Should Your Bank Adopt a Loan Hedging Program?

We are staunch advocates that banks should avoid risks that they do not get compensated for. One such risk that banks take without compensation (or revenue) is on-balance sheet, fixed-rate loans. With the current flat or slightly inverted yield curve, plus the current volatility of the market, borrowers have a pricing advantage to lock in long-term, fixed-rate loans, leaving lenders with the interest rate risk without appropriate compensation. While we are supporters of community banks using loan-level hedging, we continue to see community banks struggle to properly implement and successfully utilize a back-to-back swap (“B2B”) program. We understand why, and what community banks need to address to make such a program a success. At SouthState Bank, we utilize a loan-level hedging program called “ARC,” which is available to all community banks and, in our opinion is easier to manage and understand than a B2B program, but the point of this article is for banks to manage the risk through some loan hedging program instead of taking the risk without compensation.

Adoption of Interest Rate Swaps

Of the largest 250 banks, almost 90% are using interest rate swaps, and because these largest 250 banks hold almost 85% of all loans, interest rate hedging tools are widely used in approximately 77% of the commercial loan marketplace. However, only a few hundred community banks (under $10B in assets), show any interest rate swap volume. We know many community banks that have adopted a B2B program but after many years have zero hedges outstanding. The key question is why are so many community banks are unable to deliver a B2B program to their clients?

Keys to a Successful Loan Hedging Program

We believe that the answer to the question above is simple. Any community bank product must be understandable to the client, the front-line lender, and to bank executives. We believe that to offer a viable commercial bank product, an average commercial banker should be able to explain the product to an average client in a 5-to-10-minute conversation, with a few simple diagrams or tables. Front line lenders will not attempt to sell a product that they do not understand, or one that they think the borrower will not understand over a short meeting for morning coffee.

There are a few reasons why a B2B program may not be understandable, as follows:

- Documentation: The standard B2B program requires lengthy (45 to 60 pages), multiple, and cumbersome agreements. No line lender wants to explain ISDA documents to the average client. The ISDA documents span multiple agreements, are written in dense legalese, and integrating loan and swap documents requires substantial legal, and accounting expertise.

- Operational, accounting, and reporting support: Almost all B2B programs require additional billing and notices, accounting treatment, and Dodd-Frank and other regulatory reporting requirements for borrowers. Since the borrower’s end goal is to obtain a fixed-rate loan equivalent, any additional work, resource requirements or complexities are unwelcomed.

- Sales and marketing: If a lender hesitates to explain the documentation, cash flow, risks, and accounting of a product, clients will choose alternative products (within or outside the bank). Relying on outside third parties as agents of the product is the least desirable outcome for a community bank. Using a large bank vendor or consultant to explain a product to your client has certain unwanted connotations and liabilities for the community bank. If an internal community bank employee cannot explain the product, it may not be appropriate to the majority of the bank’s clients.

A Successful Back-to-Back Swap Program

We have seen that community banks that are able to deliver a viable and successful B2B program have one common variable – they have developed or hired inside expertise. The formula to a successful B2B program is to hold the expertise inhouse. This requires three employees that are dedicated to the required operational, documentational, accounting, reporting, and sales support functions. The positions should be as follows: 1) a senior sales rep who can educate the lenders, and explain the product to clients, prospects, and internal management, 2) a junior sales rep who can support the sales and operations function as needed (basically redundancy for travel, vacations, and other absences), and 3) operations person who can create documentation, customer reports and billing statements, handle compliance, reporting and explain entries for accounting staff. Without this minimum staff, we believe that is difficult to create a viable B2B program.

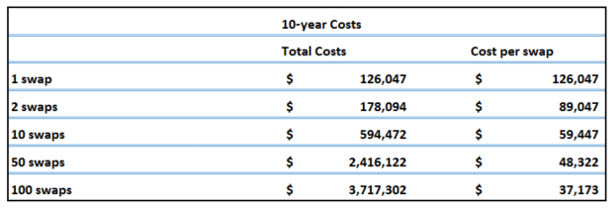

Outside of the personnel costs, a B2B program also has collateral, capital, legal, reporting, documentation, and processing costs. We have factored the all-in costs of a B2B program on a per hedge basis (assuming an average 10-year hedge term and $2mm loan amount). The table below shows our estimate cost over an entire 10-year period for a swap assuming various volumes for a community bank.

Considering the all-in costs on an individual swap, it may not make sense to start a program if a bank intends to book only a few B2B hedges. As the anticipated volume increases, the average cost per swap decreases, and at some volume the cost/benefit of a B2B program becomes compelling. For most community banks that point will be somewhere between 50 and 100 swaps.

Putting a Loan Hedging Program in Motion

We believe that 2025 may be another volatile year for the banking industry when it comes to credit and interest rate risk. Community banks should not take risk without appropriate compensation, and having a loan hedging program may be the right solution that can provide borrowers the stability that they need while not increasing risk for the bank. For community banks that do not want to trade derivatives directly, the ARC Program used by hundreds of banks throughout the country (including at SouthState Bank), offers all the benefits of a loan hedge without complex derivative documentation, derivative accounting, or monthly borrower settlement statements. We find that it is understandable to most lenders, borrowers, and community bank executives.