Preparing For the 7 Waves From The Fed Hike

Last week the Federal Reserve hiked interest rates by 75 basis points – its most significant hike since 1994. This decision coincided with rate hikes by the Swiss National Bank, its first since 2007, the Bank of England, and the European Central Bank announced at an emergency meeting that they would raise interest rates next month and again in September. This abrupt change by central banks worldwide is an important sea change for domestic banks. The Fed Hike will send seven waves toward banks. By knowing these waves banks can choose to float over them, surf them or be battered by them.

For the past 14 years, the monetary policy in the U.S. has been exceedingly loose. Interest rates were zero (real rates, almost consistently, and nominal rates through most of the last 14 years), and the Federal Reserve injected massive amounts of liquidity. This regime is now changing, and community banks need to position their lending and deposit portfolios for a period of monetary tightening. What worked effortlessly for the last 14 years may not work for the next business cycle.

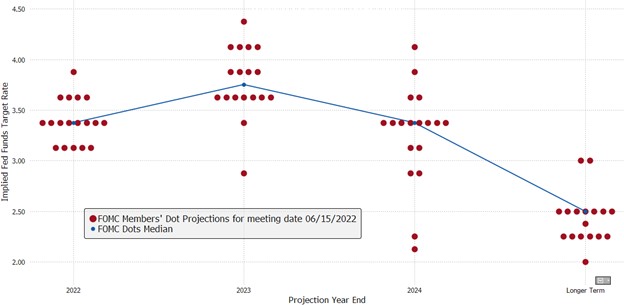

The Fed Hike and Current DOT Plot

The Federal Reserve tightened monetary policy more aggressively than expected just a week ago as inflation reached a 40-year high. The impetus for increasing rates has been higher than the anticipated CPI reading, which in May was 8.6%. This led the Fed to increase rates by 75bps instead of the expected 50bps. The FOMC’s most recent (06/15/22) dot plot appears below.

The Fed hike moved Fed Funds up 75 basis points and put the Central Bank on target for a Fed Funds rate of 3.375% by year-end. The market, however, expects a higher year-end Fed Funds rate at 3.65%. The market expects a 75bps increase in July, two more 50bps increases, and another 25bps increase in December 2022. Short-term rates are also likely to continue to climb through 2023.

After 14 years of easy monetary policy, the shift to increasing short-term interest rates and quantitative tightening will lead to a massive change in the markets, not just for interest rates but credit and liquidity risk.

Changes for community banks will be felt for years across the following transmission mechanisms:

- Deposits will decrease, and the cost of funding earning assets will increase,

- A flattening yield curve will put pressure on some banks’ earnings,

- Banks with floating-rate assets will benefit,

- Cap rates on real estate will increase, and real estate collateral values will decrease,

- Free cash flow for many borrowers will decrease as poor businesses models become challenged,

- As banks tighten underwriting policies, bubbles will burst with knock-on effects for suppliers and customers, and

- Debt coverage ratios will be challenged for lesser quality obligors.

The Fed is determined to ease inflationary pressures by aggressively tightening monetary conditions. This action will lead to decelerating economic growth and riskier ventures failing, but sound underwriting will differentiate certain banks from competitors. This secular change will allow better-managed banks to outperform their peers. Banks that have avoided, or can reduce, their holdings of riskier assets as much as possible will outperform.

Conclusion

In future articles, we will consider how community banks should manage their business model in the face of the end of the easy money economy. We will consider how liquidity and credit risks manifest in a monetary tightening environment and what community banks can do to enhance performance using technology, credit risk scoring, fee generation, and cost savings. We will also identify the most significant risks to the community bank business model for credit, interest rate, and liquidity.

Until then, beach-comfortable bankers can be on the lookout and prepare for the seven waves that are coming toward them.