisition is where the product manager works closely with marketing to help develop, hone, test, channel and deliver the message. The product manager may have input on the channel as some bank products are best influencer-driven with social media channels, while others need to be sold in-person, and others can be sold via email or digital advertising. Metrics include the number of funnel prospects, prospect growth, impressions, click-thru rates, and conversions.

Activation: If there is one underappreciated area of bank product management, it is activation. While banks often get new customers to a product, getting them to use the product for the first time is frequently overlooked. This usually occurs when bundled products are sold, and customers never get a chance to focus on specific products in the bundle. Savings accounts, for example, are often packaged with transaction accounts, but only a small portion of banks follow up to incentivize the customer to utilize their savings accounts. Similarly, personal and business debit/credit cards are issued, but a more significant percentage of customers (25% to 50%) don’t utilize the cards.

Metrics might include the percentage of customers that fund an account, complete a tutorial, complete their profile, and/or execute a transaction.

Engagement: The most crucial part of the product manager’s job is driving engagement. All else will follow if customers are engaged and find value in the product. Revenue, profitability, pricing, and volume positively correlate to engagement. As such, a central tenant in bank product management is to find ways the customer can interact with the product as often as possible in a month. Without a product manager, most bankers will overlook features and functions that enhance engagement.

Engagement for bank products includes transactions, position/transaction intelligence (e.g., balance checking), analytical intelligence (e.g., cash flow forecasting), gamification, feature usage, and social interaction. One critical feature here that is often overlooked is the tracking and visualization of user paths. Knowing where your users access the product, what features they use, how much time they spend on each product attribute, and where they go after is vital to making improvements.

Venmo produced one of the all-time best banking products by not only making payments easy but also providing users with reasons to interact socially. Key performance metrics here include time-on-task, session length, clicks per page, and number of sessions per day/month.

Retention: Increasing lifetime customer value means increasing balances/fees and retention rates. Customers will always defect due to relocation, change in marital status, death, etc., but the goal of the bank product manager is to limit defections to the extent economically possible. Engagement and retention are tightly correlated, so efforts to drive engagement up mean increased retention rates. Outside of engagement, bank product managers work on cross-selling and volume-building programs to increase engagement and profitability. Metrics here include defection rate (e.g., account closures), turnover rate/churn, and customer average life.

Profitability: Of course, the patriarch of all metrics is profitability. Unfortunately, few banks track product profitability on a risk-adjusted basis. Cost allocation and funds transfer pricing are central to any bank product manager’s profitability efforts. Understanding both total profitability and unit profitability is essential to know the contribution and scale of a given product. Metrics include the following: total numbers and unit numbers plus growth rates – revenue, operating profit, margins, and customer lifetime value (CLV).

Referrals: Finally, any good product manager is looking for qualified leads. One way to do this is to create promotions and workflow to handle referrals from happy customers. A referral platform might be a bank-wide effort, or it might be handled at the product level. Alternatively, referrals might be a stand-alone effort and might be collected via a referral contest, email campaign, or banker calling campaign. Whatever the case, bankers who overlook referrals are missing out on one of the best lead sources available and end up with higher customer acquisition costs than needed.

Putting This Into Action

Product management is crucial for banks because it ensures that financial products and services are effectively developed, launched, and managed to meet the customer’s evolving needs and the bank’s profitability goals. By focusing on research, customer/employee feedback, and competitive analysis, product managers help banks innovate and adapt in a rapidly changing financial landscape.

This strategic and tactical approach enhances customer satisfaction and loyalty and drives revenue growth and operational efficiency. Ultimately, bank product management can enable your bank to increase profitability, stay competitive, meet compliance requirements, control risk, and be responsive to technology advancements, thereby securing long-term success.