Proverbs of a Bank Product Manager

One deficiency at most banks is that while there is a business line owner, there is rarely a product manager (PM) of a particular product such as commercial loans, demand deposits, treasury management, or even digital banking. As a result, most banks roll out a new product and then move on. Neglected, products quickly become outdated and do not remain optimized. Business line owners with other priorities, overlook continuous product development. In this article, we look at the problem and the attributes of what a best-in-class product manager looks and acts like.

The Problem

Examples abound. The clearest to understand is a bank website. A bank’s marketing department may do a great job at designing a website, but then they release it and fail to make ongoing improvements. As such, it is not up to date with product changes, it is not optimized for search engines and functionality fails to grow customer engagement. However, if a bank had a product manager responsible for the website, then it would continue to make improvements monthly and help generate more and more qualified leads each month.

The Solution

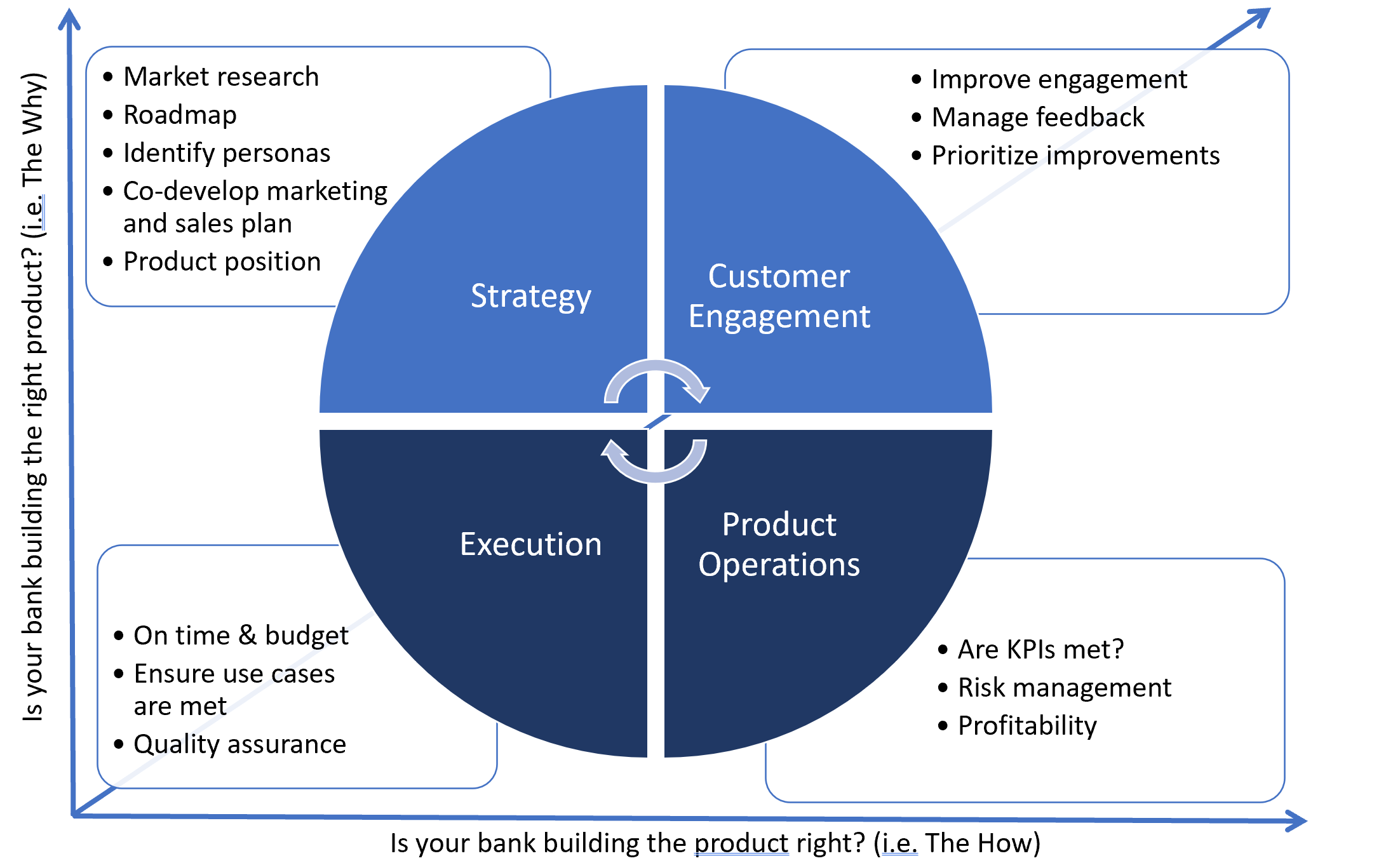

The product manager effectively solves two equations simultaneously:

1) Is the bank building any given product right; and,

2) Is the bank building the right product?

While the two questions are closely related, they are not the same. The product built wrong will fail while the wrong product will underperform. Get both questions right and the product is almost guaranteed to excel over time.

The product manager is like a director on a movie or a quarterback for a football team. If the EVP of retail is accountable for all personal banking, the SVP of Deposits is accountable for growing overall deposits while the product manager of transaction accounts is responsible for producing demand deposit products that grow deposits that grow retail. Makes sense?

The Economics – A Case Study

Let’s say a website product manager costs $135,000 per year on average. A bank website rolls out and shortens the commercial customer acquisition cycle from 30 months to 20 months and the website goes from generating zero leads to generating 10 qualified leads a month. These numbers are about typical, so they serve as a good frame of reference. The PM takes charge of the website and through personalization, functionality improvements, and optimized marketing, cuts acquisition time by another 10 months and takes leads from 10 to 20 over the course of a year. Conversions go from 5% to 15%. That is about $220k in annual cost savings and $288k of lifetime value for a benefit of approximately $508k for just that first year, or a 3.7x return on the position. That is just for one product line. The average website product manager for a $1B community bank often returns over 500%, while a website product manager for a $10B bank is twice that.

Treasury management, health savings accounts, checking, commercial loans, and 50 other bank products all show a positive return on product managers as they grow the product. When is the last time you introduced a new commercial loan type, deposit account, or improve your health savings account offering? If the answer is not since product introduction, then your bank might benefit from a PM.

The Focus and Alignment

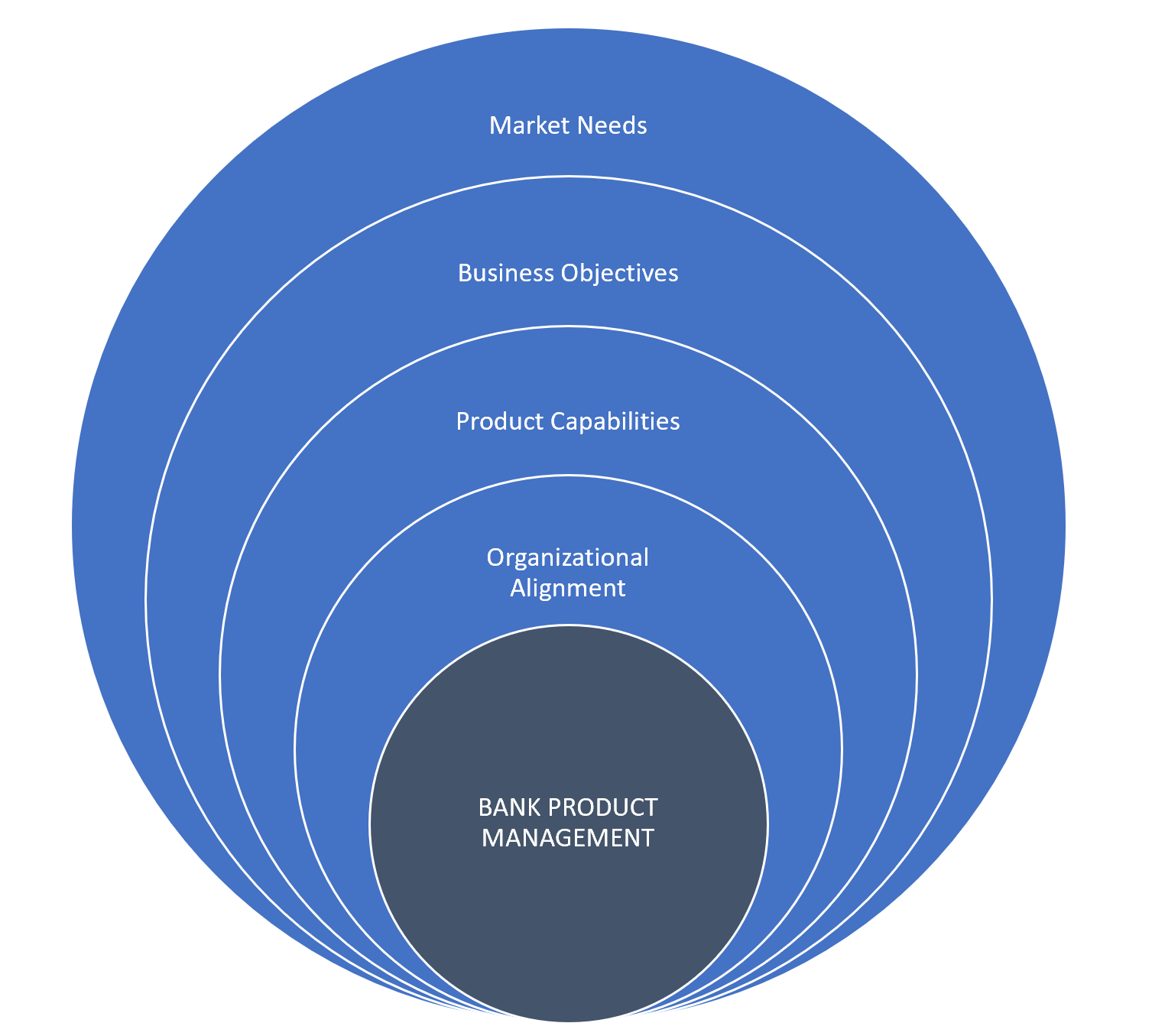

The product manager’s job is to own, end-to-end, a specific product or set of products. They are responsible for the alignment of business line objectives with what the bank customer wants and needs. The product manager, in collaboration with the business line owner, looks at the market’s needs, then sees which ones can meet the bank’s business objectives, then narrows it down to how might a product meet those objectives, and finally eliminates all the things the product could do that are not in alignment with the bank’s goals and objectives. The target is graphically represented below.

The 14 Proverbs of Bank Product Managers

After focusing on product management over the past thirty years and speaking with dozen of successful bank product managers and consultants, we collected 12 of the most important proverbs that might act as guiding principals for any bank product manager.

- Keep the Customer in Mind at All Times: The PM will think from the customer’s perspective first and foremost. Enough people will represent the bank, but the PM exists to make an efficient product for the customer, not the bank.

- Keep the Employee in Mind: If you are not asking your front-line employees for input then you are asking for trouble. Next to saving your customers time and effort, saving your employees time and effort is the next most important objective. While customers may deal with a product once a month, an employee must deal with the product every day. It’s unfortunately common for banks to design a product and never ask the employees that have to sell or service the product for input.

- You Will Save Customers and Employees Time: Time will serve as a proxy for customer and employee satisfaction if there is no other measure. All else being equal, the more time you save the customer and the employee, the more satisfied they will be (*usually).

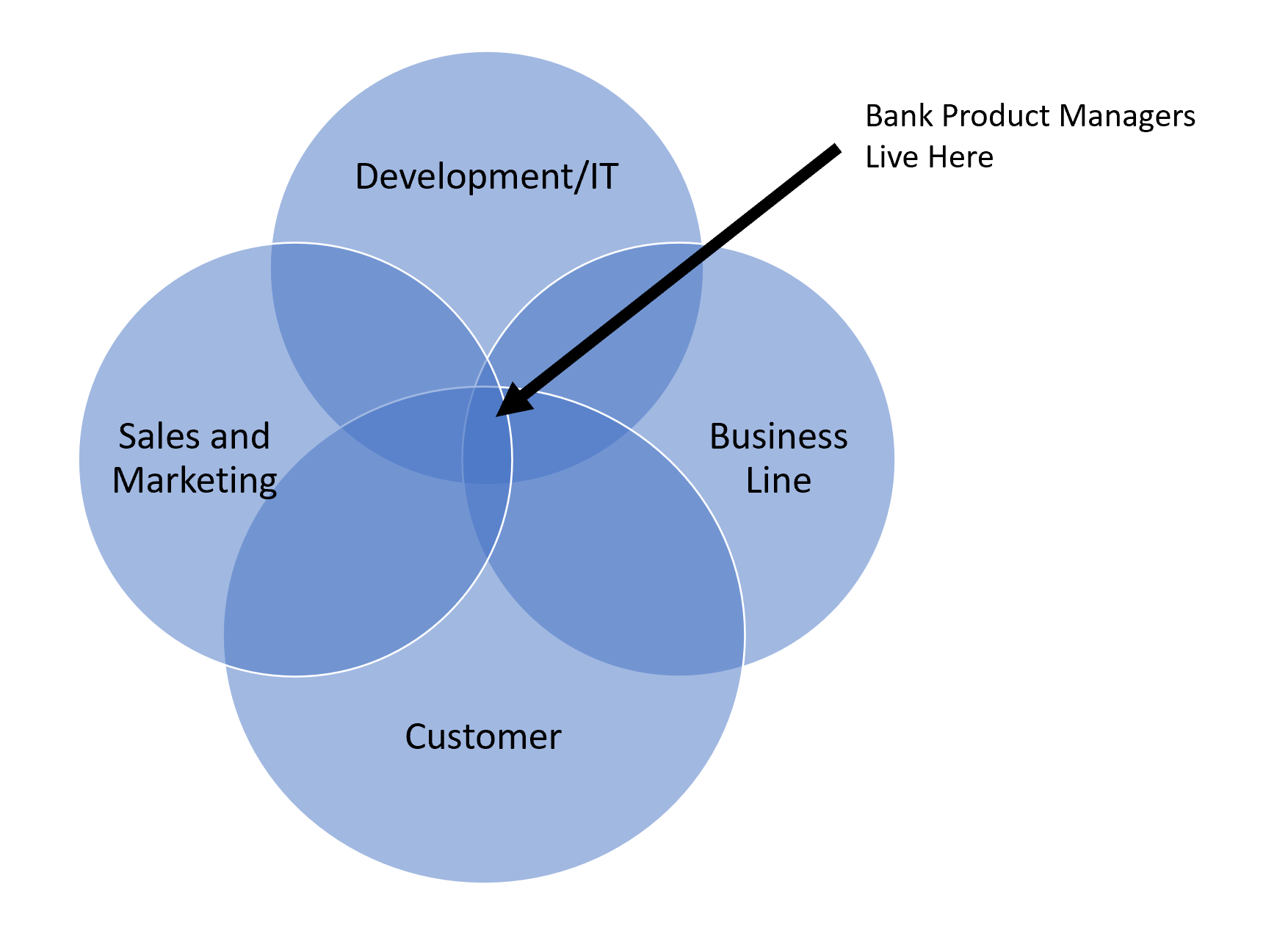

- Have Mission Clarity: Be clear on your mission and intent BEFORE starting to build or enhance a product. Use the mission to build a team. The passion around the mission will serve as a filter for those team members that want to be part of the solution and those that are just looking for something to do. One trick that Amazon uses to underscore mission clarity is to write a press release, complete with the desired customer quote, and then work backward in developing the product to match. Once the mission is clear, the product manager then goes to work to make sure all partner groups are clear on the mission and resources are managed between the customer, general business line, development/IT, and Sales/Marketing to best meet that mission (below).

- Have Customer Clarity: Know who your customer is before you start. Too many bank products fail to reach their potential because they are designed for the controller but pitched to the CEO or CFO. If your bank product is meant to be sold through your centers of influence, such as law firms and accountants, then be sure to build product features and marketing for them. One test question is to ask who is NOT your customer? If everyone is your customer, then you will eat up resources trying to be everything to everyone. Serve one customer type to start and iterate until you gain traction. Once you have success, move to your next customer type.

- Have Ownership Clarity: There needs to be a clear owner of the product if it is not the PM. This person must drive the product to achieve both customer satisfaction and the desired profitability. Lack of ownership clarity and mission are the two biggest reasons for product development friction.

- Have Goal Clarity: PMs should set clear key product indicators ahead of time and produce a product that will eventually materially move the needle on those KPIs.

- Don’t Add Features – Solve a Problem: Every new feature of a product should solve some problem. If it doesn’t, the PM must remove it. If it does, the PM needs to prioritize the development of those features to solve the most significant problems first.

- Have the Required Skill Set: PMs need to be able to be conversant in the underlying product (loans, deposits, wealth, etc.) in order to interpret stakeholder input, understand when there is a conflict, and know what is possible within the bounds of product engineering, customer preference, and bank regulation. PMs need to be technical enough to understand the project’s design requirements, the intent of the customer, and the limitations of the product. They don’t have to be able to code but need to understand the engineering aspects of the product.

- Apply the Right Talent Resources in the Right Amounts (i.e. Human Capital Management): PMs must make sure they have the right resources in talent and amount in coordination with the business owner. When in doubt, hire or bring on team members slowly rather than too fast. The stronger the existing culture is of the team, the quicker you can hire. Let culture drive the pace of team member growth whenever possible.

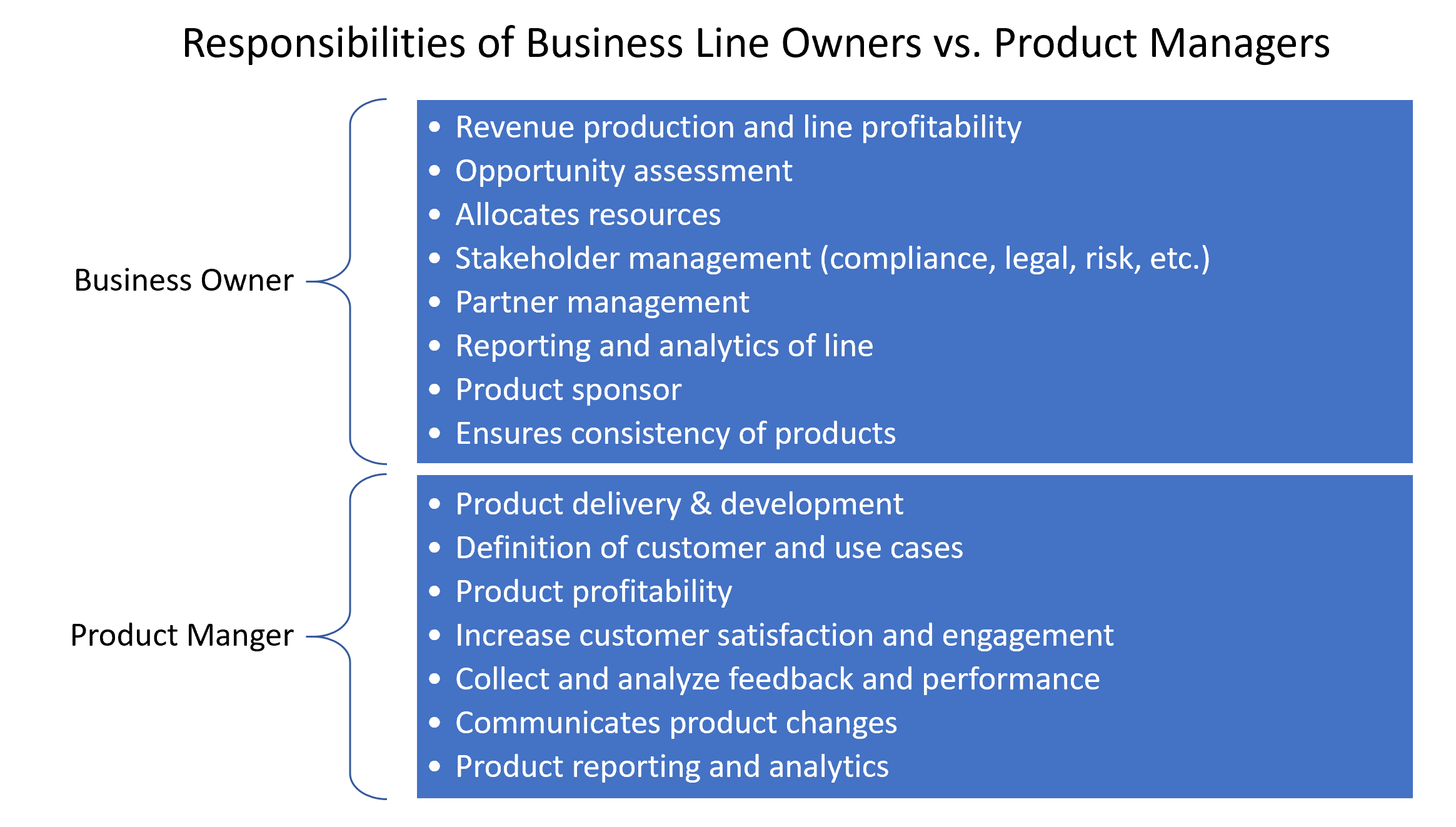

- Define Roles: The PM should ensure everyone’s roles are clear. For example, while a PM might be the product ops person, they don’t have to be. The product ops person will be an expert on the underlying operations (such as managing transactional accounts) and not necessarily on product design (which might manage a new online checking account). For that matter, the PM should not be confused with the project manager that may help manage the development of a segment of a product, such as integration.

- Clear a Path: PMs must make sure the path ahead is clear so resources can come together on the designated timeline.

- Keep The Customer Involved: Customers and focus groups should be utilized where feasible for input prior to building and after. The product is for the customer so having their input in the design and beta testing is critical to get the product right, to get the educational material right, and to make sure you have the right marketing message. Most clients love to give input plus it makes them feel valued.

- Failures Do Not Define Product Managers: If you are not failing in product development, then you are not doing it right. Innovative product managers fail about 60% of the time, meet their goals about 30% of the time, and have great success 10%. If you are not failing, you are likely not experimenting enough. Where your failures like a badge of honor. This will signal to others that it is OK to fail. Further, you will likely learn more from your failures than you ever will from your successes. Knowing when to shut down a product is just as important as knowing when to start a product. Set not only the KPIs but the KPIs for a time horizon of when you will stop a product or stop developing a product. Cut your losses early and let your winning products run.