Community Banks Often Take Risk Without Reward

Most bankers would refuse to accept risk without reward (or revenue). It would make no sense to risk the bank’s capital without adequate compensation. However, some banks are inadvertently taking risk without any additional revenue. The yield curve is currently flat, and the average community bank’s cost of funding is highly correlated to Fed Funds and SOFR (the industry’s average is over 90% with a about a 6-month lag). Fixed-rate loans originated today are creating risk without reward. There are three main considerations that bankers need to analyze to determine if the risk/reward profile of fixed rate loans is adequate in today’s market.

First – The Lending Curve of Community Banks

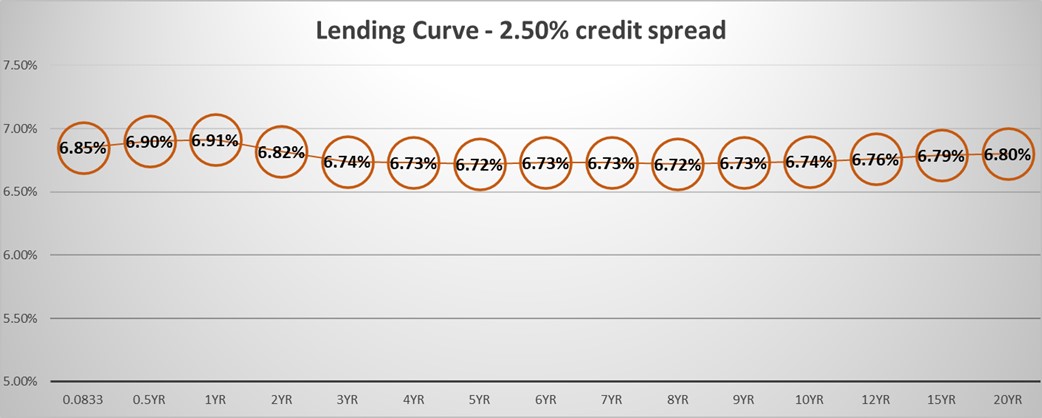

Most banks’ cost of funding is highly correlated to shorter-term rates, and banks generally prefer shorter loan duration – floating, adjustable, or fixed rates of up to one to two years. This is where the banks take minimal interest rate risk. Going further out on yield curve may make sense if banks can generate additional loan yield – this is called a carry trade. Traditionally, the carry trade offered banks over 1.00% in additional pickup in yield between their cost of funds (COF) and the five-year term (approximately 1.15% over the last 30 years, and up to 2.00% during some periods). However, with the current shape of the yield curve, banks generate no additional revenue by extending duration. The graph below shows the lending curve, based on a 25yr amortization, and 2.50% credit spread for terms ranging from monthly reprice to 20yr fixed rates. As an example, the 5-year yield is currently 13bps lower than the 1-month yield. Therefore, in today’s market banks maximize yield and minimize risk by keeping loan duration short.

While banks may want to keep loan duration short in this interest rate environment, borrowers are often better served with longer-duration loans to help stabilize cash flow, minimize refinance risk, and reduce loan origination costs. Therefore, given a choice, many sophisticated borrowers are looking for longer loan duration to decrease their risk, with about the same interest costs.

Second – Fallacy of Prepayment Provisions

Some bankers believe that declining balance prepayment provisions on fixed-rate loans offset the risk of these assets and increase revenue for the lender. This is partially true, but only marginally. Prepayment provisions do increase the lifetime value of a relationship, thus generating more revenue, increase cross-sell and upsell opportunities, and they decrease the value of the prepayment option to the borrower. This decrease of prepayment option to the borrower does motivate the borrower to keep the loan when interest rates fall – but these prepayment provision typically lack teeth and end up being unenforced.

Most banks that we deal with waive the declining balance prepayment provision if the borrower refinances within the bank. Those same banks will reprice the loan to current market rates. If rates are lower, the borrower will get the benefit of that lower rate, and this completely negates the benefit of the prepayment provision for interest rate risk protection to the bank. This makes the loan a one-way floater – if interest rates fall the borrower’s coupon will follow. However, if interest rates rise, the bank’s NIM contracts – this is a prime example of risk without reward.

Furthermore, the interest rate risk is borne by the bank if the borrower sells the property/business, or if the borrower pays off the loan with excess liquidity/cash flow – again the bank faces the same risk if interest rates are lower. Over time, and through multiple rate cycles, this behavior results in substantial decrease to a bank’s ROE.

Finally, sophisticated borrowers have multiple credit facilities, access to liquidity, and may generate substantial free cash flow. Those sophisticated and liquid borrowers (the credit quality that many banks seek), can payoff above market-priced fixed rate loans with cash on hand, and place new, lower-priced debt, at a future date. Thereby, negating the prepayment provision in its entirety. This declining balance prepayment provisions typically create risk without compensation for the bank.

Third – Extension and Prepayments

Clients will always be motivated to retain favorable loan pricing and refinance their loans when the coupon is above market – most often to the lender’s detriment. Many larger banks have concluded that their top commercial clients (CRE, C&I, and Ag accounts) should retain the ability to prepay, refinance or restructure their debt to suit their business needs, but not at the expense of the lender’s balance sheet – thus, the preference is to create a risk-reward neutrality for the lender.

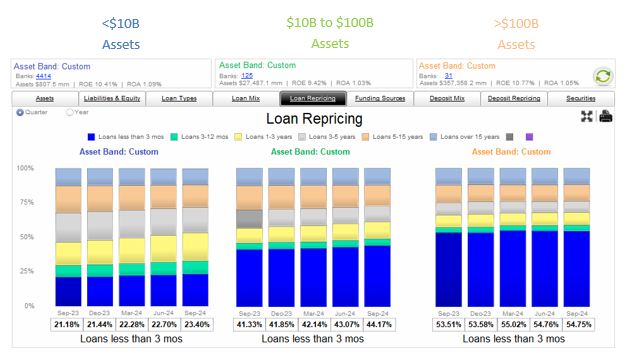

Below is a graph showing loan repricing distribution for three groups of banks: community banks (under $10Bn in assets), banks $10B to $100B in assets, and banks over $100B in assets. The graph demonstrates that community banks hold a larger percentage of their loans in longer duration buckets (these are represented by the top bands in the graph) and a smaller percentage of their loans in shorter duration buckets (these are represented by the bottom bands in the graph). Larger banks (regardless of business lines or loan categories) appear to more closely align their asset and liability duration.

These larger banks will often offer solutions for borrowers to decrease their risk by fixing their loan rates through various loan hedging program. These loan hedging programs allow the borrower to mitigate interest rate and credit risks, but still offset the bank’s interest rate risk. These solutions also allow lenders to generate much needed non-interest income. They create a risk-reward neutrality for the bank.

In the current flat yield curve environment, loan hedging creates an excellent opportunity for banks to meet customer demand for longer-duration loans, retain risk-reward neutrality and generate substantial fee income. Historically, loan hedging required substantial resources for documentation, accounting, legal, marketing and operations. But at SouthState Bank, we use a much simpler solution. Whatever solution a community bank chooses, loan hedging can be a viable tool to manage risk-reward for fixed-rate lending demand.

Conclusion

Over the last 40 years, community banks reluctantly retained fixed-rate loan maturities of up to 5 (or sometimes longer) and while the revenue did not fully compensate for the risk, there was a carry trade to generate some profit, especially as interest rates declined. However, that strategy is especially painful for banks when the yield curve is flat. While every community bank’s balance sheet composition is different, the market and current interest rate projections create a poor environment for adding fixed-rate loan duration.